Introduction

The daily high low based forex trading strategy is a breakout trading strategy from the high and low prices in the daily timeframe. In forex trading, the daily timeframe is crucial as most of the significant market players use this time table in their trading. As a result, any trading strategy in the daily time frame provides better trading results compared to the lower time frame.

On the other hand, when the price creates a rally by breaking the high and low price of the daily timeframe will indicate a significant market momentum. If you can avoid the range market, the high low based strategy can provide a reliable trading result. If you can implement the trading strategy well as per the rule mentioned below, you can make a decent profit from it in any currency pair.

The Daily High Low Based Trading Strategy

The daily high low based forex trading strategy has a simple concept:

- If the price breaks below the low of yesterday’s candle, it may move further low.

- If the price breaks above the high of yesterday’s candle, it may move further high.

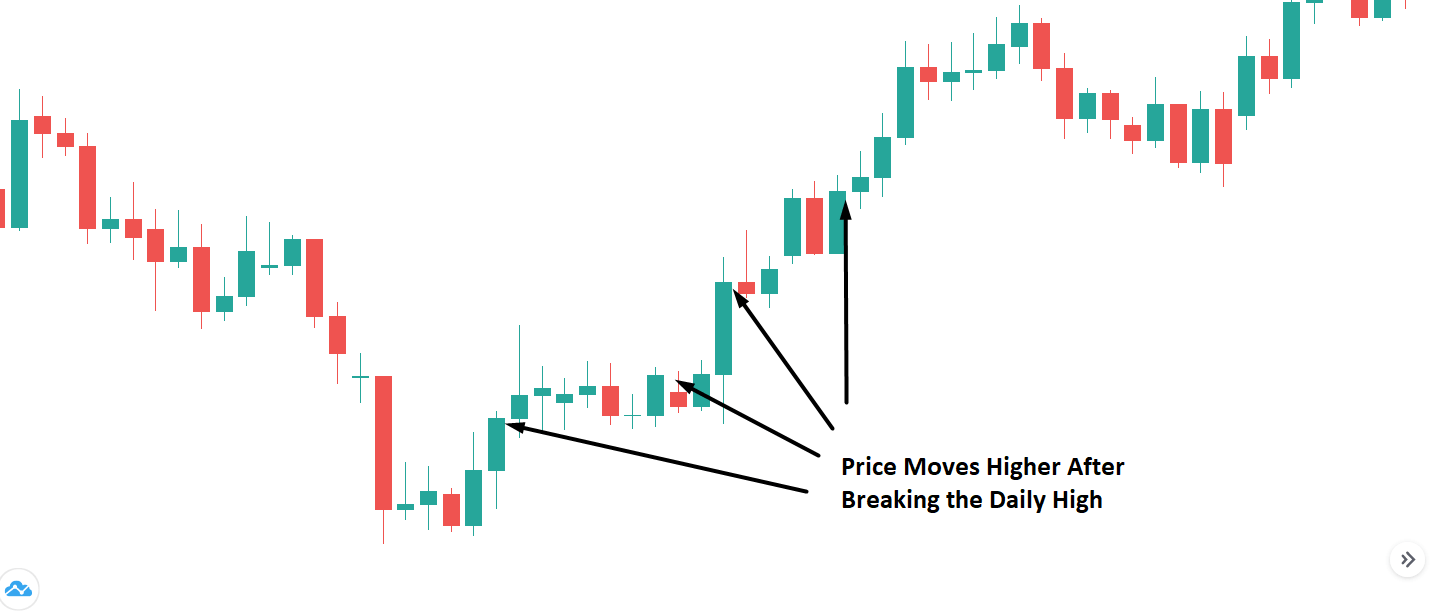

It is a standard brief of this trading strategy. Let’s have a look at the image below:

In this image above, the price has made a new higher high once it breaks above the candle high in the market area. However, there is some market condition where price moves to a range and violates the movement above or below the candle high.

If you are trading the breakout of a daily candlestick that is larger than the earlier candlesticks, you might be caught by the mean reversion of the price. In the forex market, it is often difficult to predict how long a trend could stay. Almost 70% of the time, the market moves within a range; therefore, you should find a location of the price where the breakout from a daily candle would be reliable.

