Trading ABC pattern is one of the most frequently used trading strategies by Forex/financial traders. Once the price makes a breakout, makes a correction, and produces a reversal candle upon finding point C, traders trigger their entry. It is a favorite pattern among all kinds of financial traders. It brings profit at least on 80% occasions. In today’s lesson, we are going to demonstrate an example of an ABC pattern trading.

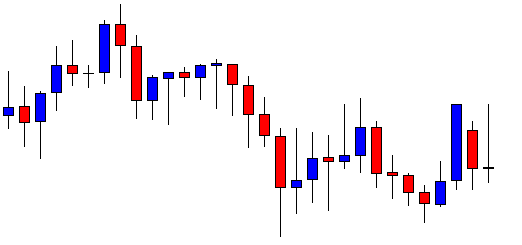

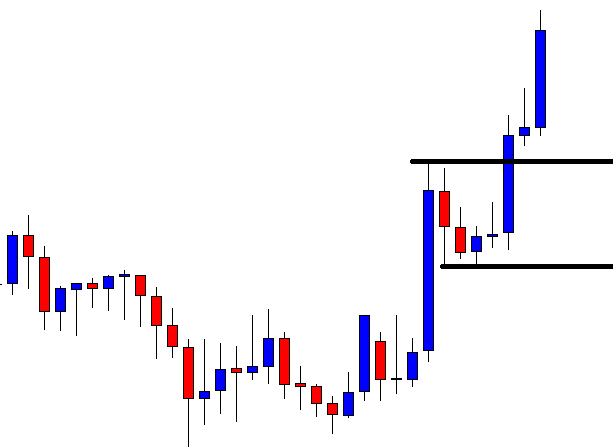

The chart shows that the price after being bearish has a double bounce at a level of support. It produces a bullish engulfing candle followed by another bullish candle. However, the price starts having consolidation. Since it is double bottom support, the buyers may keep their eyes on the chart.

The chart produces another bullish candle followed by a long bullish one. The price usually makes a correction after such a move. The buyers are to wait for the price to make a bearish correction and produce a bullish reversal candle to go long in the pair above the last highest high.

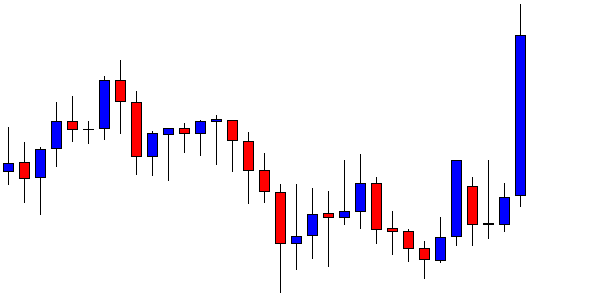

As expected, the price starts having the correction. It produces two bearish candles. The buyers hope that the chart produces a bullish engulfing candle closing above the last highest high to trigger a long entry. This is what pushes the price with more momentum. Let us find out what happens next.

The chart produces an inside bar. This is not a strong bullish reversal candle. However, the price finds its support. This is called the C point. If the price makes a breakout at the last highest high, the ABC pattern traders trigger a long entry.

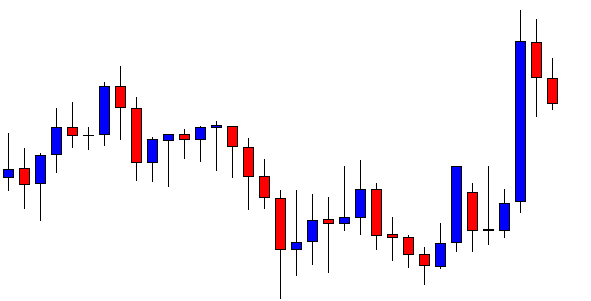

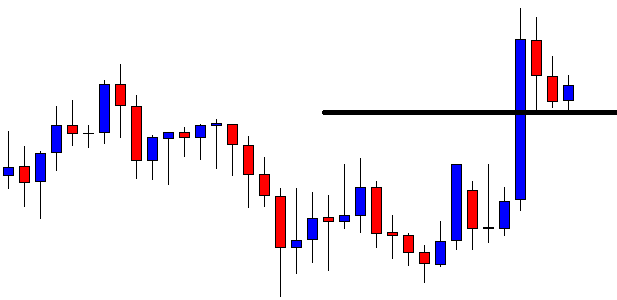

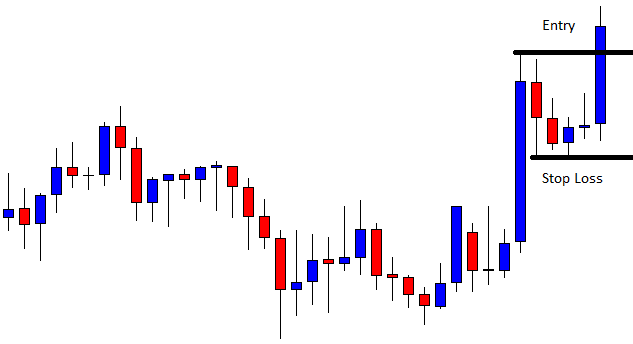

The price makes a breakout closing well above the last highest high. The buyers may trigger a long entry right after the candle closes by setting stop loss below the last support (C point). Take Profit is to be set with 1R. Let us proceed to the next chart and find out how the trade goes.

The price heads towards the North with good bullish momentum. It produces two consecutive bullish candles and hits the target (1R). Here is an important point to remember. The ABC pattern is a widely used trading strategy. Thus, the price often reverses once it hits the target. Thus, the traders are recommended that they close the whole trade and enjoy the profit. Trailing Stop Loss and partial profit-taking do not work well in this pattern. Do some backtesting and get well acquainted with this pattern. It may bring you a handful of pips.