Introduction

Cardano is a decentralized platform allowing programmable transfers of value securely in a scalable fashion. It is the first blockchain created out from a scientific philosophy. It is also the first research-driven cryptocurrency that is built on the Haskell programming language.

Cardano is traded with the ticker ADA. It has a market capitalization of $2.2 billion. It can be bought, sold, and exchanged in several cryptocurrency exchanges. Apart from USD, it can be traded against other cryptos such as BTC, ETH, USDT, etc.

Understanding ADA/USD

The price of ADA/USD depicts the value of the US Dollar equivalent to one Cardano. It is quoted as 1 ADA per X USD. For example, if the market price of ADA/USD is 0.086112, then each ADA will be worth 0.086112 US dollars.

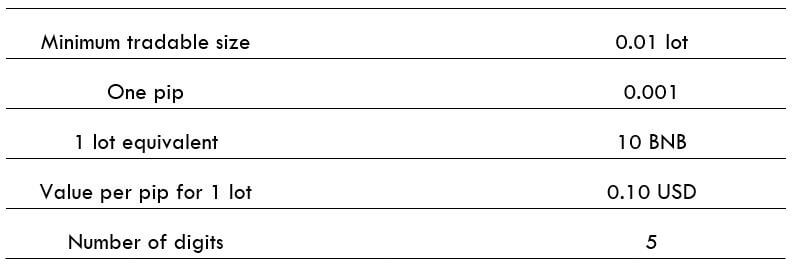

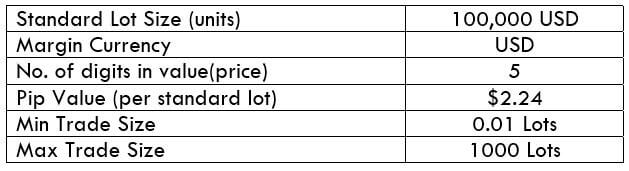

ADA/USD specifications

Forex brokers allow trading of only a few popular cryptocurrencies like Bitcoin, Ethereum, Ripple, etc. The other cryptos must be traded via cryptocurrency exchanges. And the working of these exchanges is different from that of forex brokers. As a major difference, cryptos are not traded in lots, in cryptocurrency exchanges.

Spread

Spread is the difference between the buying and selling price of the cryptocurrency. Crypto exchanges match these prices between induvial traders. Thus, there is no fixed spread. Also, typically, the spread is negligible in trading cryptos.

Fee

There are different fees charged by cryptocurrency exchanges for trading any coin. The various forms of fees include

- Execution fee (Taker or Maker)

- 30-day trading volume fee

- Margin opening fee, if applicable

Note that the taker or maker fee will be considered for opening as well as closing the trade, and will depend on the value being traded.

Example

- Short 10,000 ADA/USD at $0.085800

- 30-day volume fee is $0

- Order is executed as Taker

Total cost of the order = 10000 x $0.085800 = $858

Assuming the taker fee to be 0.26%, the opening fee will be – $858 x 0.26% = $2.23

Assuming the trade is opened with leverage, and the margin opening fee is 0.02%, the fee is calculated as – $858 x 0.02% = $0.17

If the order is closed at $0.095800, the total cost of closing will be 10,000 x $0.095800 = $958. And the fee for the same obtained is – $958 x 0.26% = $2.5

Thus, the total fee for the opening, maintaining and closing the trade would be equal to – $2.24 + $0.17 + $2.5 = $4.91

