Introduction

Scalping is a short term trading style, and it is quite popular among professional Forex traders. This type of trading is more concise than day trading, which involves traders placing buy/sell orders throughout the trading day. But Scalping is different. Scalpers believe that making money from the small price action moves is easier than waiting for the considerable moves.

For scalping, our focus should be mostly on technical analysis rather than fundamentals. By using technical analysis, traders use historical price information to predict the future price movement. To be successful in scalping, traders must have live feeds, direct access to the broker, and have the stamina & patience to sit in front of the computer and place as many trades as possible in smaller time frames to make money.

Scalping typically requires smaller timeframes such as a 5-minute, 15-minute, or even 1-minute charts. Some traders also use the tick chart or 30-seconds chart to scalp the Forex market. However, it requires an advanced skill set to be successful at this because the lower the timeframe is, the faster it moves. In this article, Let’s learn how to scalp the 1-minute Forex charts using Pin bars and Trend lines.

Pin Bars

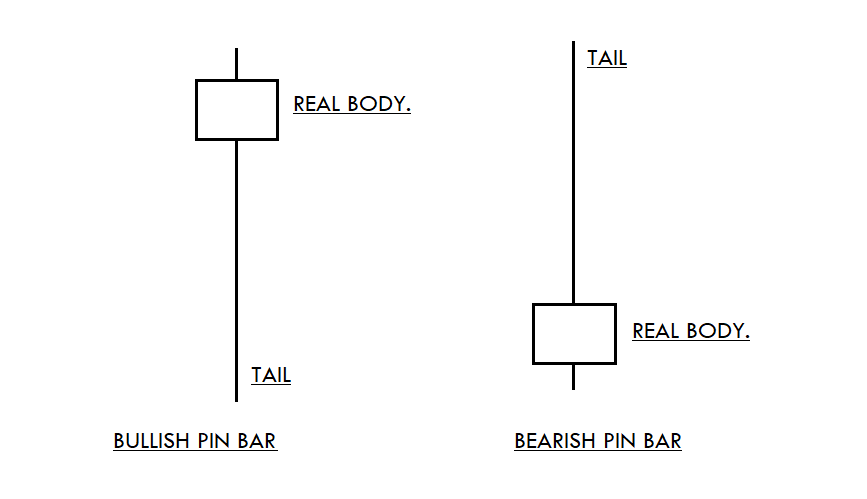

Pin Bar is a candlestick pattern that consists of only one candle, which represents a sharp reversal. There are two types of Pin Bar.

- The Bullish Pin Bar’s closing price is higher than the candle’s opening price, and the candle’s wick must be two to three times longer than the real body.

- The Bearish Pin Bar’s closing price is lower than the candle’s opening price, and the tail of the candle must be two to three times longer than the real body.

Trend Lines

Trend lines act as an essential tool for analysts while performing technical analysis. These lines are a visual representation of support and resistance levels in any trading timeframe. Traders apply these trend lines on the price charts to get a clear picture of the ongoing trend to make an accurate trading decision. Also, the trend lines on the highs and lows of the price chart create a channel.

Trading Strategy – Pin Bars + Trendlines

The one-minute trading timeframe volatiles a lot, and this small timeframe never moves in a single trend. We will always see the transitions from buy trend to sell and sell trend to buy in less than a couple of minutes. This is the essence of trading the lower timeframes. Therefore, before trading the one-minute timeframe, it is advisable to let go of all of your rigid trading beliefs.

Most of the scalpers fall into their ego and deny to close their losing positions. If you fall into this trap, then scalping is not for you. You must have a strong mindset and follow the rules like world-class traders to scalp the Forex market successfully.

