Introduction

Although many times before, we have stressed on trading with the direction of the market, yet most traders have a hard time trading with the trend. The observation is contrary to what is said by experts and professional traders since the majority of retail traders claim to be trading with the trend but end up trading counter-trend. While everyone talks of the idiom, “the trend is your friend,” in reality, most traders love to pick tops and bottoms and constantly violate the above rule.

Time Frame

The strategy is fixed to two-time frames. The daily time frame for trend identification and the 1-hour time frame for trade entry.

Indicators

We use the following technical indicators for the strategy:

- 20-period SMA

- Three standard deviations Bollinger band (3SD)

- Two standard deviations Bollinger band (3SD)

Currency Pairs

This strategy is applicable to most of the currency pairs listed on the broker’s platform. However, exotic pairs should be avoided.

Strategy Concept

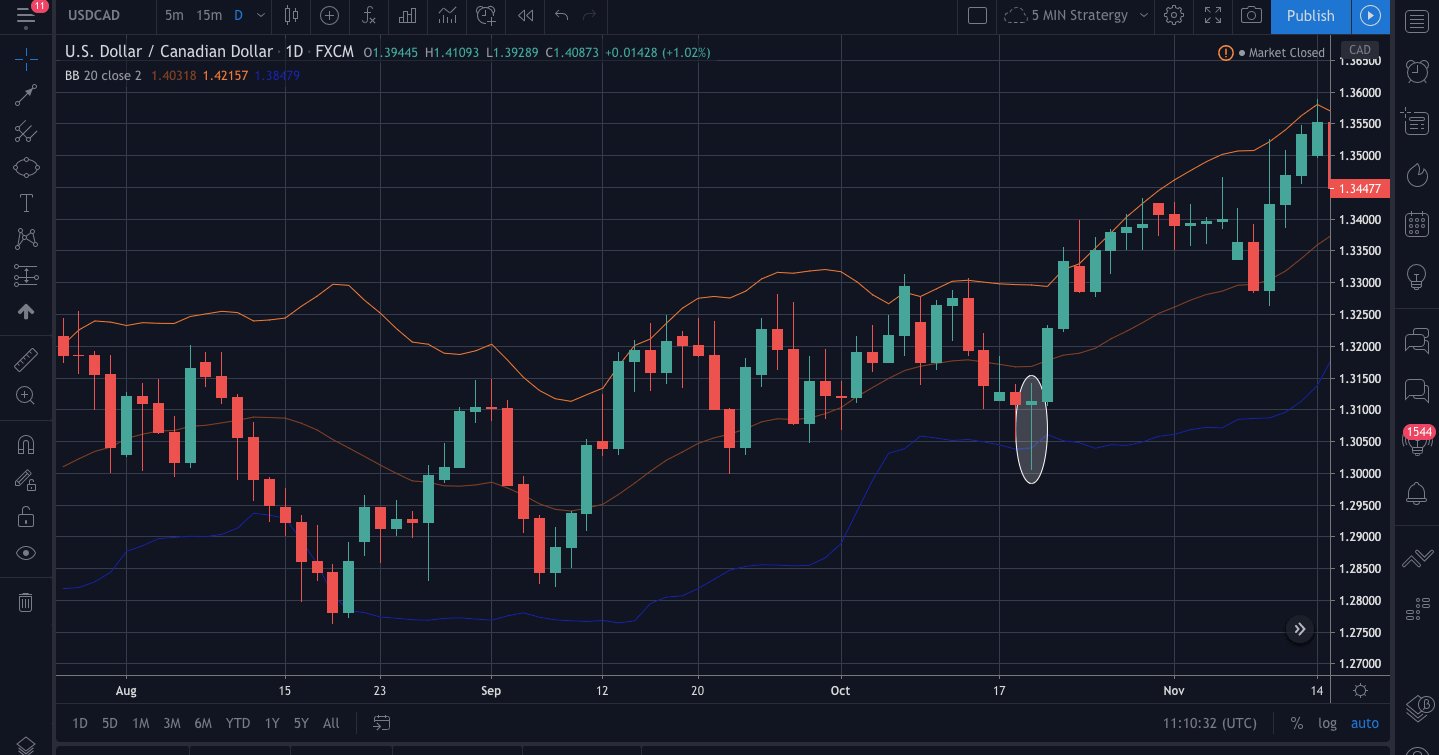

This setup recognizes the desire of most traders to buy low and sell high but does so in the predominant framework of trading with the trend. The strategy uses multiple time frames and a couple of indicators as it’s a tool for entry. First and foremost, we look at the daily chart to ascertain of the pair in a trend. For that, we use the 20-period simple moving average (SMA), which tells us the direction of the market. In technical analysis, there are numerous ways of determining the trend, but none of them is as simple and easy as the 20-period SMA.

