Hello and welcome to this latest edition of courses on demand, brought to you by Forex.Academy. In this course, we will be discussing how to assess market conditions. Just before we begin to explain what’s involved in this Webinar, please take a quick moment to familiarize yourself with our disclaimer. Moving on to our webinar outline, we’ll start with an introduction to market conditions. We’ll then progress on to looking at the three different types of market conditions. We’ll have a look at the role different time frames can play when it comes to identifying market conditions, which is quite important. We’ll have a look at techniques that can be used to objectify market conditions, of course, being objective in the market is a really important skill to have, so we look at that in some detail. We’ll then have a look at the principal of a price cycle and how it can impact market conditions. We’ll finish this Webinar by looking at how to incorporate market conditions into one’s personal training plan, so we’ll make it very relevant and very practical for you as well.

Let’s start with an introduction to market conditions. Before we define what market conditions mean, it is important firstly to note that it is impossible for a trading strategy to work all the time, which is also known as indifferent market conditions. The reality for profitable traders is that, unfortunately, losses are inevitable, and there is no getting away from that basic principle. Now, the reasons for this are often that every trading strategy approach will be built on specific characteristics, which can from time to time contrast with the conditions of a particular market. It’s a case of certain approaches, suitable for certain market conditions, and invariably you will experience times where there’s actually a clash between the market condition and the strategy that’s looking to be adopted. It’s important to take note of the fact that with a trading strategy, it is unrealistic to expect that strategy to work in every different type of muscle, market environment, and market condition. To give you a brief definition, this is the state in which a market trades. In simple terms, markets typically transition between states, or different market conditions, on a regular basis. It is important to note that each state, or market condition, possesses its own unique characteristics, which we will have a look at shortly.

Now, there are three different types of conditions which a market can experience, and I’m sure you’re probably quite familiar with some of these terms. They can be Range Bound, or also known as consolidating markets, but they can also become Break Out market conditions, which have very unique characteristics as well, and also Trending markets. What’s important to take away is that they all have specific characteristics when it comes to the best time to buy or sell, which we’ll be looking to discuss in some detail very shortly. To give you a very quick snapshot, looking at this first graph, we can identify what’s called support and resistance levels on this chart. With the blue lines, we can clearly see and identify that the market bounces off these levels, and it does so on a number of occasions. That presents those that are range-bound traders the opportunity actually to sell. When the price gets up to these levels up here, they look for opportunities and see if they can sell these markets and drive the price lower. They do so on numerous occasions, so that’s how a range-bound trader would look to capitalize; create a trading edge when they trade these markets. The same applies to buyers when they look to trade these market ranges when the price reaches a low. There are certain characteristics which can be used to define a trading opportunity, but in principle, and broadly speaking, they would be looking for opportunities to buy at the lower end of the range and looking to sell the market at the higher end of the range. So, that’s the approach a range-bound trader would like to take when trading a market like this.

Another type of market condition is referred to as a break-out of the market. This is when you receive, or you experience a certain confirmation – which suggests to you that this market is no longer looking to move and stay within a range. So what you find, you need certain confirmation to actually make this trading decision and a trading strategy. Just looking at this candlestick here, you can clearly see we break through with momentum, and we get a close beneath this level. That is a little bit of a game-changer for those that look to trade breakouts on this particular occasion. So, what you will experience is that it will provide an opportunity, in this example, to potentially look to sell this market to the downside.

Now, the third type of market condition. To sort of give you a very brief introduction to a trending market, and what’s important to sort of takeaway from a trending market. This just happens to be a bullish price trending market, meaning prices are pushing to the upside. When you look at a price chart, you will notice that for a trend to be bullish, what you’ll experience is often the price for the beginning of that particular trend to be very much towards the bottom left-hand corner of your trading screen. If the trend is to the upside, what you’ll often experience within that trend is higher prices on the right-hand corner of your trading screen. There are additional characteristics, which we look at in so much more detail very shortly.