Buy Examples

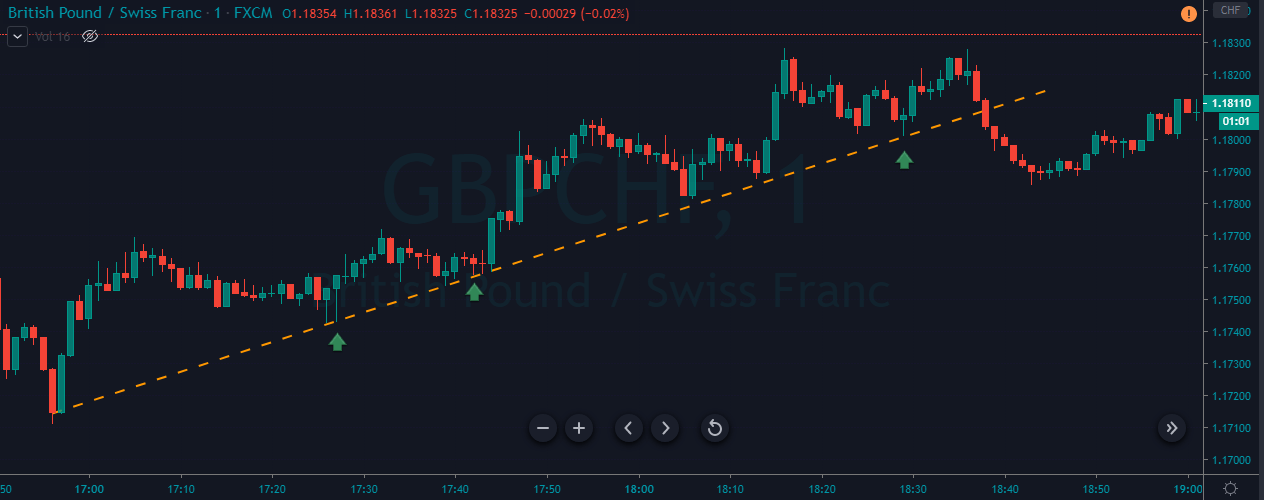

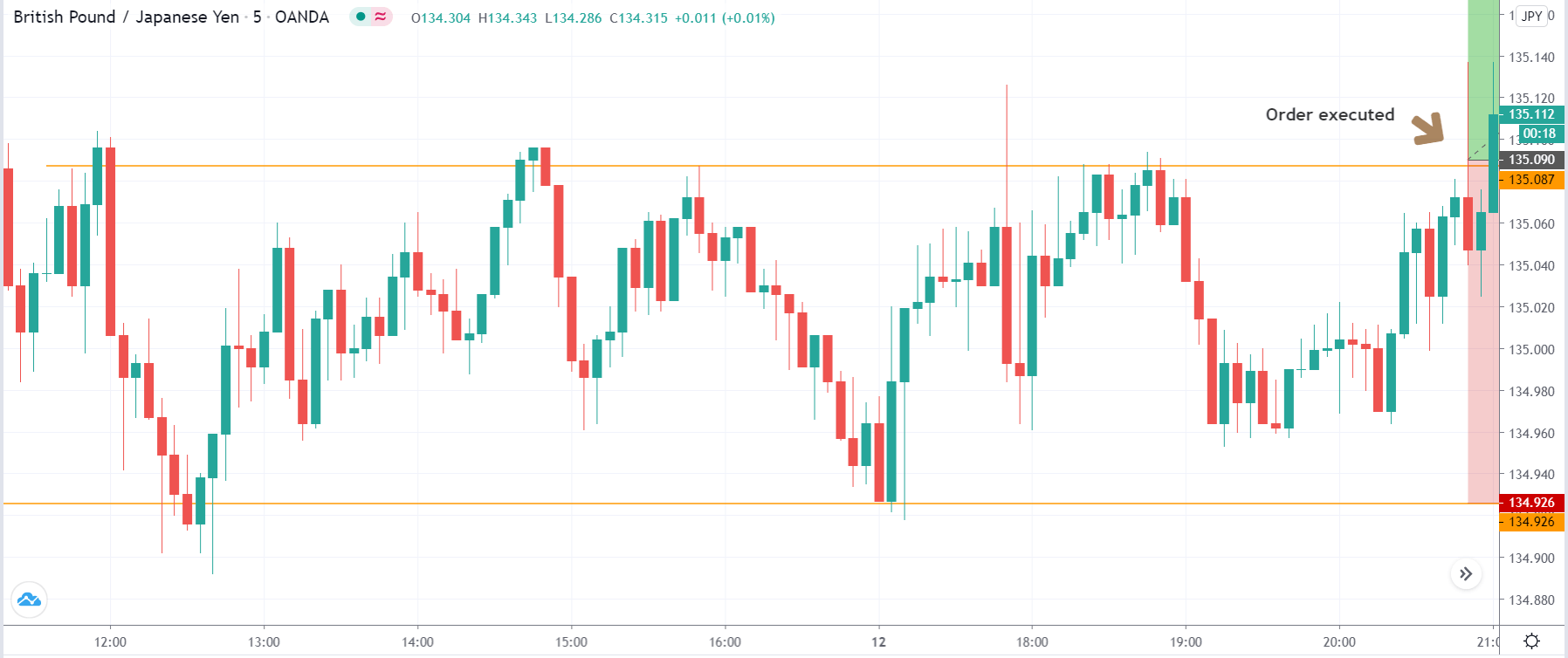

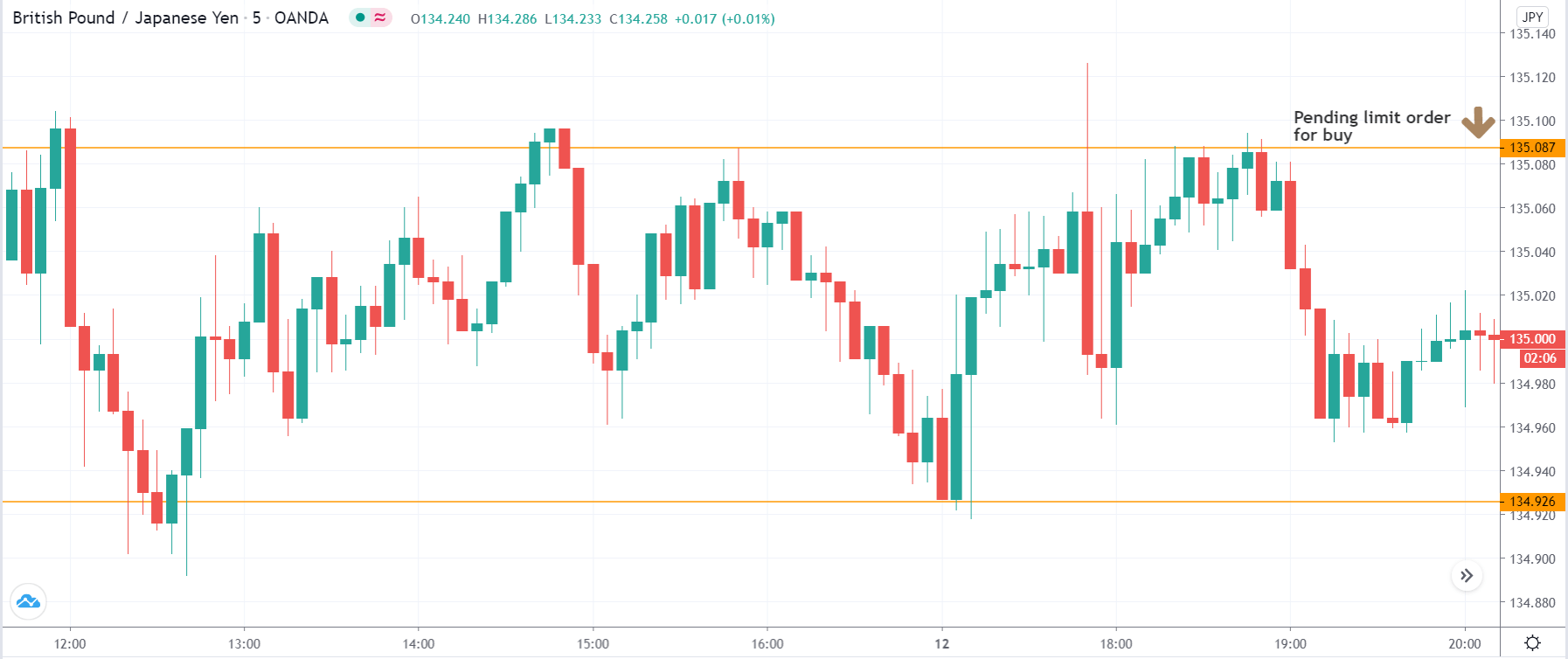

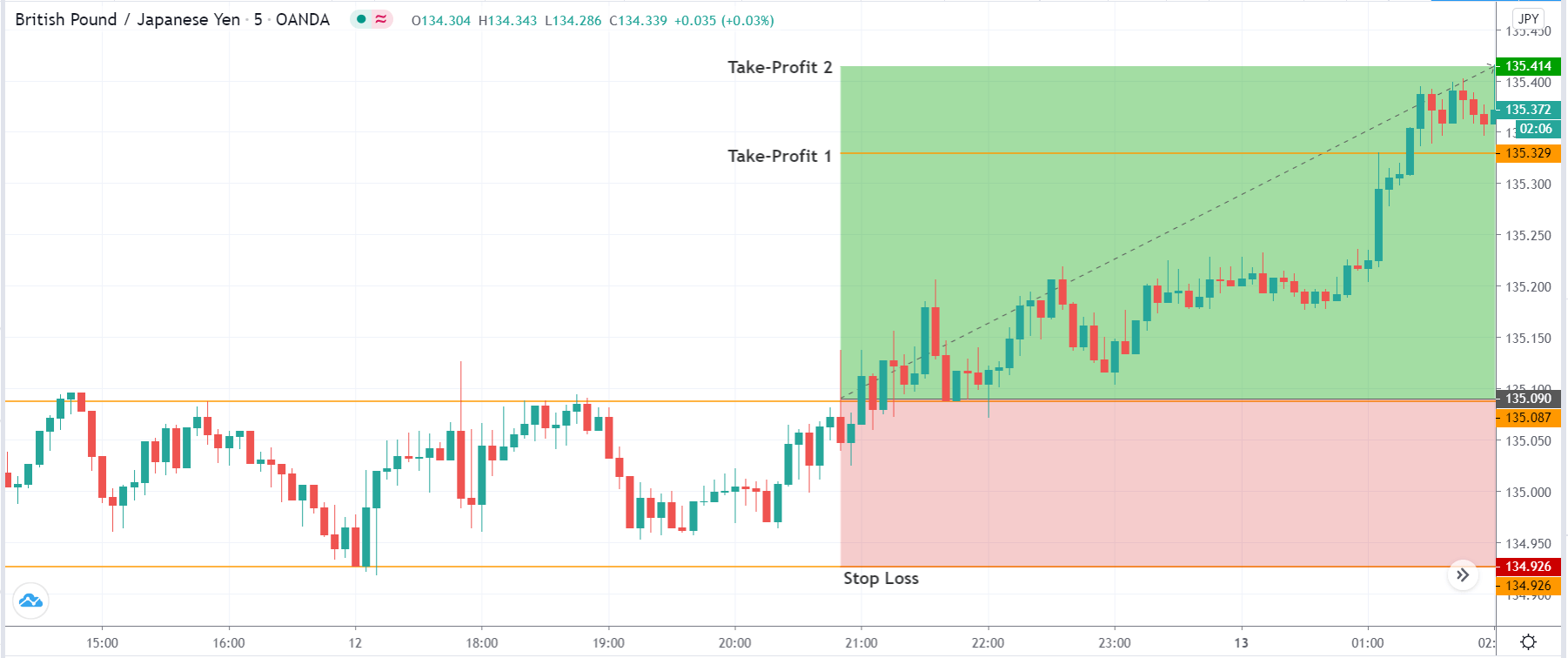

As you can see in the below image of the GBP/CHF Forex pair, the price was in an uptrend. Whenever the price approached the trend line, buyers immediately came back and printed a Pin bar candle, which is an indication to go long.

In this example, the market gives us three buying opportunities, and all the three trades performed well. When you take an entry at the pin bar formation, and the very next candle goes against you and closes below the pin bar, it is an indication for you to close your positions and wait for the next signal. On a one-minute time frame, always go for 2-3 pip stop loss and 6-7 pip targets only.