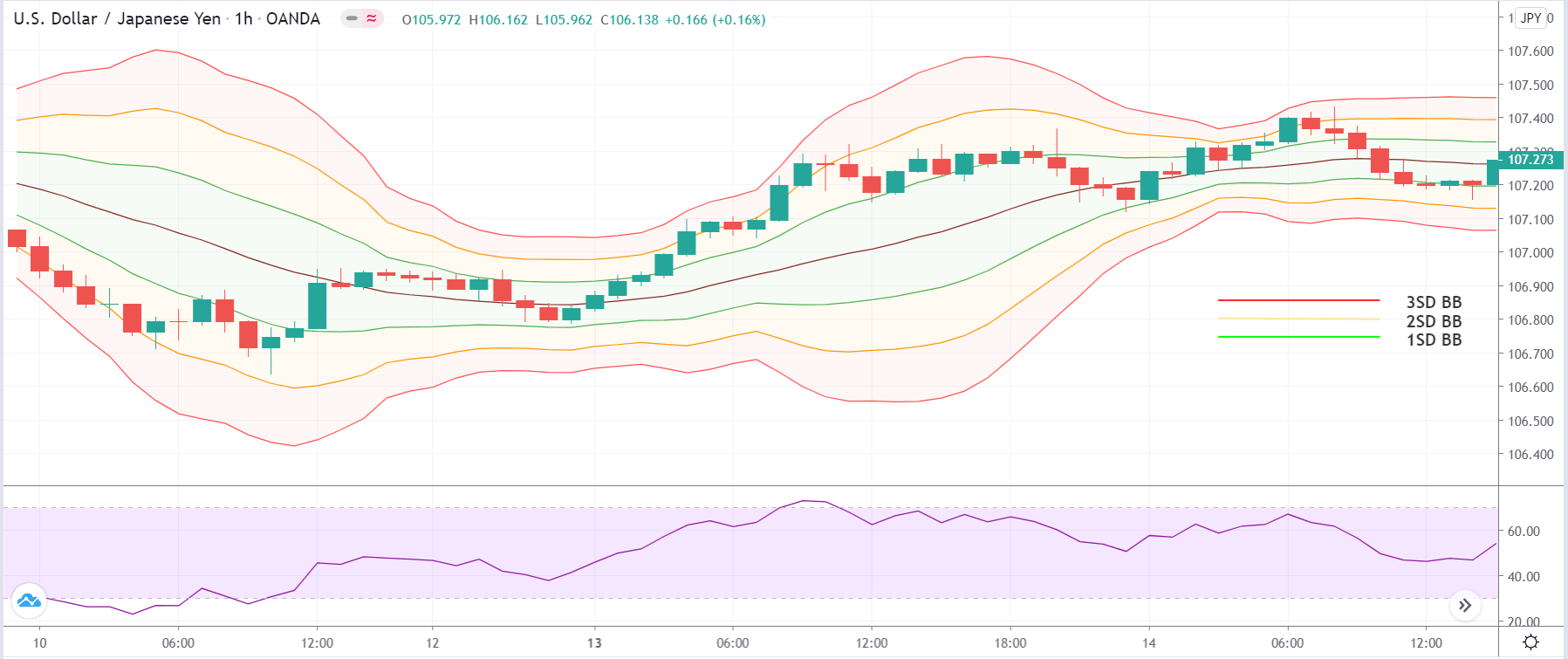

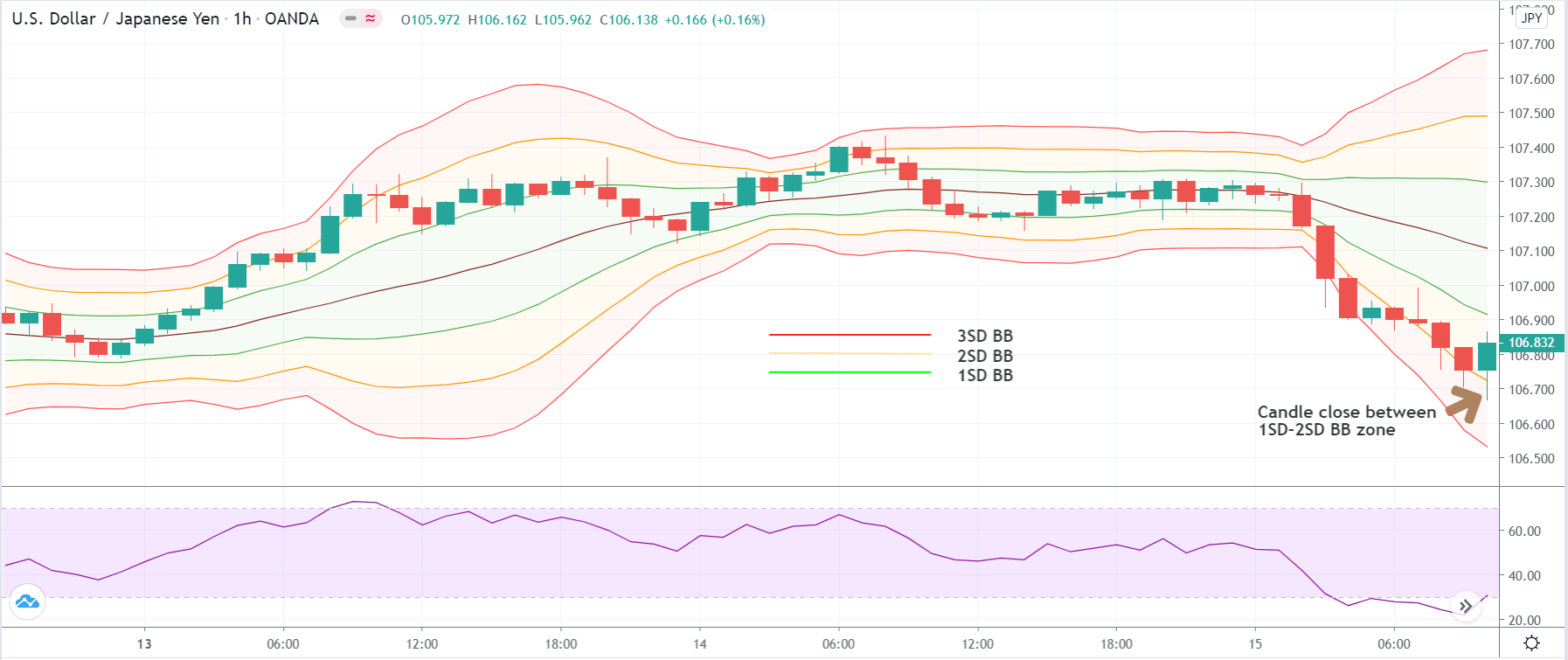

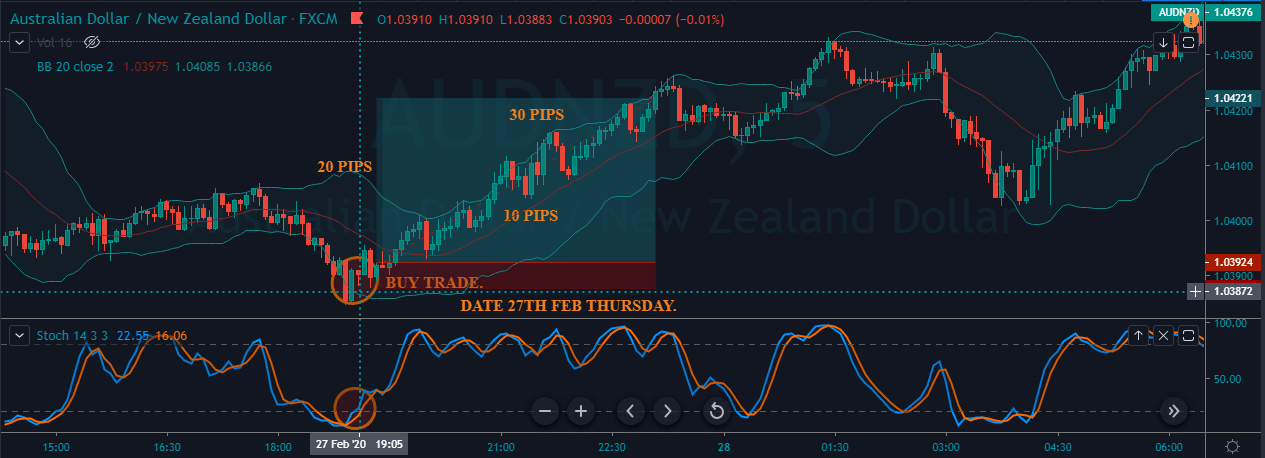

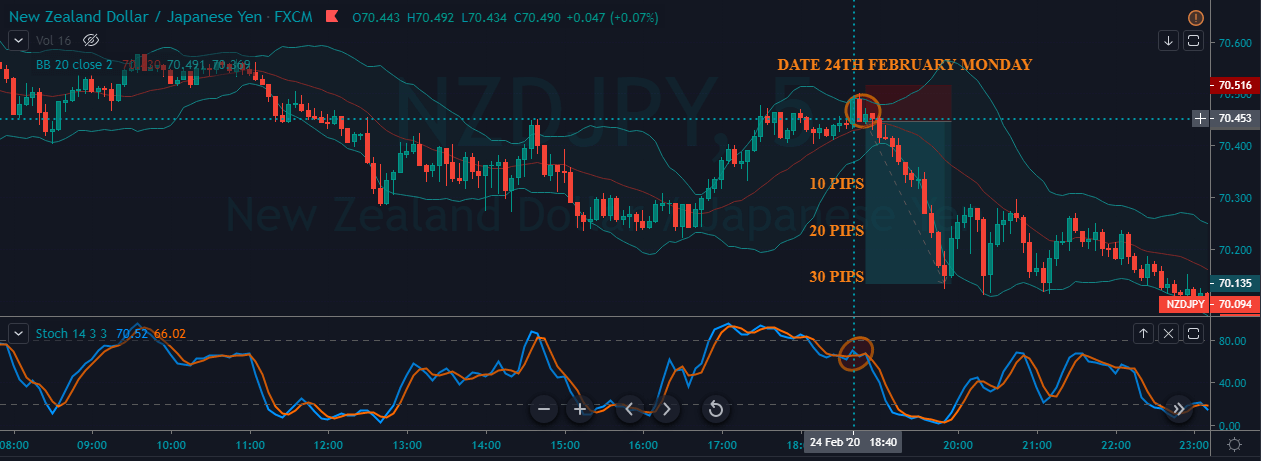

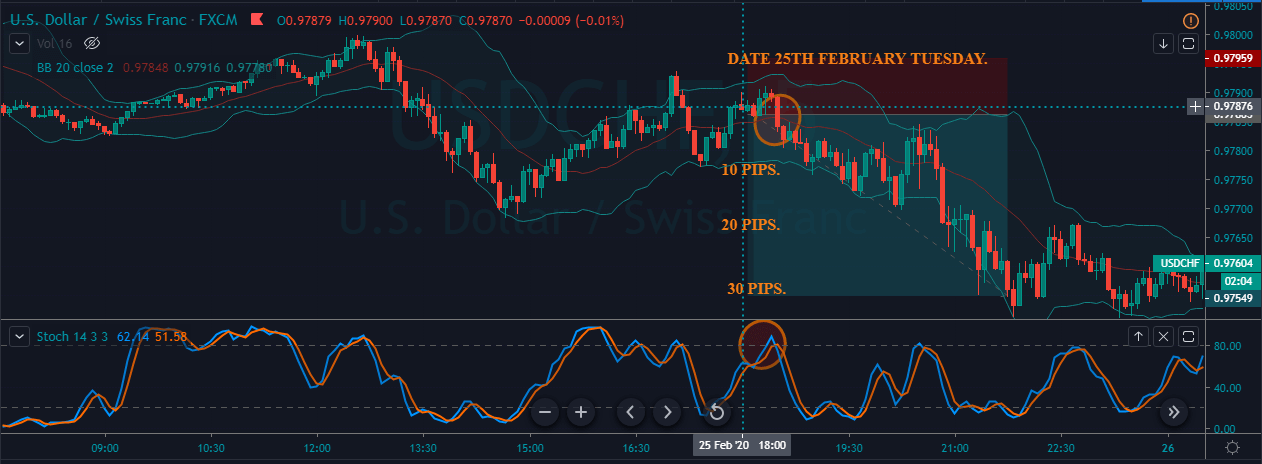

Next, we switch to the hourly charts to find our ‘entry.’ In the ‘Turn to Trend’ Strategy, we will only trade in the direction of the market by buying highly oversold prices in an uptrend and selling highly overbought prices in a downtrend. The question arises, how do we know the market is overbought or oversold? The answer is by using Bollinger bands, which help us gauge the price action.