To give you a brief introduction and a general overview, you’ve got three significant phases. You’ve got your range-bound market, i.e., a market that clearly moves within a range, you’ve got your breakout markets, and you’ve also got your trending markets. These different types of markets can present traders with some interesting and very profitable opportunities. Let’s take a look at these three types of market conditions in a little bit more detail.

First, we’ll look at range-bound market conditions and the fact that they do possess some very unique characteristics. For a range-bound market to exist, you will need to see the market respect both a clearly defined level of support resistance and see prices bounce off those levels on multiple occasions. I’m just looking at this price chart and using this as a first example. We can work with what’s called genuine levels of support resistance, and you can identify those levels fairly easily. What we can see is a clearly defined range-bound market, which moves from highs to lows and back to highs. It does this on many occasions and therein lies the opportunity for a range-bound trader to, like we’ve alluded to before, look for opportunities to sell the highs at this top edge, and look to buy the lows, which is the bottom edge of this particular range.

Another example to go through would be identifying the price action. Again, looking to determine the range, and there are some specific characteristics that would need to be seen and achieved. When we work with genuine levels of support resistance, we can identify these levels relatively easy. It’s never important to be incredibly precise with the positioning of these supports and resistance because what you can clearly see is the market respecting roughly that sort of level. That gives traders some incredible opportunities to trade.

The three conditions that need to be met for a potential for a range-bound market to actually be performed are as follows; first is with regards to the move. By this, we mean this market is clearly moving to the downside. It creates an initial low, and that low is actually the first important part of the formation of a range-bound market. The second characteristic we are now looking for is actually with regards to the recovery point, and we just refer to it as a point because it does create a high in the market. Initially, the move has been very aggressive and very bearish in this particular example, and it creates a low. Then, we normally get a bit of a recovery point, or a pullback on this market, which creates a recovery point. That’s what range-bound traders look for; they look for these points, wanting the market to behave accordingly in and around those levels. The third characteristic, which would be required to effectively look to establish a range-bound market, would actually be the range-bound trade. This is when your range-bound traders would look to effectively identify an opportunity to actually look to push prices higher, as far as this particular market is concerned.

Again, that gives us some very useful information. If we take it over to the next example, we can go through that same process again, except this time the move is coming from down to up. So, we’re now in a bit of a bullish market, up to this point it creates a high. We get the recovery point, which can be located at this level in here I located at number two. As you can see, the price continues to behave around this level for a reasonable period before, effectively, we get our range bound trade. This is where your range-bound traders would look for opportunities to sell this particular market. If they get an opportunity, they would look to exit around the lower band, whereas on the left-hand side example, a range-bound trader will be looking to buy this market, and they’ll be looking to exit at the top edge. In this particular example, we’ll be looking to a range-bound trade, looking to sell the market at this point and looking to exit roughly around the lower edge, so it obviously presents some very interesting opportunities for traders. That is effectively range-bound market conditions and how traders interpret them.

The next type of market condition we’re going to look at is our breakout market condition. Again, these possess unique characteristics. Firstly, for a breakout market to exist, you will need to see an initial break out of a range-bound market. All breakouts occur from range-bound markets, so straight away, hopefully, you can see the transition from one market condition to another. You will also need to see explosive momentum and volatility in favor of the direction of that particular breakout. To give you a little example, there’s your support resistance levels, and you can clearly see this market breaking above this level. We have the confirmation that we’re looking for, we get to confirm the break. It’s always nice to see the market come from a much lower position. It certainly gives lots of time to look to try and capture this move when we get that breakout trade above that level, looking to drive prices to the upside and that’s what we’ve seen in this particular example. It’s very important that we identified a potential for a breakout and we use our range-bound levels to do that. When we get a breakout of those levels, we can clearly see that we experienced explosive momentum and volatility in favor of the direction of the breakout. If we’re breaking to the outside, we want to see a nice explosive move and look to capture that as a breakout trader.

To give you another example, this time to the downside, we’ve got a slightly different formation in terms of our range. This is effectively a descending triangle, so it’s actually creating a little bit of downward price pressure looking to push prices lower when prices reach these levels and of course we get our breakout trade, which is what we’d be looking to do in this particular example.

