The devil is in the details, they say, so sometimes it’s important to take a step back and look at the big picture – something that is surely as true in forex trading as it is in other aspects of your life. It just might be these details that allow you to succeed in profiting while playing the percentages game.

It doesn’t matter what kind of trader you are, whether you love Fibonacci or Japanese candlestick patterns or if you have concocted your own system; it doesn’t matter if you trade on the one-minute chart or the daily chart; it doesn’t even matter if you’re a chart watcher or if you log in for fifteen minutes every couple of days – in all these scenarios there is one rule that applies to everyone. And that rule is that you will win some trades and lose others.

High-Percentage Trading

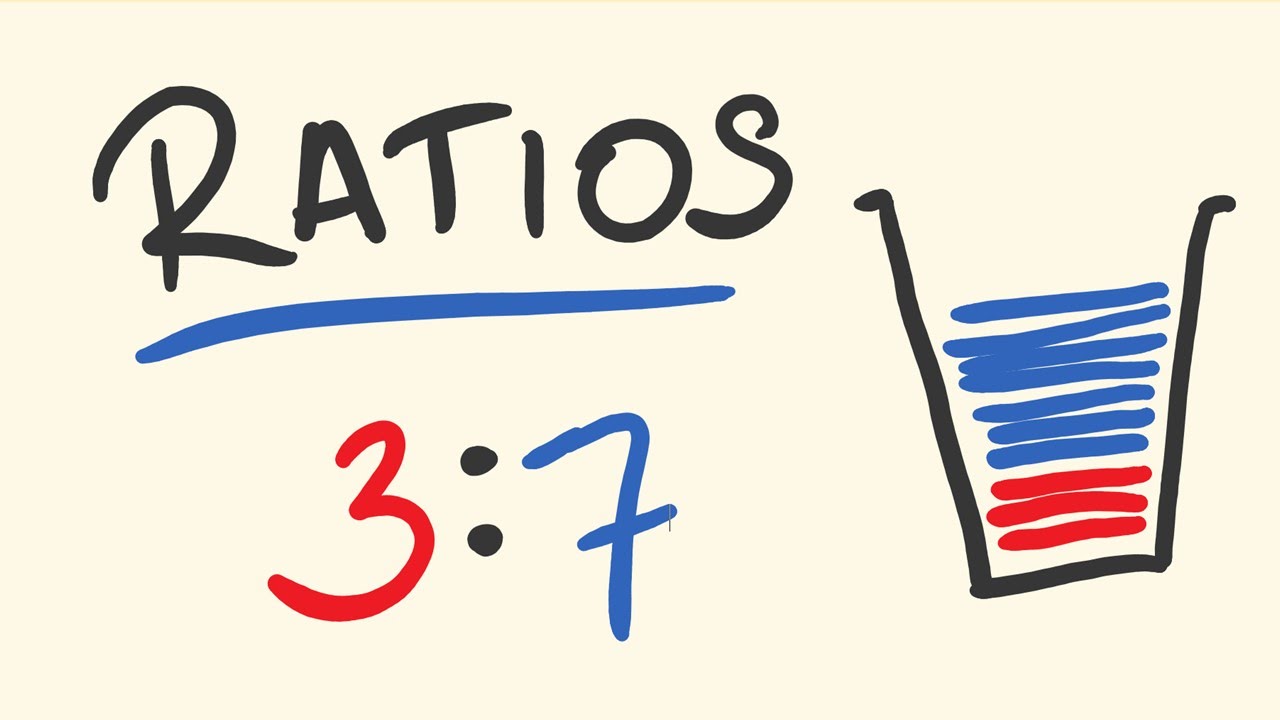

So, if you’re smart enough to take a step back and look at the big picture, you will realize that the name of the game is minimizing your losses (and not just bad trades but how much you lose when you do lose) and maximizing your gains (making sure that when you do win, you win big enough to reliably and consistently make money from trading). Sure, that sounds simple enough doesn’t it? But let’s put it like this, say you make ten trades over a given period, and out of those ten, you win on six and lose four. Well, you’re winning more often than you’re losing but are your wins outweighing your losses? But how do you get that down to three losses out of ten and how do you make sure your losses are small while maximizing your wins? If you can work that out, it’ll set you apart from the hundreds of thousands or even millions of unsuccessful traders out there – that’s what sets the pros apart from the amateurs.

But here’s the catch. Every time you go into a trade, you are convinced it’s a good one. Even if you’ve done your homework, put in the research, done the technical analysis or even if you just have a great feeling about this one – you never know in advance which trades are going to be the losers. If you did, you wouldn’t enter them and you’d probably be a millionaire almost overnight. Let’s put it like this, if you ask any trader out there right now if they can win every trade they enter, they’re going to answer that, of course, you can’t. Nobody wins every trade. But then if you ask the same trader how they feel about the trade they’re currently in, they’ll tell you they’re sure this one will be a winner.

Beginner Woes

We’ve all been there when we started out. We’ve watched video tutorials, learned about a few basic indicators, picked out a strategy online and we think we’ve learned so much. But a little knowledge is a dangerous thing. In forex trading, it can be deadly. We jump in and we inevitably get burned. We didn’t understand risk, we didn’t understand how to manage our money, we probably didn’t even understand some elemental basics, like how you can get burned when the price gaps below your stop. We probably got caught up in our own emotions or the adrenaline kick of trading and we got humbled by our losses.

The forex markets are open 24 hours a day for five and a half days per week – that gives you a lot of time to show how little you know and how many mistakes you can make. In short, it’s a lot of time to make an idiot of yourself. You can easily start trading out of boredom. Lots of people become hooked on the adrenaline of trading and end up entering bad trades. Adrenaline is deadly for forex traders. You need to be in control of those impulses and watch out for those times when your brain is calling out for stimulus. Introverts have the opposite problem – they will spend all their time second-guessing every move. Probably to the point that they will miss a bunch of good trades (which doesn’t, by the way, guarantee that the trades they eventually enter will be winners).

There are so many common mistakes people make that it is worth listing a few of the main ones because some of you reading this will still be making them:

- Trading without a plan and without knowing or assessing the risks before you enter a trade;

- Breaking the rules of your plan (be careful with this one because, at the moment, your brain will be able to come up with any one of a million justifications that will seem sensible and rational at the time);

- Getting attached to or over-focusing on one particular currency pair – sometimes when you think you’ve found a winning combination you stick with it well past its use-by date;

- Staking more and more on the next trade in the hope that it will win big enough to recover your past mistakes;

- Failing to incorporate lessons learned into your trading and repeating past mistakes.

Trading by the Numbers

And that’s the crux of high percentage trading. Every component of your system needs to be well designed so that every trade is well planned out to minimize the number of losing trades and, when those trades do crop up, to minimize how much they set you back. The flipside is that you are also working to ensure that when you do win, the wins are handsome enough to outweigh the winners. And this needs to be deliberate and systematic enough that you can rely on it almost automatically so that it overrules your own psychological and emotional state.

If you want to improve the winning percentage of your trades and apply a high-percentage trading strategy, there is really only one approach. You have to design your trading system in such a way to eliminate the mistakes and traps amateur traders fall into.

So, how do you do that?

You could do a survey of successful, experienced traders out there and ask them what are their top five strategies for improving the percentages of their trading. And you would get a bunch of different answers out there – from the psychological and philosophical to the technical and procedural. But every last one of them would have on their list some version of the below components. Every successful trading system will incorporate these four things to ensure it maximizes its wins and cuts back on losses: timing (when to trade and when not to); currency pair selection (knowing which pair to trade, when and why); trade management; and risk management. If your system incorporates these four things and does so in a rigorous, well-planned, thoroughly tested manner, you are well on your way to avoiding the pitfalls that burn so many amateur traders.

