Introduction

When you hear the word ‘cryptocurrency,’ Bitcoin is the first thing that pops into your mind. For the longest time, bitcoin has been synonymous with cryptocurrency and regarded as the future currency. In the recent past, bitcoin’s monopoly has been diluted by the entrance of thousands of other cryptocurrencies.

The cryptocurrencies’ primary objective was to serve as an alternative, and down the line, a replacement to the global fiat financial system. This objective has failed to take off. This failure can be attributed to the skepticism cryptocurrencies have faced, which has slowed their role as a legitimate alternative to fiat currencies. DeFi has helped address some of these challenges and help make cryptocurrencies mainstream.

What is DeFi?

DeFi is the short form for Decentralised Finance. At its core, decentralized finance is the provision of conventional financial services on platforms built on the public blockchain. Specifically, DeFi is based on the Ethereum blockchain platform.

DeFi is heralded as the most suitable alternative to the global financial system. This new enthusiasm about the decentralization of finance is owed to the fact that DeFi is seen as being able to solve the problems that bitcoin failed to solve.

Advancements Made by DeFi

Here are some of the advancements made DeFi, which bitcoin failed to achieve.

Creation of issuance and investing platform

These platforms operate like an ordinary stock exchange. DeFi has made it possible so that cryptocurrencies can be issued and traded like conventional financial securities. The platform brings together broker-dealers, legal advisors, and custodians, who will advise issuers through the process. Furthermore, the platform also makes it possible for asset and investment managers’ proliferation for crypto-based financial assets.

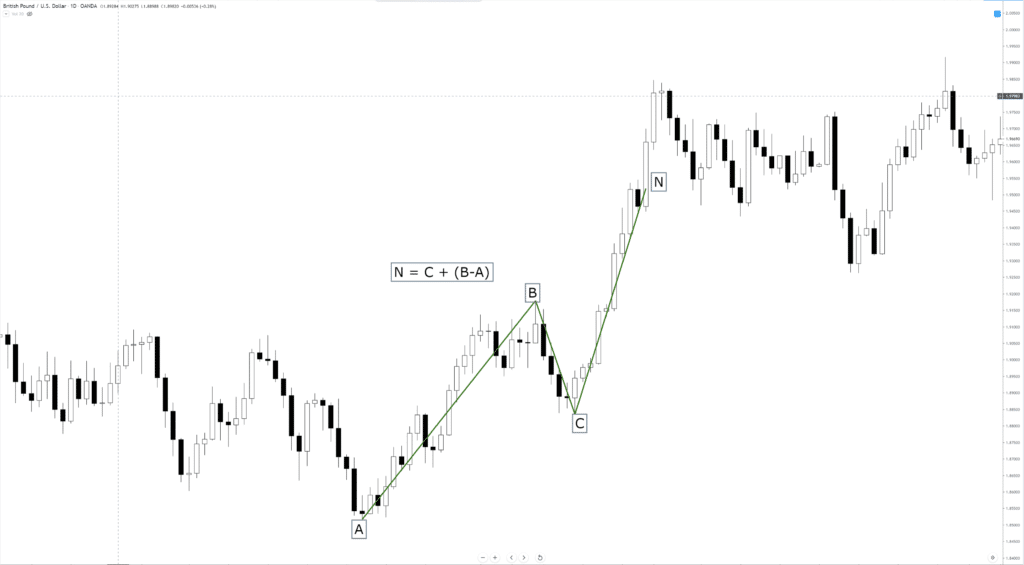

Establishment of a decentralized prediction market

A prediction market is one where individuals can bet on any future occurrences. With decentralized prediction markets, there is no form of censorship whatsoever. Therefore, it offers an incredible opportunity to hedge against future risks financially and speculate on all forms of social events globally.

Growth of open lending protocols

Decentralized open lending championed by DeFi involves the following: collateralization of cryptocurrencies; elimination of credit checks among borrowers; lending and borrowing of cryptocurrencies for trading purposes; and real-time settlement of transactions. The financial inclusion resulting from open lending is unparalleled.

Facilitated the issuance of stablecoins

DeFi made it possible for the issuance of stablecoins by facilitating the auditing of crypto reserves and ensuring manageable volatility of such cryptocurrencies. With DeFi, stablecoins can be pegged on another asset. Categories of stable coins that have been spurred by DeFi include crypto-collateralized stablecoins, fiat-collateralized stable coins, and non-collateralized stablecoins whose stability depends on an algorithm controlling the expansion and contraction of its supply.

Bottom Line

DeFi undoubtedly offers a higher potential for financial inclusion, censorship-free transactions, and improved privacy. Although DeFi is offered as an alternative to the centralized financial system, it is almost impossible to envision an economy where the centralized financial system ceases to exist. Thus, it is prudent to co-mingle the two systems to ensure complementarity, which will tone down the inherent risks associated with either system.