Overview

Gold price eases over 4% during this week, dragged by the U.S. Dollar strength, which rallies nearly 1.5%. Considering the short-term structure observed on both the market sentiment and the Elliott wave outlook, the precious metal could experience further declines during the coming trading sessions.

Market Sentiment Overview

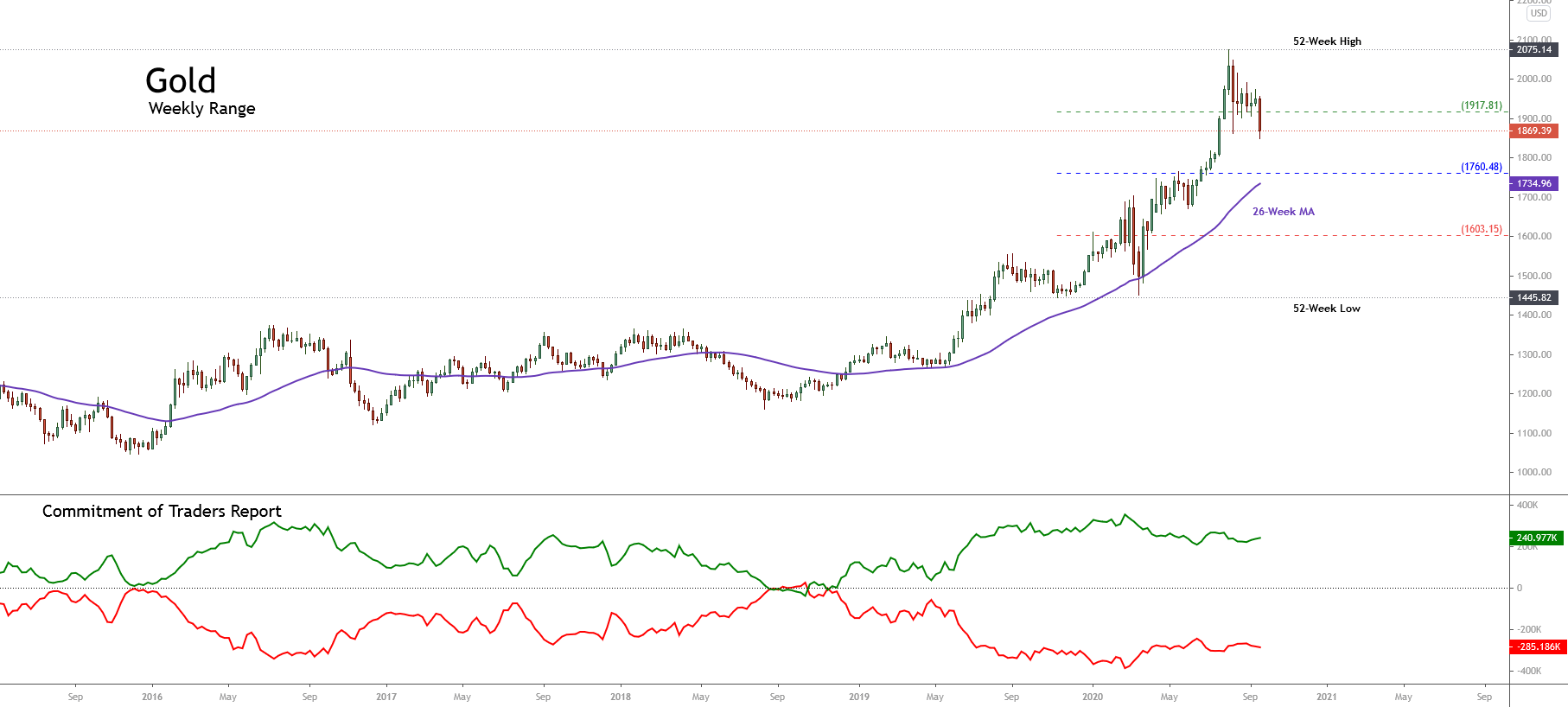

The price of Gold continues being dominated by selling pressure this week, driven by the U.S. Dollar strength, accumulating losses of over 4% in the week. However, during this year, the precious metal has advanced over 24% (YTD).

The market sentiment shown in the weekly chart reveals a decrease in the bullish bias of market participants, who have shifted from extreme bullish sentiment until the past week to a bullish bias. Likewise, considering that the price action continues above the 26-week moving average, the mid-term trend continues being bullish.

Likewise, the wide-range weekly candle, still in progress, reveals the current control by the bearish-side participants. However, the rebound at $1,848.84 per ounce developed during the trading session on Thursday 24th, leads us to observe that the yellow metal could have found a short-term support level.