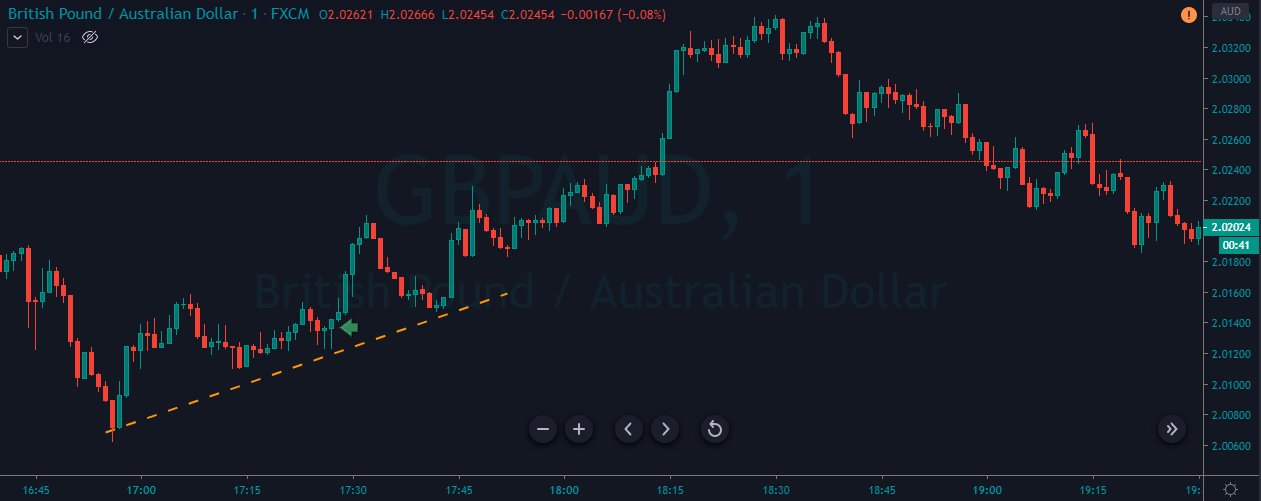

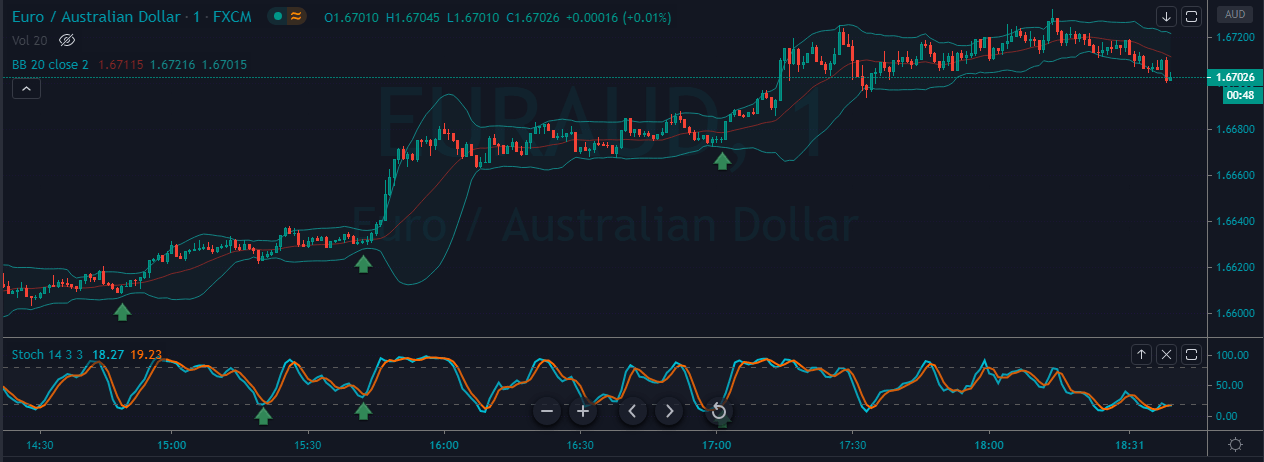

Below is another buying example in the GBP/AUD Forex pair. Here, the market gave us only one trading opportunity. As the price chart implies, the buyers were in complete control, and the price action is moving calmly. This means that there is a very less chance of spikes or fake outs. It is always advisable to find the less volatile currencies and try not to scalp the opening hours of the market.

