Foreword

All our strategies are based on input setups that have a prior market reading context, which is equal to, or more important than the pattern itself. We recommend learning with Forex Academy traders to contextualize the market, so we always know what situation we are in.

With this being said, we are going to see what this strategy consists of and how we apply it to the market.

The Strategy

As retail traders, we know that markets are managed by institutional traders or “smart hands”, and we know that they practice different trading to ours. They use huge amounts of money to buy large blocks of contracts, and because there is usually not enough supply and/or demand to satisfy them, they need to create that volume by “smart” manipulation. In the market, we can observe that with false breakouts or “shakeouts”. We have learned to identify that professional maneuver in such a way that we will try to move in favor of the market trend.

This system is based on Wyckoff`s studies and accumulation, and distribution trading ranges. The market can be understood and anticipated through a detailed analysis of supply and demand, which can be ascertained from studying price action, volume and time. The main principle is: when the demand is greater than supply, prices rise, and when the supply is greater than the demand, prices fall. We study the balance between supply and demand by comparing price and volume bars over time.

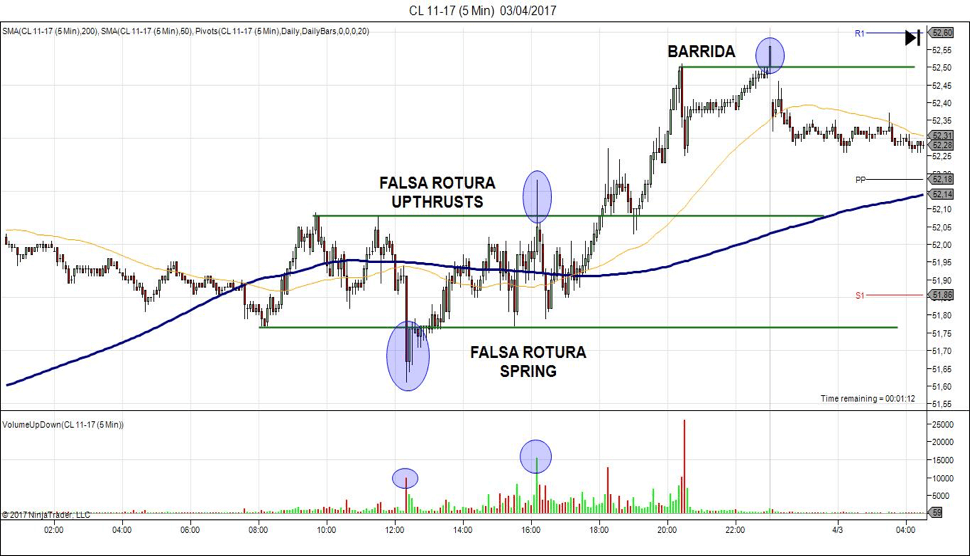

We can see our setups in the following chart:

In this example, we can see the OIL TEXAS chart in a 5-minute time frame. Supports and resistances are marked with green lines.

The first setup is known as “spring”. Smart hands induce small and retail traders to sell because they need the counterpart to buy huge amounts of lots. The volume is the footprint.

If we know how to interpret this, we have a breakthrough in our trading. Obviously, this is a bullish pattern.

The second setup is the same as the first but on the other side of the market. In this case, we have a bearish pattern that is known as “upthrusts”. Smart hands induce small and retail traders to buy because they need a counterpart to sell huge amounts of lots. The volume is again the footprint.

More to the right we have the third setup, again a professional trick. Here there was a flurry of buying, quickly scooped up by the market pros, with the stock retreating above the resistance level before the close.

All these movements are shakeouts of retail stop-loss. It is important to say that smart hands know where most traders have their stops.

© Forex.Academy