The two conditions in this case that need to be met for the potential for a breakout market to be formed; the first one being the initial explosive move close are the momentum closure, should I say above or below the range. If this is our range to the upside, you know, do we get an initial explosive move to the upside? The answer is, we certainly do. In this case, it’s above the range. Do we get continuation with a series of new highs on this particular occasion, where we’re getting this constant sort of pushing or prices? The answer is yes, we do. This is a classical understanding of a breakout market, and it ticks those particular boxes. Now, with this trade to the downside, we’re seeing exactly the same thing, so we’re getting a confirmed close. On this occasion, beneath the range low, we ask ourselves if we get that initial explosive momentum close to the downside below the range. The answer is yes, we do. The continuation can take a variety of forms. As you can see, we’ve got a nice continuation with the following candlestick and a little bit of a pullback before the market starts edging lower. As long as it conforms with seeing an explosive move above or below the range, then it constitutes a great opportunity for breakout traders. Just looking at the final version would be looking at trending market conditions.

Again, they possess quite unique characteristics as well. First, for a trading market to exist, you will need to see an initial break out of a range-bound market, so you will also need to see continued momentum and volatility in favor of the direction of the trend. Most importantly, you will need to see a series of what are called higher highs and higher lows in an uptrend and lower highs and lower lows in a downtrend. To explain this in more detail, we’ll have a look at this particular example on the left-hand side. To identify the fact that this market moves from the bottom left to top right means that we are in a confirmed uptrend pushing prices higher; however, you will also need to see periods of momentum and volatility in the direction in which we’re wanting to trade. There are numerous opportunities where you get nice and green explosive candlesticks in this particular example, pushing prices higher. That should give you more confidence to know that the likeliest response for this market to keep pushing prices higher.

As you can see on the screen currently, there are numerous examples of being able to see and identify that momentum and volatility in the direction of the trend, which in this case is pushing prices higher. What you would also need to see is what’s called a series of higher highs. These are quite easy to identify, and we will refer to it as in this particular example h/h. As you can see, as the market moves it up in favor, we get to experience a higher high, and this happens on numerous occasions, so these highs are actually higher than the previous highs. This is the classical definition of a trend, where you constantly see a series of higher highs back-to-back.

In addition to higher highs, what you would also need to see is the market being supported from the downside. What we mean by that, is you will also need to see what are called higher lows. We call these HL, for higher lows, and as you can see, these higher lows will be printed in a similar fashion to the higher highs. As the market pushes higher, we get a classical understanding of an uptrend, which prints a series of higher highs followed by a series of higher lows. I’ll just finish off these last few, and this is a classical definition of an uptrend, so hopefully, that makes sense. Prices continue to push higher, so in addition to that, we’ll move it along.

We’ll have a look this time at a trending market to the downside in this particular example. Again, what we want to see is the momentum and volatility to the downside, which is overriding the buyers in this particular example, and that’s showing nice continued strength. Keep looking to flush prices lower, so we can physically see the momentum and the volatility in this market. That’s the first thing, and we can see this as this market continues to drop lower now. We can identify this as a downtrend because the price this time is moving from top left to bottom right. What we can see is this market moving in this direction fairly consistently.

Another important characteristic of a downtrend is the fact that we will see it’s the same as an uptrend, but just reversed. We will see a series of what are called lower lows. As the market moves, it’ll print a series of lower lows on numerous occasions as this price moves in favor. This again is a classic definition of a downtrend, but you’ll also get support preventing prices from pushing higher, and these are lower highs. As you can see there, the higher the market, but they’re lower than the previous levels. Again, you get a series of these printed. These are lower highs and lower lows as this market moves down, so this is a classical sort of definition of an uptrend and a downtrend. As you can see, it’s just the polar opposite of each other.

That’s a good overview of the three different types of market conditions, and we hope you can begin to identify and see the opportunities that this can present for different traders whether you’re range-bound, whether you’re a breakout, or whether you are a trader that looks to trade the trend.

