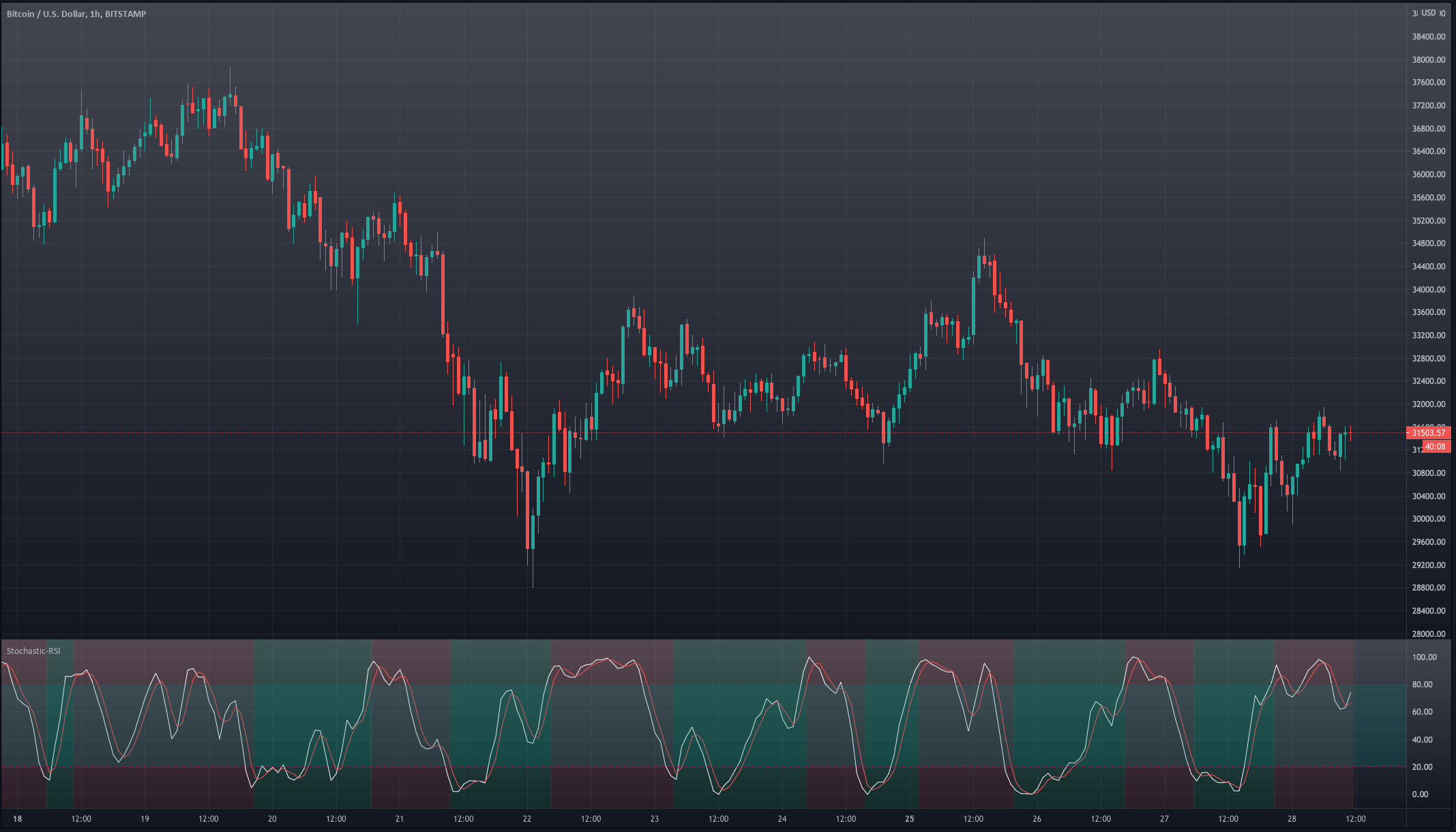

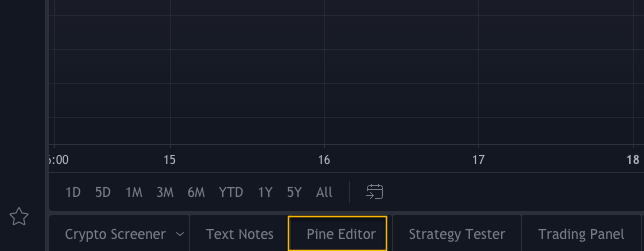

In part 1 of this article series, we have created the Stochastic RSI indicator as part of our idea for a scalping strategy. Now that we have it functional, we will make the bull/bear phases and visually inspect whether it captures the turning market’s turning points.

Possible ways to create bull/bear slices

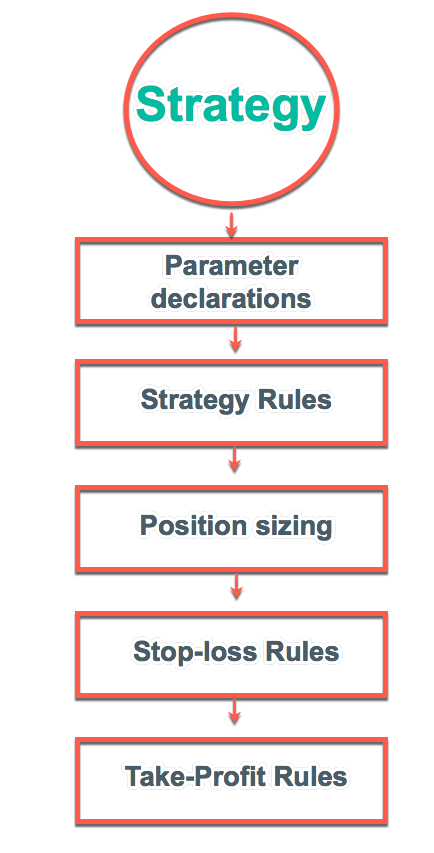

Our Stochastic RSI consists of two lines, k and d, and two trigger lines, ob and os. Therefore we can use multiple variants that may allow the creation of bull/bear price legs. Let’s consider the following 3

Variant 1 – The transition occurs at the SRSI entrance of the oversold or overbought regions.

Bull: The d-line crosses under the ob-line, which indicates it is into the overbought area

Bear: The d-line crosses over the os-line, indicating d‘s entry into the oversold area.

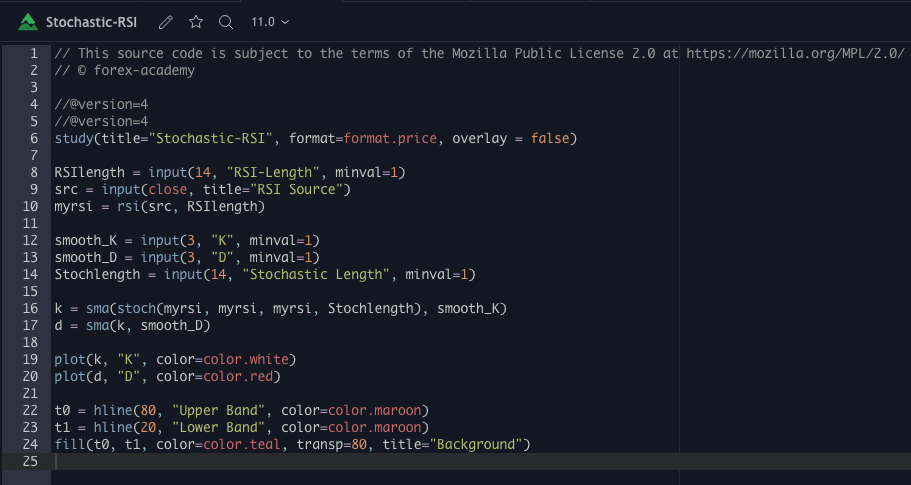

Code:

if crossunder (d, os)

SRSI_Long := true

SRSI_Short := false

else if crossover (d, ob)

SRSI_Long := false

SRSI_Short := true

else

SRSI_Long := SRSI_Long[1]

SRSI_Short := SRSI_Short[1]

This code creates a condition SRSI_Long at the cross of d under os, which holds until d crosses over ob and reverses it, creating an SRSI_Short state. This condition is only modified by d crossing under os.

The else statement ensures the condition does not change from the previous bar.

Once we have defined the bull and bear segments, we can color-shade them to visualize them in the chart. To do it, we will use the bgcolor() function.

bgcolor(SRSI_Long ? color.green: na) bgcolor(SRSI_Short ? color.red: na)

The first statement asks the condition of SRI-Long ( the ? sign). If true, the background color changes to green. Otherwise, no change (an). The second statement behaves similarly for SRSI_Short.