On the other hand, according to the latest reading unveiled in the Commitment of Traders Report, where the speculative net positioning reached 240,977 positions, reveals that the big participants still maintain their bias on the bullish side. Consequently, a massive sell-off could correspond mainly to the take-profit activity rather than to a reversal of the upward trend.

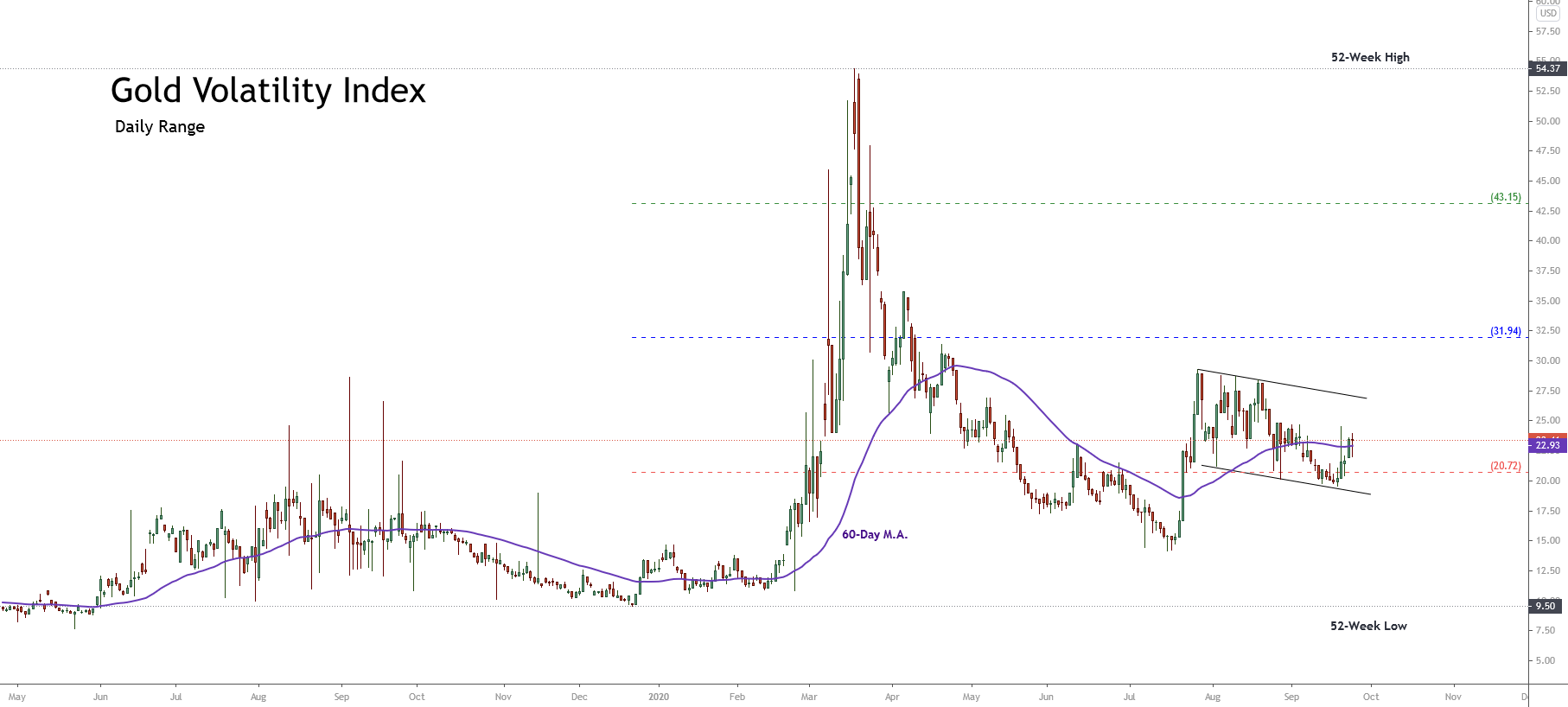

The volatility presented in the following daily chart corresponds to the Gold Volatility Index (GVZ) and shows the movement consolidating into a flag pattern. At the same time, the internal structure reveals an upward pressure, which is confirmed by its last close above the 60-day moving average. This the market context leads us to expect new increments in the precious metal volatility, and with it, further declines in the price of gold.

Under the market sentiment perspective, the big picture of the precious metal reveals that the long-term trend remains mostly bullish. However, the short-term bias suggests further declines.

Under the market sentiment perspective, the big picture of the precious metal reveals that the long-term trend remains mostly bullish. However, the short-term bias suggests further declines.