Timing

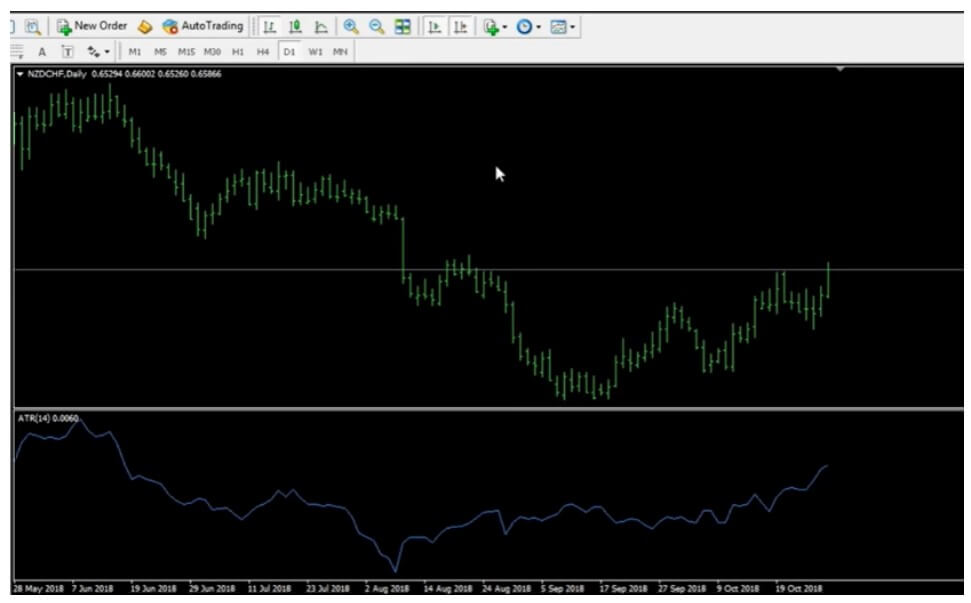

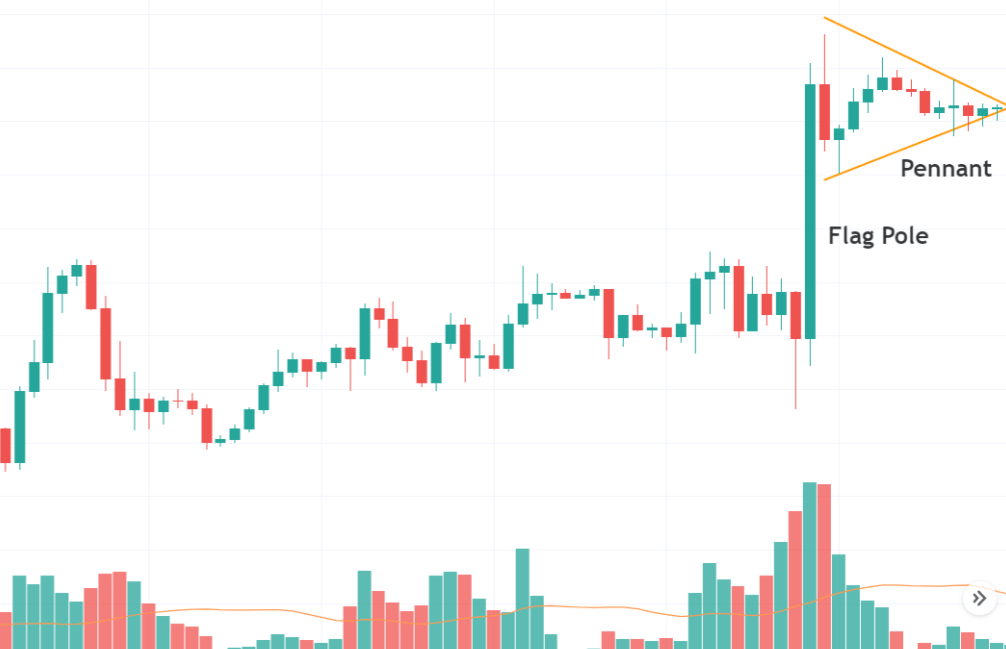

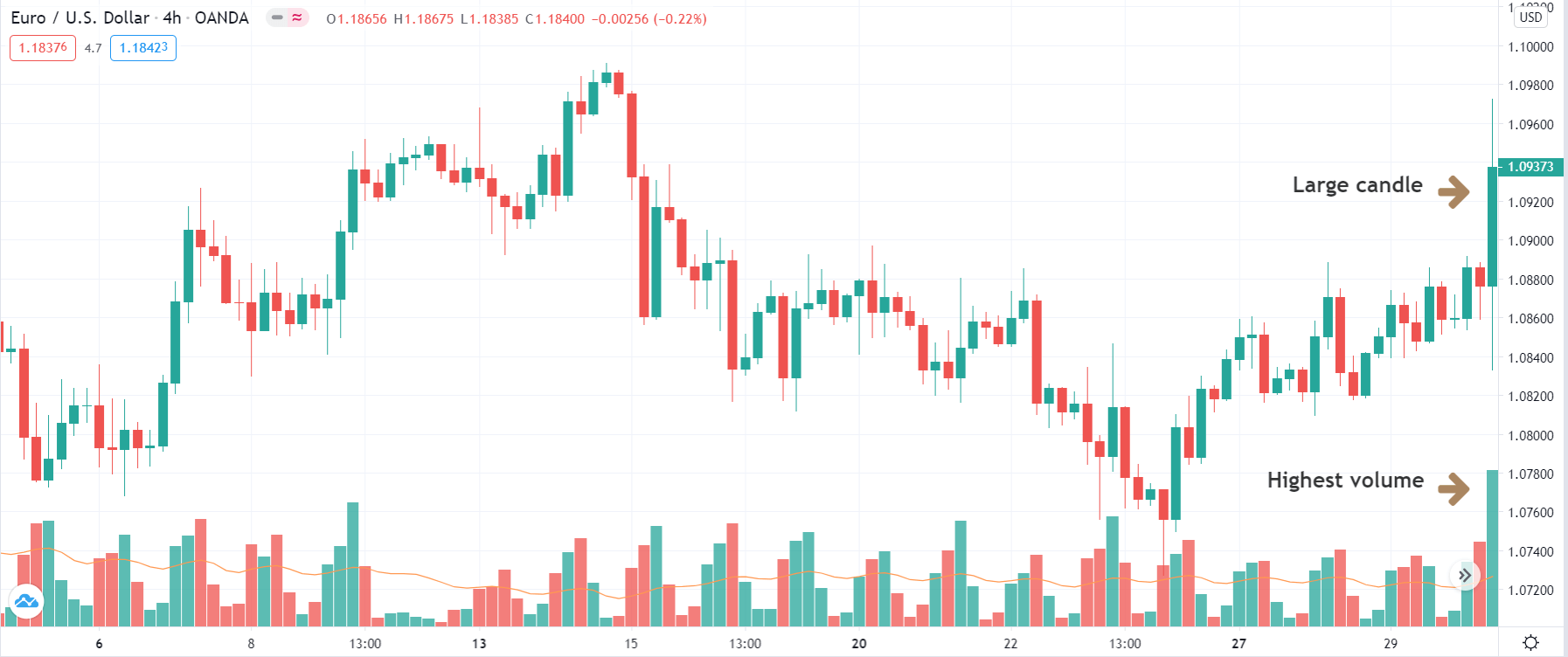

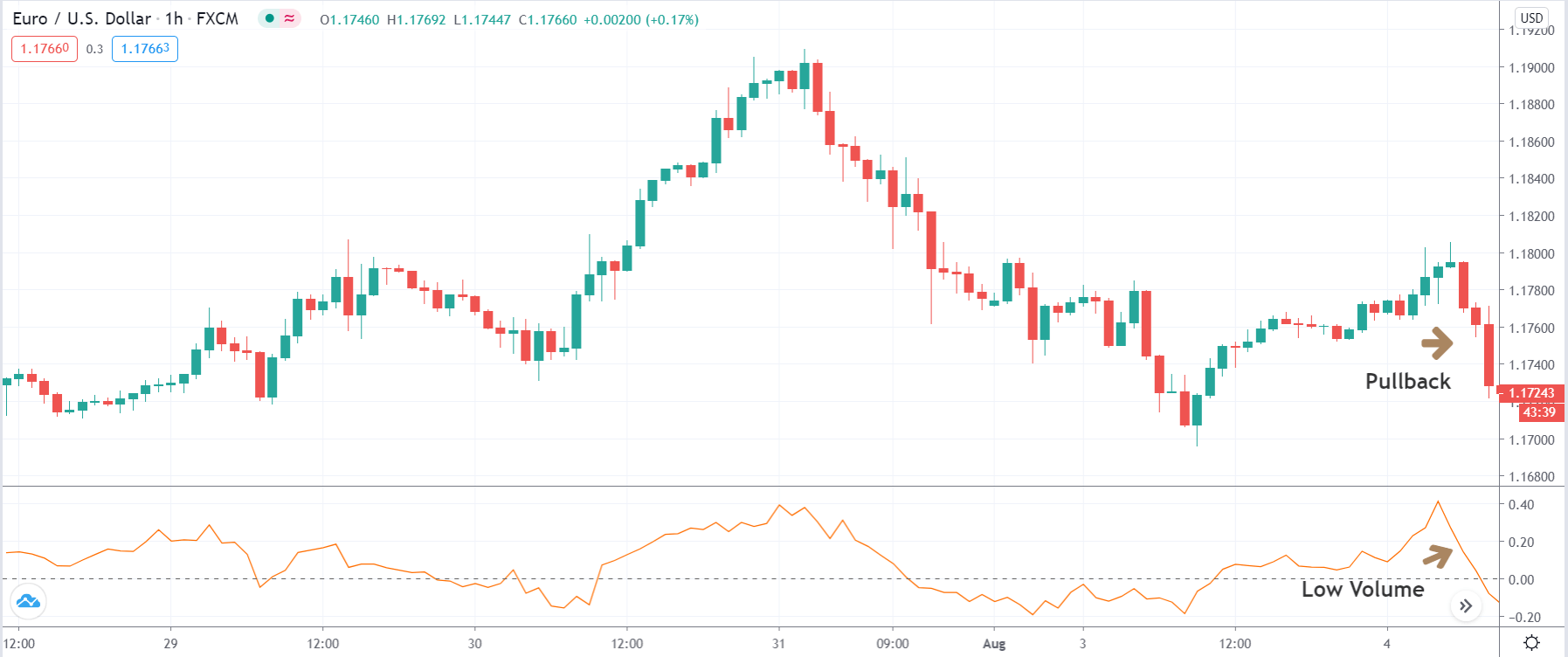

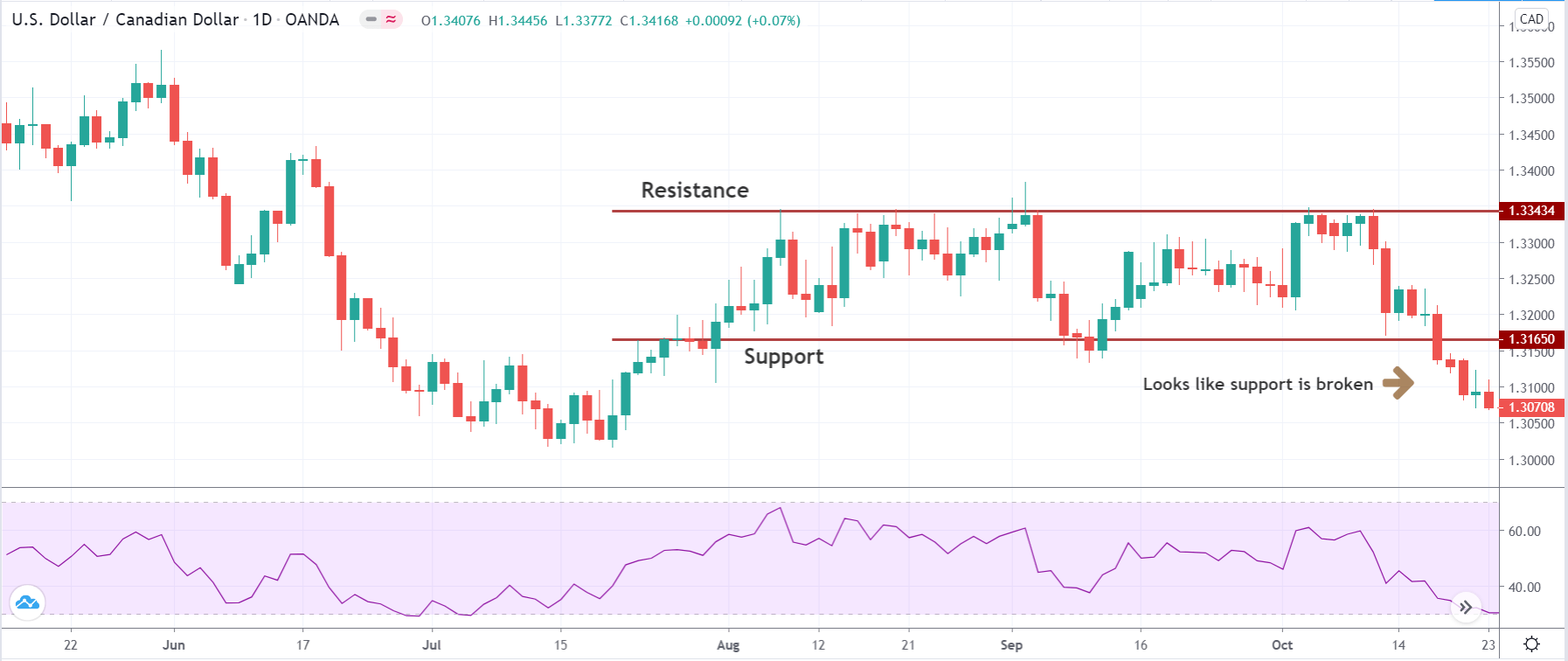

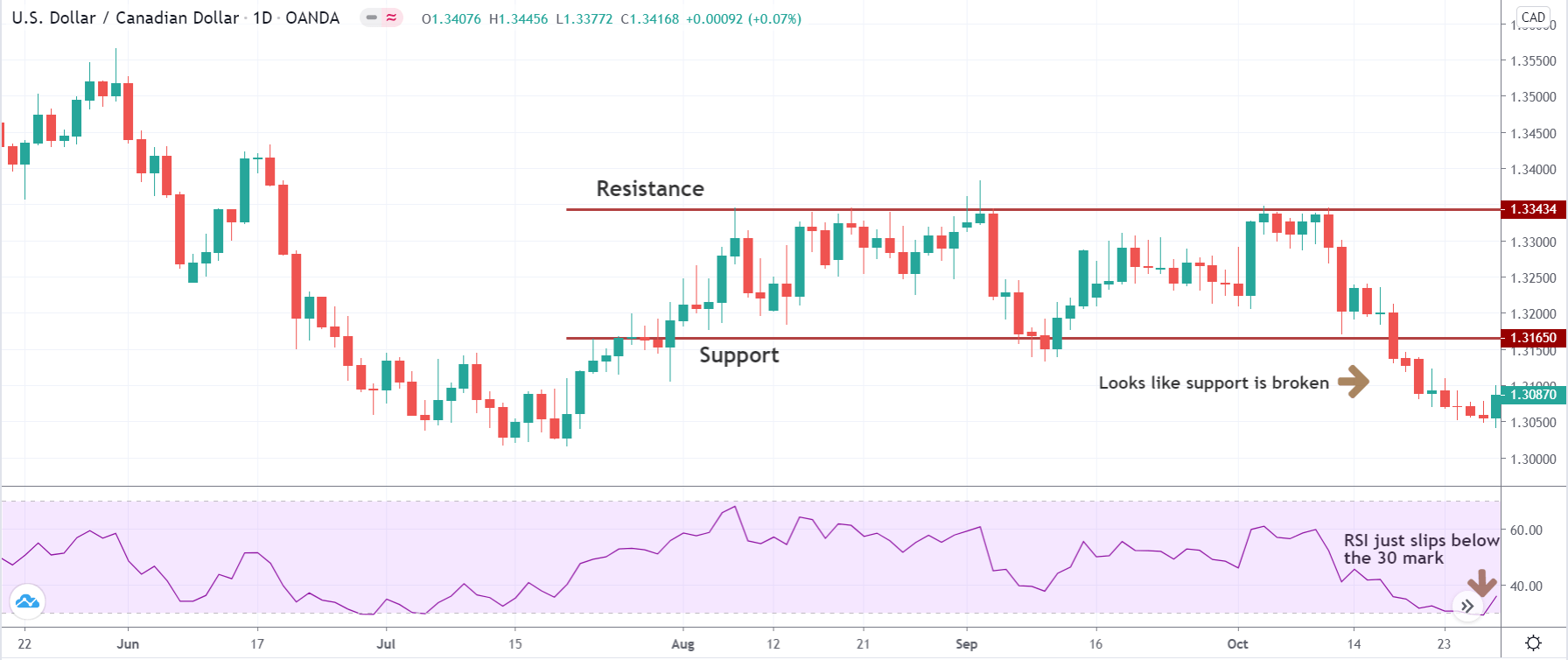

Planning your trades to coincide with those times when there are energy and movement in the market (and, conversely, avoiding those times when the market is flat) is one of the key skills in forex trading but also one of the most difficult to master.

It can’t be repeated enough that knowing when not to trade is just as important as knowing when to trade – also known as you can’t lose if you don’t play. When the market lacks strength and momentum for reliable trends to emerge, it is too random for consistent trading. In short, it is too unpredictable and you will get caught out without even knowing why it happened. Using a set of skills and tools that you have thoroughly tested in advance and that you know inside out is key to identifying those times when volume and volatility are on your side. And when they are not.

Even in a regular 24-hour cycle, there will be times when it is a good idea to trade and times when it is a bad idea. The world is a global place now and forex trading is a global activity. People who are just starting out are simply not tuned into this and think that the 24-hour cycle means that they can trade whenever is convenient for them. If you want to rise above that, at the very least you need to have these facts buried somewhere in your trading brain so that everything you do is done with an awareness of that. Because at certain times there will be a higher volume of trading and volume means liquidity.

With a higher level of liquidity, the market will be less erratic and more predictable. So you need to know which times of the day are better for volume and liquidity because those times will be your sweet spots for trading. The best of these are the overlaps between the sessions and, of those, the best one is easily the overlap between the European Session and the American session. That is usually the time of day at which the markets are most liquid because European markets are still open and American markets are just coming online.