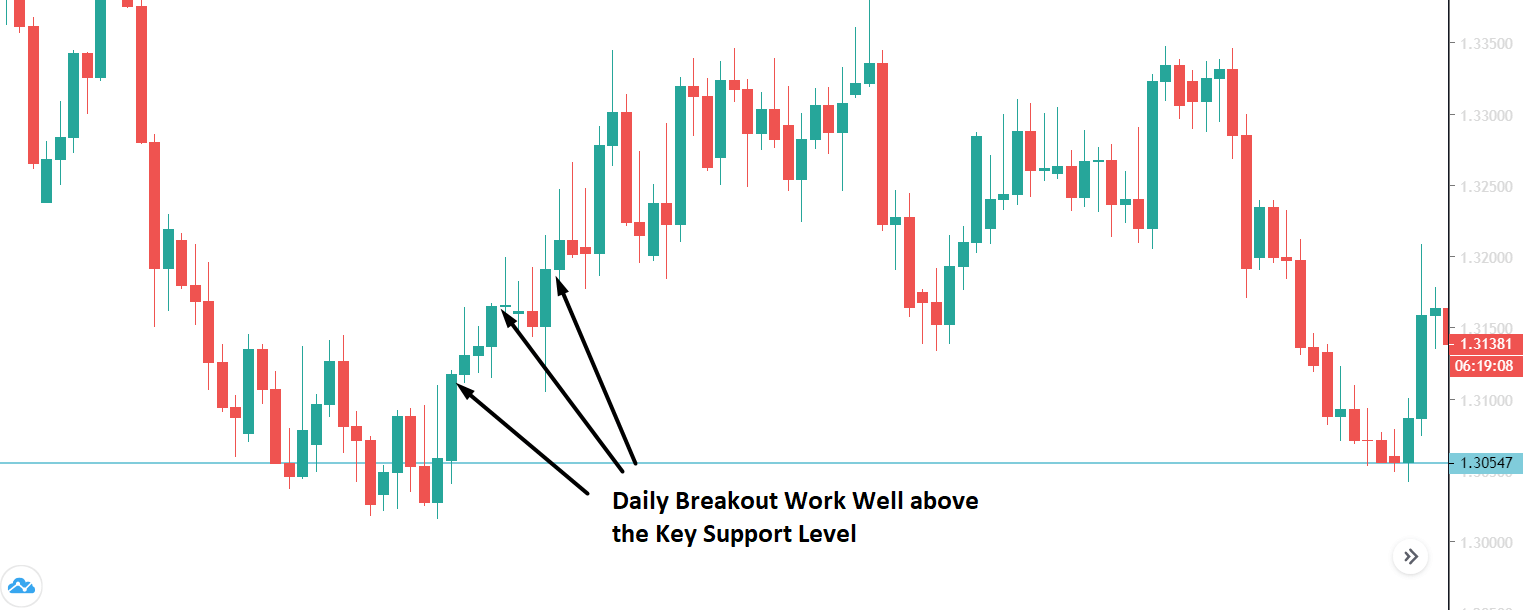

The basic concept of making a good profit from the forex market is to buy from low and sell from high. Therefore, any bullish breakout from a significant support level in a daily timeframe would indicate a reliable daily breakout strategy compared to a trade setup from the middle of a trend. Let’s have a look at the image below, how the price moved up once it got a breakout from a daily candle from a significant support level.

