Introduction

We have discussed the many applications of the Fibonacci levels in our previous course lessons. Now its time to explore the scope of these levels in the most integral part of trading, which is money management. We are all familiar with the ‘take-profit’ order and also know how crucial it is to determine the same before entering a trade.

There are numerous ways to determine the ‘take-profit‘ levels to maximize our profits, but the Fibonacci levels are said to be extremely accurate. In this article, we will validate the accuracy of the Fibonacci indicator in determining the ‘take-profit’ levels.

Placing Accurate Take-Profit Order Using Fib Levels

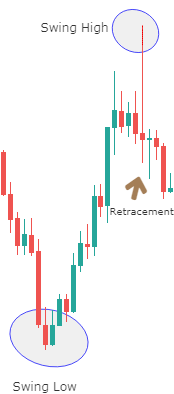

To find a trade, we need first to establish a significant trend. The primary trend could either be a continuation of a previous trend or beginning of a new trend after a market reversal. In the below chart, we can observe the market reversal to the upside. We must wait for its retracement; if the retracement follows all the rules of our Fibonacci strategy (discussed in the Fibonacci article), we can proceed to take the trade.

In the below image, we can notice a pullback coming in from the swing high. We will be evaluating this swing high using the Fibonacci levels. The Fibonacci levels used in this particular strategy for determining the accurate ‘take-profit’ placement are different from the usual Fibonacci levels we used in all the previous articles.

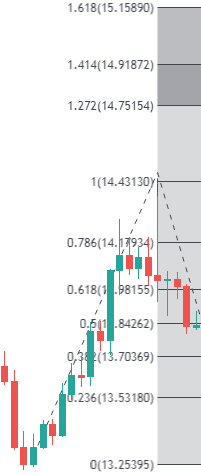

We are going to use ‘Fibonacci Extensions’ instead of retracements here. These extensions can be plotted on to the charts by using an indicator that can be found in most of the trading platforms. We use the Tradingview platform for our charting purpose, and this indicator can be found on the drawing panel of TradingView. It is available in the sub-menu of the Fibonacci tool folder and named as ‘Trend-Based Fib Extension.

To plot Fibonacci extension on the chart, first, click on a significant low, then drag the cursor and click on the recent high. Finally, drag the cursor back to the swing low. We can also highlight the Fib ratios by clicking on the retracement levels. Don’t forget to include the Fib ratios on the chart that are above 100%, as our take-profit methodology is based on those ratios.

The below chart shows how the Fibonacci Extensions are plotted on the chart using the swing low and swing high. We also see from the chart that the retracement is exactly reacting from the 50% Fib levels, which could a sign of trend continuation. But to be sure, it is prominent to have a confirmation candle at this place.

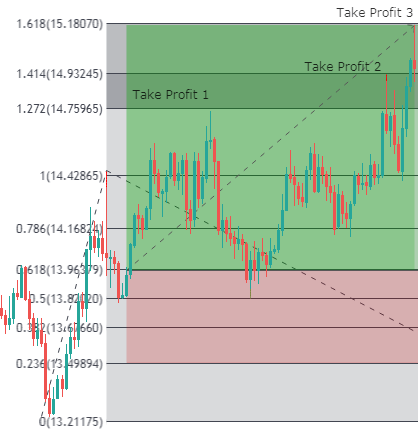

We get a bullish confirmation candle in the direction of the dominant trend, after which a potential trade entry can be made to the ‘buy’ side.

Right after entry, it is essential to determine our take-profit and stop-loss areas. Here is the part where we will be using our Fibonacci Extensions. The strategy is to take some profits at 127%, and then at 141% and remaining profits at 161%.

The take-profit points are clearly shown in the below chart. One can see that the market falls exactly after touching the respective Fib extension levels. By following this method, one can maximize their gains by taking profits at every subsequent point. The risk to reward ratio in this trade is also outstanding.

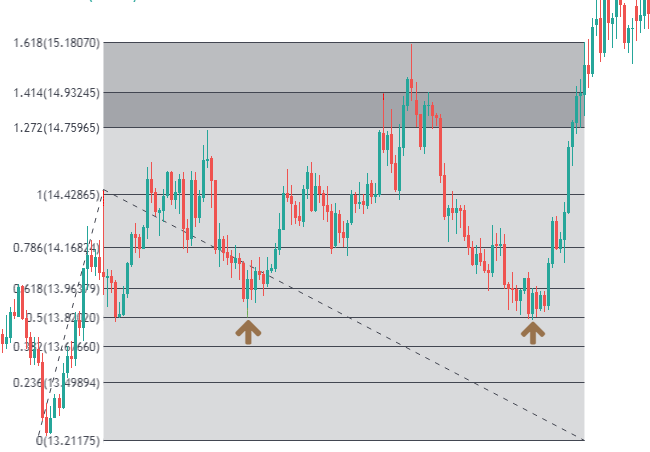

The below chart shows that the market continues to take support at the 50% fib level and eventually breaks out above our final take-profit order. The trend has completely reversed from a downtrend to an uptrend.

Conclusion

The Fibonacci tool can be used to find potential exit points in a trade with a great degree of accuracy. Hence, rather than taking a simple approach to determining the target points of the trade, we must make use of Fibonacci Extention levels to maximize our grains. Please remember that these extensions are not guaranteed levels too. So it is important not to depend upon them completely. Cheers! [wp_quiz id=”64724″]