When we start learning about trading, topics such as consistency and rules make it the last on our list, especially because, with the pace and the stress of everyday life, we make a profit our priority. However, if we are already eager to get to that financial freedom, there are specific points that we cannot turn a blind eye to and simply ignore. Experts in this field share how now, after several decades of trading, they have long stopped reading about trading itself. However, what they are still vigorously passionate about because of the benefits it brings is learning about trading psychology and about themselves.

Naturally, there is always room for improvement in terms of trading-specific knowledge, yet once you feel that you have covered enough to serve you consistently, it is time to truly focus on your actions and behavior. Today, we are going through this comprehensive list of lessons and tips which you can use as a guide to achieving self-actualization and prosperity.

Traders often see more benefits from short-term activities than what they can actually reap in real trading while heavily doubting the potential their actions can unlock over the long haul.

Lesson 1

At the beginning of a trading career, many traders are quick to assume that they can realize all of their potentials and surpass others faster than what is realistically possible. At the same time, beginners frequently miscalculate their steps and undervalue what they can produce in the long run. What this essentially means is that traders typically have a desired sum of money they wish to win in the shortest amount of time, but as it often turns out, this amount is usually equal to the overestimation of their skills and abilities at that particular stage of trading development as well as the underestimation of the success they can actualize from a long-term perspective.

Many professional traders have admitted to having had the same approach to trading at the very start, without realizing what this type of he/she wishes to attain and, for some people, this may be a dream house or a dream car, while for someone else the goal may have to do with overall financial stability that would secure a household. Especially for those with more pressing issues, everyday needs and challenges (e.g. raising children), or a strong vision of what their future should look like, the urge to reach a financial goal might make the idea of becoming a successful trader overnight that much more inviting.

What experts in this field always tend to stress over and over again is the perspective which most newbies seem to lack – if young traders could only take a step back and commit to a slower pace, they would be able to obtain increasingly greater freedom and finances. Therefore, instead of missing sleep over the initial $2000 a trader longs to earn, he/she would rather adopt a different mentality and take one step at a time to get to much more lucrative endeavors that would bring about sustainable capital just five or so years later.

Growing as a trader is a process, not a matter of learning a few tricks.

Lesson 2

While traders are constantly surrounded and bombarded with dos and don’ts in every way possible, they also need to understand that the path to becoming a self-actualized and independent trader is also a developmental process. The same path of discovery can be found in different fields of work, so actors need not be able to play out all characters until they discover a sense of inner strength and control just because they read the plot or took acting classes before. Any form of brilliance is like a jewel whose outer layers need to be stripped off until it gets its form and shine to be of any use or to be sold.

Many successful professional traders have shared their own limitations and challenges in trading: some dealt with the excessive need to overtrade, some struggled with fearing the risk which often stopped them from entering good trades and making more money as a result, and some others found taking a loss too difficult so they felt compelled to immediately enter a new trade. It is important to understand that every trader has some part of the personality that demands more attention and that is likely to have a negative impact on trading if left unnoticed and unattended.

At the same time, no development can take place unless we are eager to look within and face our inner demons because without acceptance there can be no recovery and growth. It is in human nature to need to look and feel impervious, complete, and untainted and traders can find solace in the fact that this is a shared trait across all individuals regardless of their age, background, education, or else.

The first step to growth as a trader is to acknowledge and accept one’s flaws.

Lesson 3

In order for any trader to be able to get over the hurdles caused by their own minds and emotions, he/she first needs to satisfy the number one condition and admit to being imperfect. If you are ready to recognize that you are, in this present form, less than what you need to be capable of producing the results you are hoping to obtain, you will also be able to accept yourself and leave space for improvement. Many traders are already aware of the mistakes they are making because they often stem from some unhealed parts of our minds or souls. If you are already able to notice that you feel tension building up in your body before you take some step (e.g. click the button to rush into another trade after a recent failure), you must also know that whatever action you are preparing yourself to take is not coming from a place of stability and control. However, many traders are also quite attentive and they already recognize these patterns that they feel obliged to repeat time and time again, so they feel tremendous guilt and shame for not being able to put an end to such behavior.

