Develop An Unbeatable Forex Trading Strategy

Example 1: In this session, we are going to be discussing trading strategy as this is something that new traders find difficult to develop and implement without deviation.

Any forex strategy should be a systematic step-by-step procedure for how and when to use specific tools when a sequence of analysis needs to be developed.

Typical components of any strategy should include the following:

Example 2: The types of analysis tools we will be using. Whether it’s technical, fundamental, or both, it is something that will always be personal and based on your preferences. Now, although preferences are important specific analysis tools will have a generally higher success rate, and you should take some time to learn out of your comfort zone to improve on your weaknesses. You should have a clear order setup before you as to when and how you apply these analysis tools.

Example 3: next, you will want to have a clear picture of the timeframes, and trading windows will need to use. It’s no good trading an unsocial trading window that encroaches on your sleep and day-to-day responsibilities, and in addition, we want to use the same timeframe to implement our analysis tools while considering the type of trader we want to become. For instance, scalpers will rarely use the daily time frame because they are looking for quick in and out trades based on the technical analysis of the lower time frames.

For the longer time frame Traders, it would be beneficial to scan through the pairs that you are interested in trading in order to ascertain the key levels of support and resistance enable to drill down using your technical tools to look for potential trade entries and exits.

No matter what type of trader you want to be, it is important to consider fundamental factors which might impact on your trading, or assist your decision-making such as economic data releases, interest rate decisions, and key political events. In which case, you want to keep an eye on the economic calendar for the day or even week ahead.

We want to establish what high probability trades are available based on our technical and fundamental analysis. When developing a trading strategy, we need to implement all of these features and stick to them rigidly in order to achieve consistent trading profitability. Should any part of the strategy fail for any reason, we will need to make adjustments accordingly in order to make the trading strategy more fail-proof.

Example 4: What types of orders will you be using. If you are unable to be available during the times where you would normally need to trigger a buy or sell, you must make use of pending orders. If you’re trading news and have plenty of time on your hands, you may want to enable one-click trading to quickly enter the market based on data releases. This will all factor into your larger plan, and you should write down every detail. The purpose of strategy development is to increase your probability of success through research, development, and application, just as any other commercial business would go through in their model.

Example 5: We can’t talk about developing a successful strategy without looking at risk management in great detail. Risk management is the key most important aspect of a financial traders toolbox. Trying to determine what your risk appetite is while training can initially be very difficult.

Example 6: You need to consider your available balance, the pair being traded, pip worth, lot size, and other factors. You should never be trading with money you actually need because this will play with your emotions and put enormous psychological pressure on your trading, especially when things are not going your way.

Those who consistently make money in forex trading might not necessarily have more winning trades than losing trades. A part of being a consistently winning trader is knowing when to let the losing trades go and exit quickly, with as little loss as possible, while optimizing those winning trades and letting them run on as long as possible, through careful trade management, in order to maximize the amount of pips to be one. This comes down to the risk to reward ratio and to accept losses in accordance with your strategy. And as well as accepting your profits in accordance with your training strategy. Remember, we are looking for a consistent strategy without deviation. A common mistake of new traders is to quickly take profits and let losing trades run. As a consequence of this, they need to accept a higher risk to reward ratio than professional traders. Professional Traders will typically use a set percentage of risk on every single trade. The larger the accounts size, the smaller the percentage of risk should be. For example, you could have a trade with a risk to reward ratio of 1 to 3, where one equates to 3% of your bank. You could think to take that 3% and split it into three entries. Those three entries may have varying profit levels.

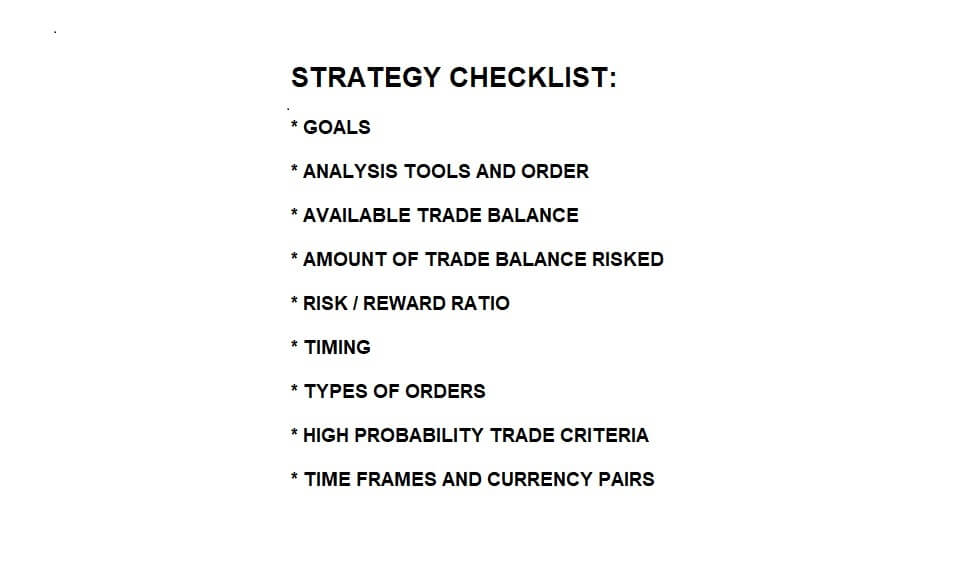

Example 7: Let’s look at the strategy checklist and add any of these components to your own strategy if you have not done so already. Be patient, test your strategy on a demo account over a period of 2 to 3-months and tweak and adjust as necessary because if it doesn’t work on a demo account, it certainly will not work on a real money account.

Successful Traders will look at the amount of money they can lose as well as the money they can make. Do not fall into the same trap as many Traders and simply bury your head in the sand when you are needed in a losing trade. Stop losses are the best way to implement against trades that run away from you. Having a frugal mindset will protect you against losses and bad decision making.

In every trade that you enter, you must have two things on your mind: at what point do you get out if it becomes a losing trade and at what point do you get out of a winning trade.

One thing is for sure when trading, there will be trades that you get stopped out of, and they then turn around and become what would have been winning trades, there will be trades that you will be stopped out of, and they will continue to have moved against you, and you will be grateful for your stop loss, and there will be trades that you get out of having taken your profit, only for them to continue on for hundreds of more pips. This is all a part of trading. It is all about sticking to

your methodology and trading strategy, making money consistently, looking for the next set up, and fighting on. Do not dwell on losses, do not dwell on what might have been, simply carry on with your strategy and remember the old adage: if it ain’t broke don’t try and fix it.