Conversely, there are also times during a 24-hour cycle when it is a bad idea to trade. Think of these times as areas to avoid – almost at all costs – because the volume of trading will turn them into choppy and unpredictable nightmares. These times are the early and late Asian session, as well as the Sunday night session.

Of course, you’ve got to remember that these are low energy periods on an ordinary day. This could change if there is a significant news event that crops up during the run-in to these periods that turn up the volume on them because everybody jumps in to take advantage of the news that’s just been announced.

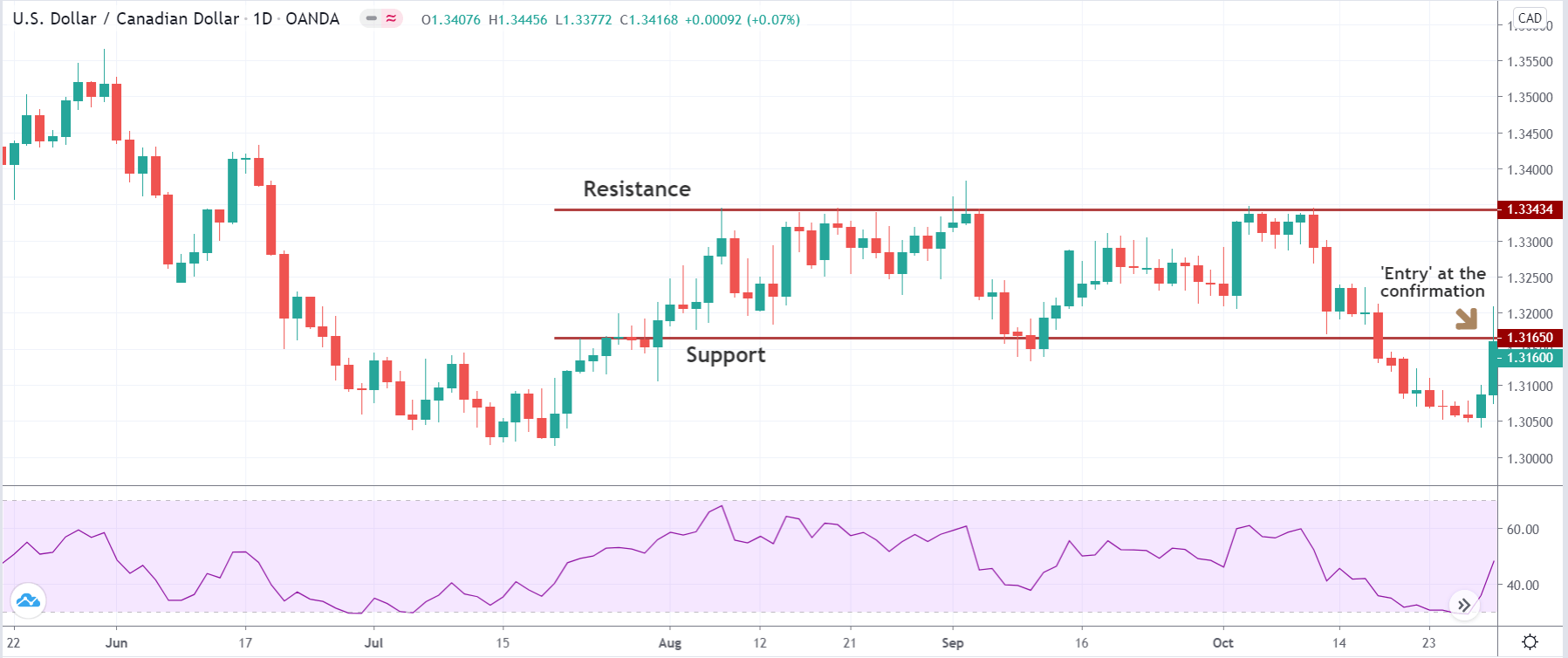

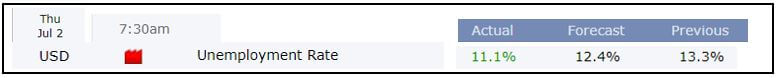

Which brings us neatly to the other critical item on your timing checklist: the news cycle. You need to get on top of the regular news cycle for the currencies you’re trading. This needs to become part of your trading day and part of your research and analysis. You can’t possibly account for unexpected news events – that’s why they’re unexpected – but you do need to be dialed into when the regular news events come around and have a good sense of how they’re going to affect the currency pairs you’re looking at.

These regular news events include announcements by central banks, national GDP reports, and other economic announcements by governments and the major financial institutions. The good thing with these kinds of news events is that there is a regularity to them, which means that you can go in and cross-reference past events with price movements. This is a useful activity to invest some time into because it will give you a better sense of how these announcements impact the markets so you can be better prepared for the next time they come around.