It is in the moment of realization that they will never be able to stop this continuous agony that helped some professional traders to discover a renewed sense of strength. Only once they gained this understanding of their inability did it become plausible for them to overcome such a tremendous challenge. Traders often keep putting more and more pressure onto themselves after they finally see traces and consequences of self-sabotaging behavior, but it is not through erasing or ignoring a specific behavior that leads to strength but through learning how to trade effortlessly in spite of it.

Trading will help you not only allow you to see the person you are but also help you build your character with time.

Lesson 4

The moment any true development is activated is after we acknowledge that we are “damaged” and accept the need to put the effort into finding a resolution to the existing problem. The gap between seeing the fault within ourselves and showing the willingness to do something about it is so vast that it is one of the key determiners of how successful a trader you can become. It is precisely this quality that will distinguish between high-achieving traders and the impulsive ones with an expiry date on their trading careers. Now that you have become aware of the triggers and situations which keep you in this perpetual loop, you are allowing yourself to get a different and more objective perspective where various creative solutions and ideas can emerge. You are growing tactics and methods that will put you out of that vicious circle, so you are no longer in need of exposing yourself to the things that used to trigger you before.

As trading is not exempt from everyday ailments and since it mimics life in all of its forms due to the shared human factor, it is easy to draw connections with some other real-life situations. We can see how some major life adjustments are carried out in the exact same manner, and any addict in recovery would also need to think of strategies to avoid provocations on a daily basis. Here we can prove to ourselves how despite the conscious assessment and recognition of our emotions, shady traits, and situations that may enable undesired behaviors and bring up more pressure and dissatisfaction, we can find peace through acceptance and focused action. When you are able to fully feel all the emotions that may range from exciting and positive to gloomy and scary and still keep moving towards your goals, you know that you have reached a new level of competency that will prevent all those hours of learning about technical tools and testing the algorithm from going to waste.

Four key trading psychology terms we need to keep in mind are recognition, acceptance, investigation, and competency.

Lesson 5

This journey is not easy, yet it is an exceptionally rewarding one in the sense of ensuring lasting changes that you will get to witness in different areas of your life. The entire introspection that you put yourself through will inevitably transfer onto your trades and your personal life as well because you will experience a renewed sense of self-confidence and self-reliance. Once you make a decision and commit to leaving no stone unturned until you see the causes of your actions, you will discover deep satisfaction and serenity that, looking back, you will know you have done the right thing. The fact that the best traders in the market keep bringing up the same topics, insisting on traders learning about trading psychology, is an indication that looking within is the only certain way to get to the top.

Even famous psychology book writers and scientists admit to there being two parts of us – one that makes an inherent part of our existence or what we call our nature and another that consists of the lessons and experiences we drew from our surroundings. Some people are, for example, born risk-takers and this is in the innate characteristic that can be further shaped or molded by the environment. Someone who was born in a family where financial literacy was openly discussed and stimulated will probably enjoy a massive head start in comparison to other trading beginners in the market. The keel will never be even and everyone will have their own share of deeply rooted beliefs that are blocking their progression towards expert-level trading. Especially since we cannot always be consciously aware of our subconscious beliefs, it is important to willfully try and test our assumptions about who we are and what we believe in. What you may discover is the realization that some ideas you firmly cling to have never truly served your best interest or helped lead to the results you are aspiring to achieve. And, of course, once we obtain new knowledge about ourselves, we can then take appropriate measures and become one or several steps closer to that ideal version of our future selves.

Challenge your belief system regardless of where these teachings came from (family, school, etc.) because you may find out that the ideas you embraced so freely never served your highest purpose.