Bollinger bands measure price extremes by calculating the standard deviation of price from its moving average. In our case, we use the three standard deviation Bollinger band (3SD) and Bollinger band with two standard deviations (2SD). These two create a set of Bollinger band channels. When price trades in a trend, most of the price action will be contained within the Bollinger bands of 2SD and 1SD.

Trade Setup

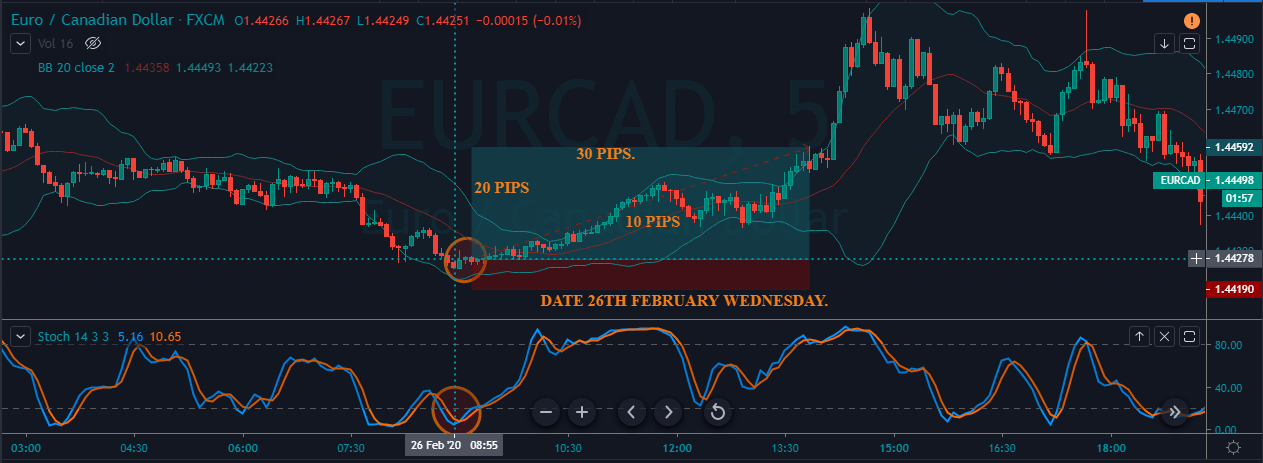

In order to illustrate the strategy, we have considered the chart of EUR/CAD, where we will be applying the strategy to take a ‘long’ trade.

