In the final article of our five strategy series, we will present one of the most successful strategies containing two not-so-popular indicators. Whatsmore, these two indicators are role-specific and could be implemented in other strategies. What makes them our pick as the most successful example is the fact they completely solve the decision-making process when to enter and when to exit a trade, closely related to risk management.

Chandelier Exit Strategy

We will start with the indicator designed to tell you when to exit. It is called Chandelier Exit. If you are wondering why we start with an indicator for exits before entries, it is because entries can even be random, but you need to know how not to turn your profits into losses, and how to keep your losses limited. This is how Chandelier Exit looks like on S&P 500 2020 bull resume run on a daily time frame (blue line):

One of the most important aspects of trading is knowing where to put Stop Loss and Take Profit orders. These two limiting orders are the backbone of money management that could be realized using this indicator. Notice how the indicator blue line acts as a support for this bull run. In June the price nearly pierced the line, further supporting the trend until it really is the right time to consider long positions in September when the price closed below Chandelier Exit. On the other side, this is a form of a trailing stop that also acts as a profit taker – it closes the long position when the trend is likely over. This way you avoid the pressure when the price is testing the support and avoid letting profits shrink too much. The balance of getting out too early and too late is what this indicator does great by default settings. Additionally, it puts you in a firm seat once the trend is rolling, and emotions at bay. Even though this example is for the bullish trend, the same applies to shorting.

The secret of this indicator that creates this balance is the volatility component in its code. To measure volatility, Chandelier Exit uses ATR, the same indicator we use for money management as explained in our previous articles. Highest High and the Lowest Low range in 22 periods (default) is used in the calculus. If you are wondering why 22, it is because a month has 22 trading days.

Does it mean you should use it on a daily time frame? The best answer would be to adapt it to your strategy for the best possible outcome. Here is a simple optimization method that could be applied to any indicator:

- Backtest a fast setting and then a slow one. Choose the better option and then try 50% slower and faster settings. If the results are better for the slower then keep decreasing the periods until the results stop getting better. Make sure that you have a good trading sample, have at least 100 trades in the first runs or you might not get valid results. Specifically for the Chandelier Exit, try to change the ATR factor first.

Chandelier Exit acts as a support/resistance line despite its name that sounds as it is for exits only. As the markets are different in volatility, the indicator needs adjustments. For a quick fit, traders eyeball the best entries and exits for obvious trends and then play with the period setting around that number. Volatile markets will require more than default setting while calmer will require shorter. Forex major currency pairs are not volatile as some indices, stocks, or crypto.

The picture below shows how the default value of the Chandelier Exit settings is not adequate to the market volatility.

