GBP/JPY Exogenous Analysis

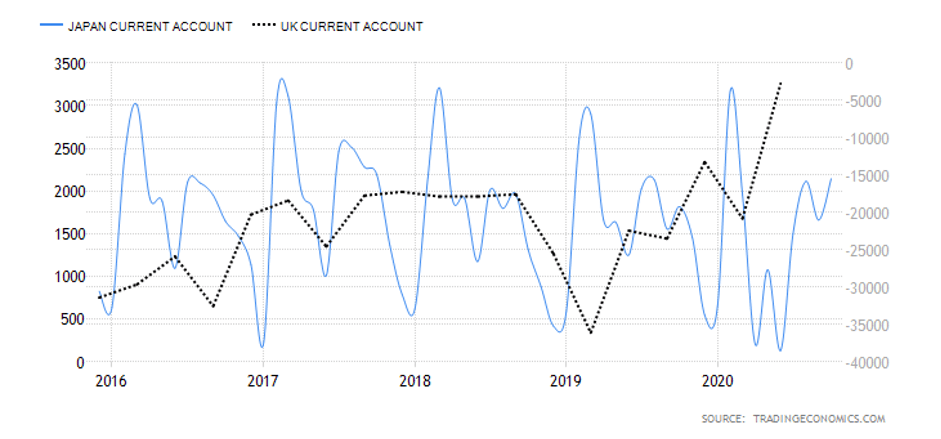

- The United Kingdom and Japan Current Account Differential

The current account data is the most comprehensive measure of a country’s participation in international trade. It is the sum of net exports, net factor income, and net transfer payments. Remember that in the forex market, the value of a country’s fluctuates depending on its demand. Therefore, when a country has a current surplus account, it means that the demand for its currency is higher, and vice versa.

In this case, the current account differential is the difference between the UK and Japan’s current account balance. If the current account differential is positive, it means that the GBP will appreciate more than JPY hence a bullish GBP/JPY. Conversely, if the current account differential is negative, JPY will appreciate faster than the GBP hence a bearish trend for GBP/JPY.

In Q3 2020, Japan had a current account surplus of $15.4 billion while the UK had a $20.97 billion deficit. Thus, the current account differential between GBP and JPY is – $36.37 billion. Thus, the UK and Japan current account differential have a score of -3.

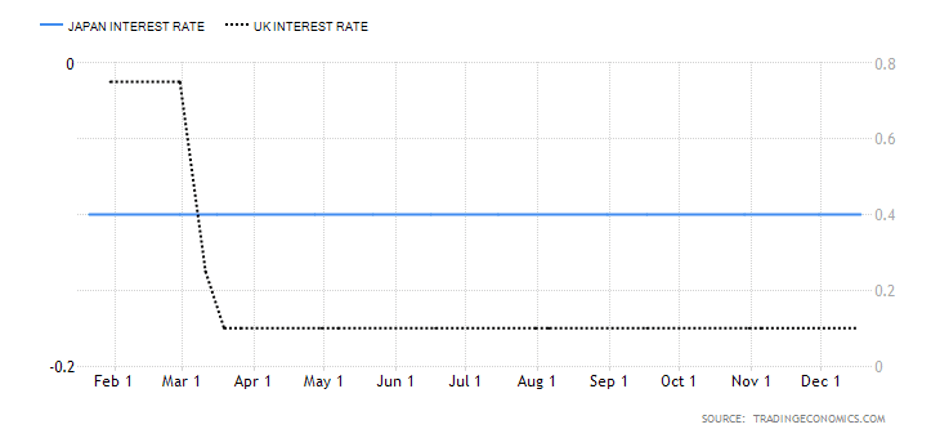

- The interest rate differential between the UK and Japan

In the forex market, the interest rate is one of the most closely monitored economic indicators. Suffice to say, traders and investors monitor every other domestic economic indicator to predict the interest rate policy changes. The interest rate differential for the GBP/JPY pair is the difference between the UK’s interest rate and that in Japan.

If the differential is positive, traders and investors can receive better returns by selling the JPY and buying the GBP, hence, bullish GBP/JPY. Conversely, if the interest rate differential is negative, currency traders would prefer to sell the GBP and buy JPY hence, the bearish GBP/JPY pair.

In 2020, the BOE cut interest rates from 0.75% to 0.1%, while the BOJ has maintained an interest rate of -0.1%. Therefore, the GBP/JPY interest rate differential is 0.2%. It has a score of 4.