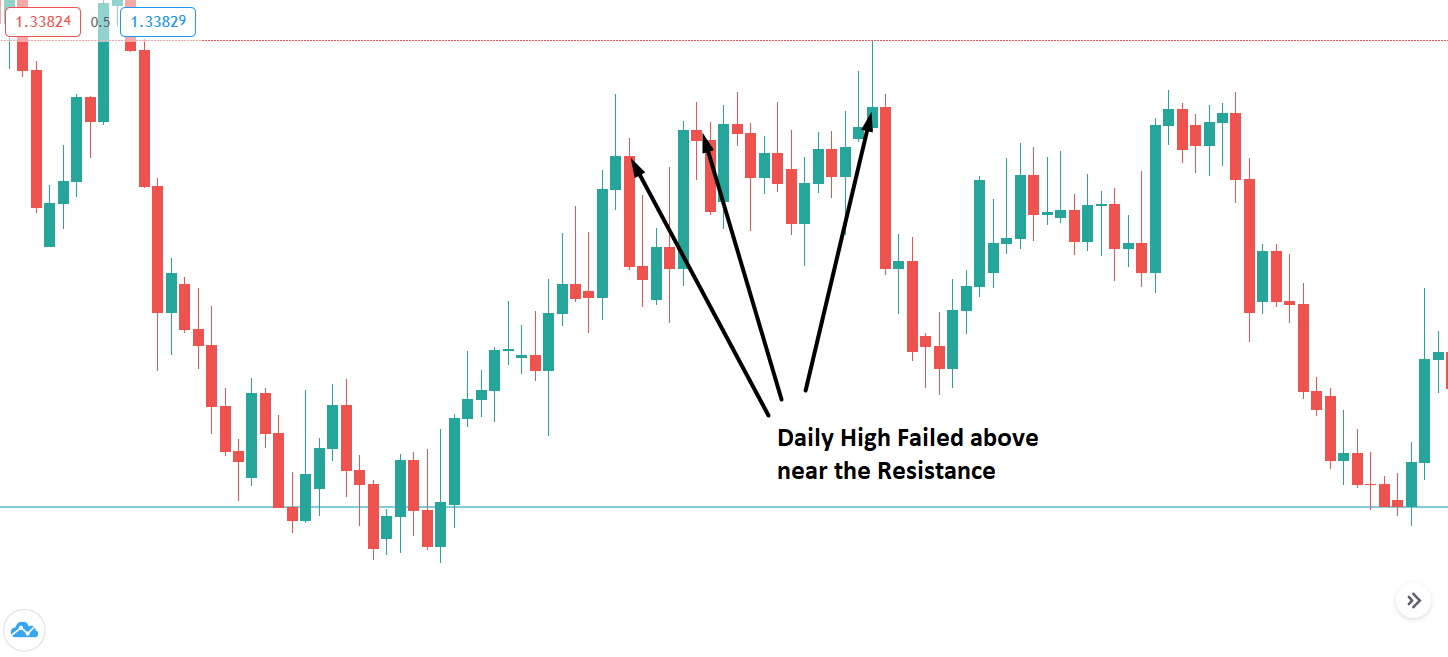

Now look at the image below and see how the price violates the daily breakout to the upside once it reached above 50% of the possible trend.

How to Trade the High Low Breakout Strategy?

This trading strategy is simple as you can make most of the trading decision a day before the movement is expected. The main of this trading strategy is to place two pending orders above or below the yesterday candle. Therefore, you can catch any movement either upside or downside from the previous day’s candle.

Timeframe

We should consider the daily timeframe to determine the high and low prices. Later on, move to the lower timeframe (usually H4) to enter the trade. However, for new traders, it is recommended to stick to the daily timeframe.

Currency Pairs

This trading strategy works well in all currency pairs, including EURUSD, GBPUSD, USDJPY, or AUDUSD. However, sticking to the major and minor currency pairs would provide a better trading result. Moreover, you should avoid exotic pairs as there is a risk of the false move by hitting the high or low and reverse back.

Breakout Rules

- Identify the currency pair that is moving within a trending environment. You can predict the direction of the price based on the market context or support and resistance.

- For example, suppose the price is aggressively creating a higher high or lower low. In that case, the price will likely continue the current momentum until it reaches the next resistance or support level. Moreover, any breakout from a significant key level often creates a fresh move either upside and downside.

- When the daily candle of the previous day closes, place a buy stop above the daily high, and a sell stop below the daily low to catch the breakout.

- Move your stop loss at 50% of the daily candle.

- For the take-profit level, you can consider the average price of the last three days’ movement. For example, if the daily candle of the last three days shows the movement of 100 pips, 50 pips, and 100 pips, the total movement would be 250 pips (100+50+100). Therefore, the average price of the last three days would be 83 pips (250/3).

