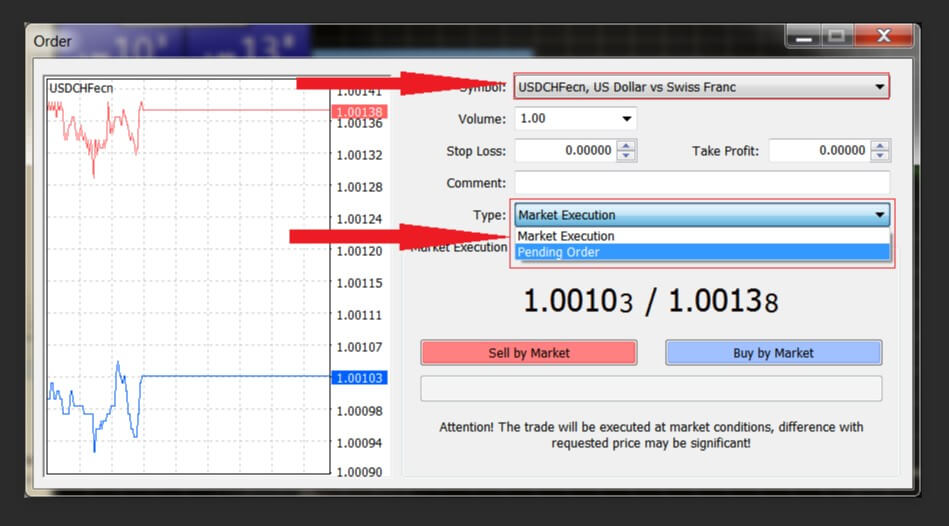

What is a pending Forex order? When we start trading in Forex, we use what is known as “market order” to participate. Just click on the button to sell or buy and you’re trading. The market order is telling the broker that he wants to get involved at the best possible price, or what is known as “market price”. There are no guarantees that you will have the price you see in the box or in the order window, but as Forex is extraordinarily liquid, most of the time it works.

Pending Orders

Pending orders on the foreign exchange market, or in other markets, are a set of instructions that you give to your broker when entering or leaving a position. Sometimes, with more complex trading platforms, you can have several actions in the same order. At its most basic level, it is looking at a scenario in which it is telling the market that it wants to enter or exit a position at an exact price. If the market does not reach that exact price, in this situation nothing will happen. There are several types of orders, but they will analyze the most basic ones that are most likely to be found.

Buy Stops

A purchase stop simply tells the agent that he wants to buy a couple of currencies at a specific price. For example, if you do not have the USD/CAD pair at 1.31, but you acknowledge that you are in the wrong position if the market reaches the level of 1.3180, you place a purchase limit at that price level to protect your account. This means as soon as the market reaches 1.3180, it will buy back the position to close trade and live to fight another day.

Selling Stops

The sales stops, of course, are exactly the opposite. If a price is touched, you want to sell the market, usually to close a position. Using an example of the GBPUSD pair, let’s say you are long at 1.30, and the price has traveled up to the level of 1.33. You want to ensure some profits, so you decide to place a point of sale at 1.3270 just below. If the market returns to the level of 1.3270, you sell your position and flatten the account, at least as long as the transaction is concerned.

Shopping to the Limit

A purchase limit is an order that says you are willing to buy a currency pair at a specific price or higher. A good example is if you want to buy the pair USD/JPY at 111.15, which is now the cheaper price than the market. As the market falls to the level of 111.15, you are only willing to buy it at that specific price, or better. It is possible to fill it at a lower price as is said to be “better”, but this is very strange to happen and always in a situation where there is a big slide during the news event. If your price is not affected, then nothing happens. You will pay 111.05 or less for the position.

Limit of the Sale

Clearly, this is the exact opposite of a limit purchase order, as it is setting a specific price you are looking to sell this pair of currencies. For example, the EURUSD pair is currently traded at the level of 1.1358, and recognizes that the level of 1.12 above is an area of resistance. You’re willing to shorten the market if you get up in that area, and you’re only willing to pay that price. You set a sales limit at that level and can complete your operation at that price or more to take advantage of the “best” part of the transaction.

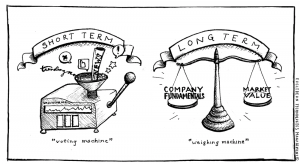

Why Not Use Market Orders?

Of course, we are all guilty of this, but you should never use market orders if you can help it. This invites a slide that can cause major problems. On many occasions, it is not an alarming concern, but it can happen. And beyond that, if it slips, there’s no recourse. You can’t call your agent and complain about the slip and hope to get a reaction in our favor. With a price limit order in this situation, you have any say in the matter.