Lesson 6

Psychology tests are becoming increasingly available and resourceful, allowing for easy access and use to analyze how individual personality traits may affect one’s trading style overall. These evaluations typically assess the following four main areas: energy, mind, emotions, and perception. The analysis of one’s energy provides insight into how energy is generated and where it is directed. It reveals whether energy is focused inwards, which is characteristic of introverts, or if it is projected outwards, which we mainly find in extroverted personality types. Those traders who fall into the second group are, for example, much more likely to overtrade because extroversion is heavily drawn to a plethora of stimuli, activities, and achievement.

Having an introverted personality type, however, opens doors to some other patterns of behavior, which can prove to be equally detrimental to trading. The second level of analysis that covers the mind allows us to understand how we see the world and whether we are a more intuitive or a more observant type of person. Here we may find that we are not as detail-oriented as we might have initially assumed, and this knowledge of how we process information can prove to be of great benefit to all aspects of trading. It can reveal its potential in the process of creating your own trading system, which needs to match your own personality for it to be able to produce results. This is another reason why so many expert traders keep saying how some trading systems, despite their creators being extremely successful and affluent, never worked for them. The next point of assessment includes the analysis of one’s emotions, or the opposition between thinking and feeling, that determine our entire decision-making process.

Many professional traders always stress how important it is to acknowledge how you feel in some key points in trading to put an end to behaviors that sabotage your trades. The analysis of one’s perception is also extremely useful because it demonstrates whether traders make decisions based on perception or judgment, leaving room for a more advanced comprehension of their approach to work. And, it is now abundantly clear that one’s entire approach to trading reflects his/her unique set of values, thoughts, ideas, and emotions and these tests can truly help traders get to the core of who they are in order for them to interpret these results and use them intentionally to their benefit.

Psychological tests do not only allow traders to learn about who they are but they also provide insight into how those traits might affect trading as a whole.

Lesson 7

The study of epigenetics has shown how we all fall under the effect of different events that permanently influence our genetic makeup. It also proves how experiences that we have leave marks in our neurology, forever changing who we are. As human beings, there are many different causes of such epigenetic alterations as our nature is in constant interaction with our environment. Our experiences in time and place and our relations with other people inevitably impact how we think, what we believe, and how we feel. For example, all traders who have traded before now have this concept and experience of trading stored in their belief system, having thus become a part of who they are regardless of individual success. The events we experienced as children also created pathways for certain triggers to produce specific emotions as if we were trained to respond in a certain manner in similar situations.

Our biology is an equally strong determinant of how these external factors shape us, so someone who is a highly sensitive person may be more reactive to the surrounding stimuli than someone with a different biology. The brain is a powerful tool that stores information, and this process is likely to set off some reaction. The more these connections between a specific context or a situation and a responding emotion are made, the deeper the pattern becomes. That is how one day we may realize we are constantly rushing into trades without knowing the reason behind such behavior. And, while we cannot surgically cut through the lenses of our own neuroscience, we can find peace understanding that our responses seem to be out of control because they are not a conscious choice we choose to make, but a well-preserved bodily function.

Many responses to the external stimuli are of chemical nature, resulting in specific emotions that always provoke similar reactions.

Lesson 8

In a Harvard study, carried out to assess altruism and fairness, the so-called Ultimatum Game was used to uncover different personality traits that take part in decision-making processes. The experiment paired two individuals, “the Proposer” who was tasked with making an offer and “the Receiver” whose role was to respond to the proposal. The players were given the sum of $100 which they were supposed to split after the Proposer decided on the amount willing to share with the other party. If both players agreed, each participant would receive the agreed amounts. However, if the Receiver refused to proceed, neither this person nor the other individual would earn any profit. During the entire process, both participants’ brains were monitored through an MRI to detect brain activity. The study has shown how, whenever the Proposer assessed how much money was to be gained, the prefrontal cortex was always activated. This particular region in the brain is responsible for various cognitive processes such as planning, decision-making, self-awareness, and problem-solving, among others, and is demonstrative of rational thinking. At the same time, whenever the Responder deemed the offer fair, the same part of the brain would lit up. While the Respondents consented with the offers they considered fair in most cases (close to 100%), the ones they believed to be unfair were rejected in approximately 50% of situations.

