There’s so much to know about scalping strategies. Scalping can provide fast, unlimited profits, but does come with risk. Knowing how to choose the instrument of negotiation is a matter of utmost importance, not only for a scalper, but in the life of a scalper there is the situation of fighting for every point of profit, and a sudden change in prices can lead to a significant loss.

Basic requirements for a better currency pair for scalping:

The narrowest and most floating spread possible. This condition is fair for highly liquid pairs and large transaction volumes: GBP/USD, EUR/USD. To be able to compare the differentials of the different currency pairs that the broker offers us, we can make the data useful from the MyFxBook portal.

Moderate volatility. Liquidity and volatility have a kind of reverse correlation. It is difficult to buy/sell a currency pair with high volatility. And vice versa, high-liquidity currency pairs have low volatility. It is very important to maintain balance, the volatility calculator can help you to do so. According to the calculator, the best currency pair for scalping is EUR/USD.

For night scalping (flat), you can trade the pair with relatively low volatility USD/CAD, AUD/USD. I want to emphasize that the meaning of the best currency pair for scalping is subjective. Price movements depend as much on external macroeconomic factors as on foreign exchange manipulations by large investors (market makers). For this reason, depending on the time, different pairs of major currency pairs or cross pairs can become the best for scalping. So, there are some tips on how you can select the best pair for scalping:

You must feel comfortable when you operate. Find your own trading style and the most suitable currency pair, investing all the time you need in training in a demo account.

Be flexible. Today you get positive results by trading in one currency pair, tomorrow, in another currency pair.

Manage foreign exchange risks. In addition to the general rules on the volume of open positions, there is one more rule regarding scalping: you should not open transactions for the two increasing currency pairs at the same time. While it can double your profits, it also doubles your potential risks, as both pairs can be reversed at the same time.

There are no recommendations on the best indicators and technical tools for scalping. Everything is individual here. Someone is satisfied with the standard MT4 indicators, someone installs unique authoring tools. Trading performance does not depend as much on the tools as on the ability to use them.

Forex Scalping Strategies: Examples

The use of scalping on Forex means that a Forex trader is under an “obligation” to monitor intensively trades and open positions. The strategies described below are based on technical indicators but are used as complementary tools for intuition and practical experience. Therefore, before you start using these strategies in a real account, practice them over and over again until they are fully automatic. And remember that there are no perfect strategies and the suggested ideas are just the basics. Don’t be afraid to experiment by adding something of your own, create something of your own, unique based on this basis!

How to Install Scalping Strategy Patterns on MT4: The trading systems described below mean that using combined indicators that are not included in MT4 and other platforms as standards. These indicators are loaded and you can find them in the “Custom Indicators” tab, the loaded pattern is located in the “Graphics / Patterns” tab. Depending on the type of operating system, folder names may differ.

Classic Scalping

This strategy is based on very basic technical tools, are 4, and are combined in a pattern: two simple moving averages, RSI and MACD. The strategy is classic, based on the principle: “Don’t reinvent the wheel, learn to feel the market”. The recommended time frame is M5. The 1-minute interval will send many false signals, but you can try looking for signals in non-standard time frames of 5 to 15 minutes. Recommended pairs: EUR/JPY, EUR/GBP: are the most effective trading signals for them.

Advantage of Beginner Strategy: Train standard indicator application skills, improve your attention (looking for multiple conditions that are met at the same time).

Configuration of the indicators:

- МАCD: MACD SMA (9), lento ЕМА (26), Fast ЕМА (12), applies to Close.

- RSI: Period (26). Base levels can be maintained: (50). Apply to Close.

- EМА (Exponential Moving Average): Period (20), Apply to Close. Change 0

- LWМА (linearly weighted ), is a moving average: Period (10), Apply to Close. Change 0

The best time for currency scalping is the European session, at this time these pairs are trading more actively, so the liquidity in the market is the highest.

Conditions for opening to a long position:

- МACD has been below zero level for some time, then draw a graph above zero.

- RSI in the same range of sails penetrates level 50 from the bottom up.

- LWМА (orange line) is above EMA (blue line). The perfect condition is when LWMА in the same interval penetrates EMA from the bottom up.