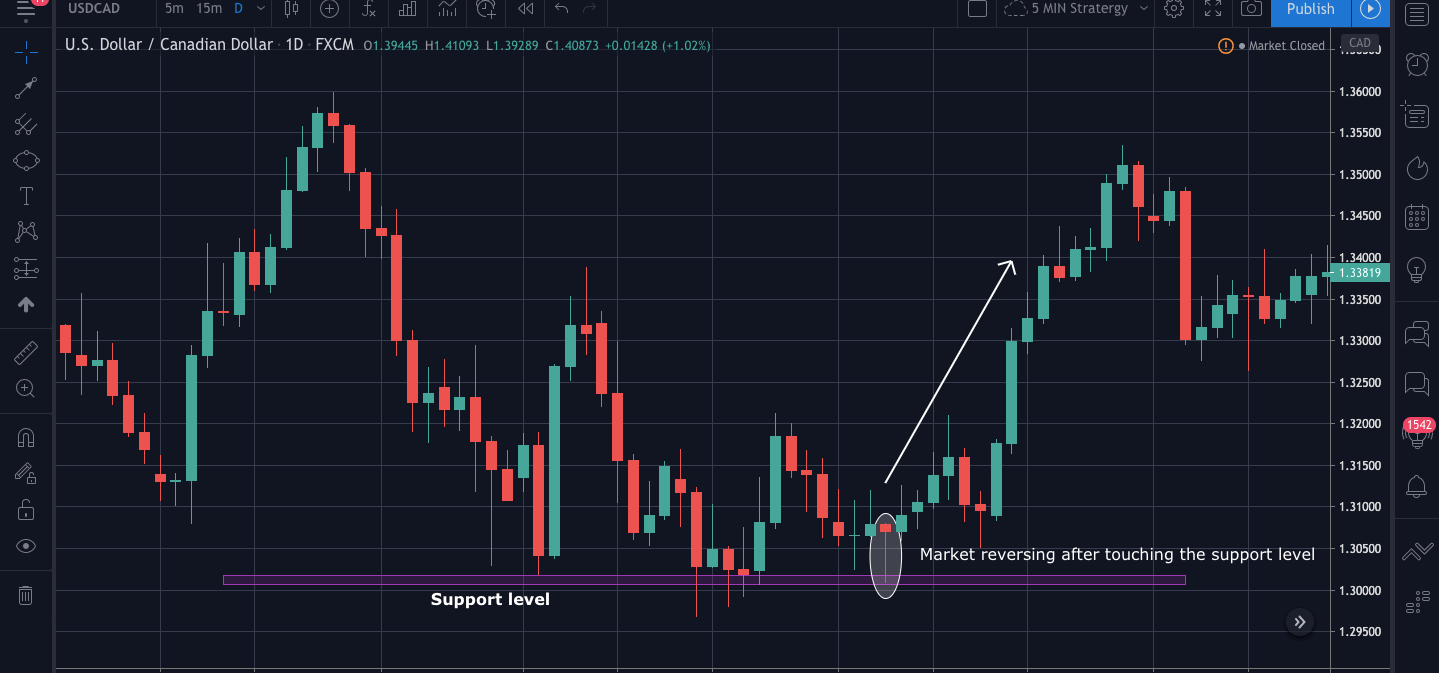

Step 1

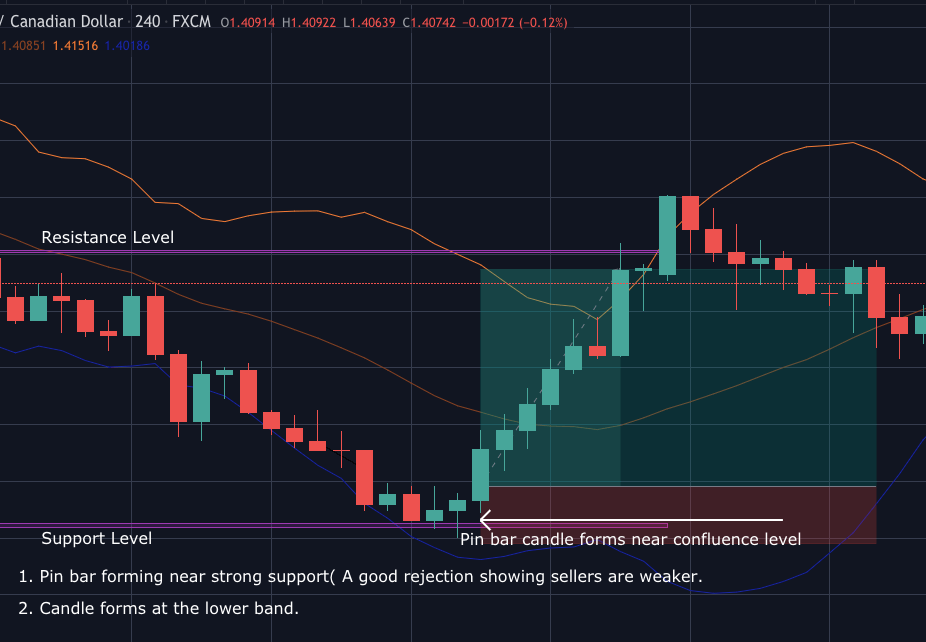

The first step is to identify the major trend of the market. This can be done using the 20-period simple moving average (SMA). If the price is very well above the SMA, we say that the market is in an uptrend. Likewise, if the price is mostly below the SMA, we say that the market is a downtrend. For this strategy, we have to determine the trend on the daily chart of the currency pair.

In our case, we see that the market is in a strong uptrend, as shown in the below image. Hence, we will enter for a ‘long’ trade at the price retracement on the 1-hour time frame.