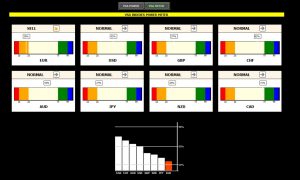

Another important topic to look at when we’re looking to identify market conditions is the timeframe in which you are trading. It’s important to note that all market conditions are relevant to the time frame you are wanting to trade, meaning you might experience, for example, a range-bound market followed by a breakout and a trend potentially on a one-minute chart, which you may struggle to see, or you might struggle to identify with on a much higher timeframe. For example, on a four-hour chart now to explain this in a little bit more detail, and let’s share with you a live chart at the point of this recording. I’ll try and explain this in more detail for you. Just looking at this bit of price section, what we can clearly see on a one-minute time frame, and this just happens to be the eurodollar, but what we can see is prices trending to the upside. We’re getting this sort of pattern, where range-bound traders may be looking for opportunities to buy and sell within this framework. As you can see, there would be multiple opportunities potentially, until something happens. At this particular area, we get a little bit of a breakout to the downside, and for that, there’s a level of support resistance, sort of sitting in this level. You can see that the market clearly breaks through that level with a little bit of volatility coming into it, which could present opportunities for breakout traders to look to see if they can push this market lower. This is just an overview effectively of an approach that might be taken from a range-bound trader in a much smaller timeframe.

Look what happens when we increase the timeframe. A lot of that analysis can subside very quickly, indeed. Now, we’re looking at a market which is clearly moving to the downside. It can be argued that there are some clearly defined levels of support resistance sitting in this market, and this market is breaking out to the downside. We’ve got a little bit of a pullback inside that level, so it’s a slightly more convoluted picture. All we’re doing is straddling what we thought was a level of support resistance, which can clearly be defined as actually being relatively close to being a significant level of support resistance, but as you can clearly see, the price action is bouncing above and below it. Now, the view could very much be that this is a range-bound market. Those that look to trade range might look at this price action and identify some opportunities, but let’s increase the time frame again and see what other information it gives us. Again, we are actually able to see a market which has bounced off a low. It’s created a new high and all we’re seeing at the moment is a little bit of a pullback, with some consolidation. At this moment in time, price is moving sideways for a relatively short period of time. Taking that analysis, a range-bound trader might look at this price action and suggest there are opportunities to trade this range. That would be down to the trader’s methodology, as to whether that’s the case. As we go through the different time frames, you can suddenly start to see how choppy this price action really is and that can give you some really useful information. Not only are there identify opportunities and much higher risk opportunities, the lower timeframe you go, and they can be based on a different rationale.

Looking at this hourly chart, you can see that the market has been moving above and below this particular level of support resistance on an hourly timeframe for a significant period of time. Again, if we go up into timeframes once more, the picture begins to change. What we’re looking at here is a pullback of the previous high, and this is for an hourly chart. This is where your pullback traders or your trend traders might look to get involved in this market. The breakout has already occurred. We get a pullback, and they might be looking to buy the pullback in a situation like this. On a daily timeframe, you can see what’s beneath it, which is a significant bull market; however, it must be addressed that market conditions can shift from one market condition to the other. Clearly, on a daily timeframe, we are getting a bull market, but it has to be said that since we’re looking at sort of mid-January, we have moved from a bull market into currently a range-bound market. We’re getting prices that move above and below our levels of support resistance, so therein lies the potential for different types of traders. The necessity really is for any trader to be able to identify the market conditions, obviously, prior to trading them. Hopefully, you found that useful in terms of the importance of timeframes. It can really look to give you a completely different complexion and outlook, depending on the timeframe that you are looking at.

Moving on to techniques that objectify market conditions, this is really about a trader looking to remain objective as much as possible. To give you a brief definition, objectivity is the lack of bias judgment or prejudice, and that can facilitate some significant benefits to traders. Now the question we need to ask, is how can a trader remain objective when assessing market conditions? There are a couple of ways in which we can do this. This is when technical analysts can come into their own because they can use certain training related indicators to help them remain as objective as possible when identifying these market conditions. We’ll go through three of them now.