Example of Daily High Low Based Trading Strategy

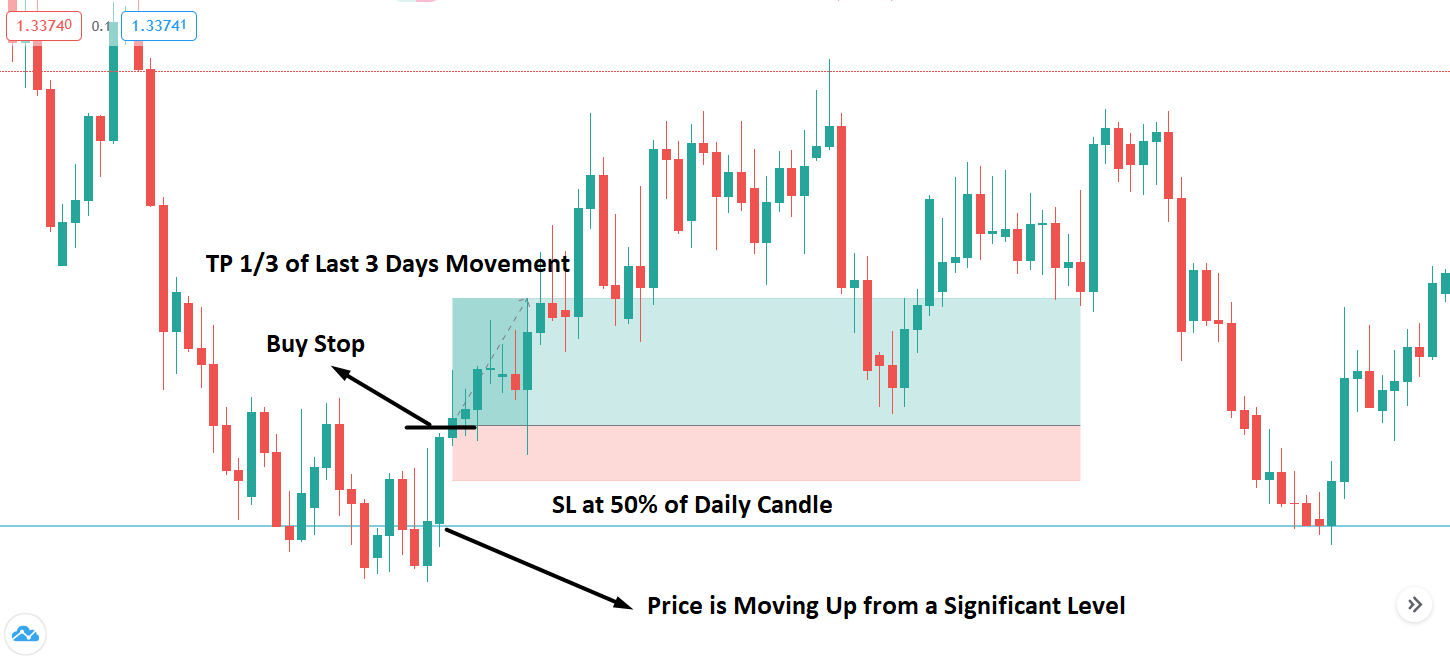

The image below represents the graphical view of the daily high low based trading strategy:

- In the image above, we can see the price moved up from a significant support level with a daily close above it. A buy Stop is taken once the price had a bullish daily close from the key support level. A similar concept will apply to the bearish market once the price has a daily close from a significant resistance level.

- The next day, the buy stop is taken, and the price moved to the take profit level. The take profit level is taken by calculating the average price of the last three candles.

- The stop loss is set at 50% of the previous day’s candle. If the stop loss hit, it will indicate that the price will reverse or consolidate more. In that case, we should wait for a further breakout or move to another currency pair.

Summary

Let’s summarize the daily breakout trading strategy:

- Identify the currency pair that is moving within a trend or likely to start a new trend.

- Set buy stop above the candle if the price is moving up from a support level and put a sell stop if the price is moving down from a resistance level.

- Stop-loss should be at 50% of the previous day’s candle.

- Take profit will be the average price of the last three days’ movement.

In this trading strategy, the challenge is to avoid correction and choppy market. In that case, you should read the price action to determine the possible movement by measuring the price momentum. Moreover, to get the maximum benefit from this trading strategy, follow strong money management rules.