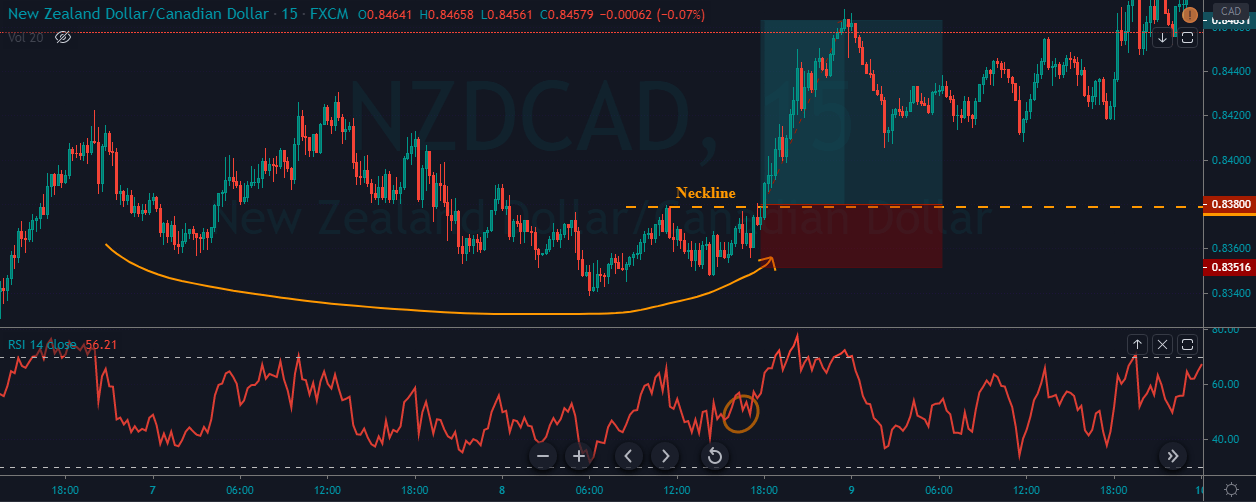

The best way to keep track of upcoming news events of this kind is to have a calendar set up with alerts giving you plenty of notice for each event. If you do this, you can update and modify this calendar as you incorporate new events and new currency pairs, which means it will evolve over time and become a better and better guide to timing your trading. The other thing to remember is that news events will affect the relationship between currency pairs, so if you are looking at, say, CAD vs. NZD, you need to be on top of the news events affecting both of these currencies. And in addition to that, you should probably keep an eye on USD and EUR news too because some of the bigger news events might ripple out to affect other currencies.

The final piece of the timing puzzle is a combination of discipline and psychology. If you know in advance that you are prone to idle chart-gazing, you might be one of those people who’s going to want to avoid being logged into your system during times when you know liquidity will be low. The danger you are trying to evade here is the temptation to trade out of pure boredom. You know it happens and it can happen to you. You stare at the screen, watching those little candlesticks take shape and your brain starts to convince you that a particular trade might be a good idea. This is the absolute worst thing you can do – as you well know – so a good way to cut down the chance of it happening at all is to help yourself exert some self-control by avoiding those times of day when you know trading volumes are going to be low.

Choosing Your Targets

Once you have organized your timing, built up a calendar of regular news events, worked it around your lifestyle and schedule, you are ready to start picking out what pairs to trade at any given time. Trading the correct pair of currencies at the correct time is a key way to improve your win/loss ratios. It can’t be overstated that the best pair to trade is where one currency is going up the most and the other is going down the most. If you’re focusing on a currency pair where both currencies are static, you’re doing it so wrong it is now time to go all the way back to the drawing board.

So part of your trading routine has to be identifying the relative strength and weakness of currency pairs during a given trading window. How often you go through this process is down to you and should be tailored to your specific trading style but we recommend that you go through this analysis at a minimum of twice a week. This will give you a watchlist of currencies to zero in on during the trading window and you can even set alerts for possible entry points.

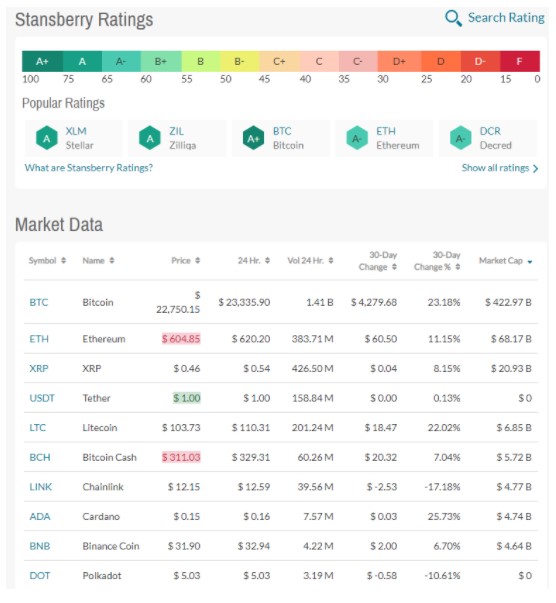

The only thing you can base this on, ultimately, is how the currencies have performed over the recent period. There are no crystal balls so you will have to stay on top of the recent performance of the currencies you are trading and evaluate their relative strengths and weaknesses. One way of doing this is to look at currency baskets and apply that approach to your trading. You will need to be aware, however, of how these baskets are weighted because that will also affect the information they’re giving you. The most famous currency basket is, of course, the dollar index (USDX), which combines six of the majors and rates them against the dollar. But, you do need to know that the USDX is very heavily euro-weighted, with the other currencies very much taking a backseat. So, USD vs. CHF movements, for example, will not really affect the USDX since the Swiss franc is only weighted in at three and a half percent (the euro, by contrast, makes up around 58 percent of the index).

Once you have identified the currencies that you are confident will be relatively strongest and weakest during the trading window, you will have generated a watchlist to focus on. Combined with your trading schedule and news event calendar, you have now narrowed the field to a few currency pairs, and the times at which trading them will be optimal. This is already so many steps beyond how amateur traders approach trading and frees you up to concentrate your system on finding the right setup for these pairs.