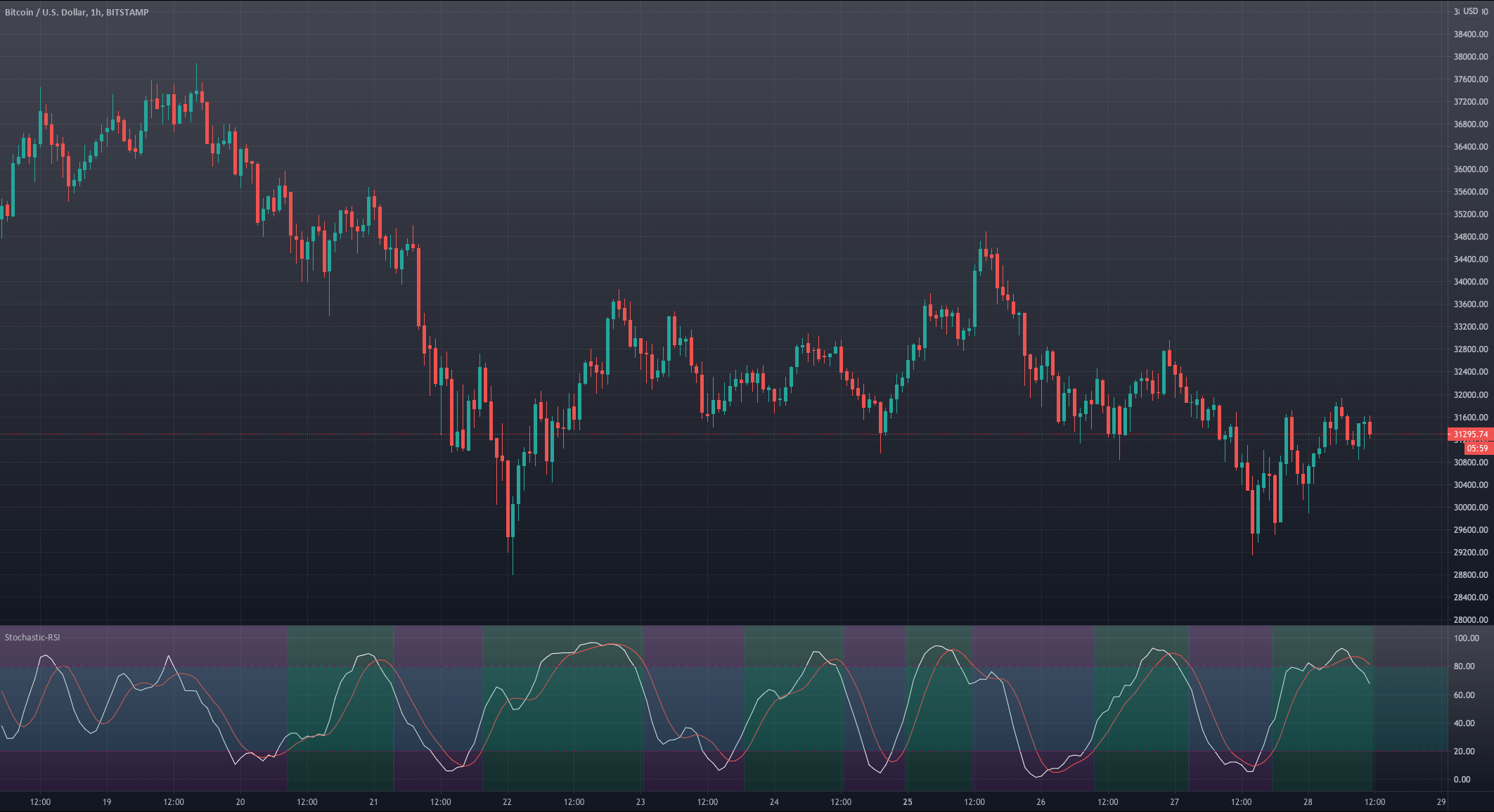

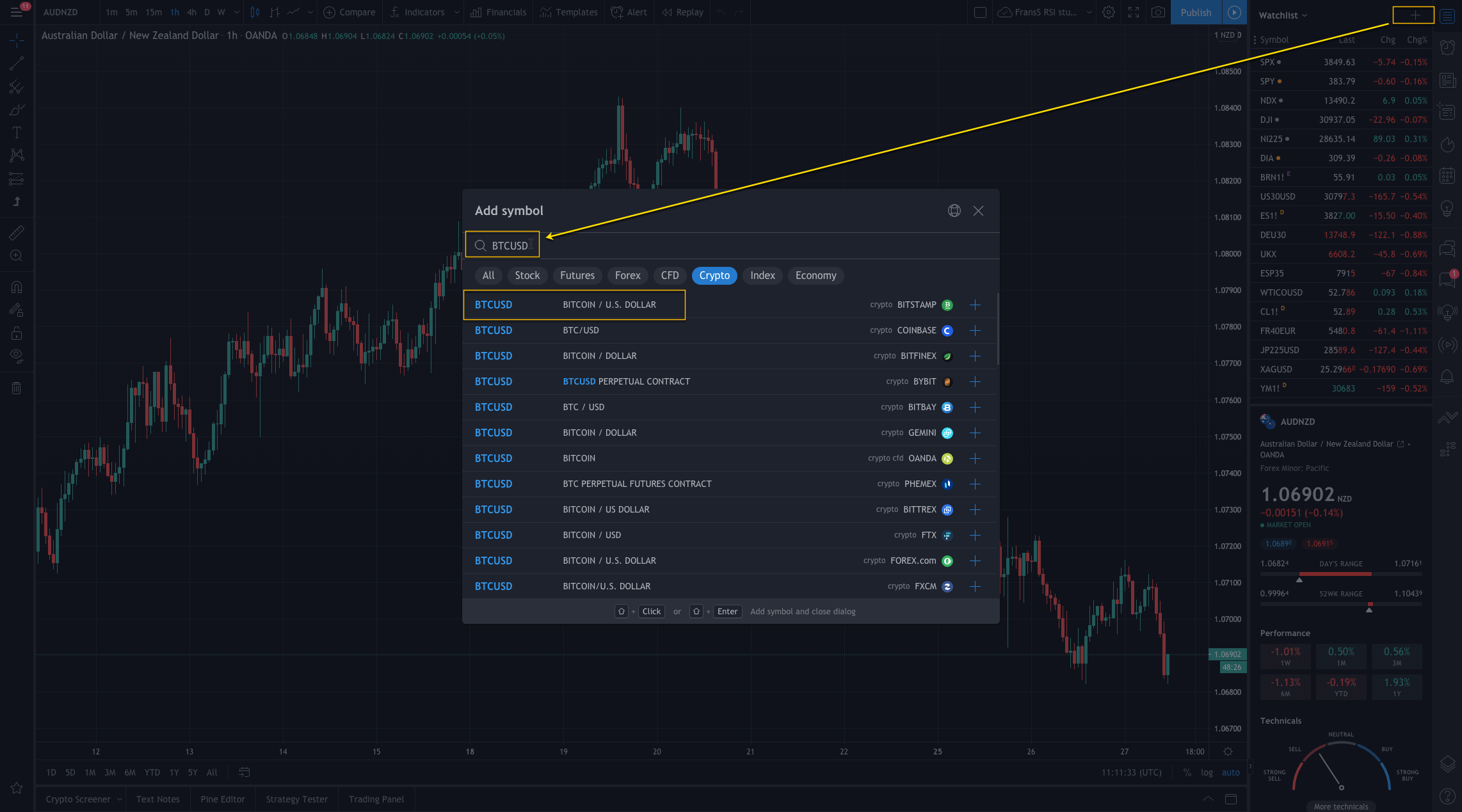

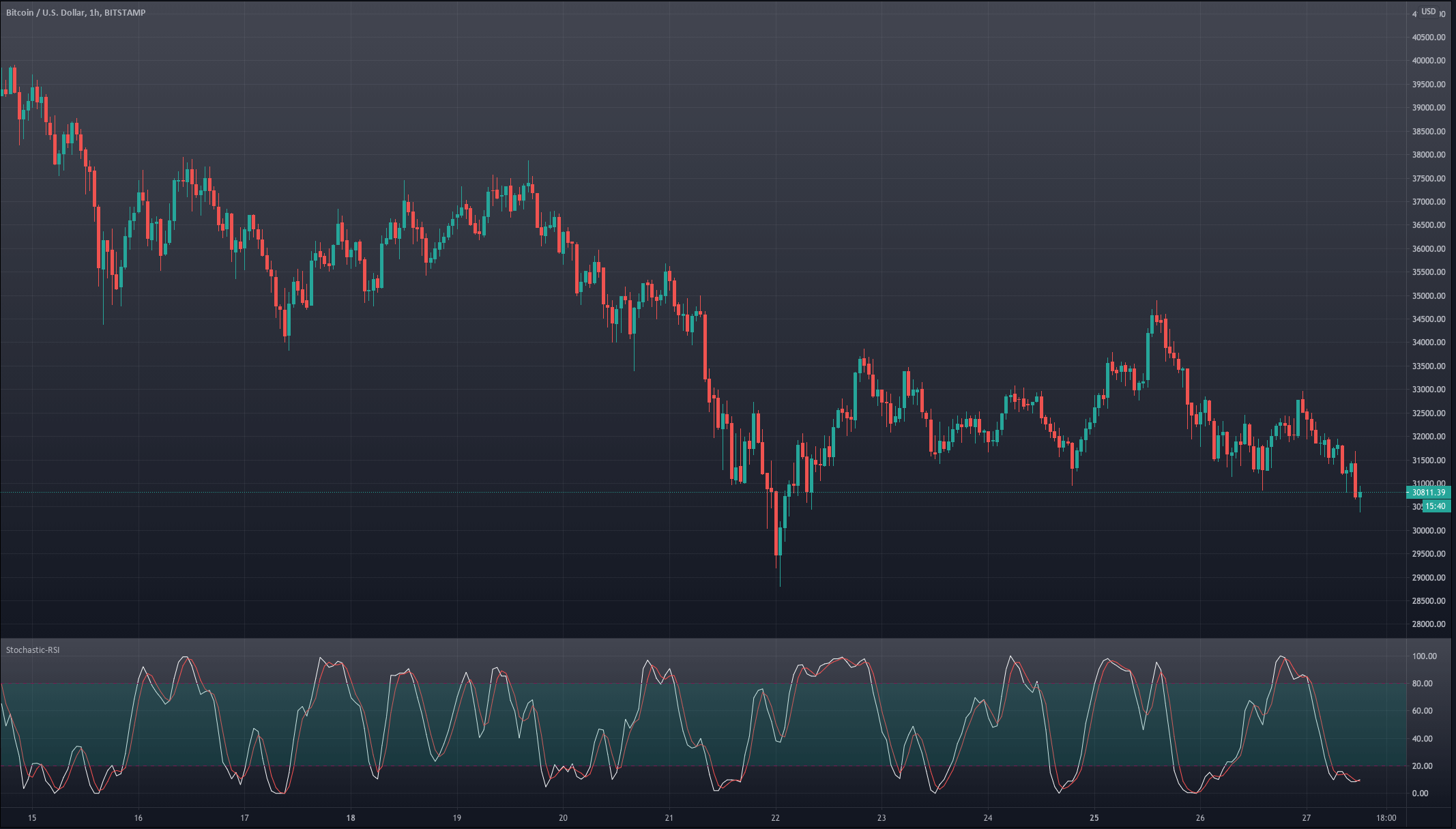

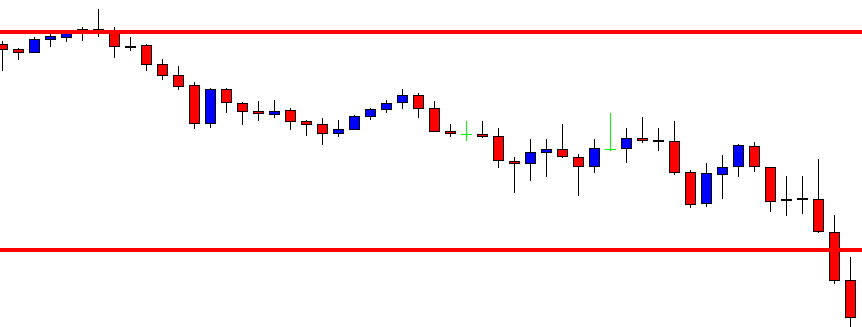

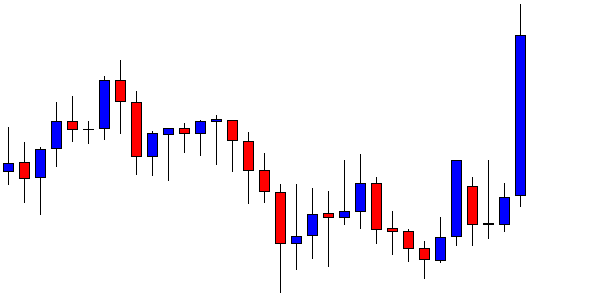

