Introduction

In the last lesson, we discussed the impulsive waves and 5-wave pattern corresponding to it. A trend is made up of the combination of the 5-wave pattern and the 3-wave pattern. The 5-wave impulsive pattern moves along the original trend, while the 3-wave corrective pattern moves against the trend. In this lesson, we shall discuss the corrective wave and then interpret the 5-3 waves.

Corrective waves

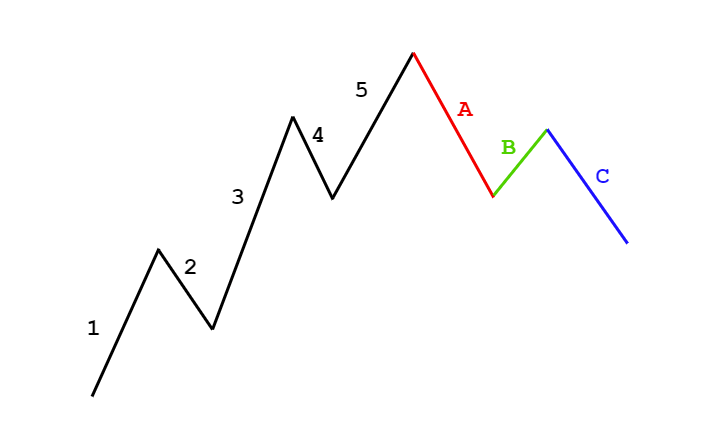

In case of an uptrend, the impulsive waves are towards the upside, and the corrective waves are towards the downside. Continuing with the example mentioned in the previous lesson, the corrective waves are represented in the below figure.

In the above figure, waves a, b, and c represent the corrective waves. The overall trend of the market is up, but corrective waves are against it. In other terms, the 3-wave corrective wave can be considered as pullback for the uptrend.

Note: The 3-wave corrective wave is also referred to as the ABC corrective wave pattern.

Reverse Corrective Wave Pattern

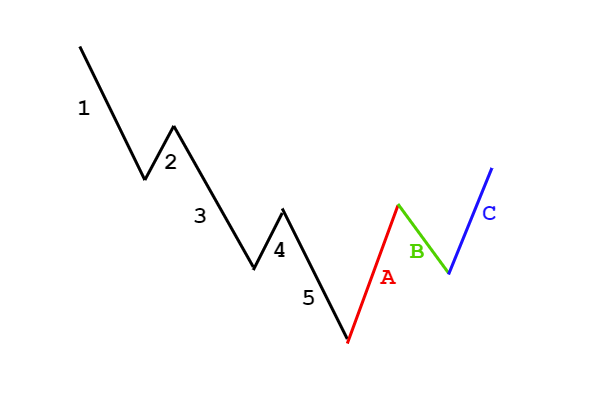

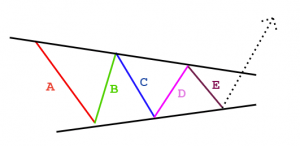

The Elliot wave theory is applicable to both uptrend and downtrend. So, for a downtrend, the impulsive wave faces downwards following the overall trend, while the corrective wave faces upwards. Below is a figure representing the 5-3 wave pattern for a downtrend.

Types of Corrective Wave Patterns

The above illustrated corrective wave is not the only type of corrective wave that occurs. According to Elliot, there are twenty-one 3-wave corrective wave patterns, where some are simple and some complex. However, a trader need not memorize all of them at once. The following are three simple corrective waves that are most occurring in the market.

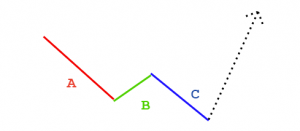

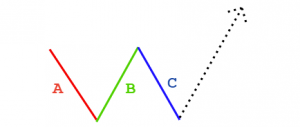

The Zig-Zag Formation

The zig-zag formations are very steep compared to the regular one and are against the predominant trend. In the three waves, typically, wave B is the shortest compared to wave A and wave C. Note that, the Zig-Zag pattern can happen twice or thrice. Also, the zig-zag patterns, like all other waves, can be broken into 5-wave patterns.

The Flat Formation

As the name suggests, in flat corrective wave patterns, the 3-wave pattern is in the sideways direction. That is, the wave C does not go below wave B, and wave B makes a high as much as wave A. Sometimes, the wave B goes higher than wave A which is acceptable as well.

The Triangle Formation

The Triangle formation is a little different from the other corrective patterns. The difference is that these patterns are made up of 5-waves that move against the overall trend. These corrective waves can be symmetrical, ascending, descending, or expanding.

These were some of the most used corrective patterns used by traders. These must be known to technical traders by default. In the next lesson, we shall discuss another important concept related to the Elliot Wave theory. [wp_quiz id=”71613″]