Sell Examples

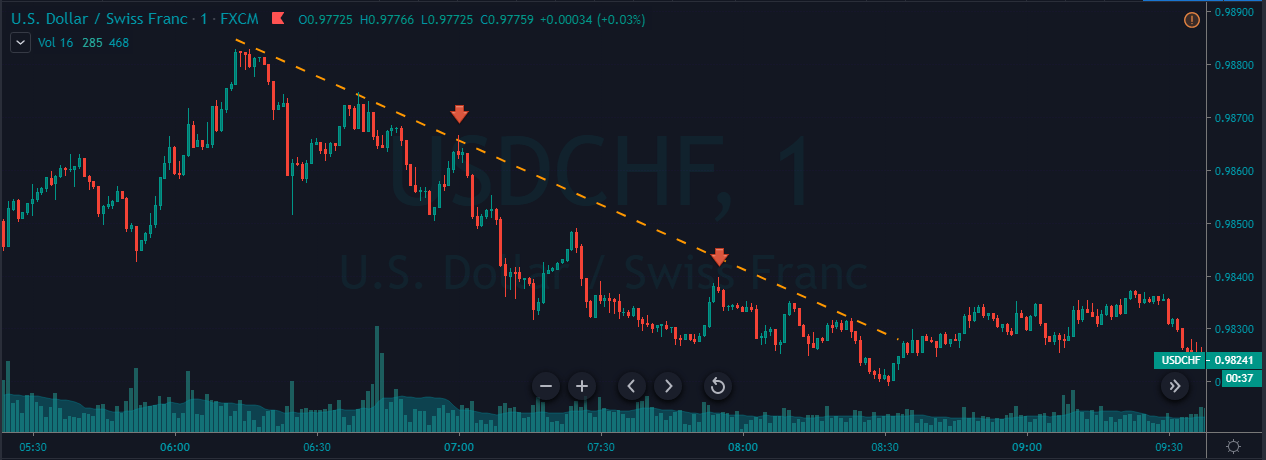

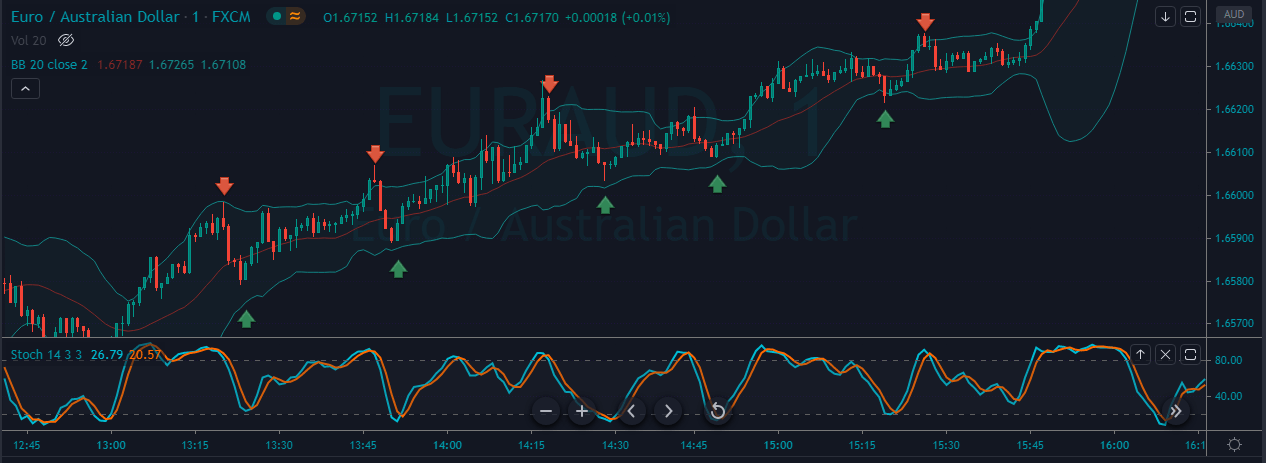

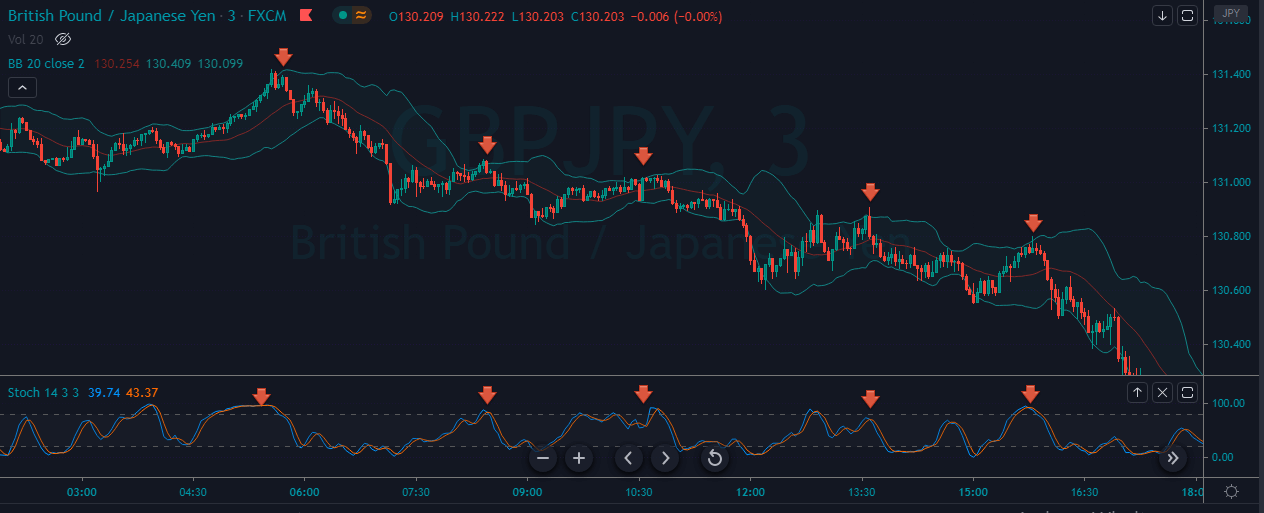

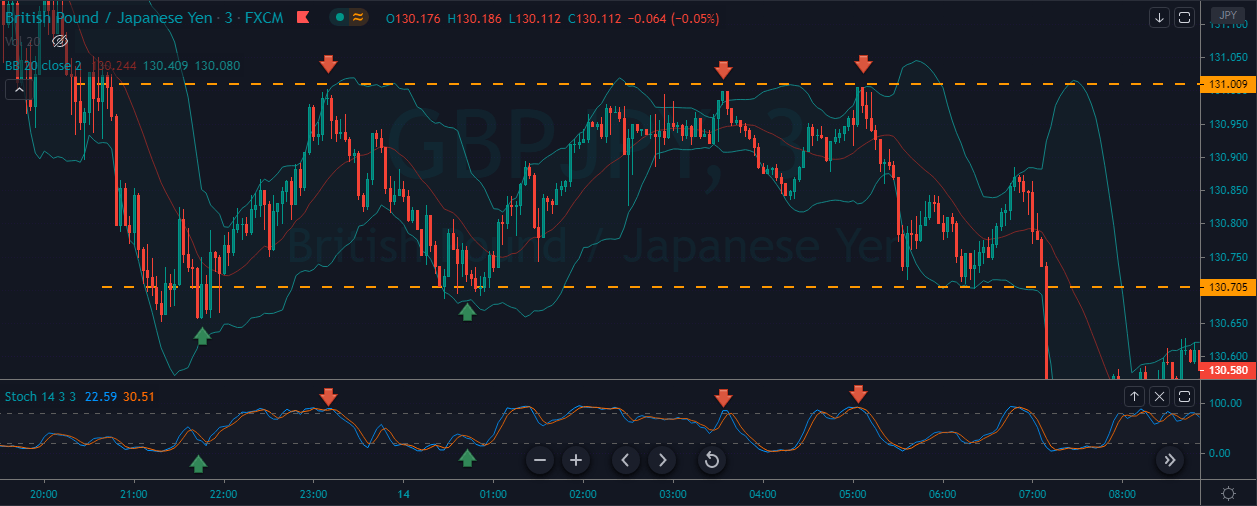

In the below USD/CHF 1-minute Forex chart, the overall trend was down. We can see the price printing the pin bars twice in a downtrend, which indicates us to go short. There are various ways to close your positions. We can choose any significant support/resistance area to book profit or close our positions when the price action starts to lose its momentum.

Some scalpers prefer to ride longer moves based on the market circumstances, while some like to close their positions after making 5 to 6 pips. So exiting completely depends on your trading style.