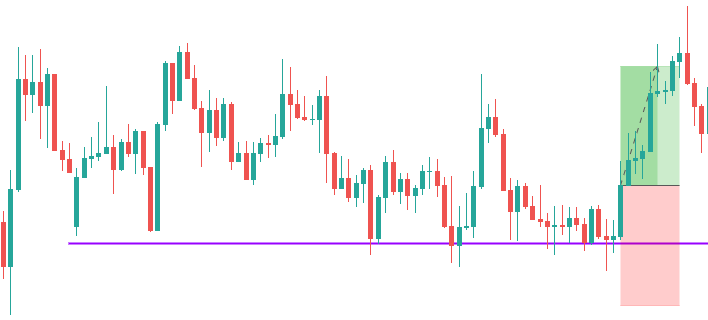

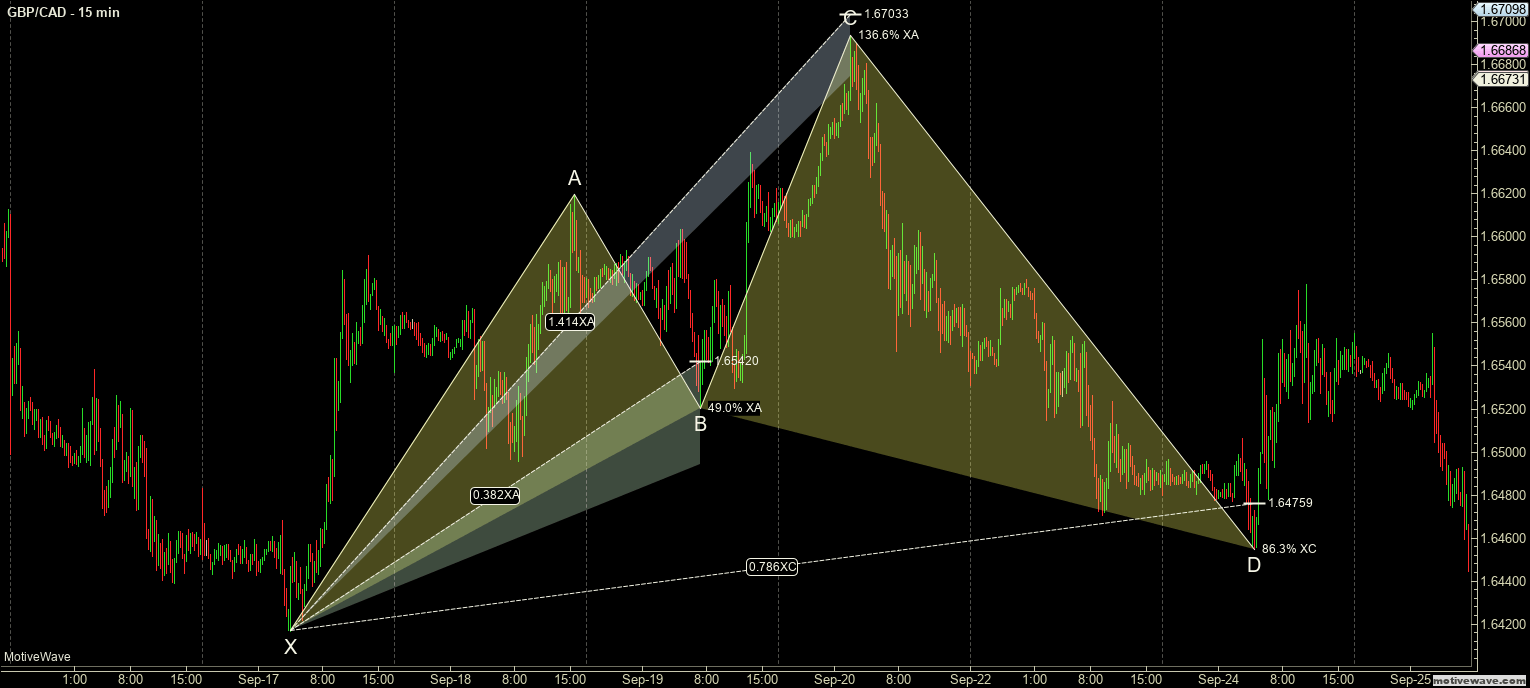

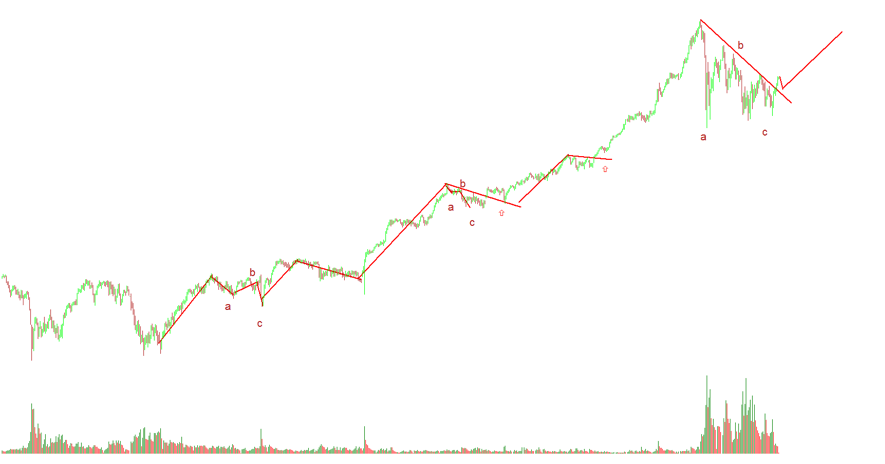

Let’s see how this piece of code behaves in the BTCUSD chart.