Chart Setup

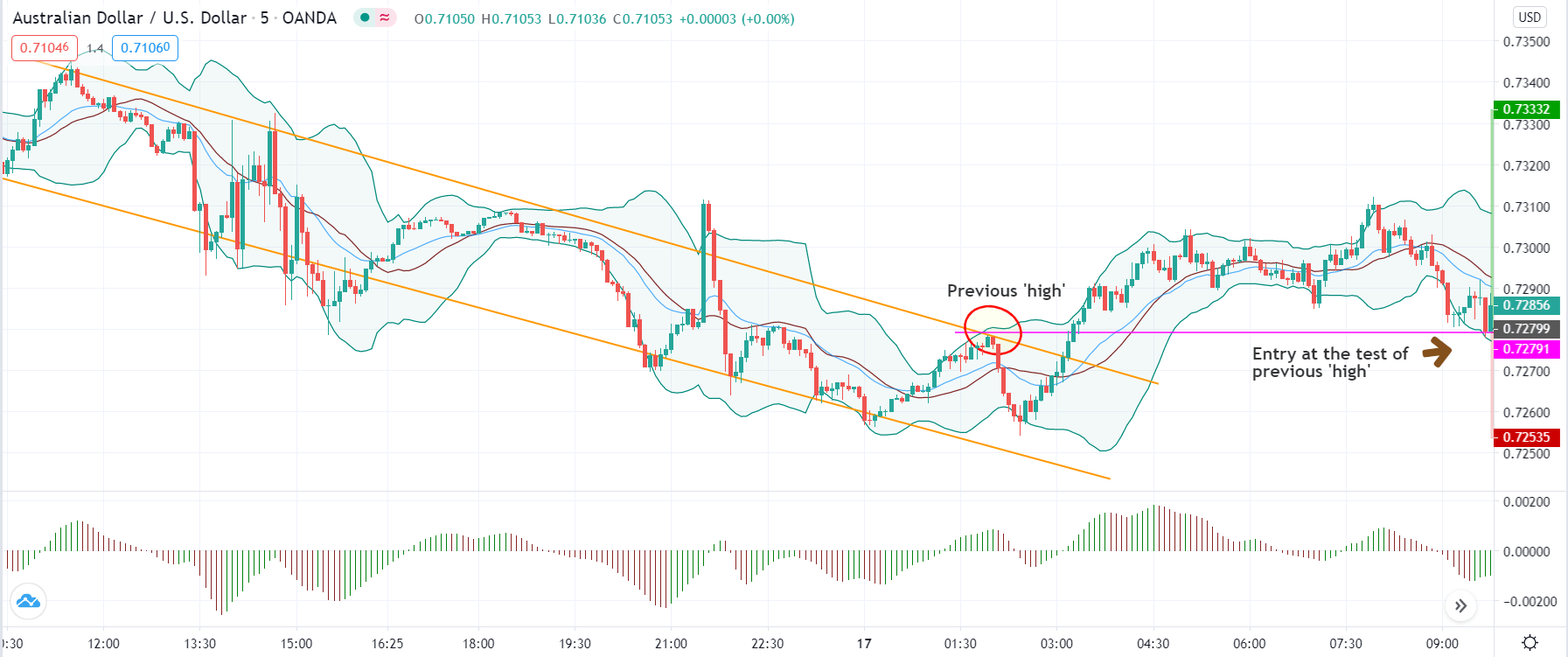

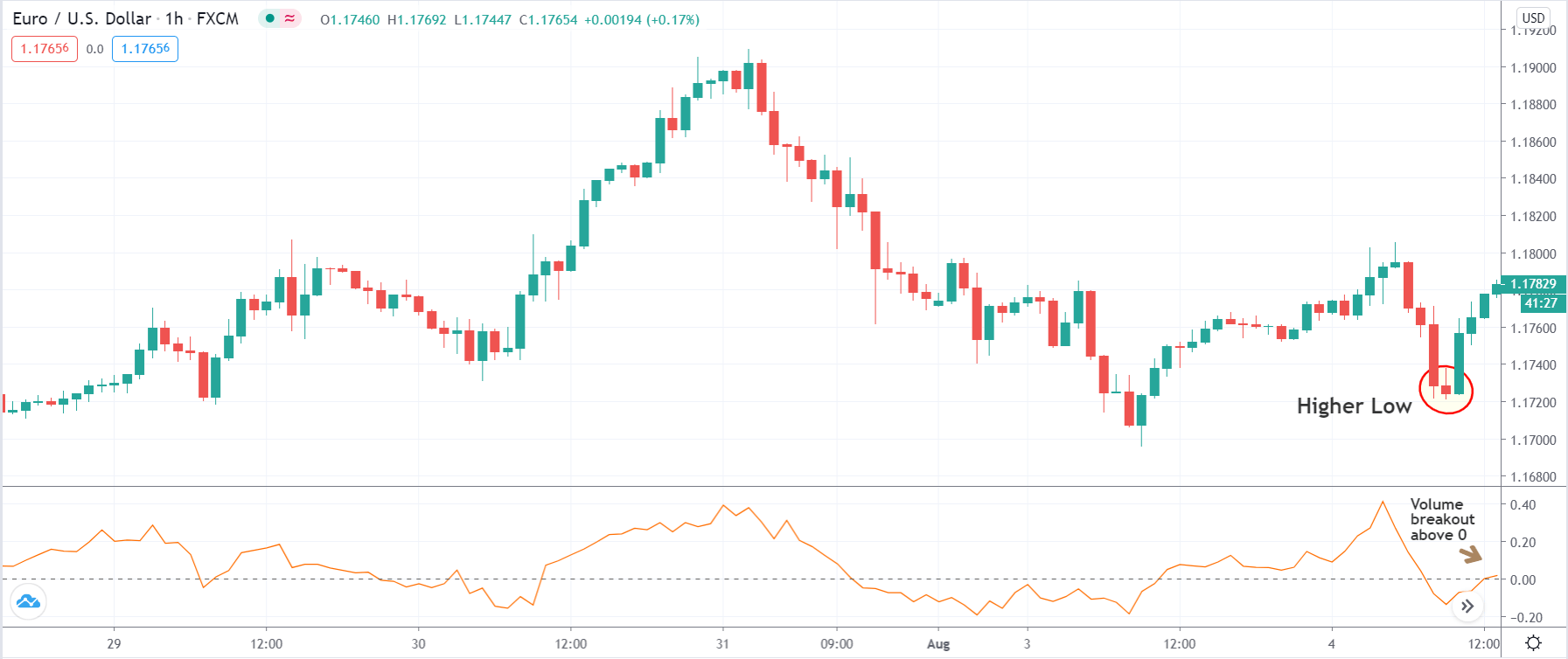

This is where the fun begins. You’ve invested your time into identifying when to trade those pairs that you have determined are going to be the strongest and weakest in relative terms, now it is time to put your technical analysis skills to work. Boiled down to its most fundamental meaning, technical analysis is the set of tools, indicators, and procedures you have developed to help you identify a trade entry point. This is the part most inexperienced traders jump straight into, completely ignoring everything else we’ve been discussing here. The area where beginners and amateurs tend to flounder is that they ignore the rules of their own setup.

A setup is, after all, basically a checklist of conditions that have to be met before you (and the system you have developed) say it is ok to trade. The reason you have a checklist in the first place is that you want to cut down on all those things that are going to lead you time and again into losing trades: guesswork, emotional responses, rash decisions. If you can eliminate these and instead follow a system that you have tested and tweaked over time and that you are confident will churn out a positive ratio of wins vs. losses, then you are well on your way to becoming a successful trader.

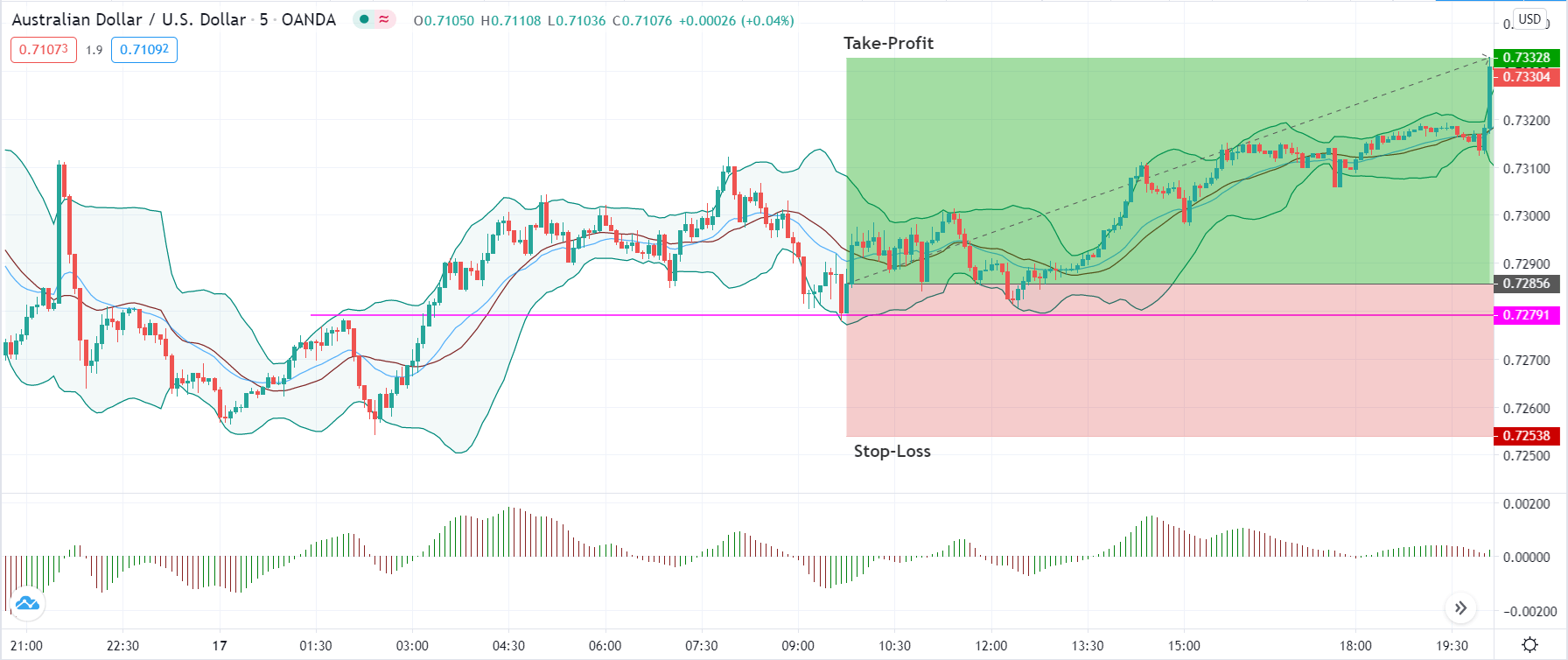

Conversely, you need to be able to stay in those trades that are going your way for as long as possible in order to make sure you are getting as much out of them as you can. This is trade management and it is crucial to your success as a trader.

Now, one way people maximize their profit while keeping their losses low is to use an automatic trailing stop that tracks behind the price by a set number of pips. This is a legitimate technique but you should also be aware of its drawbacks. The main one of which is that while the trailing stop will track the price as it trends in one direction, it will never track it in the other, which makes this whole approach vulnerable to pullbacks and could see you knocked out of a trade before it matures.

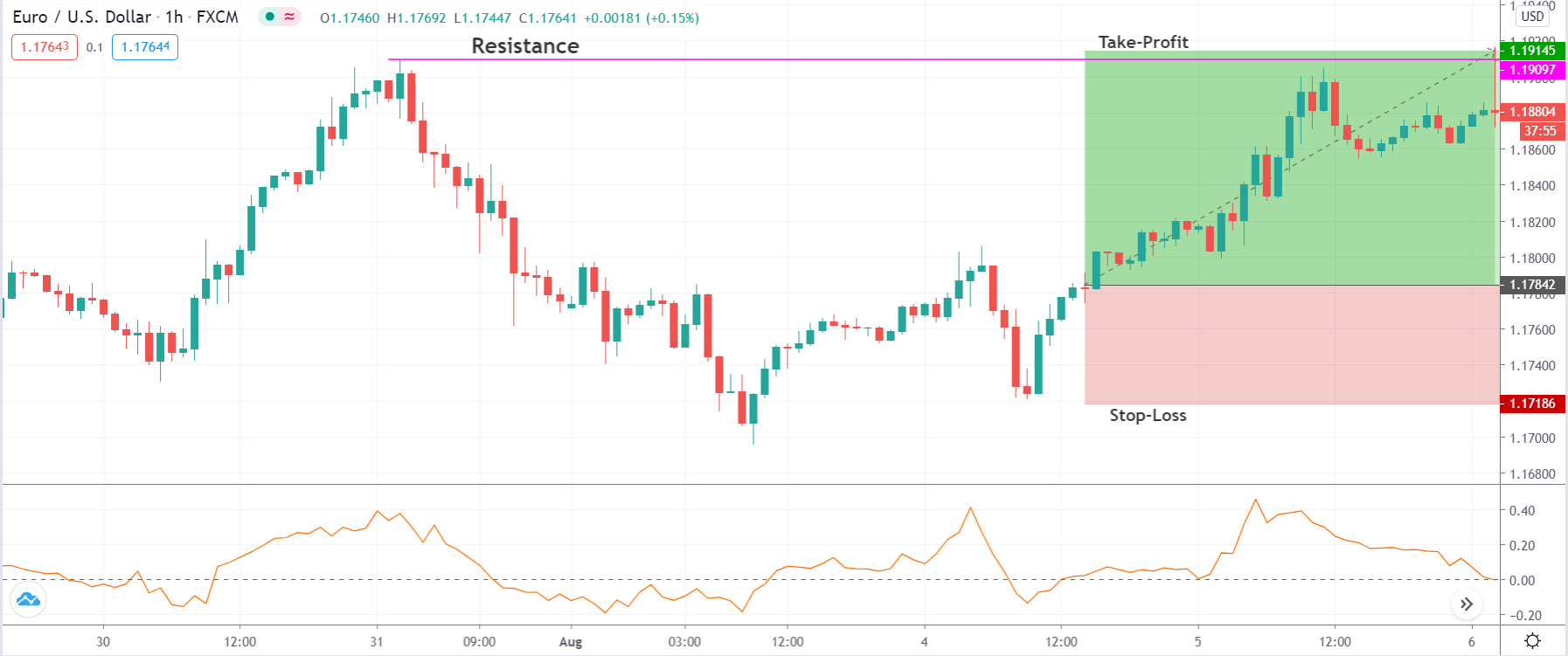

An alternative approach is to peg your stop/loss to an indicator that is going to see you through to the end of a whole price movement. For example, you could enter a trade and have your stop fixed at X pips from the trade entry point. You would then only move it up once the price has gone up X number of pips so that your new stop is at the break-even point. From here you could peg your stop to the parabolic SAR so that you move it up every time your indicator generates a new dot on your chart. If you’re in a reliable price trend, this method will see you through it to the point at which the SAR hits the price, which is the most likely endpoint for that movement.