What is particularly interesting is that, in such cases, the MRI showed activity in a different part of the brain which governs emotional feelings such as fear or anxiety. This conclusion is extremely important because it proves how, despite the assumption that we are always coming from the place of clear, logical thinking, our decision-making processes are not necessarily always representative of rational thinking. The fact that another brain region activates when we make decisions proves how some of the decisions we make do not come from the right parts of the brain responsible for rational decision-making. Moreover, the study further suggests how in some situations people are utterly incapable of using the prefrontal cortex when they find themselves in a losing position, which should help traders understand why some of their reactions lead to losses.

Even though we assume to be rational, studies have shown how some decisions are made in the part of the brain responsible for fear and anxiety.

Lesson 9

Various other studies proved how different emotions activate different regions in the brain, which undeniably affects the decision-making processes. A study of hunger carried out at Ben-Gurion University of the Negev, Israel, researched judges and analyzed more than 1,000 parole decisions made across a period of 10 months. The judges who took part in the study had vast judiciary experience of 25 years on average, which also meant that they had attended numerous Parole Board hearings up to that point. What is interesting is that time of the day emerged as a crucial factor in determining the outcome of a hearing, and hunger directly proved to have a direct impact on the decisions made in the courtroom. The study has revealed how the best time of the day to go before the judge was between 9 and 11 in the morning, indicating a 25% higher chance of seeing a positive outcome. Nevertheless, the next time slot, between 11 and 12, turned out to be the least favorable period in a day, while the window of increased opportunity would only return after lunch. Another drop in parole rates was recorded after 3 PM, lasting until the next rise at 5 PM. These causal associations demonstrated in the above-mentioned study can also be found in the world of trading, where we need to use our systems to trade.

Things that happen inside the human body with all the processes and the connections that are established throughout our lives may have more to do with the sequential, repetitive decisions that we make without understanding why. Sometimes to quiet down their minds and get into a state of complete focus, some traders like to practice meditation which allows them to reach a state of complete centeredness. By doing so, traders quiet down their minds and emotions, thus heavily decreasing the potential of stress residue or any hidden emotional pile-up to affect the trading. Meditation is, however, only one type of activity that leads to improved physical, psychological, and of course physiological state, and traders should explore different pursuits and/or routines that would provide them with the peace and quiet their minds and bodies need before and during trading.

If hunger can affect the decision-making in judges with over 25 years of experience, imagine what occurs in your body that you have no control over. Find an activity that can help you feel centered and relaxed before you start trading.