The trade will open in the next candle after the main condition is met, MACD intersection at level zero. The rest of the signals in this case are confirmation signals, but you should not enter an operation unless all conditions are met. We place a stop at the level of 5 points (you can a little more, depending on volatility). The estimated earnings are 5 points regardless of spread coverage. By reaching the target, the transaction can be secured by trailing or closing. The second option is more acceptable. During the release of important news, this strategy does not work.

Conditions for opening a short position:

- МACD has been above zero for some time, and then draws a graph below zero.

- RSI in the same range of sails penetrates level 50 from top to bottom.

- LWМА, represented by an orange line, is below the EMA, represented by a blue line. A perfect choice would be if LWMA in the same range penetrates EMA from top to bottom.

Market entry is similar: as soon as the MACD penetrates level zero, an operation can be opened.

You shouldn’t have a big win. The strategy suggests winning just a few points. Signals appear almost every day, so you can not limit more than one or two currency pairs. If you have managed to resume the beginning of the trend, you can increase the size of the target benefit.

:max_bytes(150000):strip_icc()/dotdash_INV_final_Forex_Scalping_Jan_2021-01-ca1c8dff08824bff87ed01fdd1dba239.jpg)

Scalping In A Saturated Market

This scalping strategy aims to resume the moment of maximum saturation of the market. That is such a state when the trend is already ending and there is an inertial movement of price just before the reversal.

The strategy uses the Laguerre Volume indicator, which helps you identify the moment of saturation of the market volume. Its developer, John Ehlers, originally worked with equipment designed for space signal processing in the 1970s. As he was a proponent of cycle theory, the indicator was developed on the basis of this theory. It was eventually modified by a French mathematician Laguerre.

The indicator is efficient for signaling the start and end of micro-trends. I’m not suggesting you try to understand the indicator’s calculation formula unless you are an expert in mathematics and programming. Just download your ready pattern here. This strategy will suit perfectly those who are just starting scalping, as the M15 time frame allows you to estimate the signal without haste and gives you more time to make a decision. The currency pair is USD/CAD, traded when the market operates unchanged after saturation.

Advantage of the beginner strategy: it is a simple strategy that does not require high concentration and emotional stress on the part of a trader.

Laguerre Volume configurations: gamma = 0.618, the number of bars analyzed = 5000, Levels: 1; 0.75; 0.5; 0.25; 0. The gamma value is used to calculate the indicator levels. The higher the value, the smoother the line will be. The value of 0.618 in this case is the optimal balance between smoothing and lag.

Conditions for opening to a long position:

- Trading takes place during the night period of the flat from 00:00 to 07:00 ЕЕТ. After active trading during the European session, there is the attenuation phase with inertial price movements.

- Laguerre Volume first crosses level zero and then reaches level 1.

- During the increase of the indicator to level 1, there is an increasing candle with the body that is not less than 3 points.

- You can enter an operation in the next candle by covering it with a stop loss at a distance of 8-10 points. The target profit is 5 points, after that, you can completely close the position or part of it, moving the stop to the entry-level or leaving the position open by protecting it with a trailing stop.

Conditions for opening a short position:

- Trading takes place from 00:00 to 07:00 ЕЕТ.

- Laguerre Volume first crosses level zero and then reaches level 1.

- During the increase of the indicator to level 1, there is a candle that falls with the body that is not less than 3 points.

- The principle of opening the transaction is similar.

Laguerre volume does not always increase in the interval from 0 to 1 ideally straight. Sometimes, there are setbacks, and then, it resumes by rising. That is why, if the indicator reaches, for example, the level 0.9 and is reversed, it is better not to open a transaction. The straighter the indicator’s path to target level 1, the more accurate the signal is. You should not open an operation if the indicator tests the level twice, as shown in the figure above. You can test the strategy in pairs, including Australian and New Zealand dollars, other currency pairs should not be traded with this strategy.