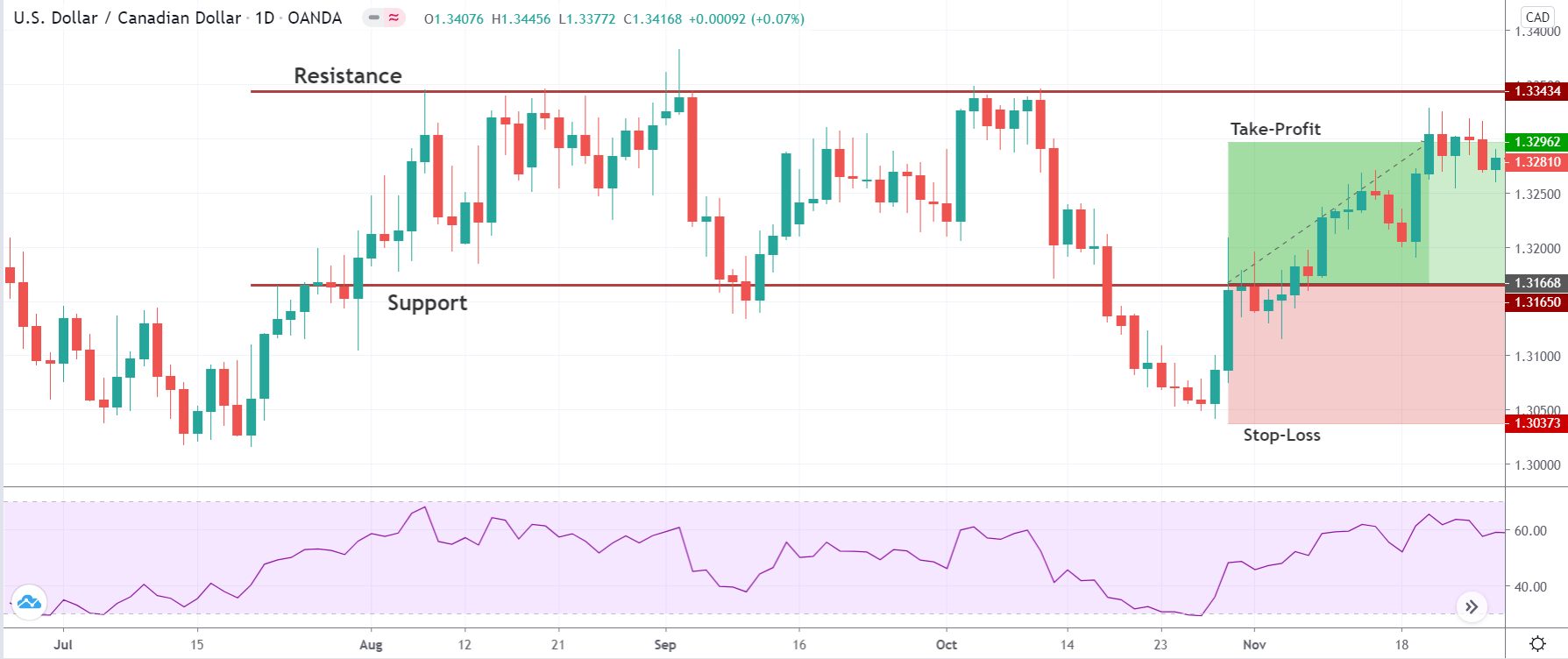

Risk

Assessing whether the risk you are taking with a trade against the potential rewards you can reap is the final key component of high-percentage trading. You need to have a definitive plan in place to cut losing trades quickly and for an acceptable loss, while maximizing the profit you take from winners to ensure that your gains outweigh your losses. In short, if the rewards do not justify the risks, don’t trade.

But remember, staying out of those bad trades is just part of the equation. Go back to the ten trades we discussed earlier on in this article. Each time you trade you are only getting into those trades you think will work out for you, where you think you’ve done your homework to the best of your abilities and where you think you did everything right. But, as we know by now, some of them will fail and, going in, you have no idea which ones. So you need to have a plan in place to get your capital out on time and having lost as little of it as possible.

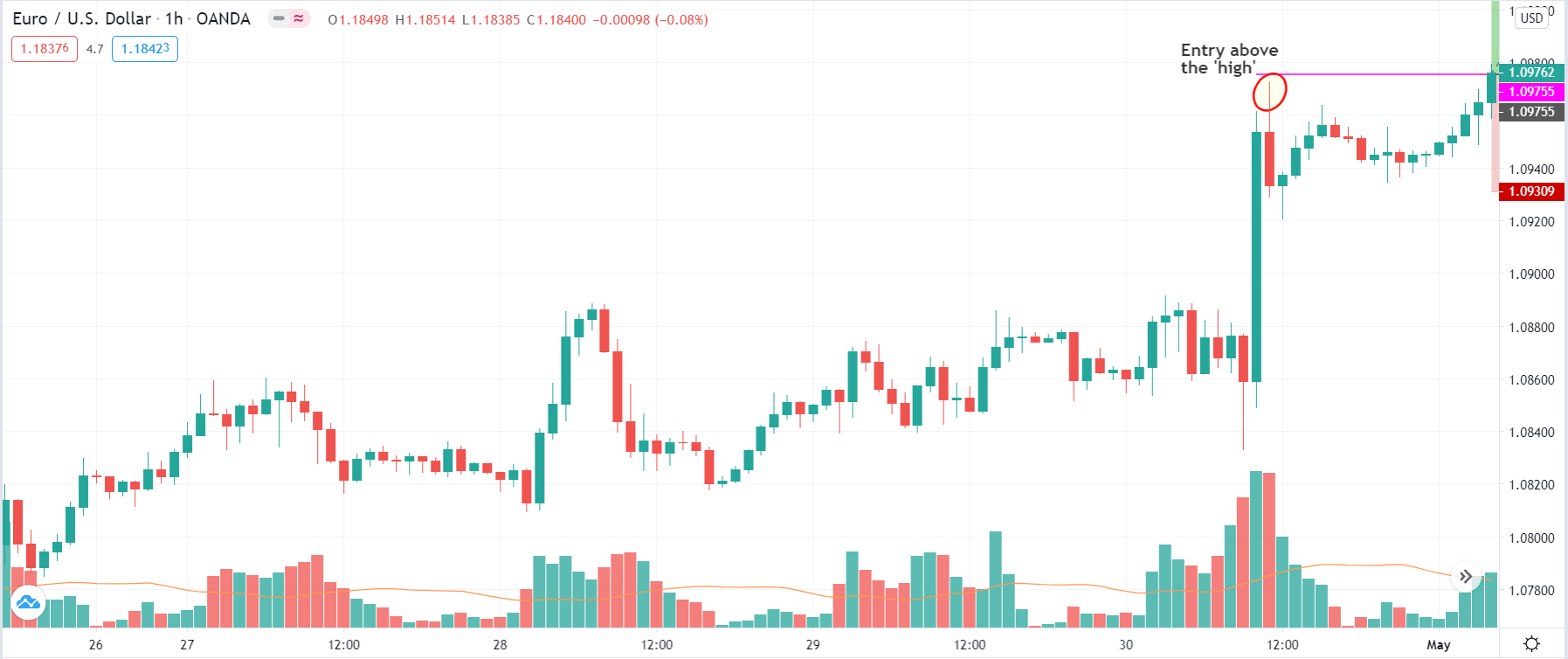

Position sizing should also be something for which you have worked out and systematized to the point where you have a way of calculating the stake on each trade based on clear and detailed criteria. This is key to managing risk and is going to have an impact not only on each individual trade but on your whole portfolio.

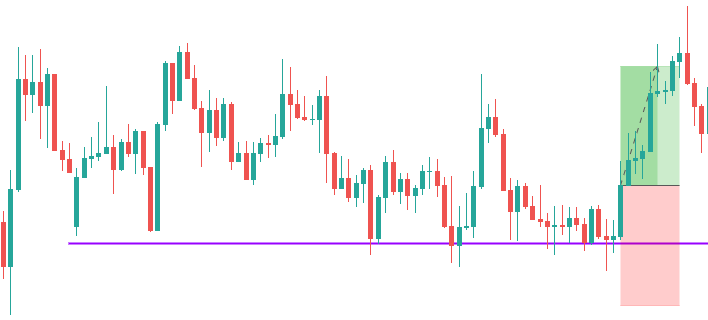

One technique you can introduce to your approach to position sizing is scaling in. This is where you split your trade entry into stages, only committing part of your capital at each stage. Say, for example, you have a trade entry signal on a given currency pair. Rather than committing all of your capital in one go and hoping your stop doesn’t get blown out of the water, you could commit one-third of the amount you intended to risk on this trade and see how it performs. If it performs as predicted, you can then begin committing the remaining two thirds in separate installments. You can even go in with a slightly looser stop/loss order on that initial third, given that you are risking a smaller amount. This gives you a bit more leeway to see how the movement is going to pan out without your stop/loss getting crushed in a nasty pullback.

Whether you choose to scale in your trades or deploy any other position sizing technique, the name of the game here is to make sure you have a deliberate, well-planned approach to managing how you commit capital to your trades. Because risk management is not only about eliminating those trades you do lose, it’s also about making those losses acceptable.

Evolution

So the last thing to say is that you should never rest on your laurels. Yes, all of the components of high-percentage training that we talked about here are supremely important and yes you should incorporate them all into your system if you want to improve your trading outcomes. But even once you’ve done that you can’t expect to just sit back and reap the rewards. You need to use this as a springboard from which you will embark on a journey of constant progress. You will need to focus on your trading system and on yourself because that’s the key to evolving and becoming a better trader in the long-term.

