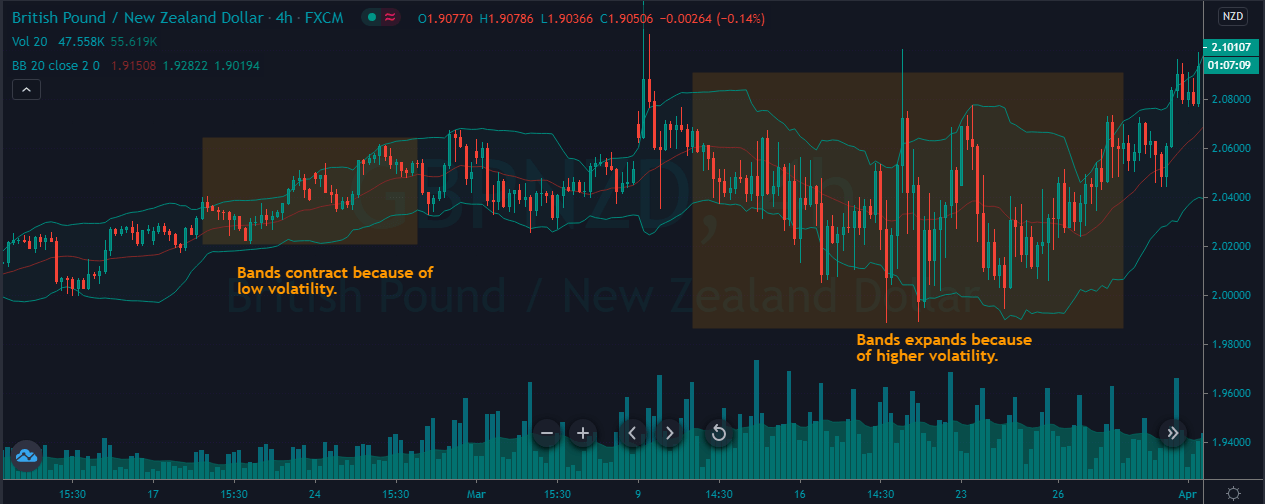

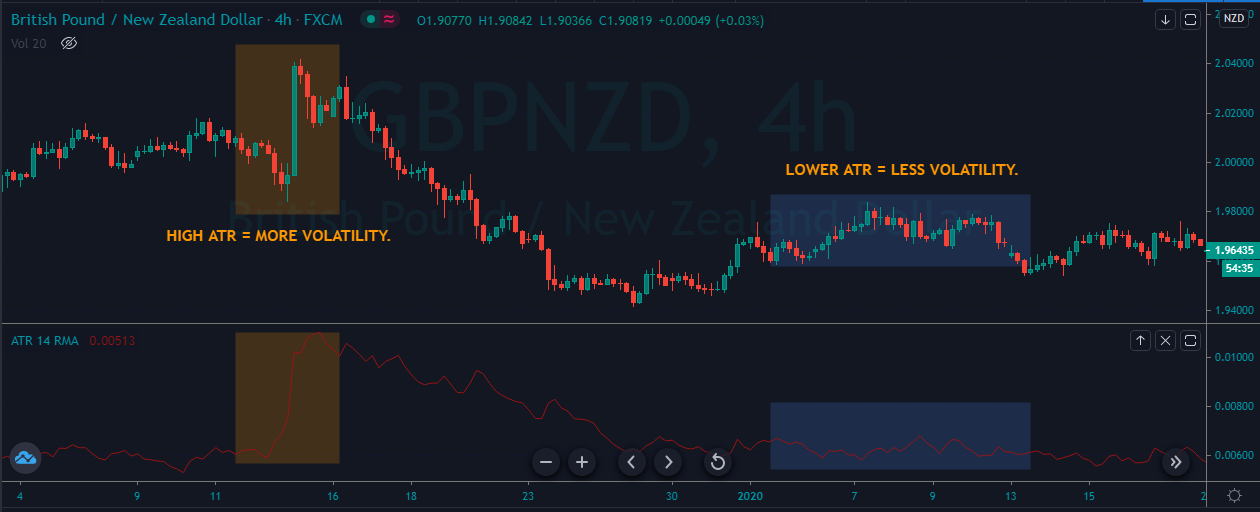

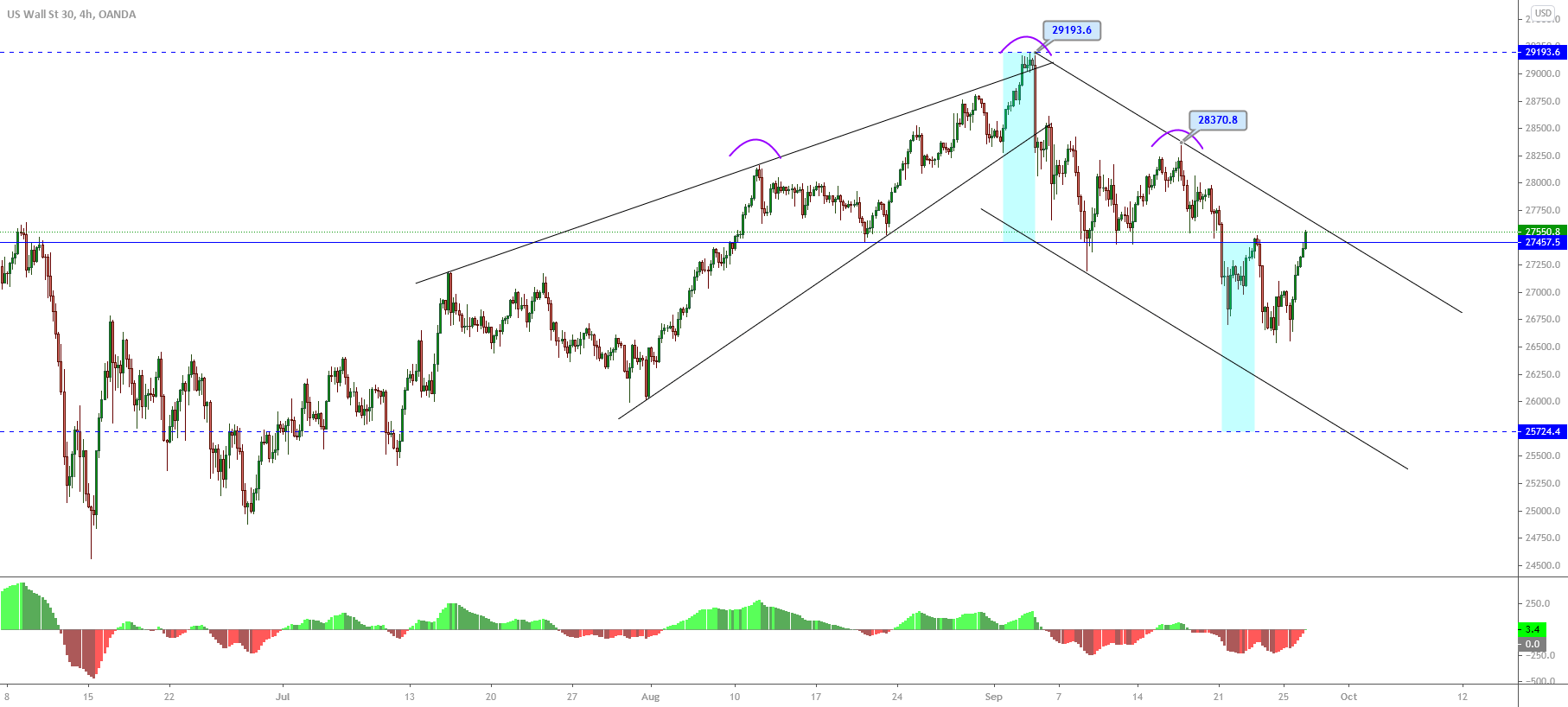

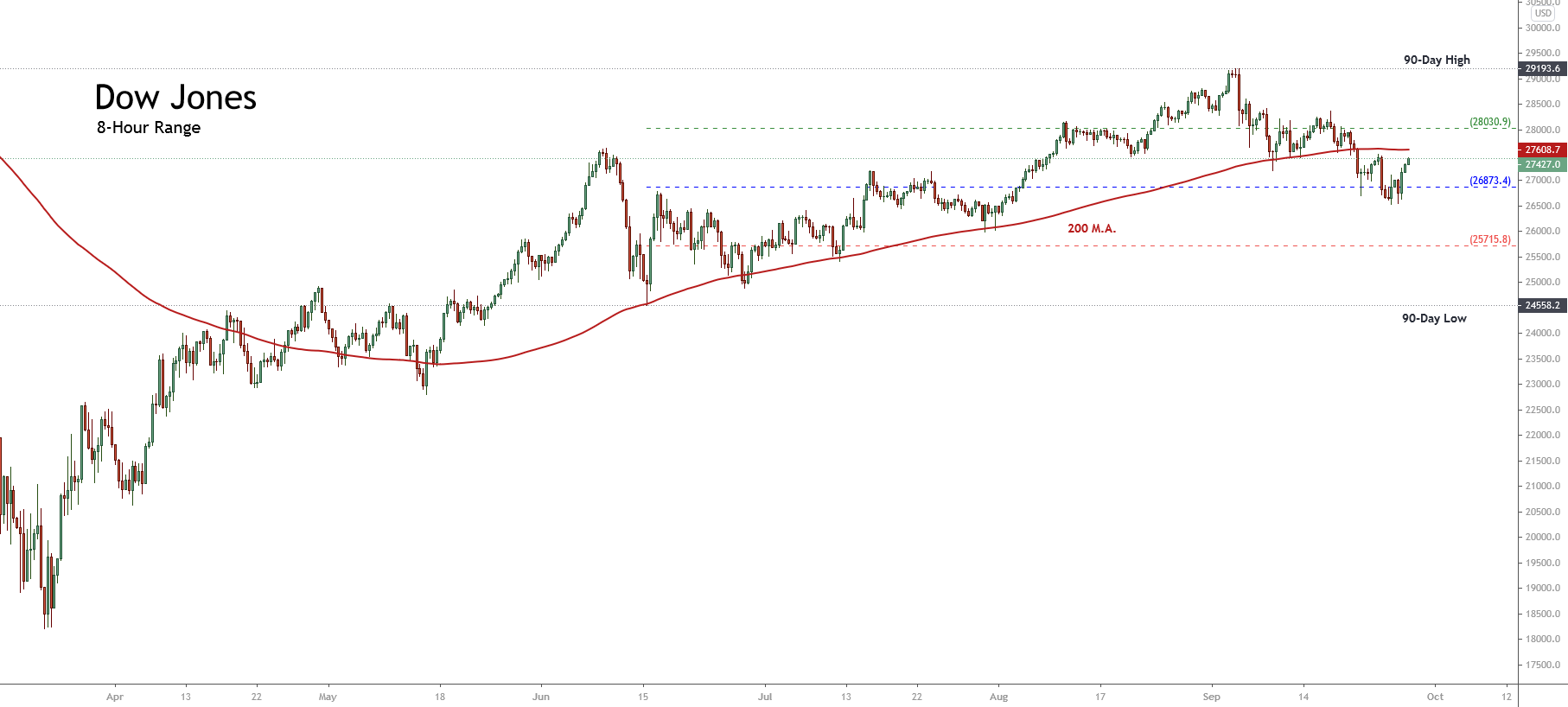

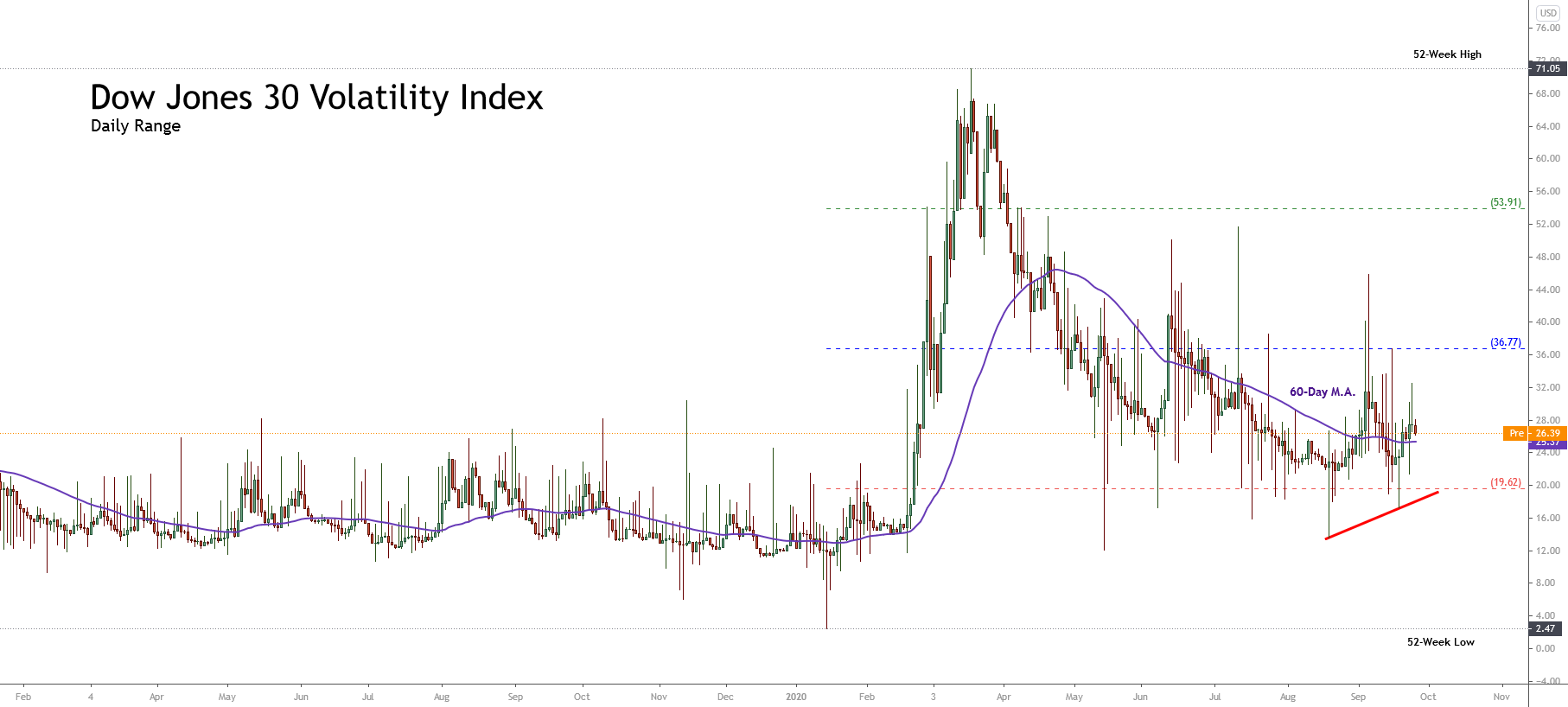