The first one is just identifying support and resistance. I didn’t find genuine support resistance normally on bigger timeframes, and this will allow you to assess the market conditions properly. So, when we look at price action like this, it’s very choppy. We can literally apply a technique. It’s something that we’ve used in previous slides, and we’ve discussed it a little bit now in detail, we’re simply looking to identify a top edge or a top edge range in this particular market and a lower edge or a bottom edge range. We’re getting this market moving from highs to lows, and doing so in a relatively consistent manner when we identify these genuine levels of support resistance because that’s what’s happening. They’re supporting prices at the lows, and they’re resisting the price from pushing higher at the highs, and that is what can give traders some significant opportunities. As you can see, we have price action, which is slight and obviously slightly bearish to the downside, but very much moving sideways. That’s really what you would need to take away from price action like this, that you are clearly in a range-bound market. You have your range-bound highs and lows, and the market is bouncing in between them. If you happen to be a trend trader, this is not really the market condition in which you would be looking to execute trades. That’s how support-resistance can be used to remain objective. All you would need to do when using support resistance is to basically acknowledge what you are seeing and not psychologically talk yourself out of what is actually happening. That is just a little bit about support resistance.

Another technique that could be used is a basic understanding of Japanese candlesticks, and of course, this works hand in hand with support resistance. An understanding of Japanese candlesticks and their respective support/resistance will help you with objectivity. Again, we’ll have a look at this same chart. We’ll identify those levels of support resistance, as in the previous chart, and we can see that price is slowly moving down, making lower lows and lower highs. There’s a gradual grinding to the downside where we can look at the Japanese candlesticks and the information they’re telling us, which is that we are rejecting prices from moving higher at these levels. It’s doing so on a number of occasions, so that can give those that understand Japanese candlesticks a good opportunity to look to try and sell these markets at these levels. As you can see in this particular example, they can do so on many occasions, and the same applies to the downside.

So, we can identify if we understand Japanese candlesticks and how they respect and react with levels of support resistance. All of a sudden, we can pin this is a range-bound market. For those range-bound traders, this can provide really interesting opportunities to push higher. The reasons why they can make these decisions is because they’ve got a comprehensive understanding of market conditions. Again, you can see the rejection to the downside on many occasions within these areas. You can see the same again just recently, so your range-bound trader would be looking for an opportunity to look to take this price back to the upside. They’ll continue to do so until this range, the market condition that we’re currently experiencing, transitions to a new market condition, so that’s another technique that can be used to object to find market conditions.

When you apply this moving average, you can still identify visually your support-resistance. You can have a comprehensive understanding of Japanese candlesticks, but if you apply a very straightforward simple moving average to the chart (you can do so on any MetaTrader 4 platform), you can generally sort of identify. Don’t forget this is the moving average of each candlestick over a certain period over a certain number of candlesticks. As you can see, you should derive at the same conclusion, which is that this market is ever so slowly drifting slightly to the downside and is very much range-bound because we’re getting prices breaking above the moving average, and below the moving average. This is happening on many occasions, and that’s why a simple moving average can assist you with being able to remain objective about what is truly happening with this market. We can see this moving average, that prices are trading through it on many occasions and that is obviously a good thing for range-bound traders. It can provide them potential opportunities to look to sell the highs and buy lows, and this is just another technique that can be used to assist you with market conditions.

Moving on to price cycles and market conditions, price cycles can also be used by technical traders to support the identification of market conditions. There is cycle theory, and it asserts that cyclical forces both long and short, without doubt, drive price movements in the financial markets and that price cycles can be used to anticipate turning points in a particular market. These turning points can often be identified as periods of consolidation, or clearly defined in indecision, effectively allowing the market to pull back. Do not expect psychoanalysis to pinpoint reaction highs or lows necessarily. Instead, psychoanalysis should be used in conjunction with other aspects of technical analysis and to try to anticipate these turning points to a greater degree. To explain this in a little bit more detail, price cycles can also be used by technical traders to assist with the identification of market conditions.