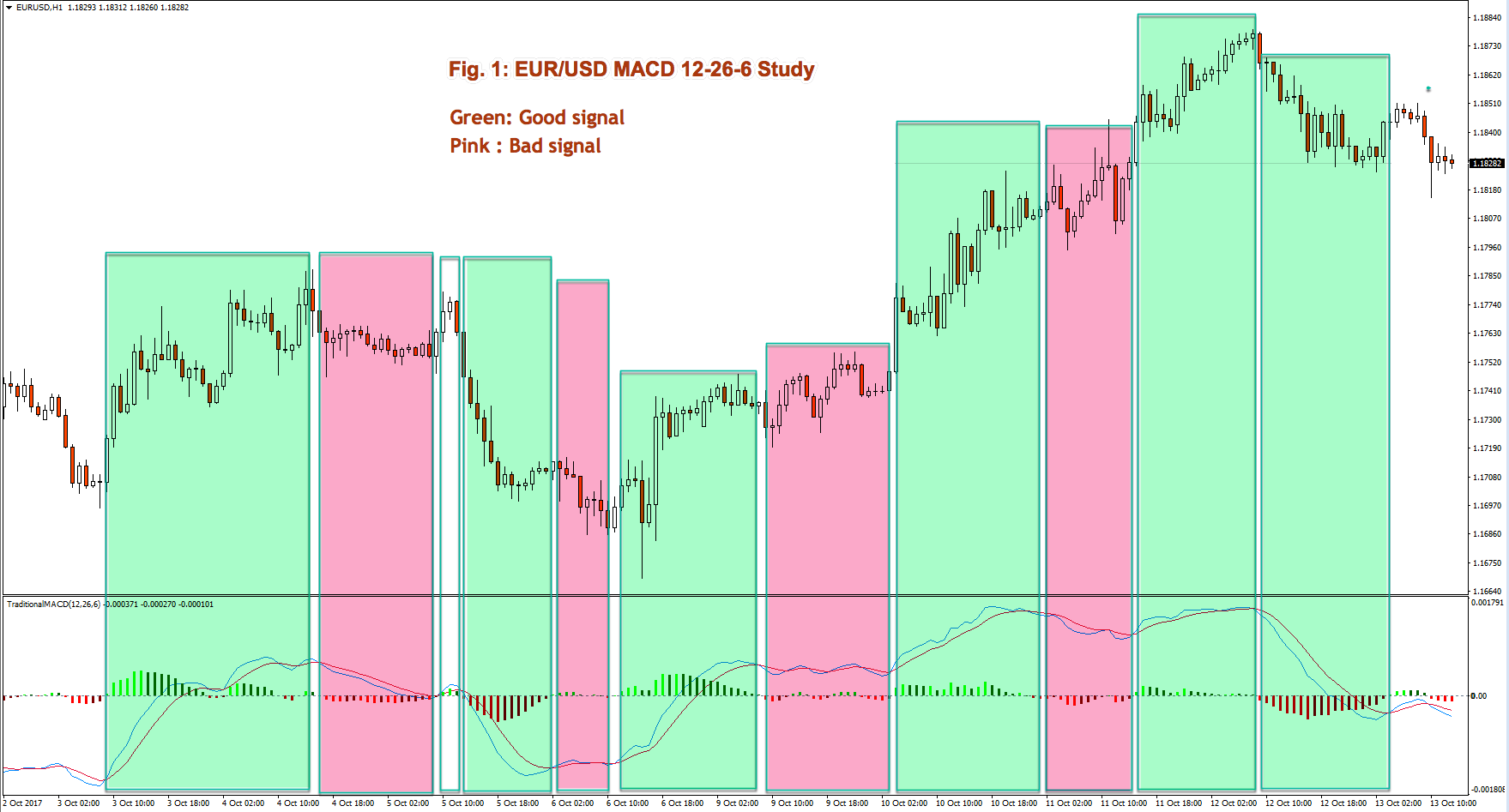

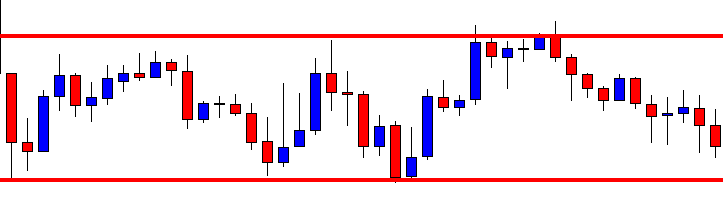

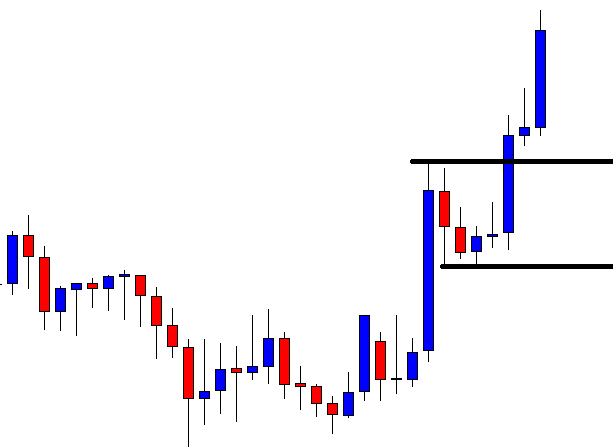

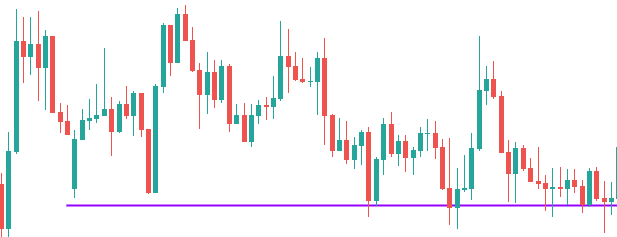

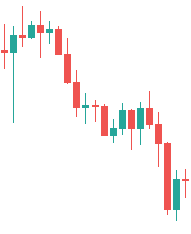

Variant 1 triggers the transitions too early. We see that on many occasions when the stochastic RSI enters the overbought or oversold region, it is more a signal of trend strength than a turning point.

Variant 1 triggers the transitions too early. We see that on many occasions when the stochastic RSI enters the overbought or oversold region, it is more a signal of trend strength than a turning point.

Variant 2 – The transition occurs at D and K’s crossovers if in the overbought/oversold regions.

Bull: the k-line crosses over the d-line, if below os ( inside the oversold region. We ignore crosses in the mid-area)

Bear: the k-line crosses under the d-line, if above ob ( in the overbought area. We ignore crosses in the mid-area)

Code:

// creating the long and short conditions for case 2

if crossover(k,d) and d < os SRSI_Long := true SRSI_Short := false else if crossunder(k,d) and d > ob SRSI_Long := false SRSI_Short := true else SRSI_Long := SRSI_Long[1] SRSI_Short := SRSI_Short[1] // bacground color change bgcolor(SRSI_Long ? color.green: na) bgcolor(SRSI_Short ? color.red: na)

The last section for the background change is similar to Variant 1.