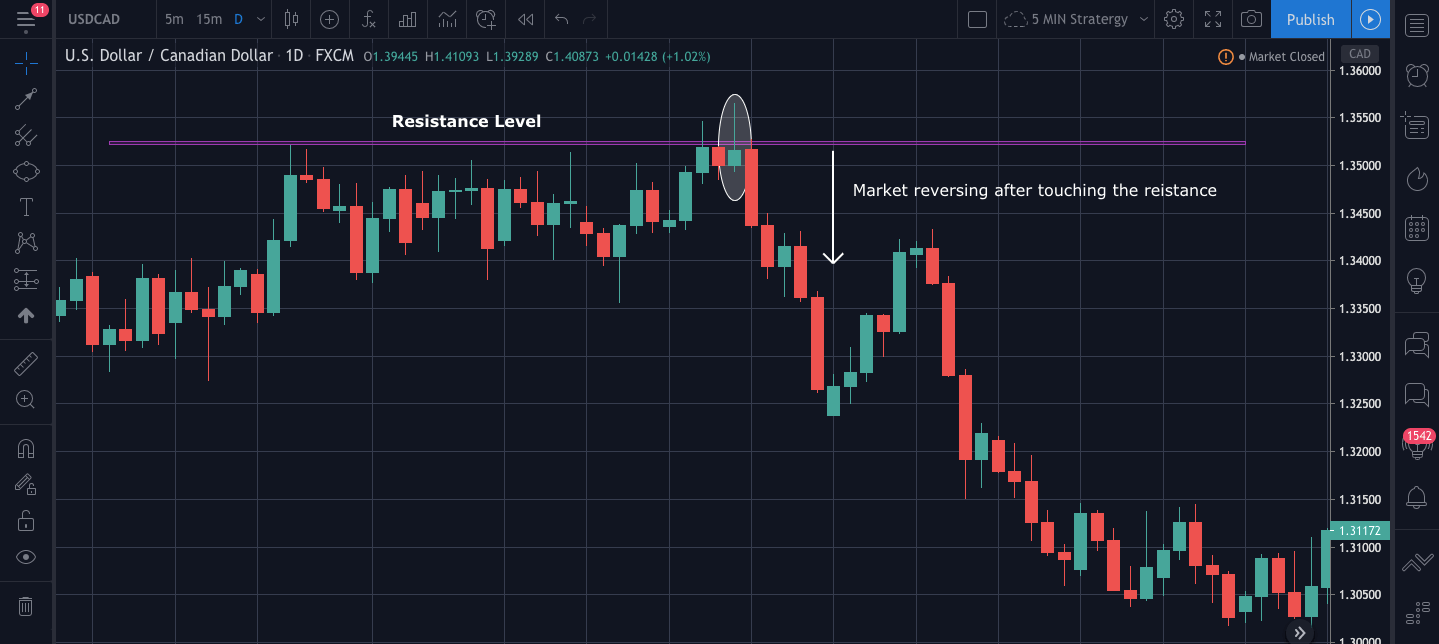

Step 2

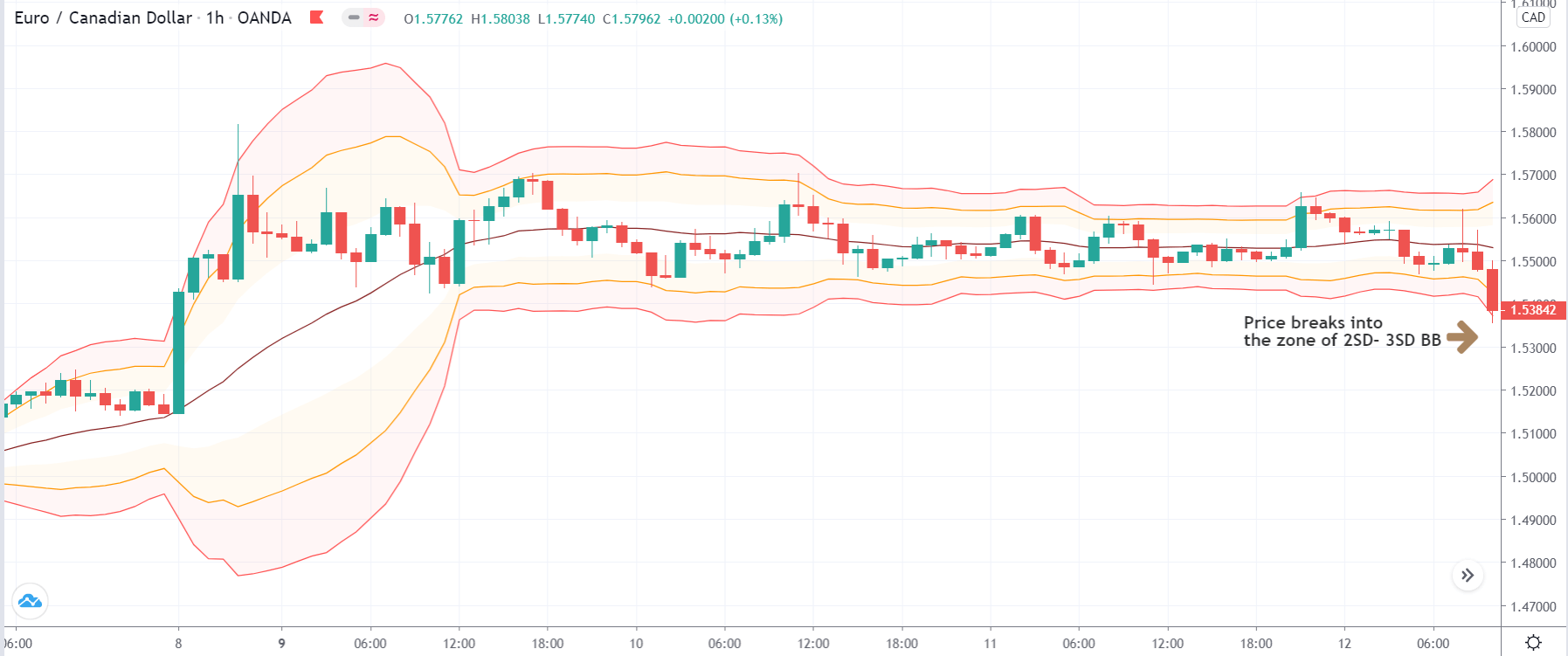

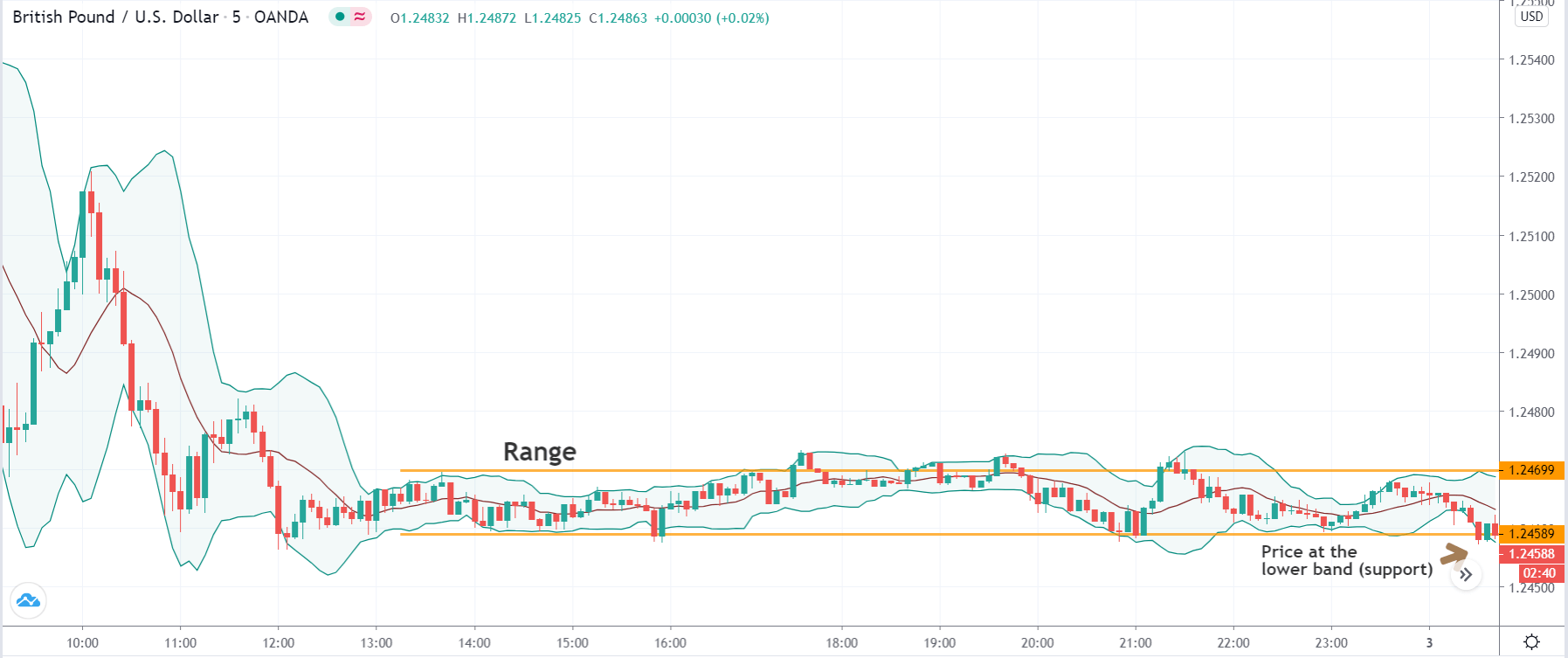

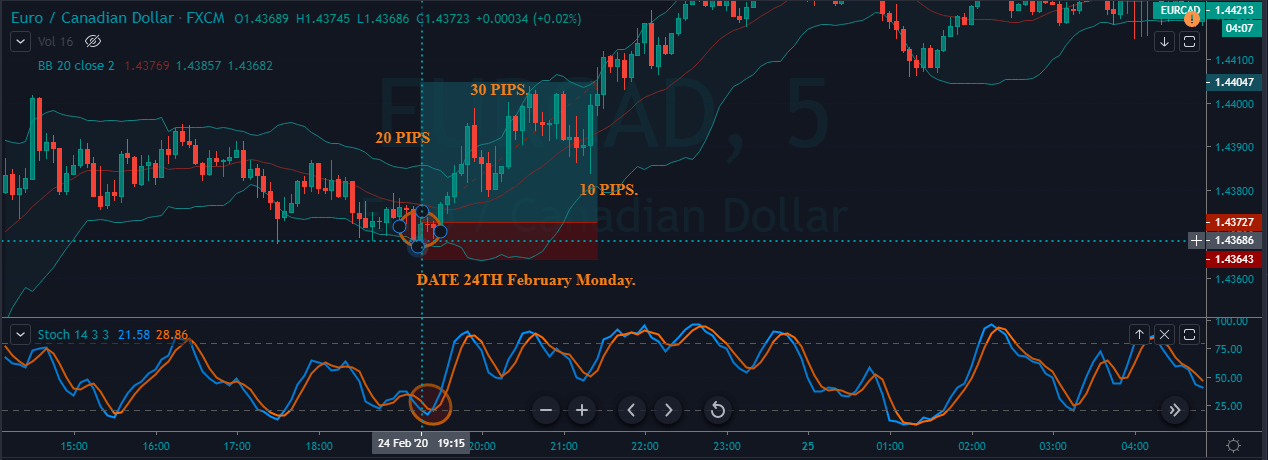

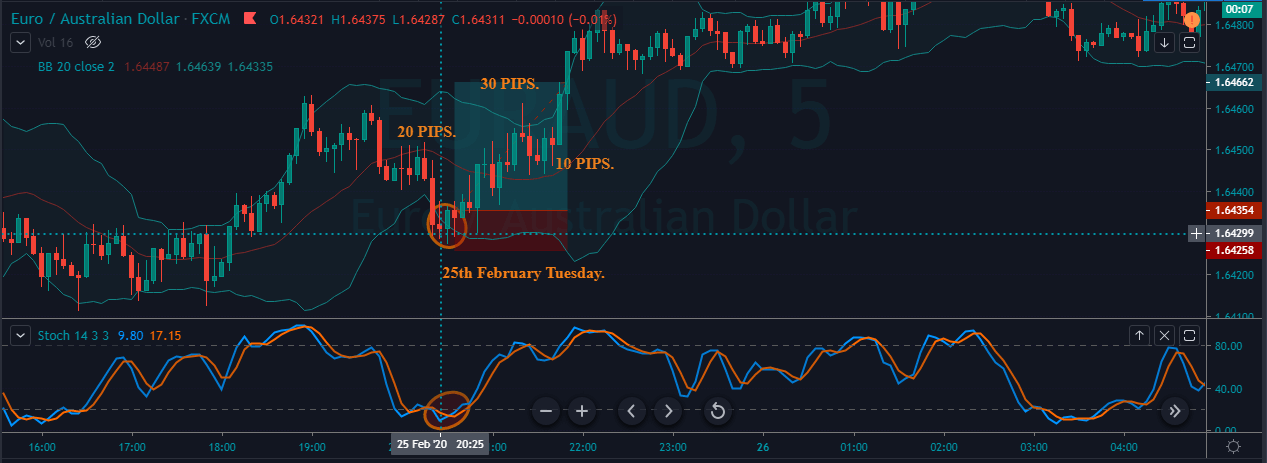

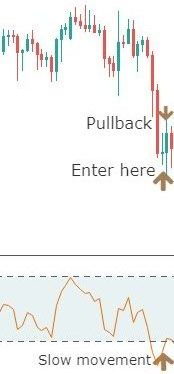

Next, we have to change the time frame of the chart to 1 hour and wait for a price retracement. In order to evaluate the retracement, we plot three standard deviations (3SD) and two standard deviations (2SD) Bollinger band on the chart. After plotting the two Bollinger bands, we need to wait for the price to get into the zone of 2SD-3SD BB.

In the below image, we can see that the price breaks into the zone of 2SD-3SD BB after a lengthy ‘range’ movement.