Lesson 10

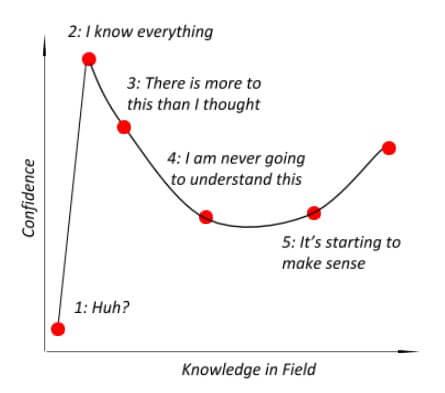

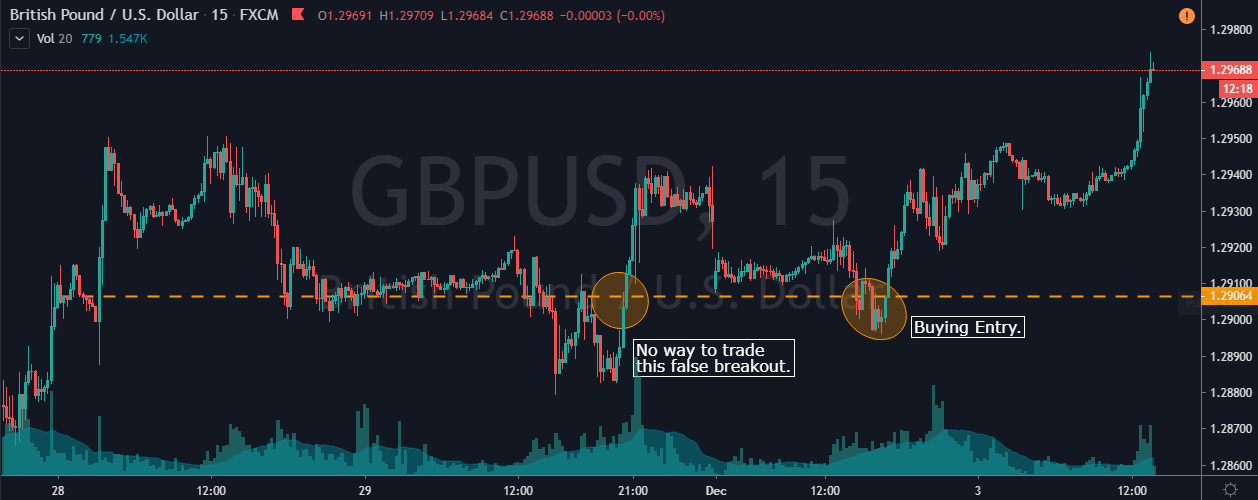

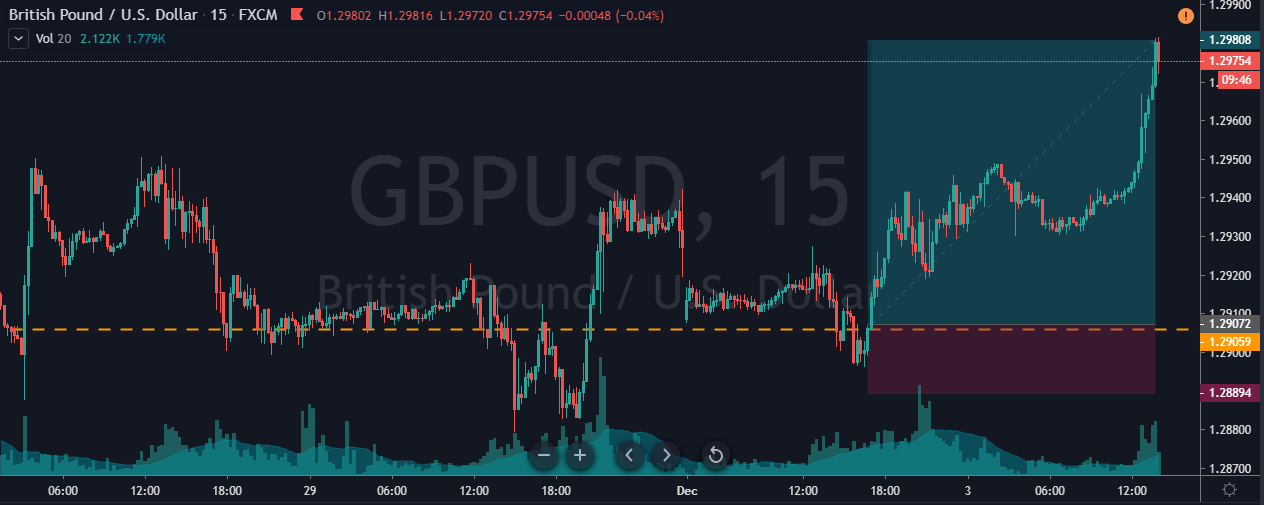

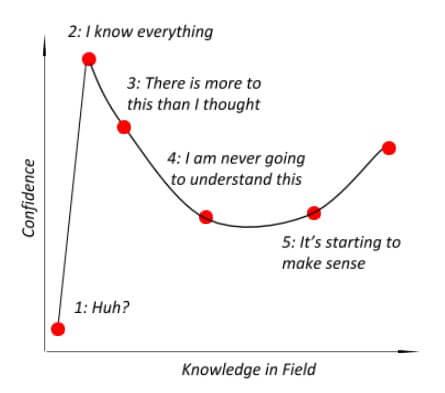

The knowledge of the human body and mind we accumulate with time might make us feel that people are doomed in terms of the ability to fight against our own nature. However, it is only with this knowledge that we can willfully leave more room for acceptance. As more information is gathered, traders need to increasingly invest in exploring their own actions and which steps they choose to take at a particular moment in time. Often people fall for the same trap now commonly known as the Dunning–Kruger effect that makes them view their cognitive abilities as greater than what they actually are, which is the most vivid in those with the least amount of knowledge. Many traders feel exceptionally confident immediately after going through several books on trading, yet when they get immersed and explore the topic more thoroughly, they start to realize that trading is harder than what they had ever expected before. At this point, some traders decide to quit, whereas others choose to devote more time and effort into becoming more knowledgeable about this field. As the curve keeps rising, so does the understanding of the subject, with traders finally reaching a higher level of competency. The rationale of the chart below is to let traders know that if they continue to put energy and keep going further, they will inevitably accrue knowledge and experience and reach the level of expertise they need to be successful at trading.