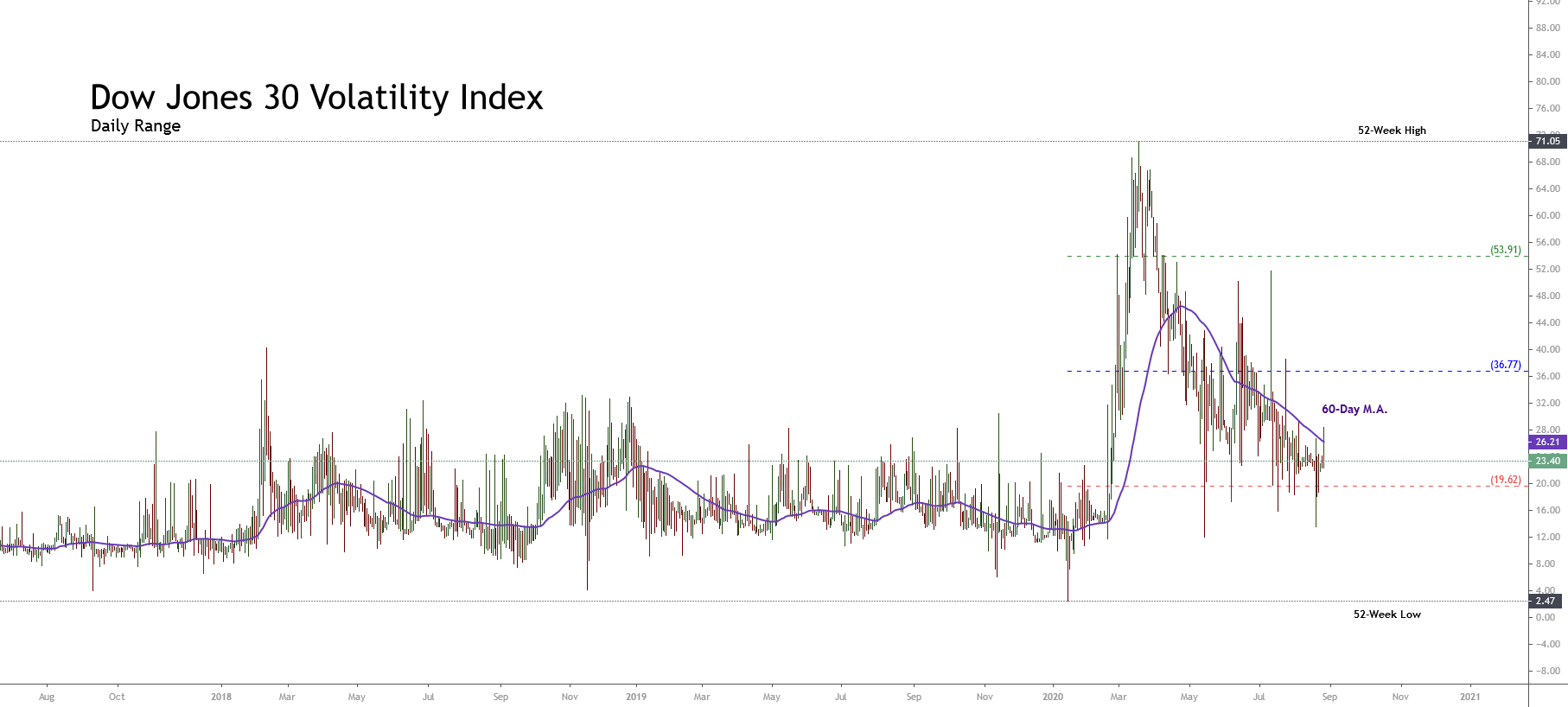

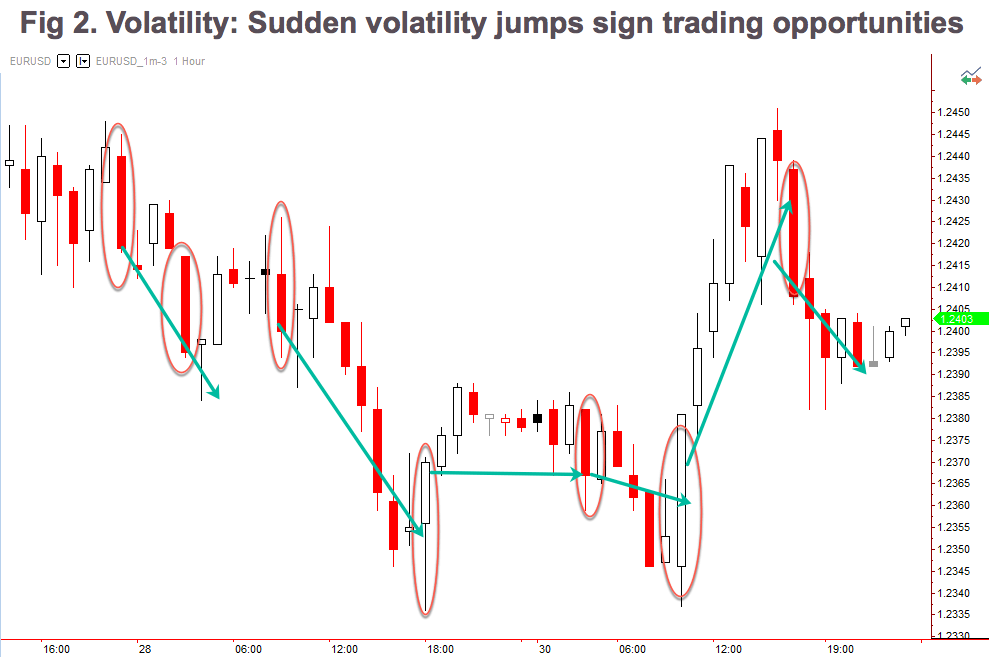

Market volatility can be both a blessing and a curse, Many traders out there trade only in the most volatile of conditions, while others get hit pretty hard when it takes them by surprise. The volatility of the markets at what give us our profits as well as our losses, so it is important that we have an understanding of how to control our trading during times of volatility and also how to potentially predict it to help us get through it with as little damage as possible. Volatility has caused a lot of accounts to blow in the past and it will cause a lot more to in the future to, so that is why we are going to look at different ways that you can help prevent it from happening to you.

