On Friday, the market awaits U.S. economic events, which are expected to drive some price action during the U.S. session today. The U.S. Commerce Department will report January retail sales (+0.3% on month expected) and December business inventories (+0.1% expected).

The Labor Department will post the January import price index (-0.2% expected). The Federal Reserve will release January industrial production (-0.2% expected) and capacity utilization (76.8% expected). The University of Michigan will report its Consumer Sentiment Index for February (99.4 expected).

Economic Events to Watch Today

EUR/USD – Daily Analysis

The EUR/USD dropped 0.3% to 1.0842, the lowest level since April 2017. Later today, the eurozone’s fourth-quarter GDP growth will be reported (+1.0% on-year expected)

The money markets are currently pricing approximately 6-basis points of a rate cut by the end of 2020, against a zero probability seen a month earlier. On the other hand, the EUR/USD currency pair may find some bids if the German data prints better-than-expectations. Whereas, the technical bias will remain bearish until the pair does not reach above the 10-day Moving average at 1.0940.

Traders are currently waiting for the German data to take new positions. The market will also keep their eyes on Italian Trade Balance and Flash Employment Change for taking fresh cues.

Later today, official reports on January retail sales (+0.3% on month expected), industrial production (-0.2% on month expected), and the University of Michigan consumer sentiment index (February preliminary reading, 99.4 expected) will be released.

Daily Support and Resistance

- S1 1.0767

- S2 1.0828

- S3 1.0851

Pivot Point 1.0888

- R1 1.0911

- R2 1.0949

- R3 1.1009

EUR/USD– Trading Tips

The EUR/USD fell dramatically to trade around 1.0841 support level, and it seems to form a Doji candle today, perhaps due to a lack of trading volume and liquidity. If this happens, we may see the bullish trend in the EUR/USD pair in the week ahead. At the same time, if the EUR/USD pair manages to drop below 1.0840, we may see EUR/USD prices going towards 1.0760. Let’s look for buying trade today above 1.0840.

GBP/USD– Daily Analysis

The GBP/USD rose 0.7% on the day to 1.3046. U.K. Chancellor Sajid Javid has resigned from his position, and his deputy Rishi Sunak will succeed him. Investors speculated that this might pave the way for more fiscal stimulus.

On the other hand, the fears of coronavirus are decreasing and supporting the risk recovery. As a result, the U.S. 10-year Treasury yields stay modestly down to 1.61% while stocks in Asia are marking a recovery from Thursday’s declines.

Looking forward, the lack of U.K. data will push the cable traders to keep eyes on political/Brexit headlines, as well as coronavirus update. However, the U.S. Retail Sales and Michigan Consumer Sentiment Index will entertain the momentum traders during the later part of the day.

The GBP/USD broke above 1.2950 resistance level, which is now looking to test the next resistance around 1.3045. The following support level is likely to be found around 1.2950 for now.

Daily Support and Resistance

- S1 1.2888

- S2 1.2928

- S3 1.2944

Pivot Point 1.2968

- R1 1.2984

- R2 1.3008

- R3 1.3047

GBP/USD– Trading Tip

On the 4 hour timeframe, 1.3000 is the most crucial level for the GBP/USD as a violation of this level can lead Sterling prices further higher towards 1.3045 and 1.3065 in the coming week.

The MACD and RSI are holding in the buying zone, supporting bullish bias for the GBP/USD pair. Let’s look for bullish trades above 1.3000 today.

USD/JPY – Daily Analysis

The USD/JPY slid 0.3% to 109.75. The USD/JPY is struggling to keep their gains ahead of key U.S. data and looking toward fresh developments in the coronavirus. The USD/JPY trades around at 109.78 and consolidates in the narrow range between the 109.76 – 109.87.

According to the news from China Health Commission, the epicenter Hubei province reports 4,823 new cases on the second day of using the new diagnosing method. The number of people is in severe and critical condition, and the number rose to 9,638 from the prior figures of 7,084.

It should be noted that China’s President Xi Jinping told on Thursday that the government’s struggles are starting to have positive effects on the Chinese economy.

It is worth to mention:

1: Reports 116 new deaths.

2: Total confirmed cases rise to 51,986.

3: Number of people in serious and critical condition 9,638, from 7,084 yesterday.

4:Around the globe, a total of 65,236 cases, 1,487 deaths.