People are prone to having a cognitive bias in which the ones with low ability at a task overestimate their ability (see Dunning–Kruger effect).

Lesson 11

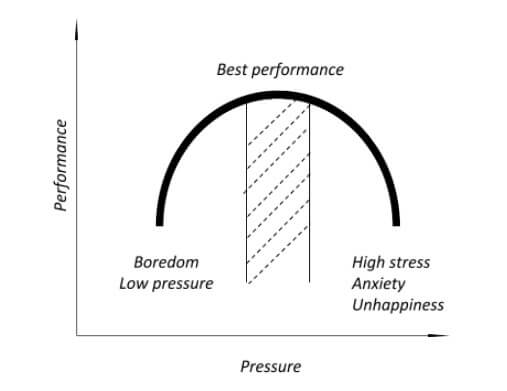

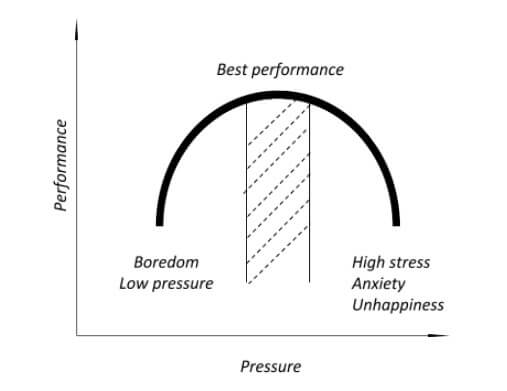

The discoveries made in the field of homeostasis (or what we know as the Yerkes—Dodson law) indicate a connection between pressure and performance. This relationship is increasingly important for extroverted individuals who are usually fond of stress and a busy schedule. The ones who feel motivated by having a variety of tasks to complete may also feel less motivated if the quantity of stimuli is low. What these individuals perceive as a lack of challenge makes them put less effort as a consequence. On the other end of the spectrum, when the quantity of stimuli goes beyond a certain range, the levels of cortisol and some other hormones become increasingly high, thus affecting the natural homeostasis in the human body. At this point, these people may show signs of stress, anxiety, and impaired decision-making. The chart below also exhibits the mid-point where people at the peak of performance are found. The area in between the extremes exhibits the perfect homeostasis or the flow where we can find individuals who are sufficiently motivated and who may, at the same time, struggle if presented with a lighter workload. When transferred to trading, we may find direct implications of this study in the manner traders approach their trades, and it is becoming increasingly important to recognize these patterns our personality types bring into trading.

The knowledge of how you work under pressure may tell you where your mistakes in trading are (see Yerkes—Dodson law).