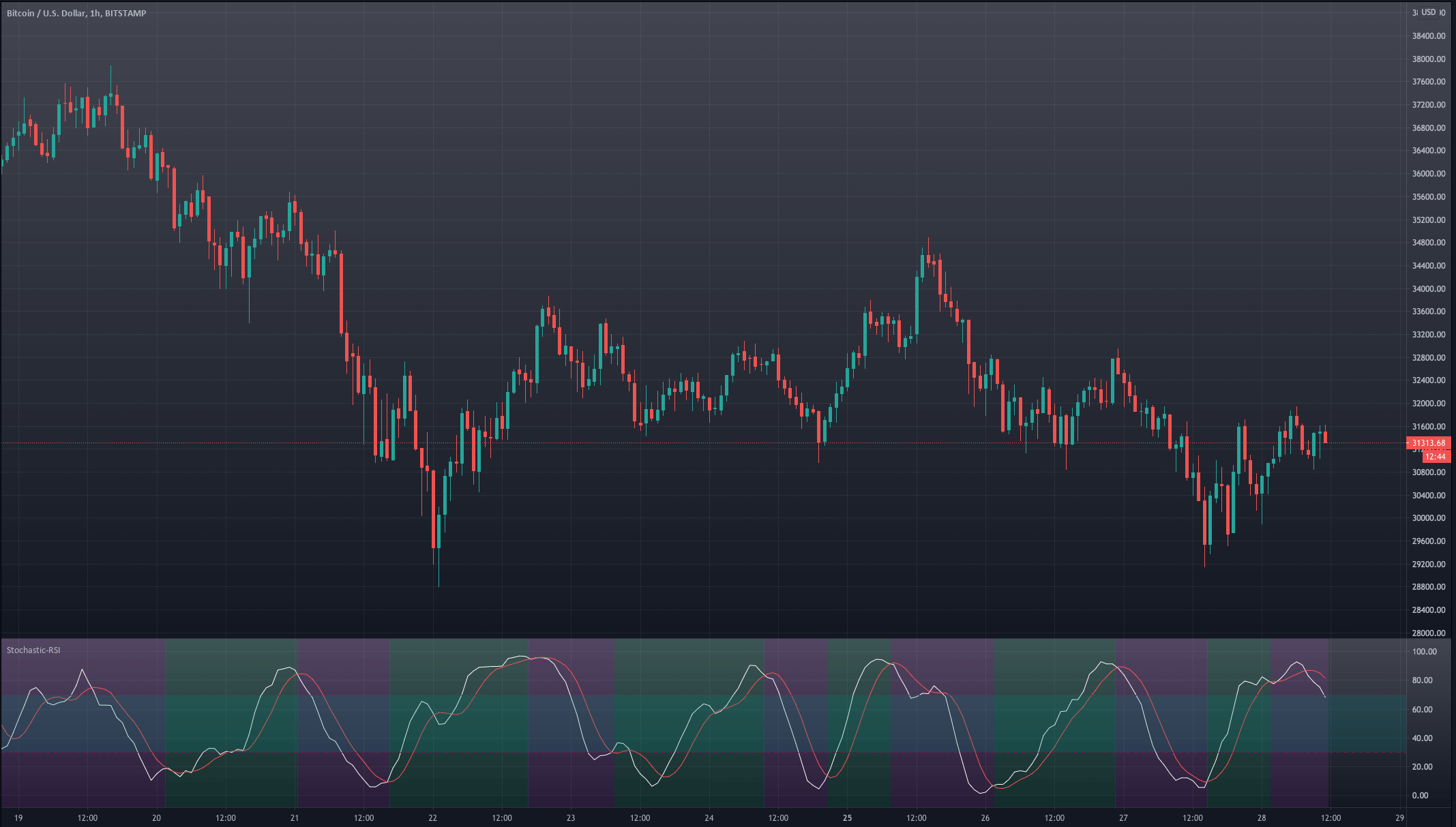

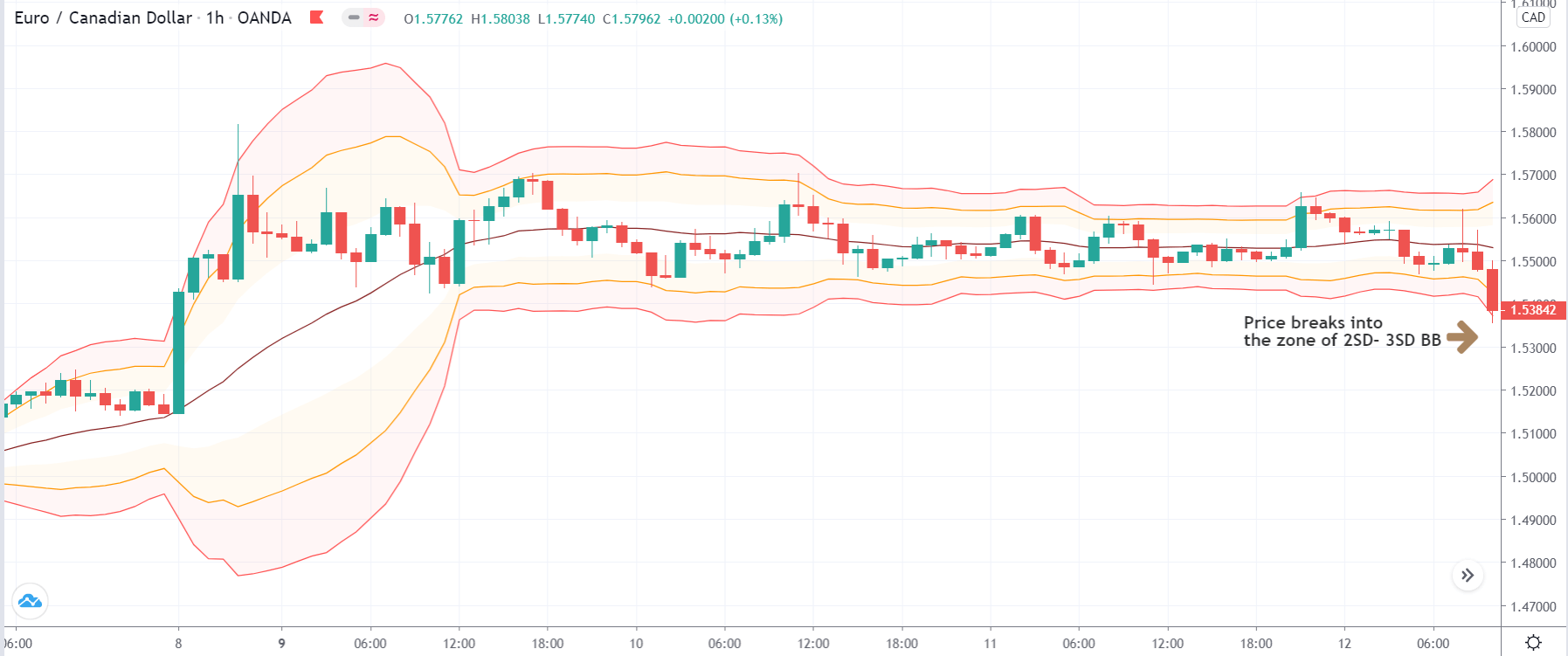

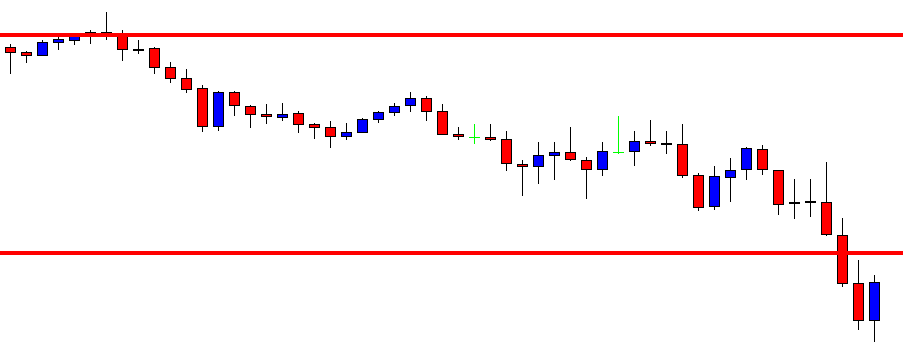

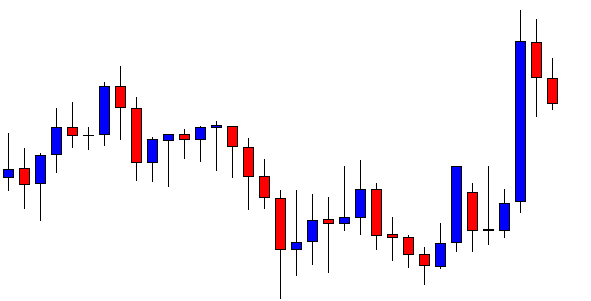

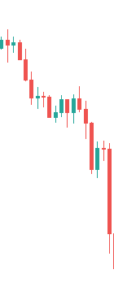

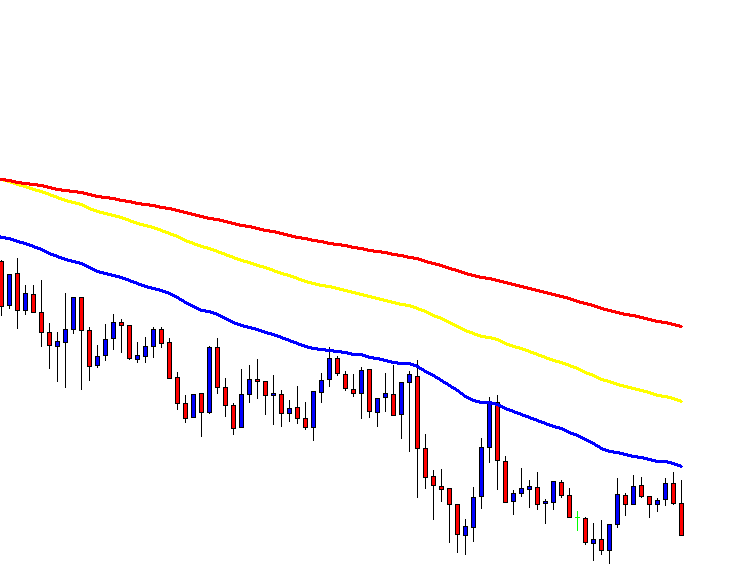

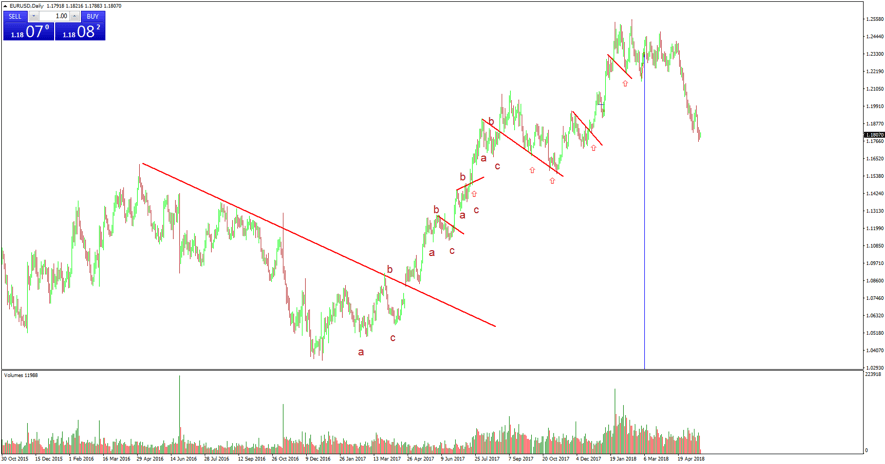

Let’s see how it behaves in the chart.

Variant 2 is an improvement. We see that the bull and bear phases match the actual movements of the market, although entries are still a bit early, and in some cases, it missed the right direction. It can be useful as a trigger signal, provided we can filter out the faulty signals.

Variant 3 – the transition occurs when d moved to the overbought or oversold region and, later, crosses to the mid-area.

Bull: the d-line crosses over the os-line

Bear: the d-line crosses under the ob-line.

if crossover (d, os)

SRSI_Long := true

SRSI_Short := false

else if crossunder (d, ob)

SRSI_Long := false

SRSI_Short := true

else

SRSI_Long := SRSI_Long[1]

SRSI_Short := SRSI_Short[1]

// bacground color change

bgcolor(SRSI_Long ? color.green: na)

bgcolor(SRSI_Short ? color.red: na)