I want to share this chart with you, this happens to be an S&P 500 daily timeframe, and you can see that the timeframe along the bottom is over the last four years. You can use price cycles, and it’s a well-known price cycle with regards to the S&P. There are a couple of caveats to this because this is a more recent chart. There’s been a number of developments within markets like the S&P 500, which has changed what used to be a little bit more reliable price cycle. Nonetheless, if we roll this on that there’s just a MACD down the bottom of this particular chart, which you can reference as well, and what this particular chart shows is a typical price cycle that you may experience in the S&P 500. The principal of the price cycle in the S&P 500 is that normally between November and April you’re likely to see prices push higher, and from May through to October you’re likely to see a price cycle where prices are squeezed lower. These can move to varying extents, which is why it’s important to make sure if you’re conducting price cycle analysis, that you are combining it with other, more reliable forms of analysis. Nonetheless, in each of these sections of the year, you’re likely to experience prices pushing higher, and you can see that in three out of four out of these periods, even though this middle one here has experienced a significant pullback. It has spent a majority of time retracing that particular pullback. The same applies from the upside, so it has been historically expected for prices to look to move lower during this particular cycle. As you can see, it doesn’t always ring true, but it is important to know that price cycle analysis should be combined with other methods of technical analysis. So that’s just a little bit about price cycle in conjunction with market conditions.

Let’s move on to how to incorporate market conditions into one’s personal training plan. The first thing to do is for you to decide the type of trader that you are. Do you prefer to try ranges, breakouts, or trends? That’s the first thing, because obviously there’s multiple opportunities, depending on your time availability and things of that nature. More experienced traders can trade multiple market conditions as well. Then, it’s just a case of looking to get really good at identifying the unique characteristics of each particular trading style. Whatever approach you want to adopt, whatever fits your personality, your capital, and your time availability. Then focus on the key characteristics of that style and take it on board; obviously, the timeframe that you would like to trade, and of course your tolerance to risk as well. Finish with a personal trading plan, to identify market conditions before executing a trade, something most new and experienced traders really struggle with. Please make sure you first identify those market conditions before you execute a trade. Don’t just jump into the markets blindly.

A basic trading methodology should look to revolve around things like deciding what markets you would like to trade, which is trade selection. Then, identify the market conditions of that particular market, and once you’ve identified that, and this is how it fits into a personal trading plan, then you can focus on the trade setup characteristics.

Let’s say we are a range-bound market. We need to set up the characteristics of seeing those top edges and looking at the Japanese candlesticks on whatever indicator you may be using, or whatever form of technical analysis you may be looking at, to adopt those characteristics and see if that trade conforms with those characteristics. The more criteria that are reached, the more confidence you should have in that trade and the more consistent you should become trading those particular setups. Then, your approach needs to focus intently on trade entry, what price are you actually looking to get into that market, and of course trade exit as well. So, we’re talking about risk management and making sure that you always draw that line in the sand, in terms of making sure that you mitigate risk obviously as quickly, or as well as you possibly can, and really have a strong focus on protecting your capital. The final part is obviously the trade management side, which will hopefully lead to a successful outcome for you. Within trade management, you’re talking about how you can mitigate risk. Can you look at a book and profit in that particular trade? Should we be looking to cover the position, or take profit? Whatever the case may be, you’re managing that trade as effectively as you possibly can. This is just an example to show you how identifying market condition fits in with an overall trading approach.

That just about concludes this particular Webinar. To review, we’ve introduced market conditions, and we’ve looked at the three different types of market conditions. We’ve looked at the importance of looking at different time frames, we’ve looked for some techniques to objectify market conditions, we looked at price cycle, and market conditions as well. Finish there with how to incorporate market conditions into one’s personal trading plan. All that’s left for me to do is to thank you very much for joining us on this latest installment of courses on demand, which have been brought to you by Forex.Academy. We hope you enjoyed it and we hope to see you soon. Do take care and we’ll see you soon. Bye for now.