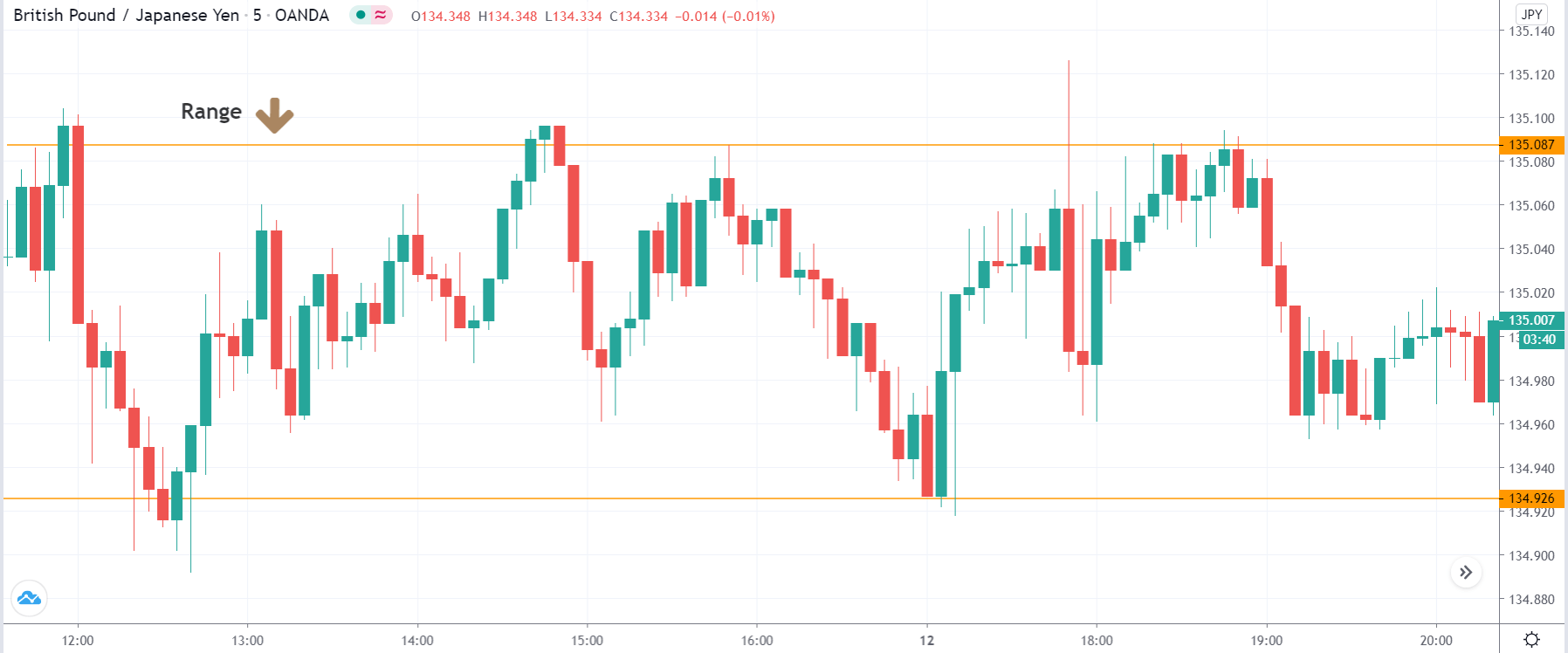

Below is another selling example of this strategy in the USD/CHF Forex pair. When price approached the trend line in a downtrend, we can see the market printing Pin Bars. This shows that the price action is ready to print brand new lower lows. Activate your trade when the market gives both the signals. In healthy market conditions, expect brand new lower lows or higher highs, and please avoid trading choppy market conditions.

Conclusion

Scalping proved to be a great way to make profits in a very short time. Make sure to understand that it requires a lot of hard work, patience, and dedication to master trading the lower timeframes. The more the trades you get into, the more the amount of money you will make. Scalping can be very difficult in the beginning, but with some practice and a right strategy, you will get the hang of it.

It is hard to scalp the 1-minute chart by using price action alone. Most of the highly successful scalpers use some indicators and candlestick patterns to confirm the market trend. Using the pin bars and trend lines on the 1-minute chart will help you filter out the bad trading signals, and this will drastically enhance the odds of your trades. Cheers!