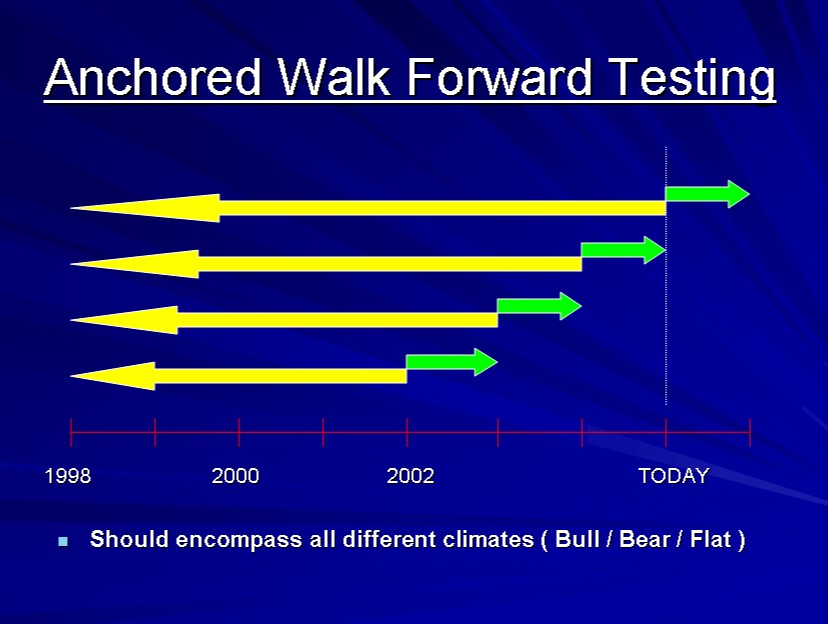

So take this opportunity to build a trading system that incorporates all of the elements that were outlined here, build on it, develop it, research new tools, techniques, and indicators. Test them out individually and test out how they work when integrated into your system as a whole. Make sure that you test the historical validity of your system and all of its components but also plug it into a demo account and take it through a run of forward testing. As well as being the only way to ensure that everything works as you intended it to, testing can also do wonders for your confidence when entering into trades because you can feel that whatever the outcome, you have procedures in place to either minimize the loss or maximize win.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Forex_Scalping_Jan_2021-01-ca1c8dff08824bff87ed01fdd1dba239.jpg)