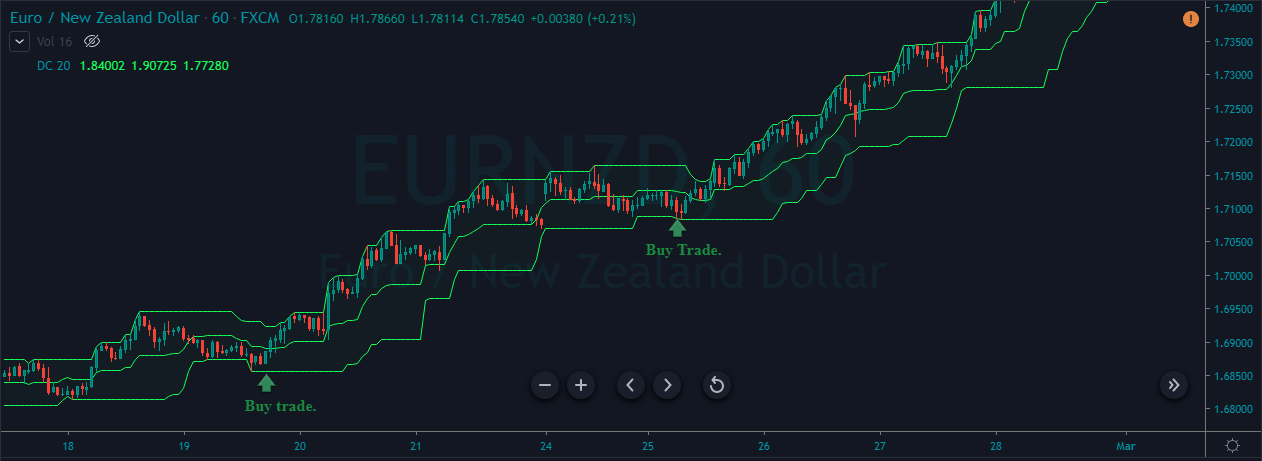

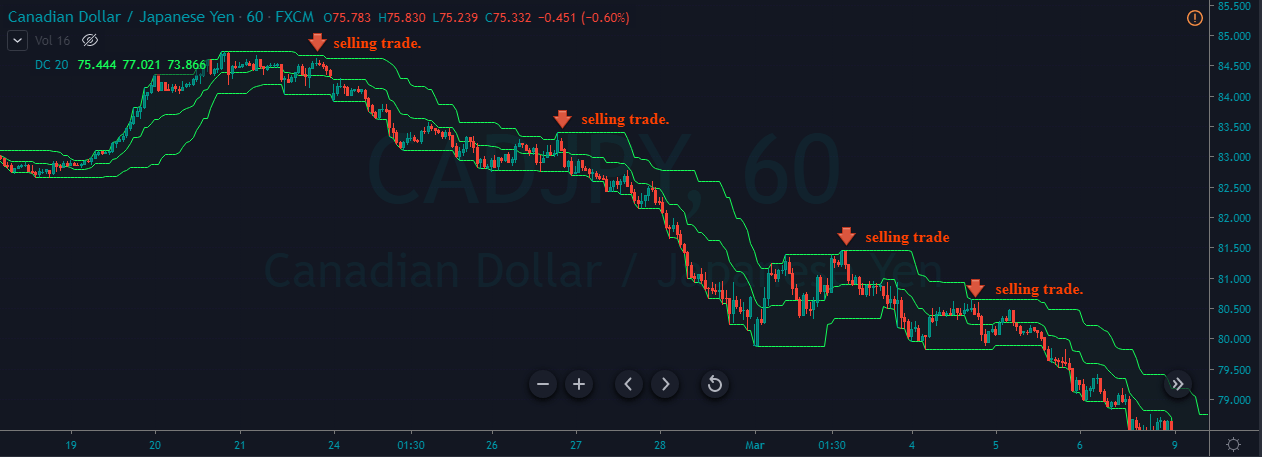

“Scalping by Trend” Strategy

Unlike other trading systems, this trading approach suggests entering a number of trades at the beginning of the trend. In theory, one could put a single input and maintain it until the trend is reversed, but scalping also involves taking profits from setbacks/corrections. And also, this strategy will allow you to win money with short trends.