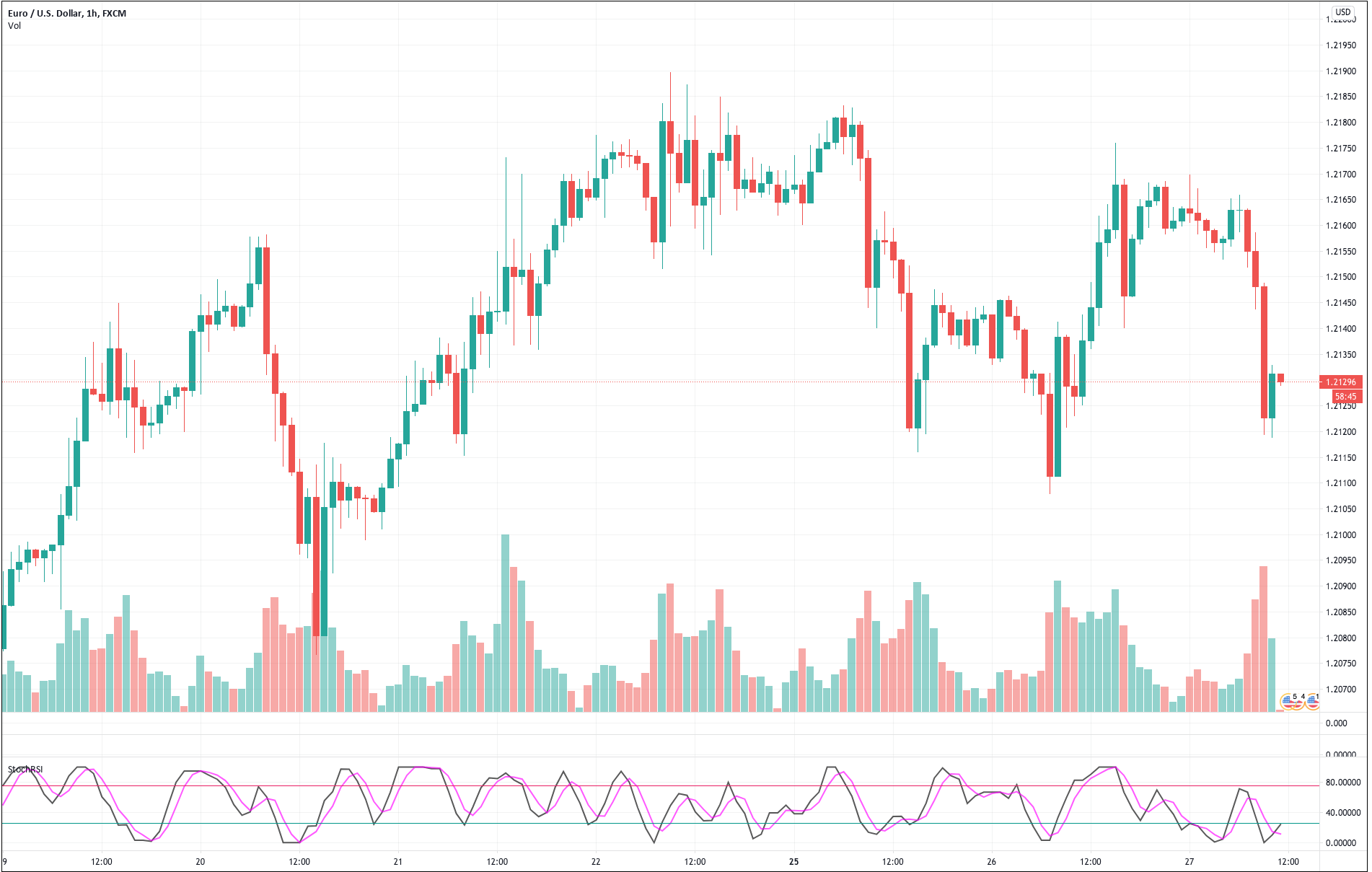

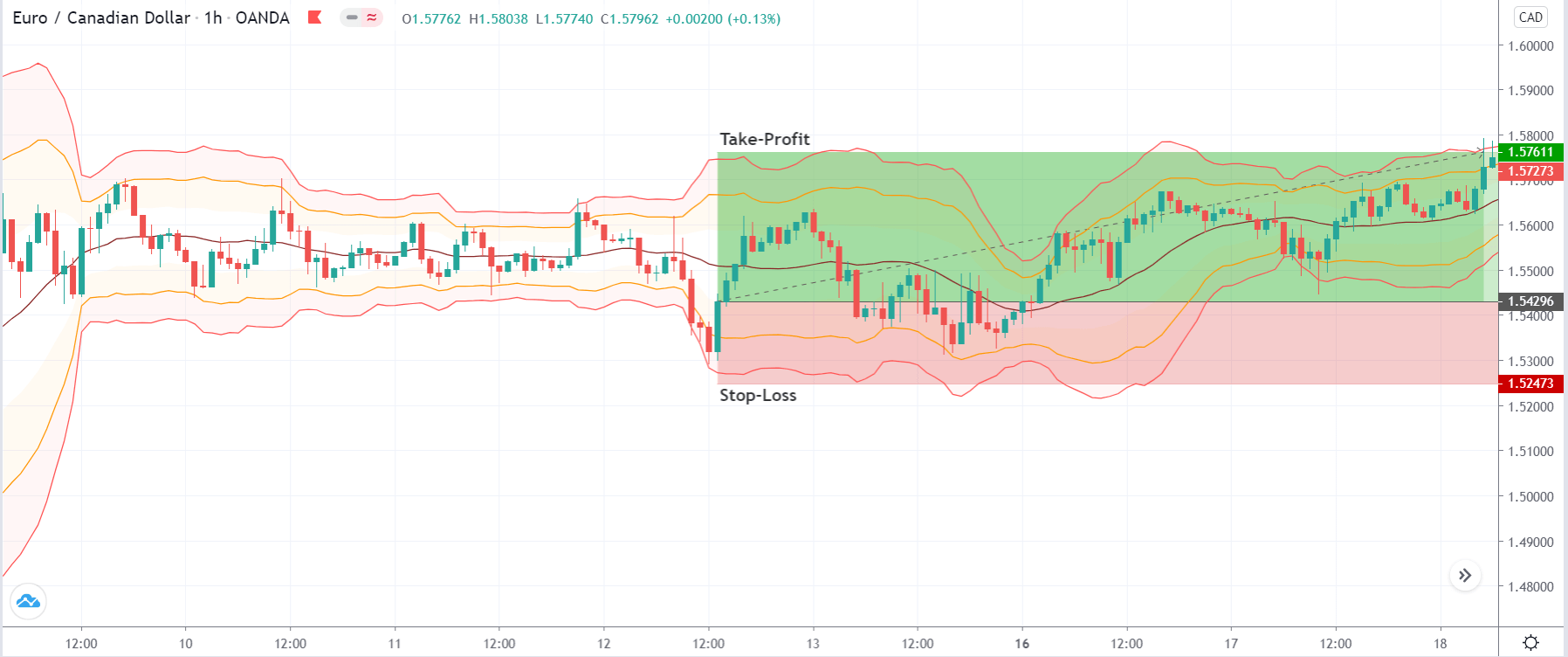

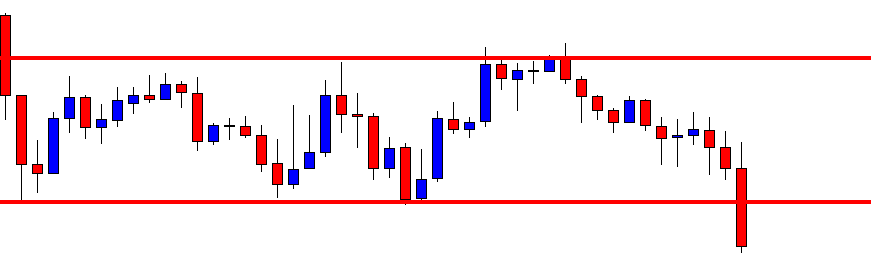

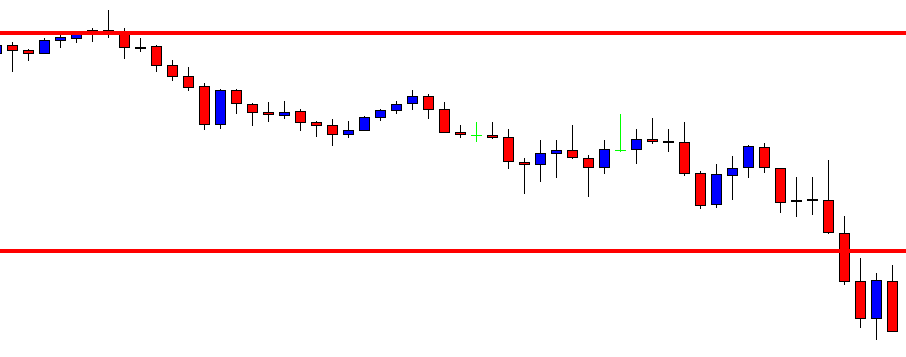

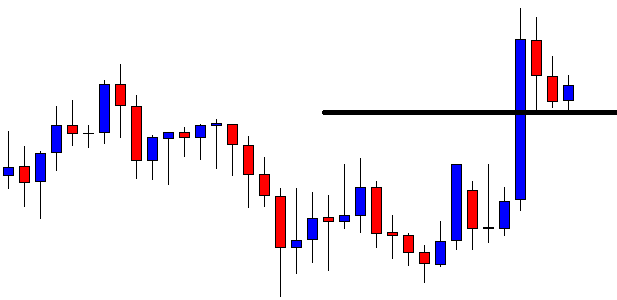

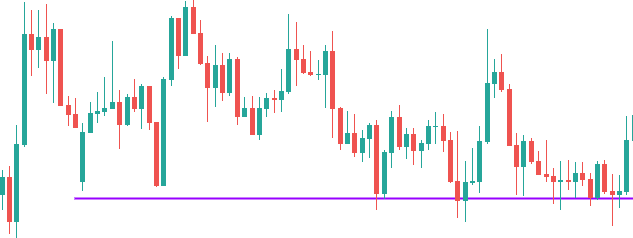

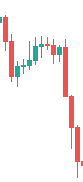

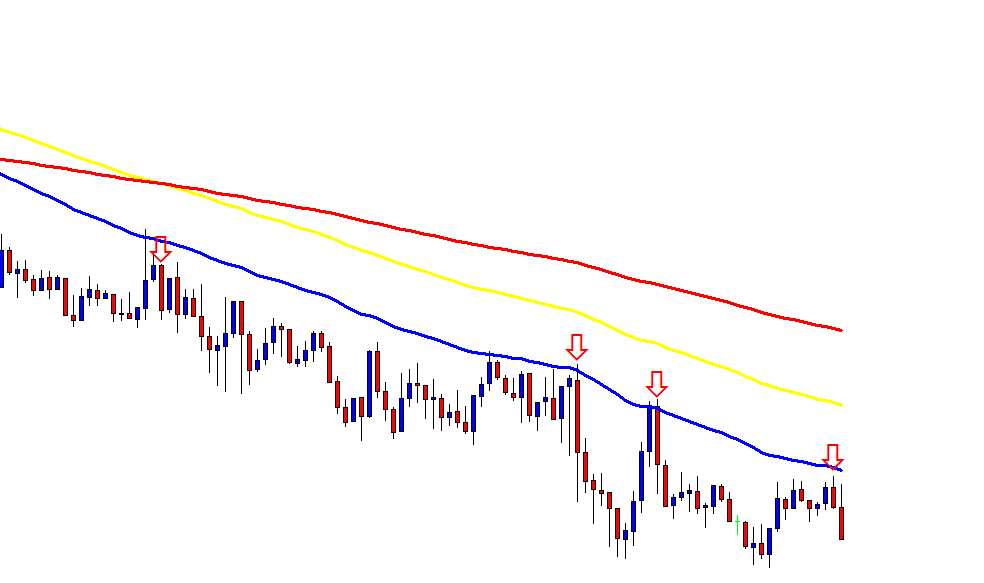

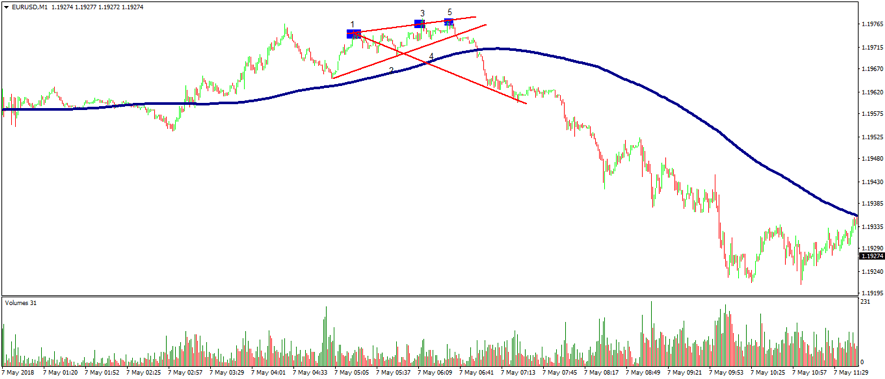

And this is how it behaves in the chart.

Variant 3 lags the turning points slightly, but this quality makes it more robust, as, on most occasions, it’s right about the market direction. This signal, combined with the right take-profit, may create a high-probability trade strategy.

Let’s try this one. But this will be resolved in our next and last article of this series.

Stay tuned!