Donchain Channel Strategy

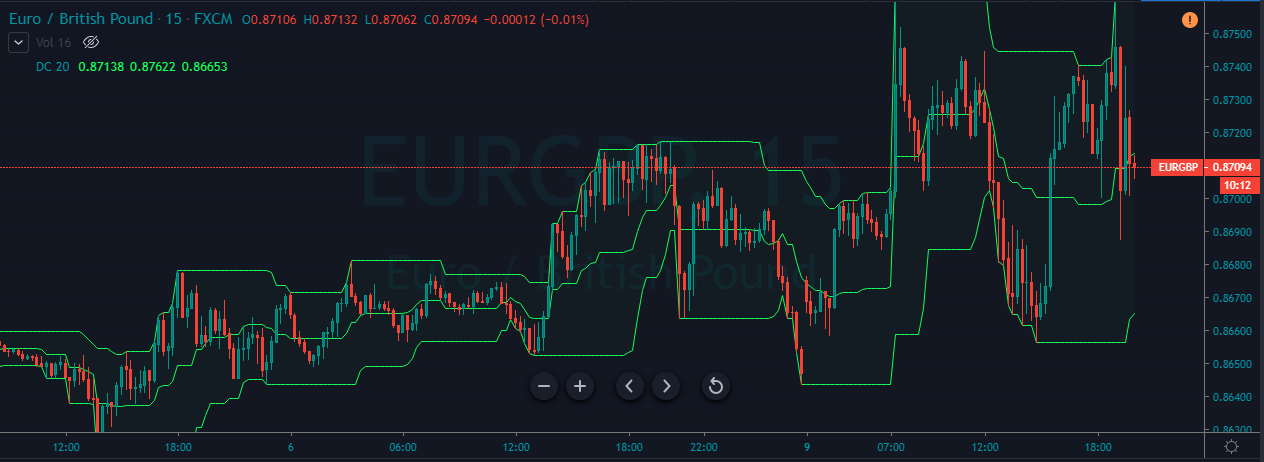

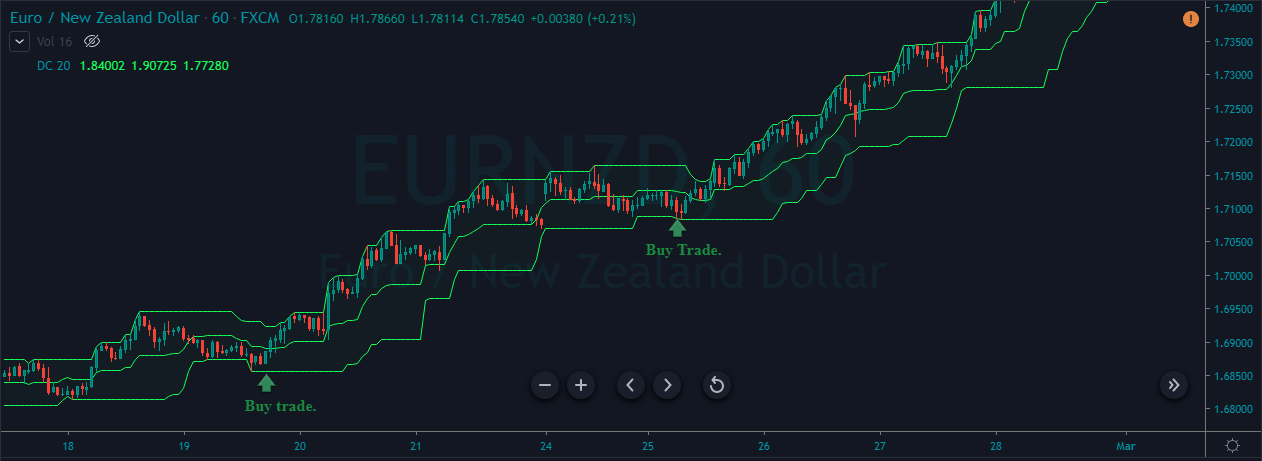

This indicator measures higher highs and lower lows for the set period (default is 20). It forms a channel similar to the popular Bollinger Bands but it has special properties that are very useful to set up money management. Volatility is the core of what these channels represent, they are expanding when the volatility increases and contract when it is calming down. Now, while it may sound the same as the Bollinger Bands, it is actually the primary element of the famous Turtles Strategy and not a reversal idea stemming from the Bollinger Bands.

This strategy follows the breakout principle where the price is breaking through the Donchain channels, meaning the channels are representing support and resistance lines. Whenever the price closes outside the channel it is a signal to enter a trade. If you wonder where to exit, that would be when the price pierces the other side of the channel, signaling an entry just in the opposite way. Now, beginners may question how to find a signal since the channel lines are adapting to the new price lows or highs for the specified period. The answer lies in the line extension. Simply just draw or imagine an extended horizontal line covering the channel wall before the latest candle and see if the price has closed outside the channel. If it is then that is your entry or exit signal. Just do not consider these breakouts as the oversold or overbought areas.

The Donchain Channel is very closely tied with the simple Support And Resistance PA trading to the point it is just a facilitator so you can see the lines. As with the S/R trading, previous resistance that was violated becomes support and vice versa. As for money management, Stop Loss acts as the profit taker and as the loss limiter. Placing the Stop loss on the chain lines is actually a trailing stop that you can move manually or you can set up a custom one that follows 2xATR value in 20 periods which is also the default for the Donchain Channel.

The Donchain Channel is very closely tied with the simple Support And Resistance PA trading to the point it is just a facilitator so you can see the lines. As with the S/R trading, previous resistance that was violated becomes support and vice versa. As for money management, Stop Loss acts as the profit taker and as the loss limiter. Placing the Stop loss on the chain lines is actually a trailing stop that you can move manually or you can set up a custom one that follows 2xATR value in 20 periods which is also the default for the Donchain Channel.

Another option for money management is to use the midpoint of the channel as the exit line. Some traders use this type for more active trading where the exit is more aggressive to capture profits. However, entries then should also be more frequent since long trend following is likely to be interrupted with shallow exits at the midpoint. One more option that is often overlooked is to use the midpoint as the first Take Profit point and then moving the Stop Loss to breakeven. The remaining half of the position might continue if the trend resumes thus giving you the potential of the long trend while the risk is nullified. Most traders consider this option as the best since it blends the best of the two worlds, following long trends and having some profits while the risk is open only until the first Take Profit.

How you set up money management rules should be closely related to the win rate and the Stop Loss/Take Profit distance. If you have a high win rate then consider expanding up the Take Profit distance to capture more gains from a trending market. While the risk amount is up to you, experienced traders do not risk more than 5% per trade of the total balance.

You may notice both strategy examples are trend following on mid to long term timeframes, they are not designed for smaller time frames. There is too much noise and sudden high-intensity candles that trigger false signals regardless of the settings. If you still consider using smaller time frames, use the Donchain and the Chandelier Exit with a higher timeframe filter for gauging general trends. This way you ensure a higher probability for a winning trade in that direction.

As this is the final example of the series, try to use something out of each strategy to make up your unique setup. Keep perfecting it, even if the effort does not bear winning results, know you have so much more experience that will serve you permanently.