Forewords

All these strategies are based on input setups that have a prior market reading context, which is equal to or more important than the pattern itself. So, we recommend learning with Forex Academy traders to contextualize the market to know always on which situation we are in.

That said we are going to see what this strategy consists of and how we apply it to the market.

The Strategy

We know that the market moves by impulses and setbacks and that many of these setbacks are in 3 waves, the so-called. A and C are corrective waves, while B is impulsive. Knowing this behavior, and that the B often reaches the F62 of A, we can try to catch the C wave.

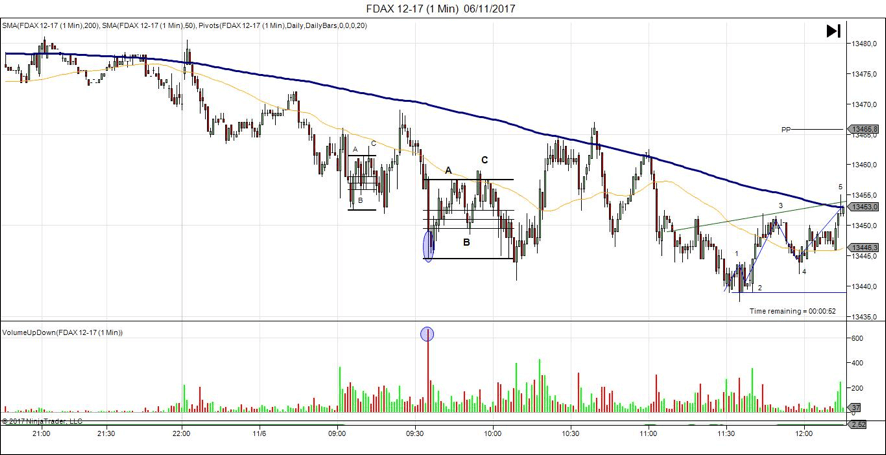

We can use graphics to make this explanation clearer.

In the center of the graph, we see how the price is falling and leaves us with a candle of climatic volume. As we already know, these candles are usually not followed, so we expect a correction. We know that the most usual corrections ABC patterns, so when B arrives at F62 of A, you can try the length to search for C. Remember that context is essential, in this case, the climax helps us.

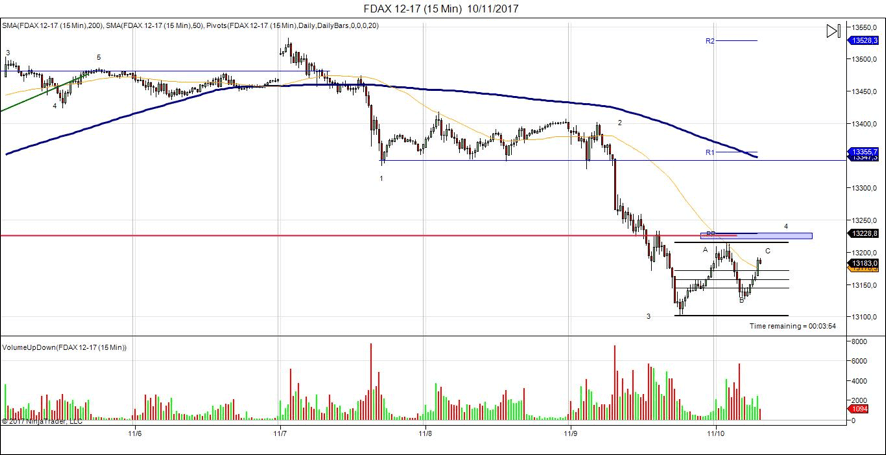

Let’s go with another example:

Now we are looking at the graph of the DAX in the 15-minute time frame. We see how the price is in a bearish trend, and according to Elliott’s count, we are doing wave 4, and then doing the last bearish leg or wave 5. This wave 4 is a correction of the bearish trend, and as we have already said, the corrections are often in ABC. The context tells us that when the B reaches the F62 of A, it is a good area to look for a length and take the C.

We remind you that you must always combine context with setup, and in this case, it is understood that this pattern is not worth much without a proper context behind it. This is what happens with everyone, but we believe that with this example, it is shown clearer

© Forex.Academy