Forewords

All these strategies are based on a series of input setups that have a prior market reading context, which is just as important or even more important than the pattern itself. We recommend learning with Forex Academy traders to contextualize the market, so we are always aware of the present situation.

That said, we are going to recap the basis of this strategy and how it can be applied to the market.

The Strategy

A climax is nothing more than a candle that we see at the end of a trend. Whether bullish or bearish, it has a lot of range, a large volume, and typically closes far from maximums in case of a bullish candle, or far from minimums in the case of a bearish candle. These are candles that mark a stop in continuation, and, for expert traders who know how to analyze them, they produce very good results.

Let’s see an example so that we can see the facts:

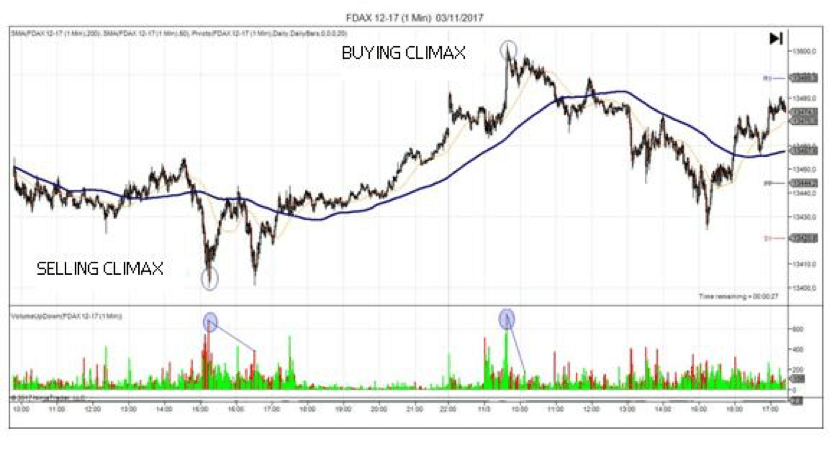

This is a graph of the DAX-30 1-minute chart, buy logically, these patterns are valid for any timeframe and market. When we have a candle with climatic volume at the end of a trend, we understand that a climax could happen, which means a pattern of no continuation. It is a very typical movement to finalize trends and create a market reversal, or at least to correct the current trend.

A simple way to trade climaxes is to look for volume discrepancies when the price falls (or rises) back towards the area of large volume.

In the example of a sale climax, we see how the price falls again, making a double bottom with volume divergence, hinting that the test to the offer to make up the bullish rally was right.

A bit further to the right in the graph, it shows a buying climax. Here the price moves to test the area (f62) with much less volume, implying that the demand test to begin the bearish rally is valid.