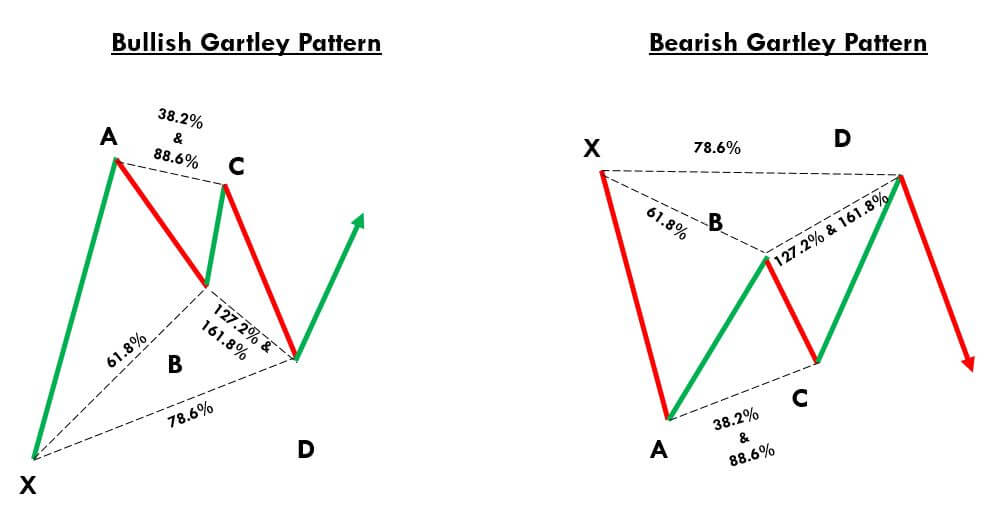

Gartley Pattern Trading Strategy

Gartley Pattern Trading Strategy

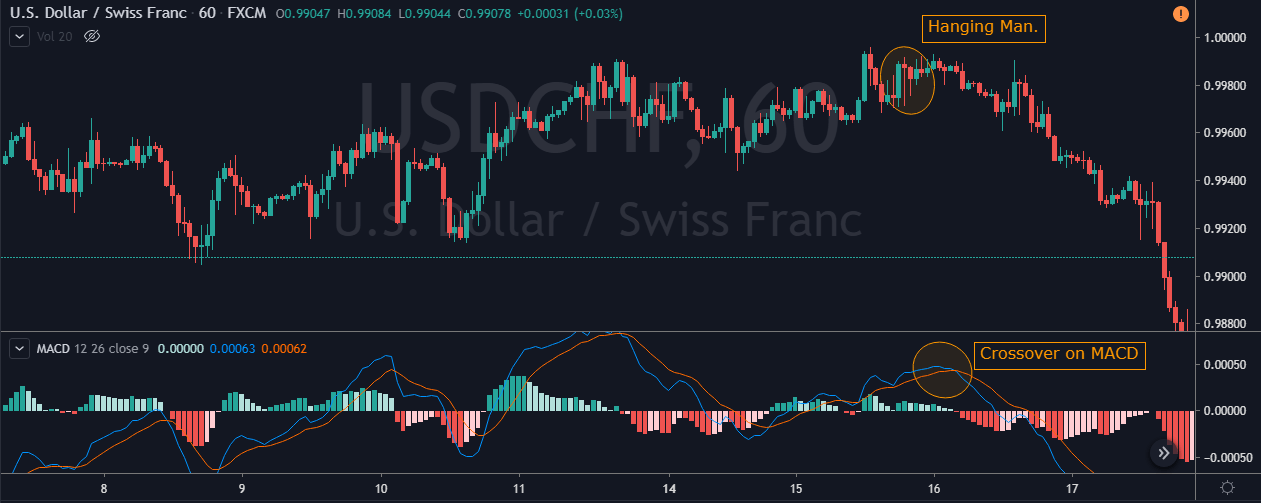

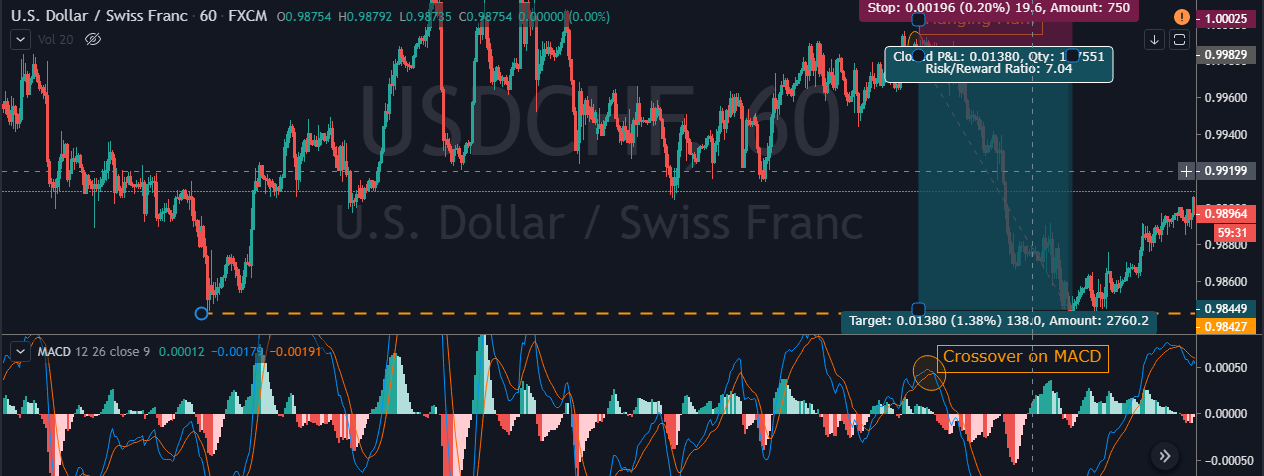

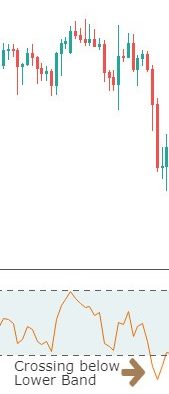

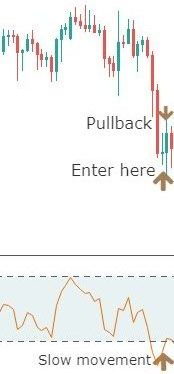

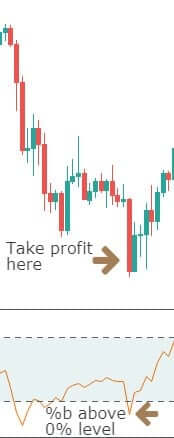

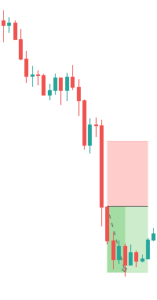

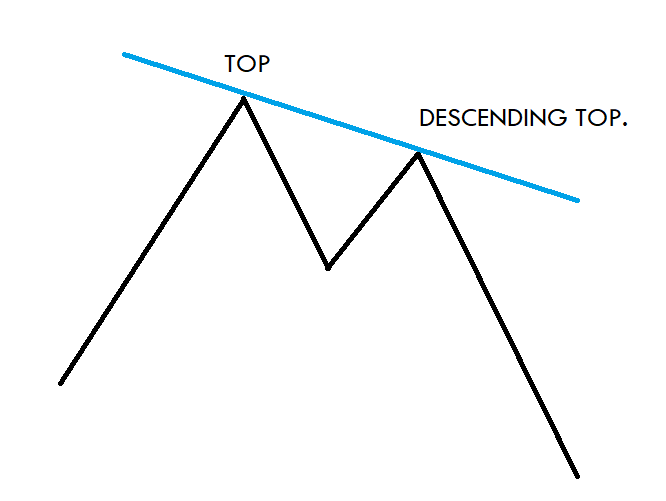

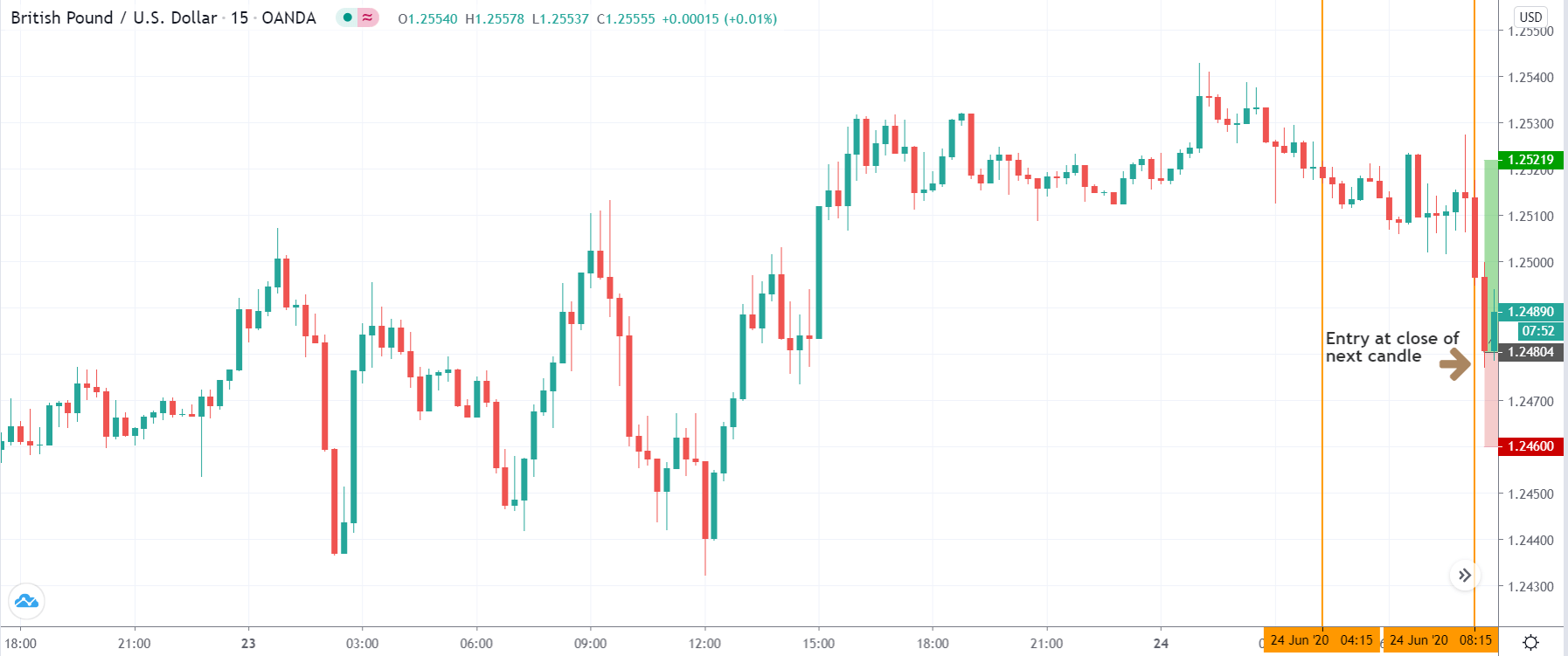

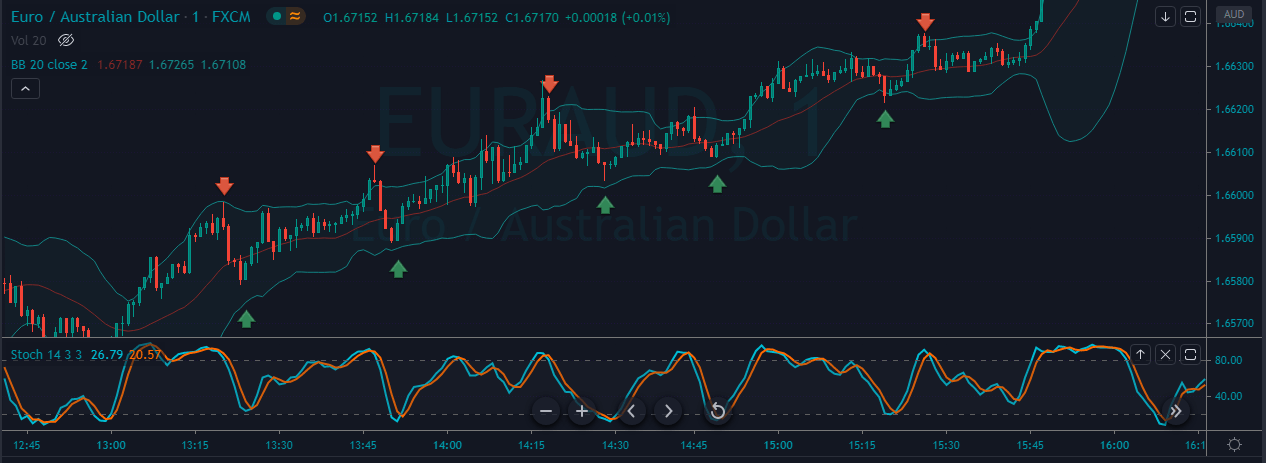

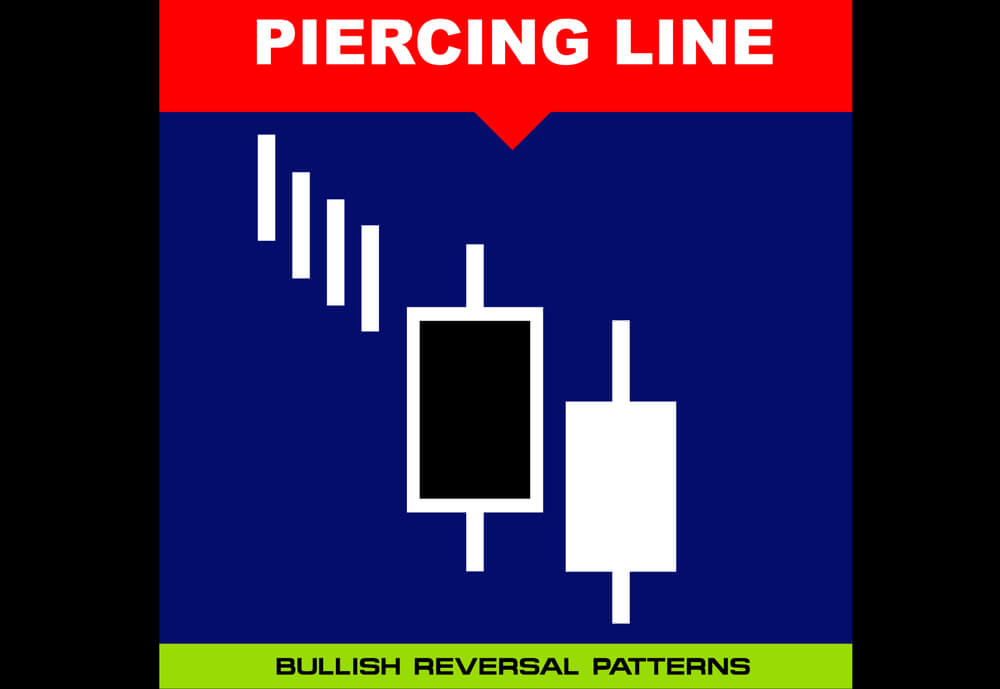

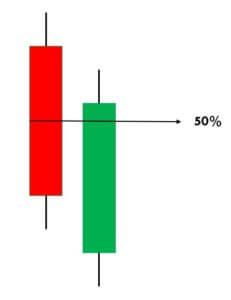

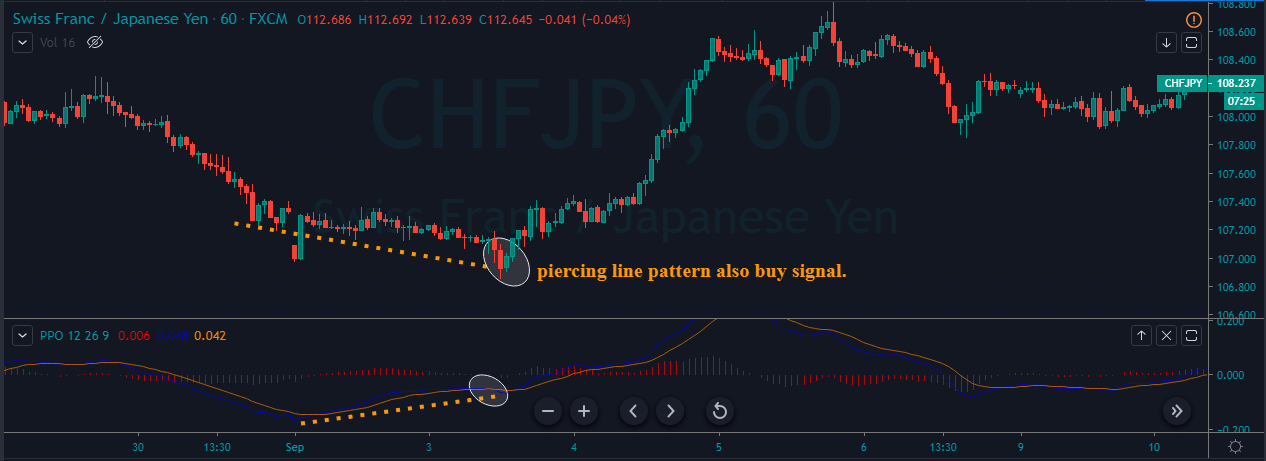

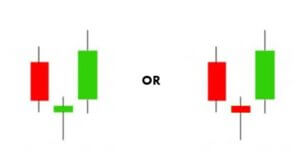

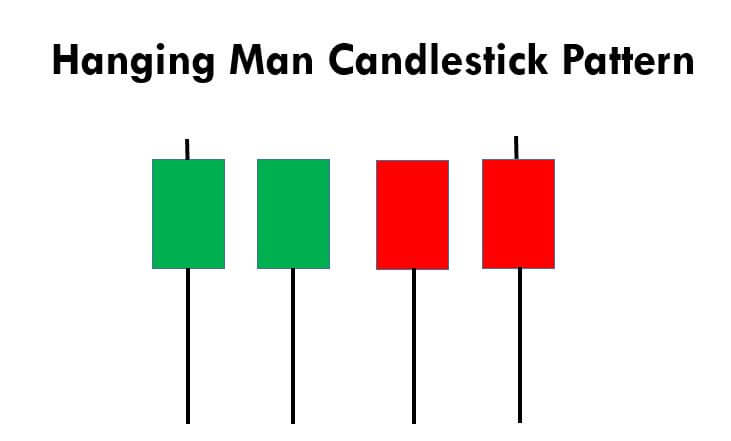

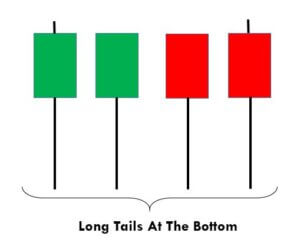

This pattern is not confirmed unless the price falls shortly after the Hanging Man. If the next candle closes above the high of the Hanging Man, this pattern is not valid. After the pattern, if the very next candlestick falls, then it’s a clear indication of the reversal. Now, if you see a Hanging Man candlestick and the above-discussed rules apply, you can go ahead and take the trade. But since it is crucial to have an extra confirmation, let’s pair this pattern with a technical indicator.

This pattern is not confirmed unless the price falls shortly after the Hanging Man. If the next candle closes above the high of the Hanging Man, this pattern is not valid. After the pattern, if the very next candlestick falls, then it’s a clear indication of the reversal. Now, if you see a Hanging Man candlestick and the above-discussed rules apply, you can go ahead and take the trade. But since it is crucial to have an extra confirmation, let’s pair this pattern with a technical indicator.