Step 3

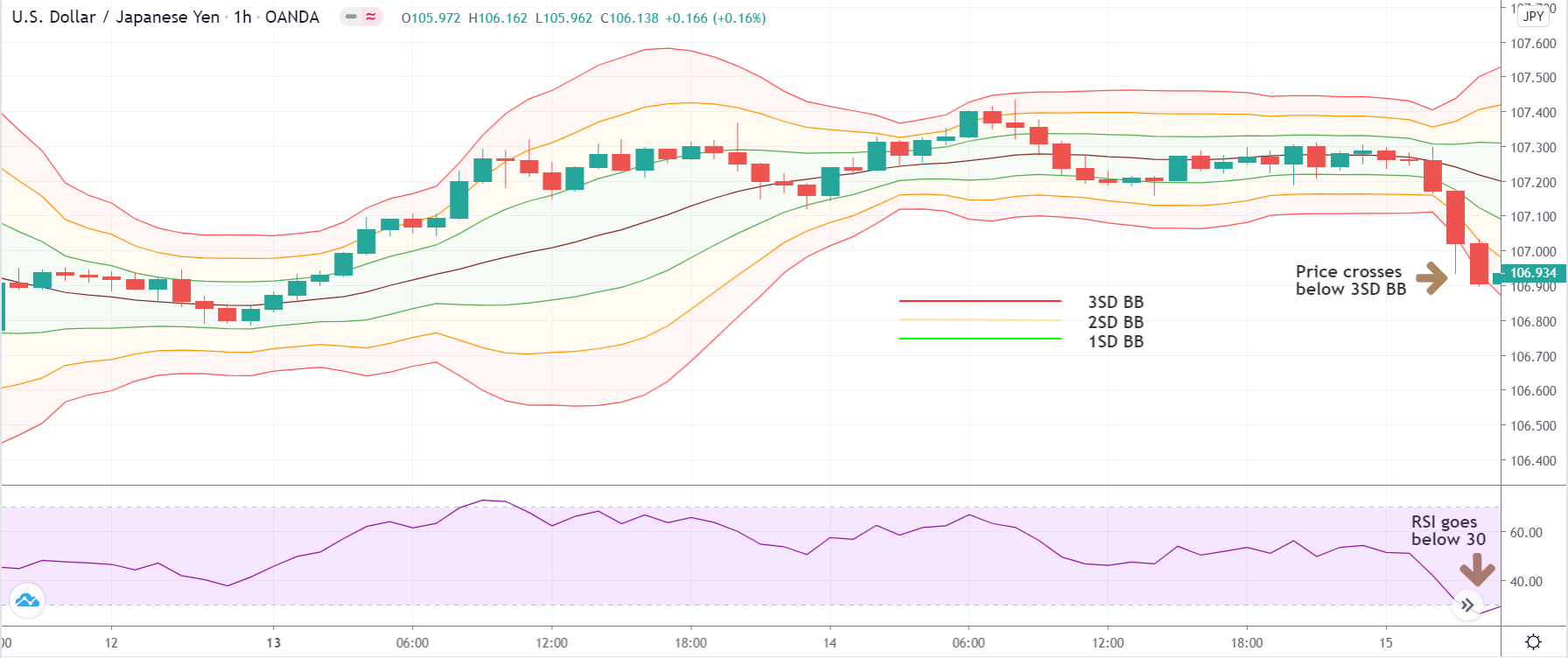

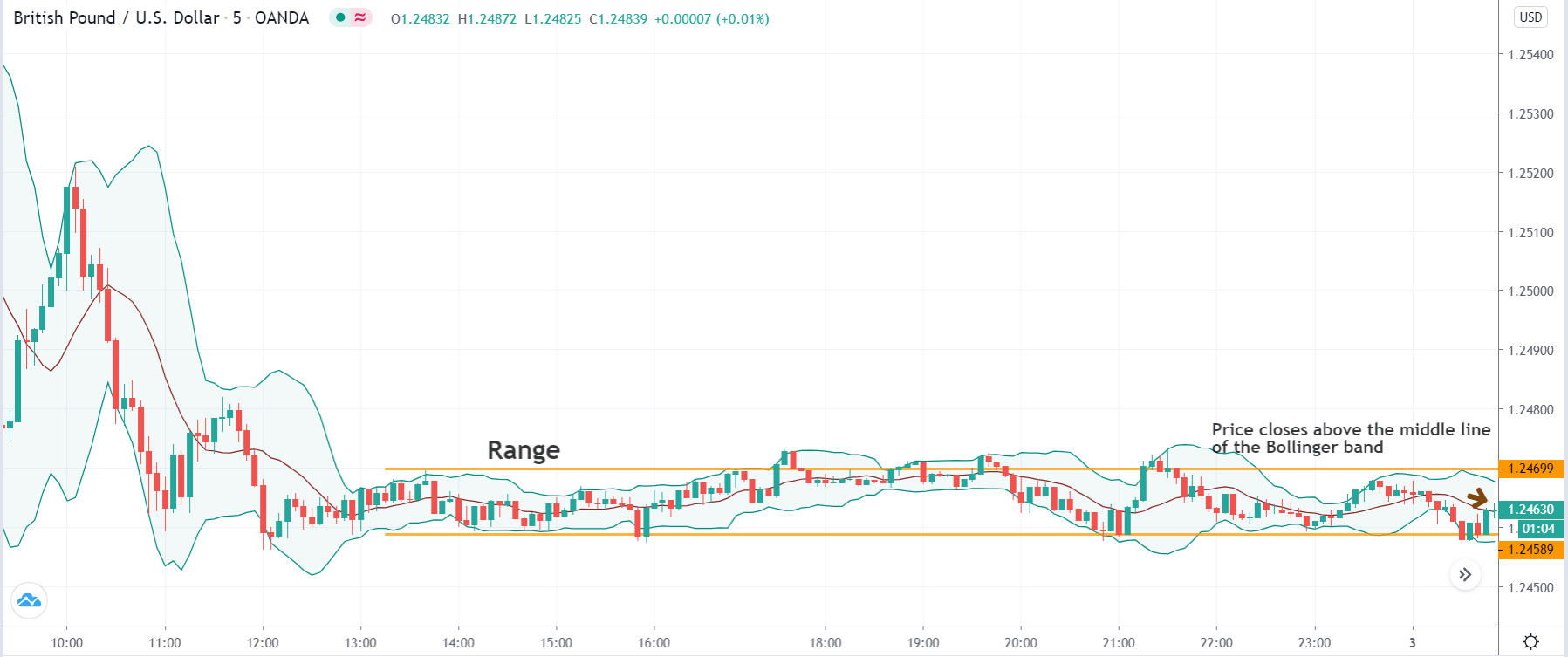

Once the price moves into the zone of 2SD-3SD BB, we wait for the price to bounce off from the lower band of the 3SD BB to give an indication of a reversal. In a ‘short‘ set up, the price should react off from the upper band of the 3SD BB, and give an indication of downtrend continuation. During this process, we need to make sure that the price does not break below or above the 3SD BB. Because if this happens, the ‘pullback’ is no more valid, and this could be a sign of reversal. This is a crucial aspect of the strategy.