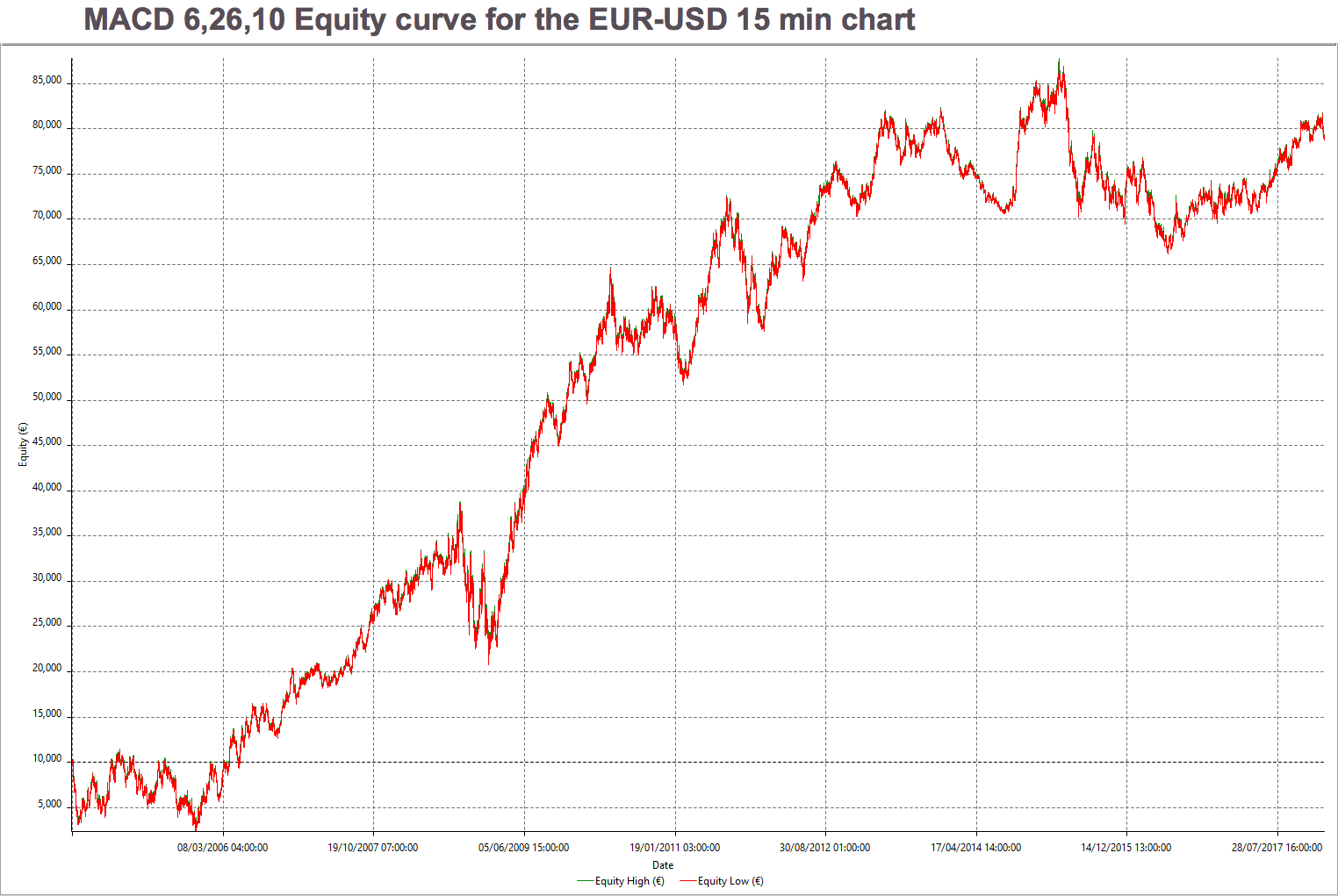

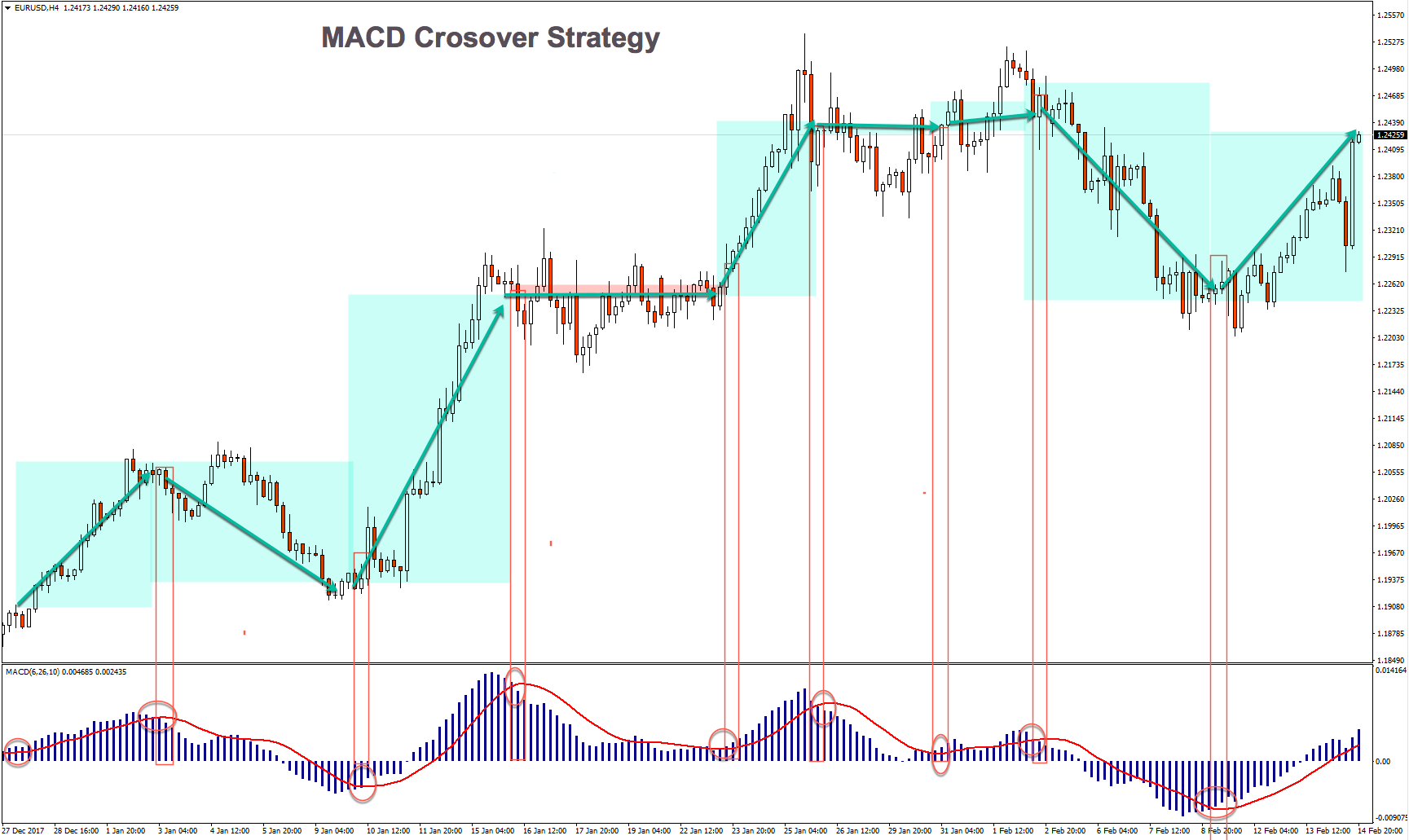

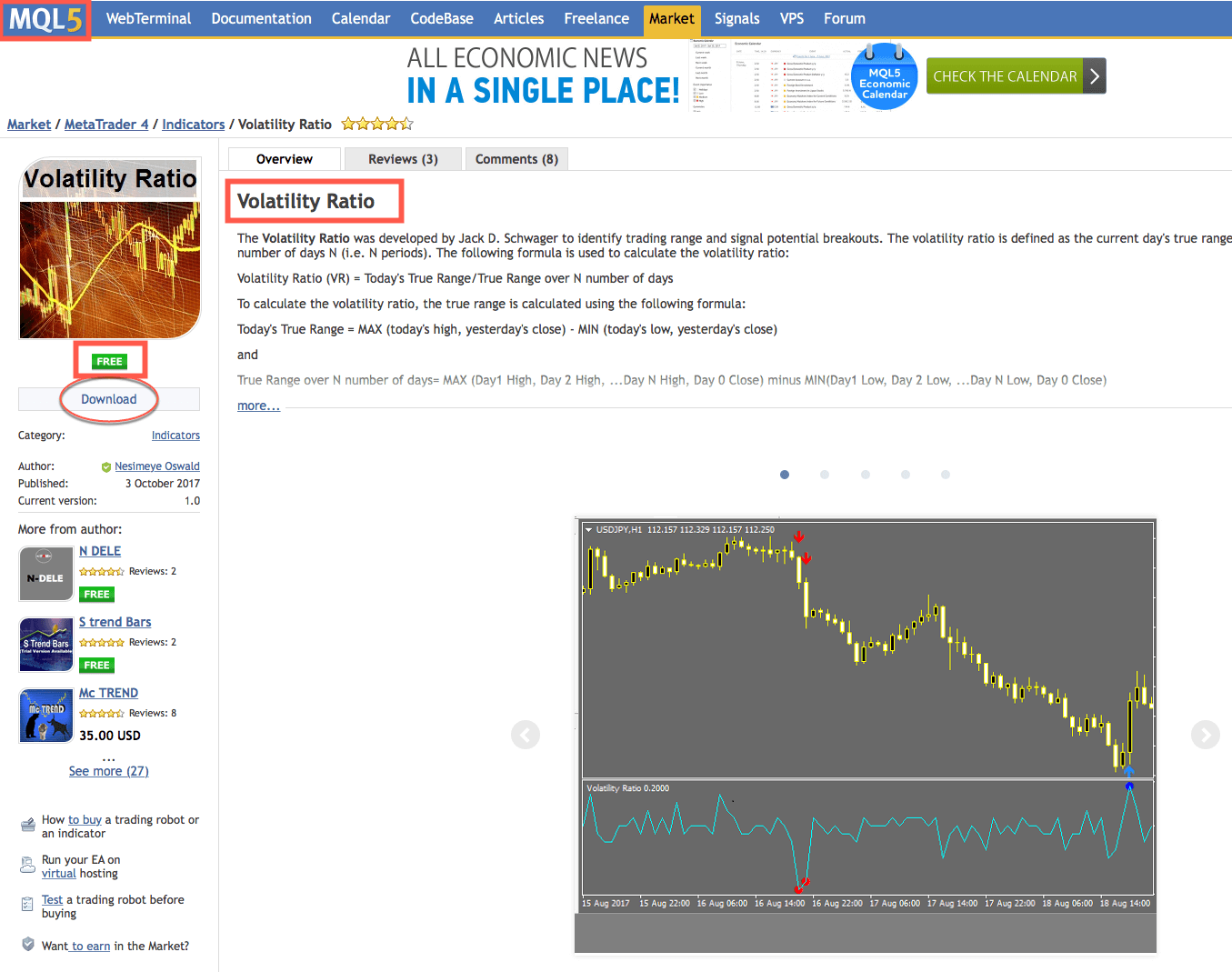

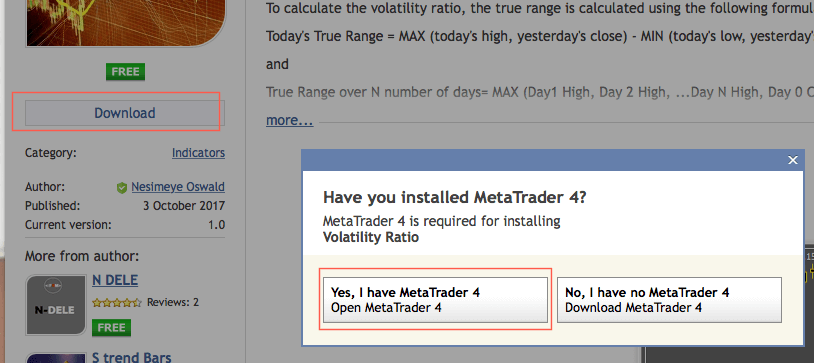

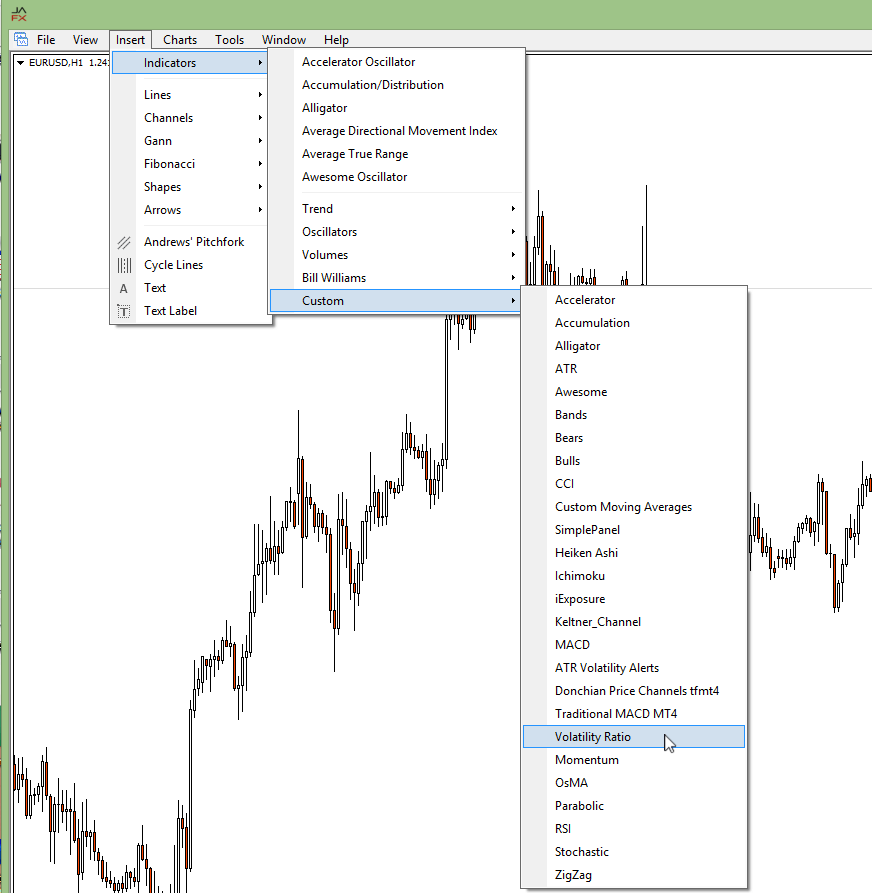

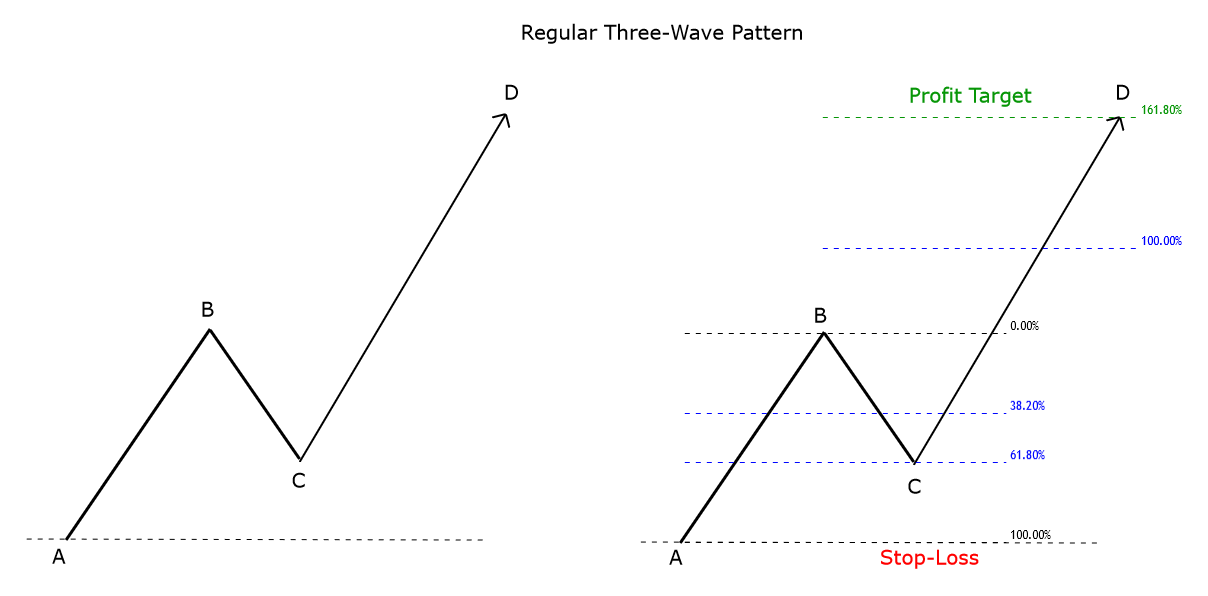

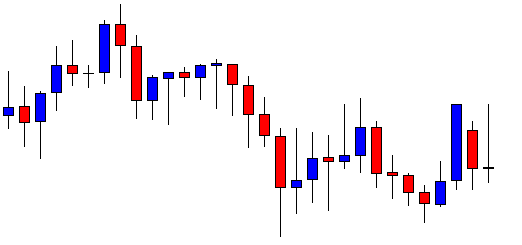

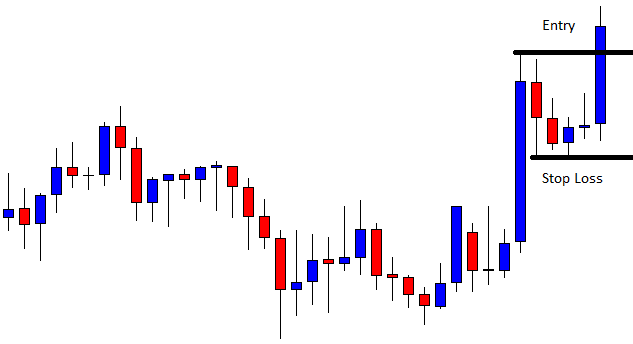

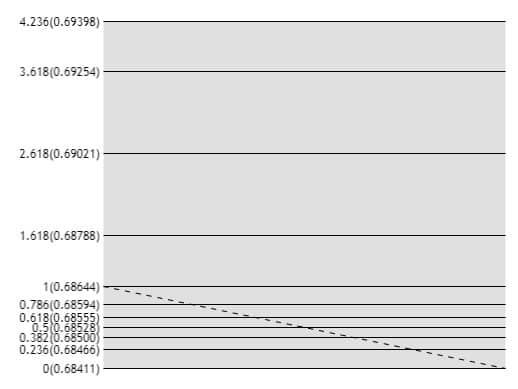

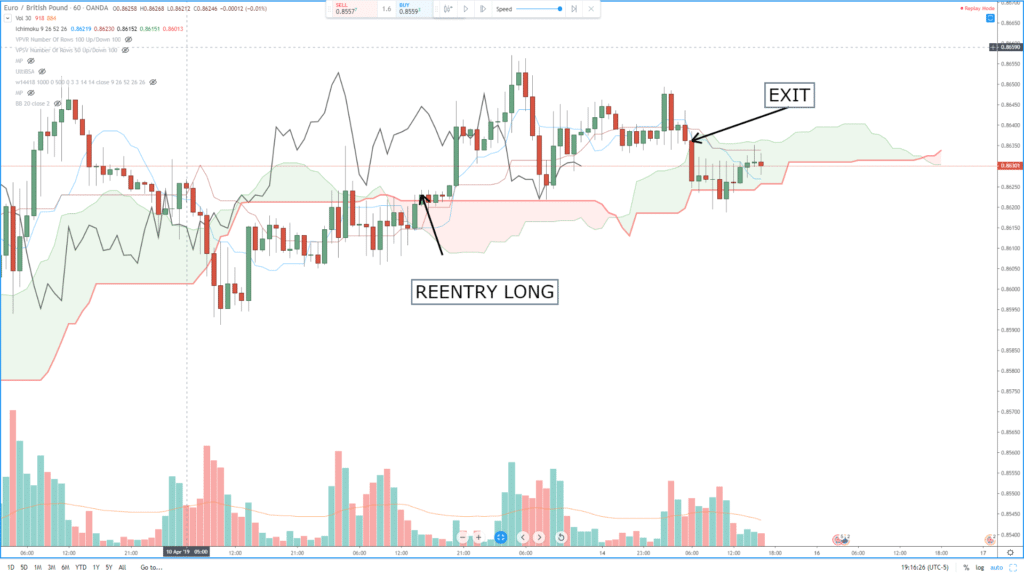

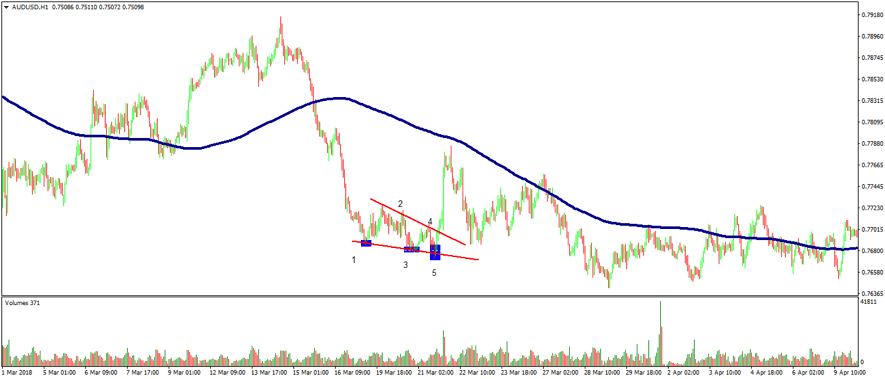

For our example, we will use a simple yet quite exciting indicator called Stochastic RSI, which applies the Stochastic study to the RSI values. This operation smoothes the RSI, and it reveals much better the turning points on mean-reverting markets, such as in Forex. Let’s see how it behaves as a naked strategy.

For our example, we will use a simple yet quite exciting indicator called Stochastic RSI, which applies the Stochastic study to the RSI values. This operation smoothes the RSI, and it reveals much better the turning points on mean-reverting markets, such as in Forex. Let’s see how it behaves as a naked strategy.

The main drawback of the SMA is its abrupt change in value if a significant price move is cut off, particularly if a short period has been chosen.

The main drawback of the SMA is its abrupt change in value if a significant price move is cut off, particularly if a short period has been chosen.