As in result, the U.S. 2-year Treasury yields initially extended the reaction to the coronavirus news to 1.39% before rebounding to 1.44%, which is where they were pre-news. 10-year yields similarly fell to 1.57% before recovering to 1.62%.

Daily Support and Resistance

- R3: 110.63

- R2: 110.33

- R1: 110.21

Pivot Point 110.02

- S1: 109.9

- S2: 109.71

- S3: 109.4

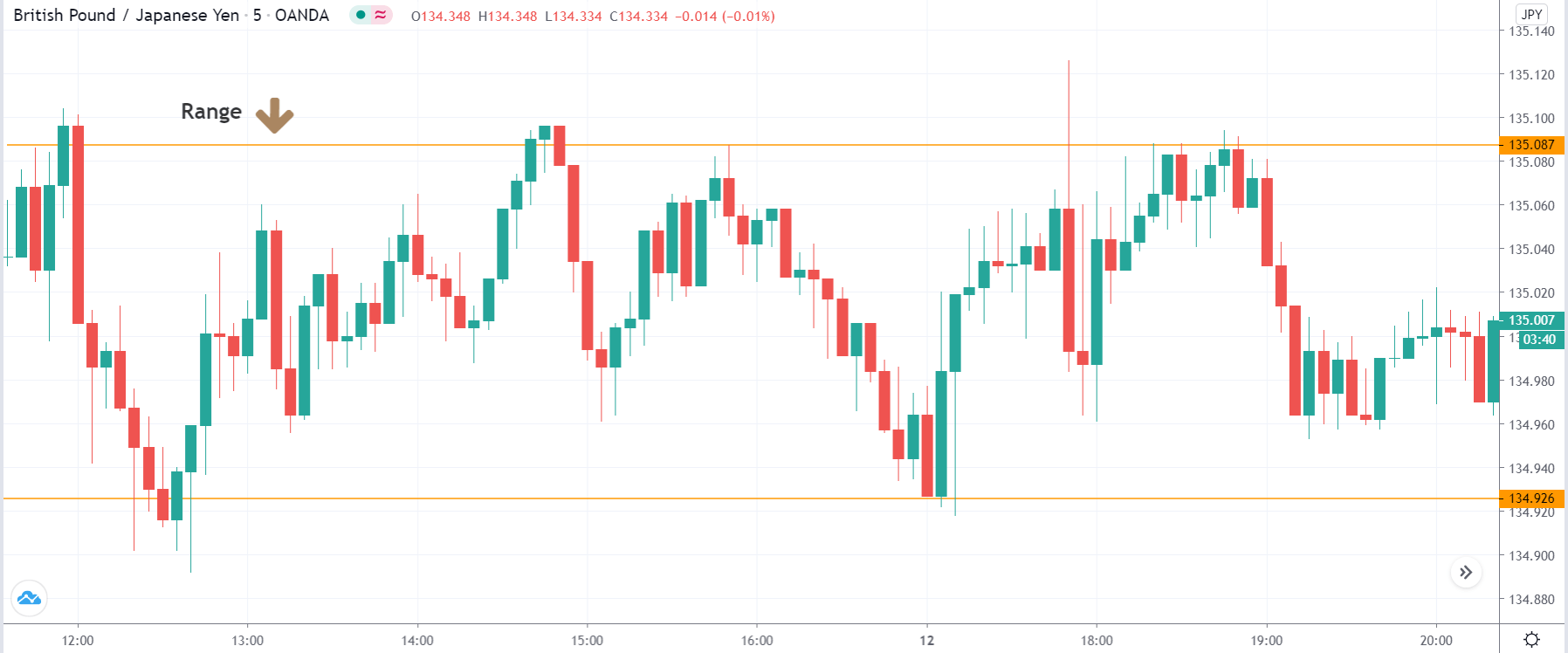

USD/JPY – Trading Tips

On Friday, the USD/JPY pair hasn’t changed much as it continues to trade with in the same trading 110.025 – 109.500. Apparently, it is due to a lack of economic events, but we may see movement during the U.S. session on the release of U.S. Retail Sales data. At the moment, the USD/JPY pair is holding below 110 resistance as it failed to violate the horizontal resistance level of 110.025.

In case, the USD/JPY manages to break above 110.025 level; we may see USD/JPY prices going towards 110.350 at first and then towards 110.850. Alternatively, the USD/JPY can drop to 109.300 in case of failure to break above 110.025.

All the best for today!