Lesson 12

When you read about all the potential dangers of the human mind, the first thing you should not do is not fear yourself. Rather strive to be mindful before you sit to trade, enter that stage of homeostasis and flow through willful effort. Consider topics such as routine and steps to prepare yourself for whatever your next trade is going to bring along. It is vital that you think about the ways you can give yourself much room for allowing for good opportunities to occur, so clearing your mind should be made a priority. Here, at this stage of inner peace, you can actually go over the points where you have not acted in your best interest in the past without judgment. By facing the past challenges with a calm and open mind, you can come up with strategies to avoid any future repetition. All of these activities are there to support you and give you the strength to bring out your best qualities and potential. Without going deep, traders are not fully embracing who they are and are, thus, limiting themselves to a version of themselves that is simply “less than.” Trading skills are not a pill that we can just take to one day to reach success out of the blue. In the same way, we cannot see people as inherently, right from the start, good or bad traders, yet they have grown to become the best possible traders with time and with hard work.

Traders are not born but developed.

Lesson 13

As we can see from the information presented above, investing in learning general trading knowledge alone is simply insufficient and the sole focus on key trading terms can actually shift your perspective away from your real potential. This, naturally, does not imply that looking into charts and understanding the vast trading terminology is a negative approach but it does point to the need to pair it with the conscious effort to discover oneself. There is no fear or weakness in looking within because if you have already failed in the past, the results are there to remind you of the uneasiness of losing money and taking losses. Cut the strings of painful events and recognize your weak points. We cannot escape who we are, but we can endure the act of self-scrutiny if we know that the end result is going to be a positive one. When something hurts, the only way we can put an end to the continuation and the reverberation of its impact is through understanding why something happened in the first place. If something can serve as a lesson, it never truly was a mistake but an opportunity for growth. The purpose of any loss is to help us step into the individuals we feel proud of, helping us develop both as people and as traders.

If something helps us learn, we cannot call it a mistake.

Lesson 14

If you feel convinced now that introspection and inner work is the only real path to self-actualization and prosperity, you can follow the steps we are going to share with you here. Firstly, start off with identification and acceptance of your weaknesses, nurturing an understanding that we all have our own pile of dirt to tackle. Avoidance is not an option if you are serious about who you want to become, and it is also one of the easiest ways to fail as a trader. Secondly, devote time to the planning of how you will avoid repeating the mistakes of the past. Nevertheless, be mindful of the fact that jotting down a plan alone is not going to do the work. What all traders need is discipline that will create a completely new routine through the repetition of healthy strategies and techniques.

If you find discipline to be stressful, find comfort in knowing that numerous experts revealed how such a structure actually allowed them to feel liberated. Knowing what you need to do can put a lot of pressure off your chest and allow you to take up other creative endeavors in life too. Next, you do not need to fight your nature but embrace it in its full form. Learn to trade in spite of your shortcoming and, by all means, do not let yourself remain obsessed with your losses, letting the guilt and shame reside somewhere inside you. Instead, understand that your traits cannot be erased but can be guided and transmuted so as to serve you. Do not fall for the lie that you are ever going to be perfect because you will soon be in a fast lane going back to where you started. Keep reminding yourself of your weak points and maintain vigilance over your own risky behaviors through practicing discipline and consistency.

Discipline equals liberation.

Lesson 15

One of the last notes to remember is that the essence of success in trading lies in the combination of various key aspects which we all refer to as competence. Composed of experience, knowledge, skill, behavior, performance, and goal, competence is indeed both complex and layered. It is no wonder then that some believe how traders need 10,000 hours, or five years with a 40-hour week routine, to become experts. This, however, should not make you want to give up but the opposite because the benefits that you will grant yourself are immense and immeasurable. Aside from seeing the financial reward, you will get to learn about yourself in a way that you would hardly ever be able to. You will learn how to be successful and how to enjoy that success in every respect, applying it to all areas of your life. Now that you are fully equipped with all the knowledge, go ahead and start digging. It is worth it.