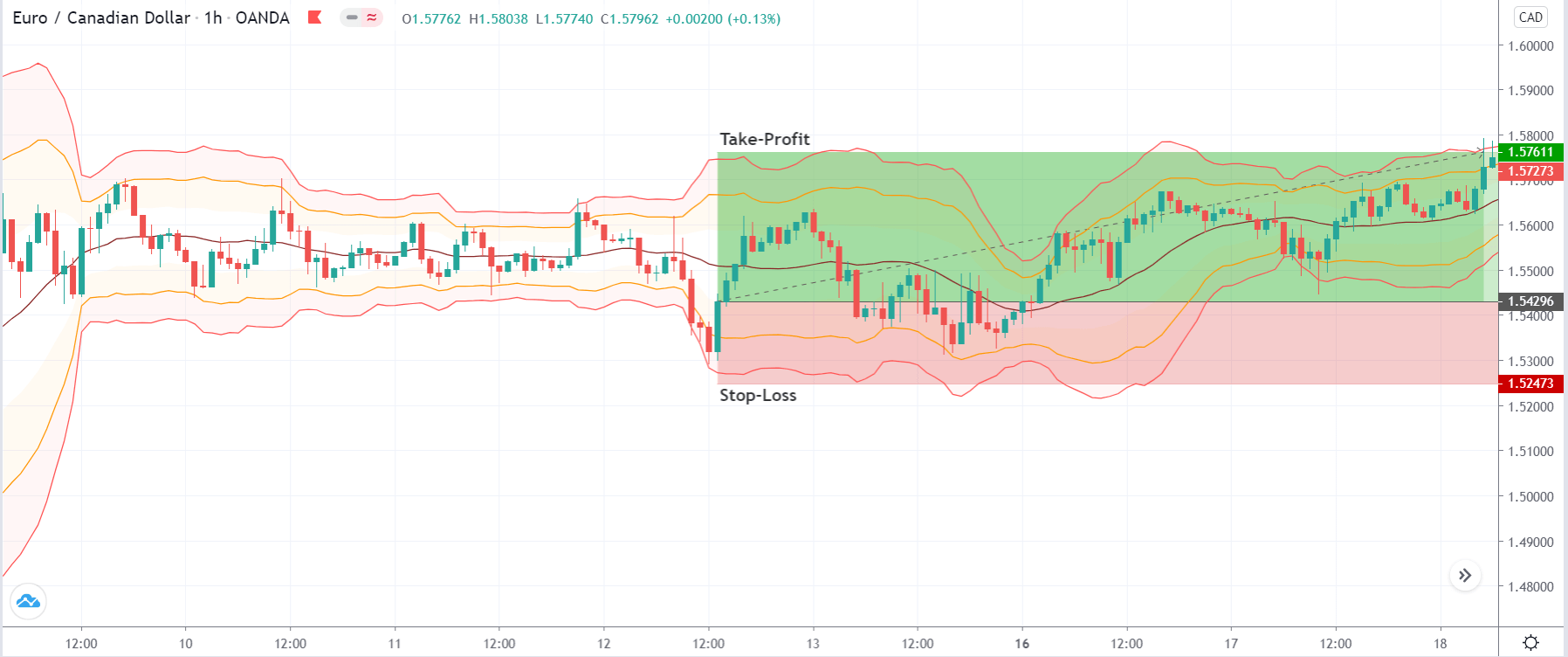

The below image shows how the price bounces off from the lower band of the 3SD BB two candles after the price moves into the zone.

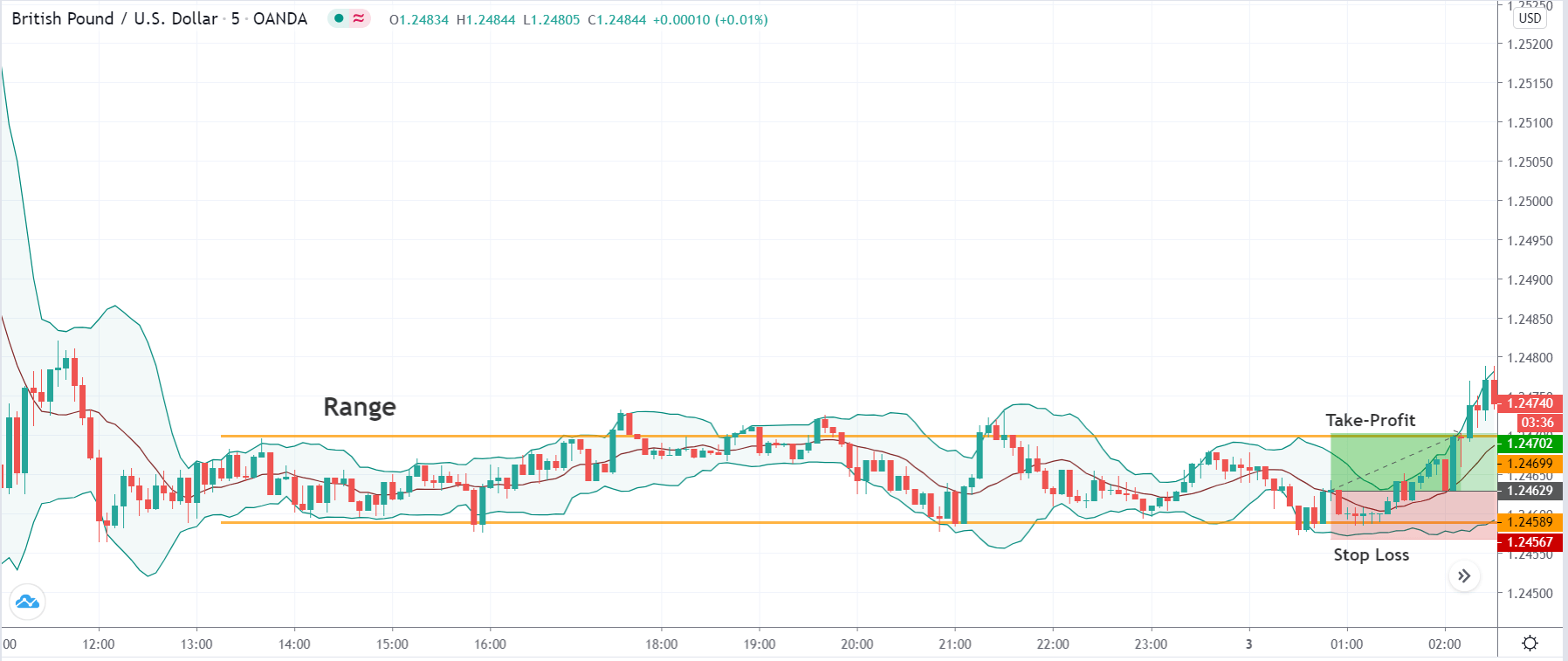

Step 4

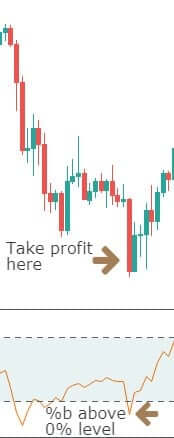

We enter the market at the first sign of trend continuation, which was determined in the previous step. Now we need to define the stop-loss and take-profit for the strategy. Stop-loss should be placed below the lower band of the 3SD BB, in case of a ‘long’ trade and above the upper band of the 3SD BB, in a ‘short’ trade. The ‘take-profit’ is not a fixed point. Instead, we take our profit as soon as the price touches the opposite band of the 3SD BB.

In the case of EUR/CAD, the resultant risk-to-reward of the trade was a minimum of 1:2, as shown in the below image.

Strategy Roundup

The beauty of this setup is that it prevents us from guessing the turn in the market prematurely by forcing us to wait until the price action confirms a swing bottom or a swing top. If the price is in a downtrend, we watch the hourlies for a turn back to the trend. If the price continues to trade between the 3SD and 2SD BB, we stay away as long as we get confirmation from the market. We can also set our first take-profit at 1:1 risk to reward to lock in some profits.