Foreword

All our strategies are based on input setups that have a prior market reading context, which is equal to, or more important than the pattern itself. We recommend learning with Forex Academy traders to contextualize the market, so we always know what situation we are in.

With this being said, we are going to see what this strategy consists of and how we apply it to the market.

The Elliott Wave Theory

Elliot wave theory offers us different investment opportunities both in favor of the trend and against it. Elliott identified a particular structure to price movements in the financial markets, a basic 5-wave impulse sequence (three impulses and two correctives) and 3-wave corrective sequence.

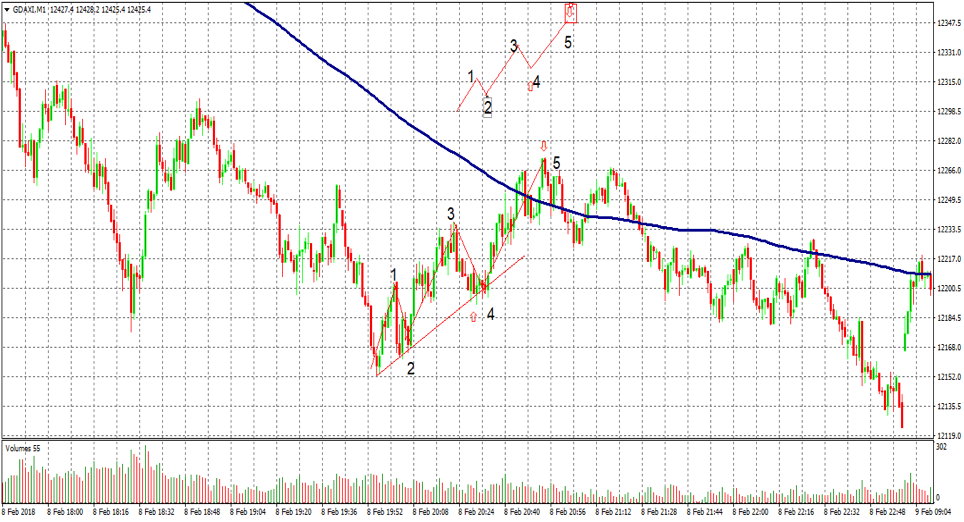

Let’s see an example for a better understanding of this theory (click on the image to enlarge):

The chart above shows a rising 5-wave sequence. Waves 1, 3, and 5 are impulse waves because they move with the trend. Waves 2 and 4 are corrective waves because they move against this bigger trend. A basic impulse advance forms a 5-wave sequence.

The trend is followed by a corrective phase, also known as ABC correction. Notice that waves A and C are impulse waves. Wave B, on the other hand, moves against the larger degree wave and is a corrective wave.

By combining a basic 5-wave impulse sequence with a basic 3-wave corrective sequence, a complete Elliott Wave sequence has been generated, with a total of 8 waves. According to Elliott, this whole sequence is divided into two distinct phases: the impulse phase and the corrective phase. The ABC corrective phase represents a correction of the larger impulse phase.

The Elliott Wave is fractal. This means that the wave structure for one big cycle (Super Cycle) is the same as for one minute. So we will be able to work in any timeframe.

Let’s see the three rules for our trading:

- Key 1: Wave 2 cannot retrace more than 100% of Wave 1.

- Key 2: Wave 3 can never be the shortest of the three impulse waves.

- Key 3: Wave 4 can never overlap Wave 1.

- We could trade in favor of the trend on wave 3 and wave 5 and only against the trend once wave 5 has finished.

To know when a wave may have finished, we can use Fibonacci projections and retracement. Fibonacci ratios 38.2%, 50.0%, and 61.8% for retracements and 161.8%, 261.8% and 461.8% for Price Projections and Extensions.

© Forex.Academy