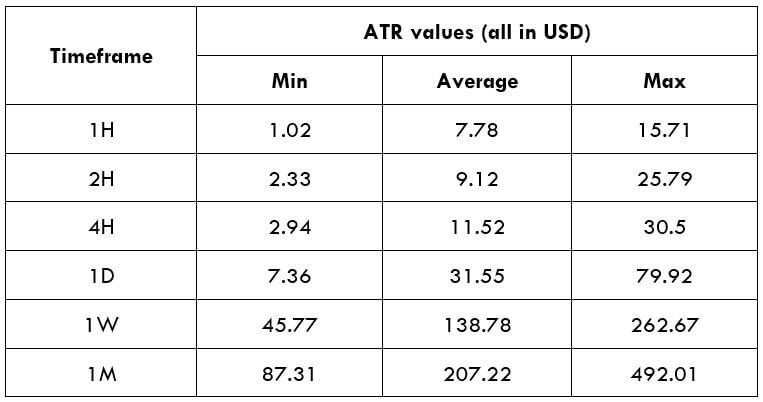

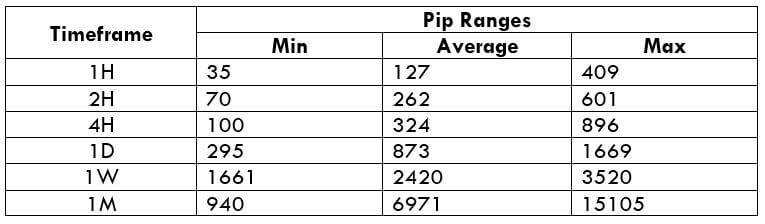

Trading Range in ADA/USD

The trading range represents the number of units moved in the pair in a specified time frame. For example, if 10,000 ADA/USD is traded and the average unit movement in the 1H time frame is 0.000778, then it means the pair will yield 10,000 x 0.000778 = $7.78.

Note: the above values are for trading 10,000 units of ADA/USD. If X units are traded, then the ATR values will be,

(Above ATR value / 10,000) x X units

Procedure to assess ATR values

- Add the ATR indicator to your chart.

- Set the period to 1

- Add a 200-period SMA to this indicator.

