The Morning Star is a bullish reversal pattern that occurs at the bottom of a downtrend. A Morning Star is a combination of three candlesticks: The first candle shows the continuation of the downtrend. The second candle shows the weakness, and the third candle shows the strength of the bull.

There are two types of Morning Star:

- Morning Star

- Morning Doji Star

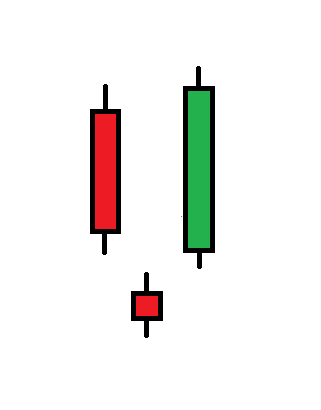

Morning Star

The Morning Star starts with a strong bearish candle followed by a gap down. The star candle may have a little bullish or bearish body. However, the third candle is to be a strong bullish candle closes at the above of the first candle’s open.

Have a look at this.

See the first candle, which is a strong bearish candle. The next candle starts with a gap closing as a little bearish candle. This one may have a small bullish body in some cases. The third candle starts with another upside gap. It is to be a strong bullish candle closing at the above of the first candles’ open. This states that the bull has taken control of the bear.

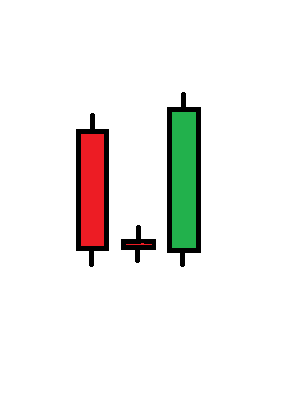

Morning Doji Star

Let us have a look at the Morning Doji Star

In this case, the star candle comes out as a Doji candlestick. The first candle comes as usual as a strong bearish candle. The third candle opens right at the support level and finishes above the first candle’s open. It states that buyers have started dominating the market.

In both cases, the first and third candles’ attributes are the same. The second candle varies. However, both types explain the psychology of the market, showing that the existent downtrend has come to an end, and an uptrend has been formed.

The Morning star is a visual pattern that is spotted out by the traders easily. It is the preferred pattern among all kinds of traders from price action traders to traders based on indicators.

How Traders Based on Indicators/Price Action Use the Morning Star

Traders based on indicators may use the Morning Star when it is produced at the Supply/Support zone. Moving Average, RSI, Bollinger Band, Parabolic SAR indicate Supply/ Support zone. If a Morning Star is produced at the zone that is a supply/support zone of those indicators, an entry may be triggered at the close of the third candle.

The price action traders may use horizontal, Trend Line, Fibonacci Support/Supply zone to take en entry on the Morning Star. If a Morning Star is produced at the supply/support zone of a horizontal/Trend Line/ Fibonacci levels, an entry may be triggered right after the close of the third candle.