Limiting Trade Sizes

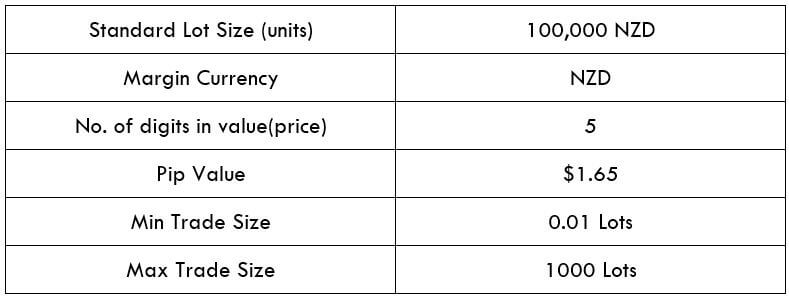

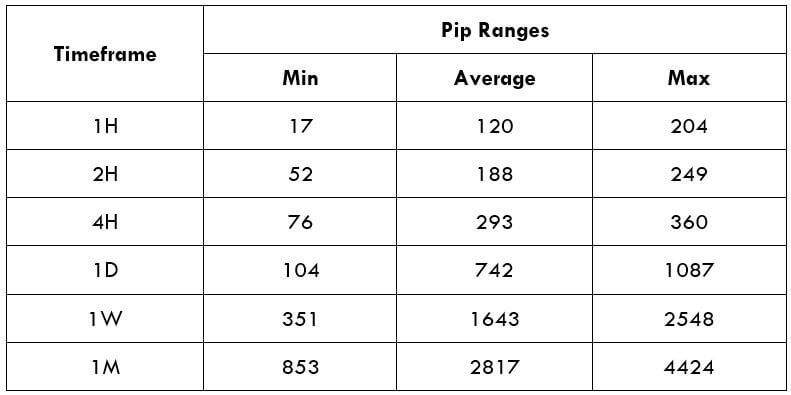

The first thing that you can do to help protect yourself and your account during these volatile times is to limit your trade sizes. The larger your trades are the more danger you will be putting yourself in. During extreme volatility, the markets can jump up and down in pretty large chunks. This is something that can be pretty deadly when it comes to an account that is using larger trade sizes. So in order to combat this, we need to ensure that we are either using the appropriate trade sizes for our account or if we often use larger ones, to try and reduce them during these times. This will then prevent any larger losses should the markets jump in the opposite direction. It will, of course, reduce any profits should go the right way, but during these extreme times, it is important that you protect your account above all else.

Sit Back and Watch

Sometimes you just need to step back and watch. The markets can be a dangerous place to trade, and knowing when things might be a little too much can be a great trait to have as a trader. Not every situation will merit a trade. In fact, when times are really extreme, it can often be better to simply not trade at all. Why risk what you currently have in order to make a bit more when the conditions are so volatile? Protect what you currently have and sit out the markets this time. You will have plenty of time to make some more profits once things have settled down again. You also need to consider that your trading plan probably didn’t take these extreme conditions into consideration, so you will be kind of trading blind, which is an increased risk in and of itself.

Always Use Stop Losses

When it comes to managing risks, ensuring that you have stop losses in place is vital. You should be using stop losses anyway, as this is an integral part of trading. If you aren’t using them, then you are trading wrong and are putting your account at risk with every single trade. This risk is multiplied tenfold when it comes to volatile conditions. If you are going to be trading during these conditions then you have to have them in place and you have to have them with every single trade that you place. I know we are repeating things, but you should not be placing any trades without a stop loss being in place. Protect your account before you think about making any additional profits.

Monitor the News

Monitor the news. Often, during times of extreme volatility, there is a real-world event that is causing it. This could be something like an economic news release, or it could be a disaster such as an earthquake somewhere in the world. Whatever it is, there will be news about it, and being on top of this and understanding what is going on can give you a big advantage. Normally when there is a lot of volatility, people are jumping in trying to make a quick profit, not really knowing or understanding why the markets are behaving the way that they are. This can be used to your advantage. By understanding what is happening, you are also able to gauge when the sentiment may change, allowing you to trade in that direction and profiting from people trading the current movement. Of course, this comes with risks and you may be potentially trading against the trend. The markets do not always react the way that you would expect, but it can be an advantage to understand what is happening with the news nonetheless.

Diversify Your Portfolio

Something that you probably would have been told at some point is to diversify your portfolio. When it comes to trading forex, this would simply mean that you are trading more than one currency pair. This is a way of helping to protect your account as you are not putting all of your money on a single trade or currency pair. Volatility can of course affect all markets, but it can also be concentrated on certain currencies, meaning that while one pair may be going a little crazy, some of the others may be more stable. This could then mean that you are unable to trade the less volatile pairs while the volatile ones are doing their thing, or it could mean that you can counter some of the risks of the volatile pairs with trades on the more stable ones. Either way, it is good practice to ensure that you are diversifying your portfolio and expanding into more than just the single currency pair.

So those are five of the things that you can do to help you survive the markets when they are going a little crazy with volatility. There are other things that you can do, and your own style of trading will help you to get through it and to better understand what it is that you need to do in order to prevent the risks, but the five things we have mentioned are a good start and are generally relatable for everyone. We wish you the best of luck once the markets start picking up their volatility levels!