The strategy uses the following indicators: Classic Stochastic and Awesome Oscillator (Awesome Oscillator)», learn more about the principle of calculation and application here. Two moving averages analyze the trend line in the one-hour time frame.

Advantage of the beginner strategy: it is a good example of how you can make money with scalping additionally using a longer time frame. The pair will be GBPUSD, the main trading interval is M5, the auxiliary is H1. Trading takes place in the European session.

Configuration of the indicators:

- Awesome Oscillator: all settings are default.

- SMA 1: Period 50, represented by a red line, is applicable to close.

- SMA 2: Period 200, represented by a blue line, is also applicable to close.

- Stochastic: %К – 14, %D – 7, Slowing down – 7, Sliding method – Simple, Levels – 20 and 80 (basic).

Conditions for opening to a long position:

- Chart analysis with time frame H1. The direction of both slides: up. The red slip should be above the blue.

- Analysis of the graph with time frame M5. Stochastic is in an area that we call oversold, this happens when it is between levels 0 and 20, and in the signal, candle leaves it. Awesome Oscillator draws a column of green, always below level 0.

- The more vertically the stochastic exits the oversold zone, the more accurate the signal is. After all, conditions match in the next candle, you can open a transaction. The target benefit is 10-15 points, the stop can be placed the same or a little more.

Conditions for opening a short position:

- Chart analysis with time frame H1. The direction of both slides: downward. The red slip should be below the blue.

- Analysis of the chart with time frame M5. Stochastic will be in the area we call overbought when it is between levels 80 to 100, and in the signal, a candle comes out of it. Awesome Oscillator always draws a column of red above level 0.

- The condition of opening the transaction is similar. If the trend is constant, you can open a series of transactions.

Scalping By Levels

Level trading suggests two scenarios: breaking the channel limit with the start of the new trend or rebounding from the limit (support/resistance level) and returning to the middle of the channel, that is, to the equilibrium level. This is a perfect scenario. In reality, everything we have set out here may be something different:

The channel boundary break may be an inertial price movement and may not start a new trend, the price may return to the channel after a brief movement.

Movement within the channel can also be chaotic. After a rebound from the limit, the price fails to reach the mean (let alone the opposite limit) and is reversed.

For an intraday channel strategy, these are all risks. But not for the scalping that allows you to make profits both from the channel break and from price swings within the channel. The psychological levels, in this case, serve as an objective reference that helps you to assume at least approximately the potential reversal points within the channel.

The strategy suggests building a “Slip Envelope” where the price will return. Stochastic will identify the probability of channel boundary break, internal levels are created based on Fibonacci levels. Stochastic in this case will be a complementary tool, moving averages and levels with coefficients of 61.8; 161.8; 261.8; 361.8 are combined in a single MavEn indicator, which you can download through this link. The moving averages in the indicator are constructed by adding 3 LWMA with periods (30, 50, 100), which shall be weighted by the closing price.

Advantage of beginner strategy: an excellent combination of scalping and channel strategy.

Time Frame – М5 (5 minutes), torque – EUR/USD. MavEn configuration unchanged. Stochastic configurations: %К – 14, %D – 3, Slowing down – 3, Prices – Low/High, Sliding method – Simple. The levels are standard (20, 80).

Conditions for opening a long position:

- The candle closes below the red line.

- Whenever we find the price below the red line, the oscillator drops to the oversold zone (below level 20).

- Both the price and the stochastic must be below the red line for more than 10 candles.

- The price goes up above the red line.

- After the candle closes above the red line, we open an operation with a stop at a distance of about 10 points. We leave the market when the orange line is reached (Fibonacci level 61.8).

Conditions for opening a short position:

- The candle closes above the red line.

- While the price is above the red line, the oscillator goes up to the overbought zone (above level 80).

- Both the price and the stochastic must be above the red line for more than 10 candles.

- The price drops below the red line.

The conditions for exit from the market are similar. Other lines are auxiliary, but, if they begin to indicate a reversal and the profit has already covered the spread, we close the deal and wait when the price exceeds the limit for the next time. If the price for a long time is between the red and blue lines (8-10 candles and more) or outside the red line, we do not enter the market.