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

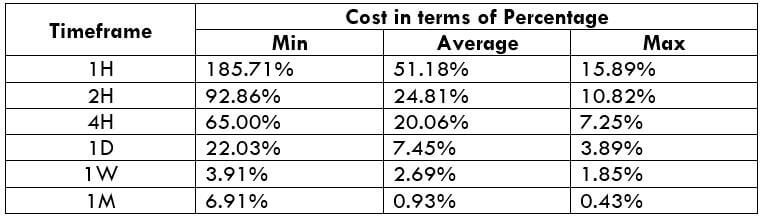

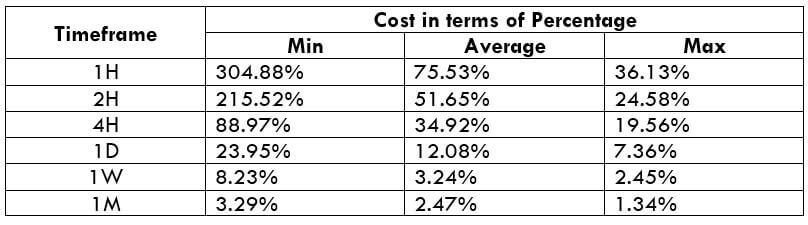

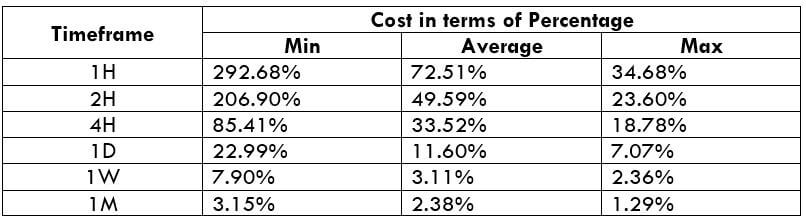

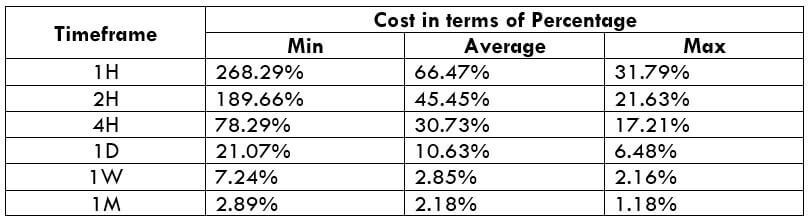

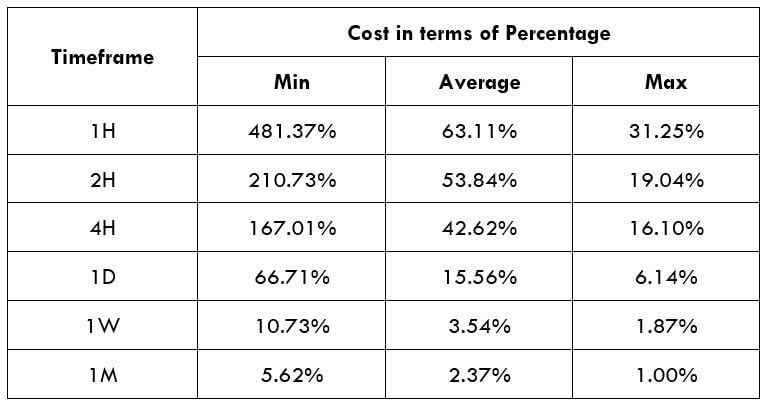

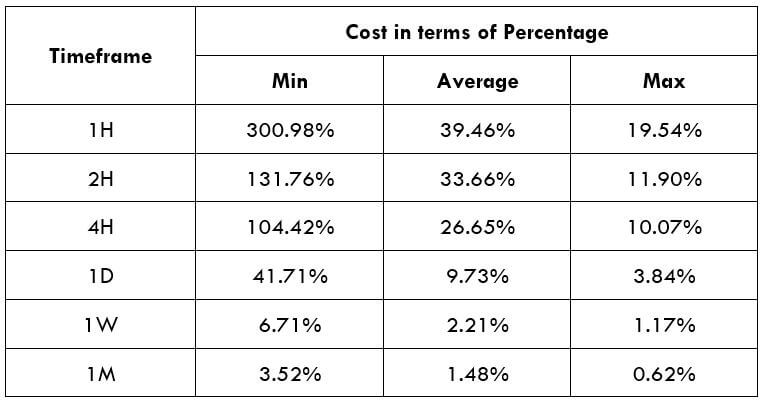

ADA/USD Cost as a Percent of the Trading Range

The following tables depict the variations in total cost in terms of percentage based on the change in volatility and time frame.

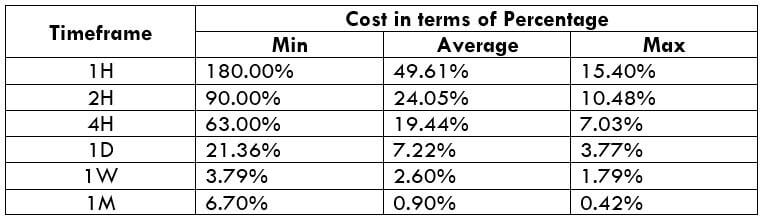

Taker Execution Model

Opening = $2.23 | Margin fee = $0.17 | Closing = $2.5

Total fee = Opening + Margin fee + Closing = $2.24 + $0.17 + $2.5 = $4.91

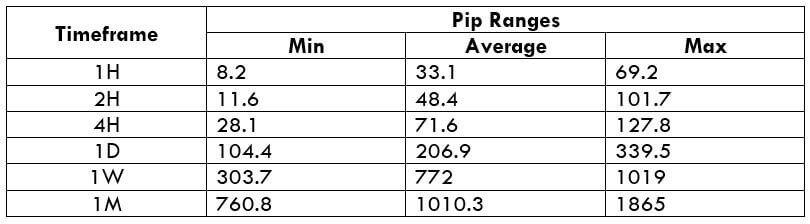

Maker Execution Model

Opening = $1.37* | Margin fee = $0.17 | Closing = $1.53*

Total fee = Opening + Margin fee + Closing = $1.37 + $0.17 + $1.53 = $3.07

*Assuming maker fee to be 0.16% the trade value.

Trading the ADA/USD

Cardano stands 10th in CoinMarketCap in terms of market capitalization. Thus, making it a tradable pair in the crypto market. Almost all forex brokers do not ADA enabled for trading, so it must be traded through cryptocurrency exchanges. The fee structure here is quite different from forex brokers. However, the overall fee is more or less the same.

Comprehending the above tables, the magnitude of the percentage depicts how expensive/cheap a trade will be relative to the time frame and profit/loss. Let us understand this with an example.

The average values in 4H and 1D are 26.65% and 9.73%, respectively. The percentage in the 4H time frame is greater than the percentage in the 1D time frame. This means that the total cost for both is the same ($4.91), but relative to the generated profit, it is higher in the 4H time frame. A detailed reason for this can be given from the trading range table.

In the trading range table, the corresponding values are $11.52 and $31.55. This can be interpreted as, an average of $11.52 will be generated in trading the 4H time frame, and $31.55 when trading the 1D time frame. The fee in both cases is the same. Thus, we infer that the fee that is paid to generate $31.55, the same fee is deducted for generating $11.52. And hence, this is exactly what the higher percentage value depicts.

Reading through the row, the percentage values for a time frame is highest in the minimum column and least in the maximum column. So, if you’re are able to deal with higher volatility, it is ideal to trade when the volatility is around the average or maximum values. And if you cannot deal with the high volatility, you may trade the higher time frames to reduce the relative costs.