There are a lot of different strategies out there including things like scalping, day trading, swing trading, trend trading, and position trading. This can make things quite complicated and hard to work out what strategy and style is best for you. These different styles can be further broken down into two different categories, short-term trading, and long-term trading. By combining them into these categories it is easier for us to analyse the advantages and disadvantages of both which makes it easier for you to decide which style may be best for you, and that is exactly what we are going to do in this article.

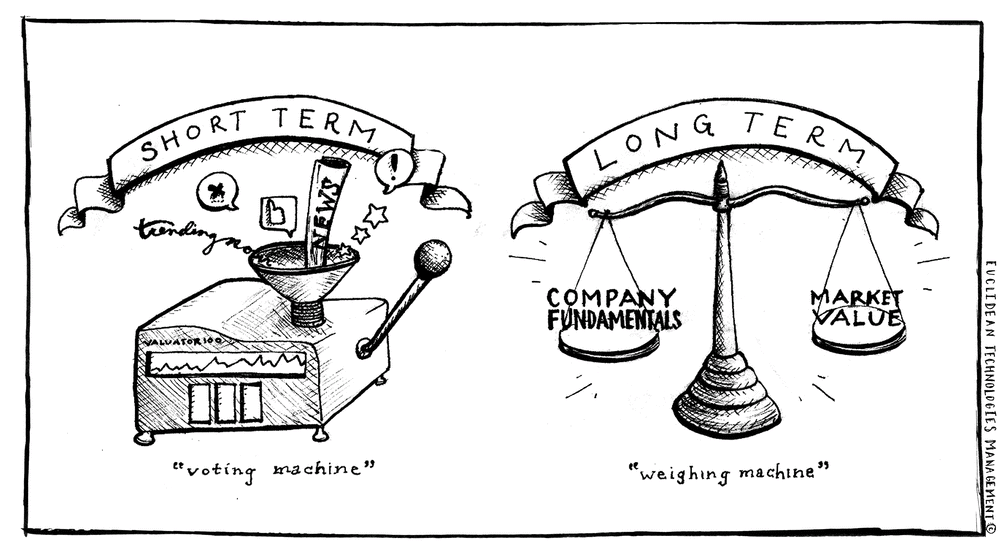

When you started trading you were probably told to think long term, that trading is a long term prospect and that you should not be expecting quick returns, this is true, but it does not mean that each individual trade needs to be long term. So let’s take a look at some of the advantages and disadvantages of trading a short-term strategy. Short-term styles of trading are often seen as scalpers and day traders, both of which do not hold trades for more than a day.

Advantages of short-term trading styles: The first and most obvious advantage is the fact that you will get your money quicker, a short-term style of trading means that you won’t be holding the trades for long, so you will close them quickly and will get your profits quickly. There is also a huge earning potential when it comes to short-term trading, due to trades being closed quickly, you can place many more trades, meaning that you have more potential trades to make a profit on. High volatility currency pairs may make this style very profitable. There is also a limit to the amount of your capital that is at risk when trading, due to not holding trades for a long time, your capital is regularly freed up for more trades, this also means that you won’t be holding your losing trades for a long time either, thus reducing the amount of risk that your account is under at any one time.

Disadvantages of short term trading styles: One issue with opening and closing a lot of trades quickly is that it can become quite costly, in fact, each trade that you make will have a cost, either an omission or a spread cost when you open up a lot, commissions can start to add up and can eat into your profit potential. We mentioned that you can have a lot of profit potential, the other side of the coin are the losses that you can get too. Opening up a lot of trades, if they all start going the wrong way, you can potentially have a lot of trades that have gone rd and which end up as losses. It can also be quite stressful, you will need to maintain concentration when trading, these are not set and forget strategies, you need to sit there concentrating and making decisions pretty much all the time. The other disadvantage is that it takes up a lot of your time, you need to be actively trading, you ain’t place trades and then walk away, you need to be there and you need to be constantly analysing the markets and external factors that may potentially affect the markets.

Examples of short term trading styles include things like support and resistance where you buy and sell on the support and resistance levels, candlestick patterns also fall into this category, things like inside bars, triangles, pennants, and flags can all be used to help work out trades that can be closed within a few minutes to a few hours. So those are the advantages and disadvantages of short-term trading, let’s now take a look at the advantages and disadvantages of longer-term trading styles.

Advantages of long term trading styles: Trading longer-term strategies can actually save you time, what we mean by this is that they are often set and forget strategies, you place a trade on and then can easily walk away and let it do its thing, you do not need to sit there constantly watching the markets. It can also be less stressful, due to the fact that you are not constantly needing to do anything such as watching the charts. You can also take your time with your analysis, there is no rush and no stress in placing it quickly. Each individual trade can be much more profitable than short-term trading style, this means that you can make as much with a single trade as you would with 10 or 20 from a scalping strategy. These sorts of styles are also cheaper, as you are placing fewer trades, you are also spending less on things like commission which can often eat into your profits. It is also far easier to adjust your trades when news events come out or economic data, making it slightly safer and more resilient to market movements.

Disadvantages of long-term trading styles: There are of course disadvantages to this style of trading, firstly you will be waiting for your profits, it can take a long time for trades to close, from a day to months. It also requires a lot of research and analysis, with this style of trading you are often putting on larger size trades, and so you need to make sure that it is right, you need to put in a lot of time and effort into analysing the markets and other various data sources to ensure that you are putting on the right trade. Some strategies that are considered long-term are things like swing trading and position trading, both of these strategies hold onto trades for a long period of time, sometimes even weeks or months.

So those are the advantages and disadvantages of short and long-term staples of trading. Which one is right for you will depend on your own personality and time constraints. There is no harm in trying a number of different styles until you find the one that is right for you. Hopefully, this has given you an insight into the differences between the two, whichever you decide to stick with for a while to ensure whether that style is right for you or not.