Elliott Wave Outlook

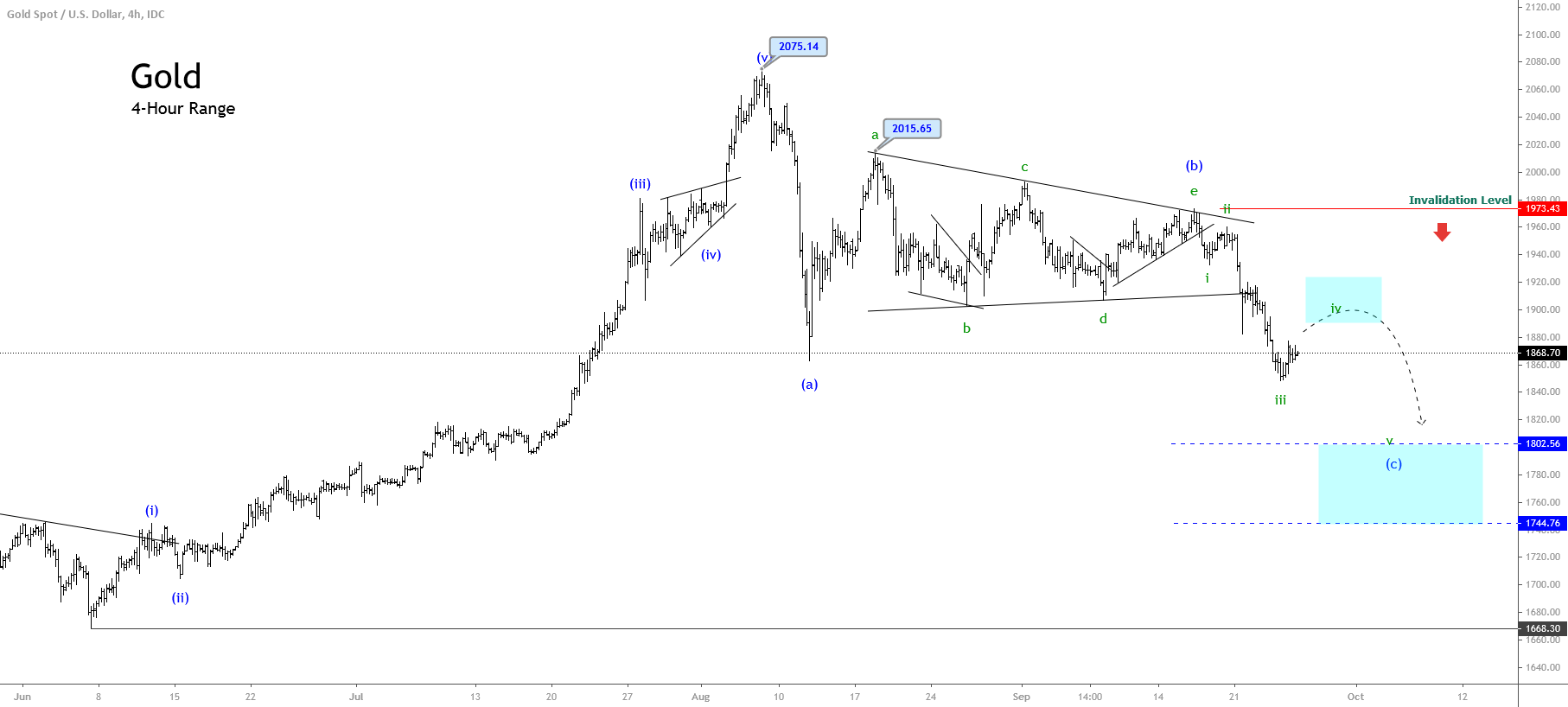

The gold price on its 4-hour chart shows the progress of a corrective sequence, which began on August 06th when the price reached its all-time high at $2,075.14 per ounce. Once this record high was reached, the precious metal found sellers which currently are maintaining the price under pressure.

As said, after Gold was controlled by the sellers, the price began a corrective structure made by three waves of Minuette degree labeled in blue, which is currently developing its wave (c). In the figure, we distinguish that once the price closed below the base-line b-d of the triangle pattern, the yellow metal confirmed this wave (c) that remains in progress. The internal structure of the wave (c) unveils that Gold advances in its third wave of Subminuette degree identified in green.

According to the Elliott wave theory, the wave (c) follows an internal structure formed by five segments. In the previous chart, we see that the price moves in its wave iii labeled in green. Consequently, the precious metal should develop a consolidation sequence before dropping to a new lower low with a potential target zone between $1,802.56 and $1,744.76 per ounce.

Finally, the invalidation level of the current bearish scenario locates at $1,973.43 per ounce.