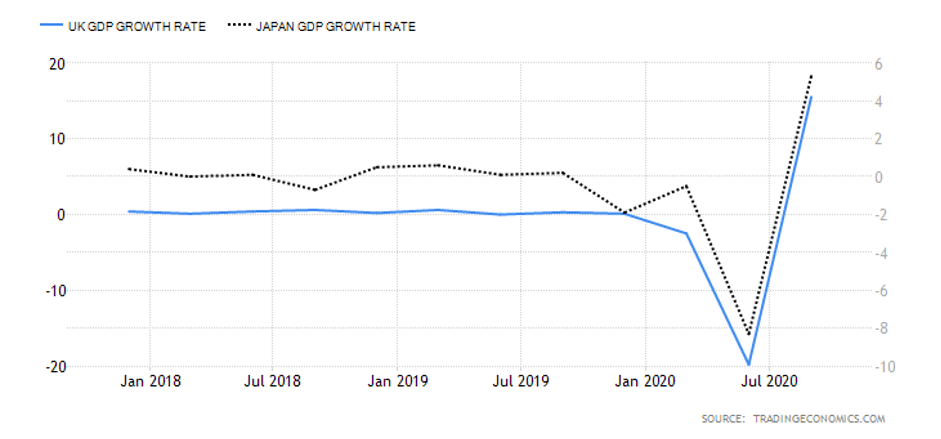

- The differential in GDP growth rate between the UK and Japan

The GDP growth rate differential measures the difference between the UK and Japan’s average annual growth rate. This is an effective way of comparing two economies since all economies vary in size and composition.

When the GDP growth rate differential is positive, it means that the UK economy has expanded more than Japan. Hence, the GBP/JPY will be bullish. Conversely, if the differential is negative, Japan’s economy has expanded faster than the UK’s. Hence, the GBP/JPY pair will be bearish.

In the first three quarters of 2020, the UK economy has contracted by 5.8% while Japan contracted by 3.5%. The GDP growth rate differential is -2.3%. Thus, we assign a score of -3.

Conclusion

| Indicator | Score | Total | State | Comment |

| The UK and Japan Current Account Differential | -3 | 10 | A differential of – $36.37 | The UK has a current account deficit of $20.97 billion, while Japan has a surplus of $15.4 billion. This is expected to continue to widen as both economies recover from the pandemic |

| The interest rate differential between the UK and Japan | 4 | 10 | 0.20% | Both the BOJ and the BOE have no plans to change their monetary policies in the foreseeable future. This means the differential will remain at 0.2% in the short-term |

| The differential in GDP growth rate between the UK and Japan | -3 | 10 | -2.30% | The UK economy contracted more than the Japanese economy. As economic recovery progresses, this differential could change |

| TOTAL SCORE | -2 |

The cumulative score for the exogenous factors is -2. That means that the GBP/JPY pair is set on a bearish trend in the short-term.

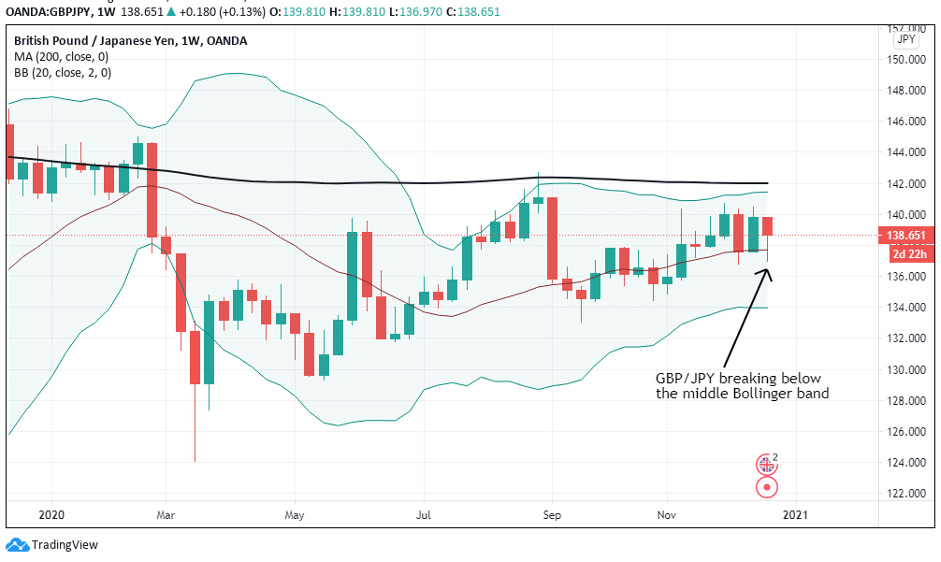

Technical analysis of the pair shows the weekly chart attempting to break below the middle Bollinger band.