Time, something that forex trading needs a lot of, and there are a lot of different things that you can be spending your time on. So much so that you are most likely leaving certain things out. For many, that thing would be the creation of their strategy. Either you are spending too much time on other things, or you simply just want to get started with your trading. Either way, you won’t be spending enough time on your strategy, getting it right and so this can lead to some negative results. Today, we are going to be looking at some of the reasons why you should be spending just a little more time on your strategy.

Create It

The first step for any strategy is to simply create it. Depending on the strategy it can take a different amount of time to create. Some will take a few hours, others may even take a few days to create. You need to look at what you are planning to trade, when you are planning to trade it, and also how much free time you have, as this will affect the type of strategy that you can use. You need to take your time when creating it, do not rush it, the last thing that you want is a half-complete strategy, you won’t get any success from that. So take as long as you need in order to ensure that your strategy is working and is suitable for the current trading conditions.

Learn It Inside Out

There is absolutely no point in only learning the bare bones of the strategy that you are planning on using. Instead, you need to learn everything that there is to know about it, for a number of different reasons. You need to know what the training rules are in order to know when you should be putting on trades and when you should be avoiding trades. Knowing which market conditions work well for it and which ones do not. You need to learn the limitations and what the strengths are of the strategy. Ensure that the first thing that you do is learn what there is to know about it before you even consider starting to put on trades.

Learn How to Adapt It

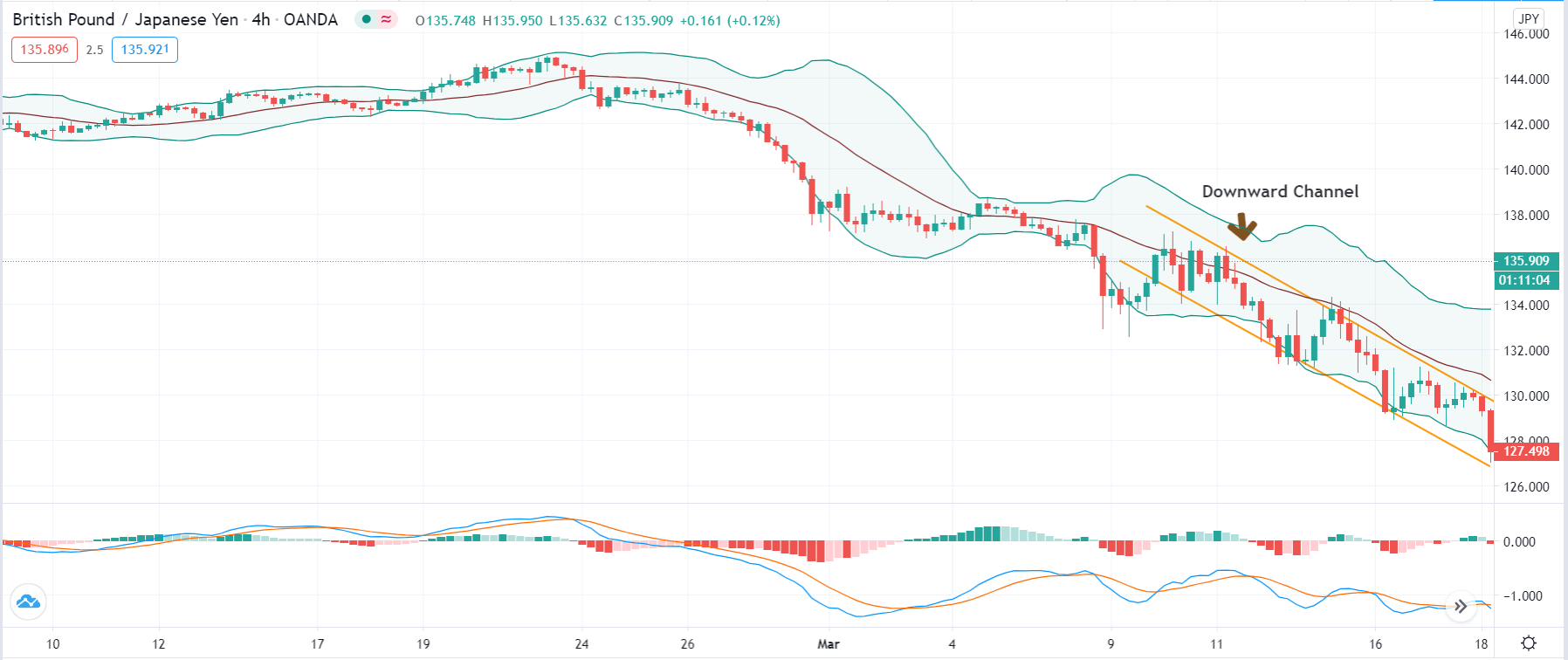

Let’s be honest, sometimes a strategy works brilliantly, the markets are working for you and each trade that you put on is doing well, but that isn’t going to last forever. It never will because the markets will always be changing. Due to this, you need to have a good understanding of how you can adapt the strategy that you are using. In order to do this, you will need to spend a little extra time looking at different contingencies. If you do not do this, then as soon as the markets change, you will struggle to make profitable trades as you do not know how to adapt the strategy and so stick to the older rules that were previously working before. So spend that extra time on your strategy to work out how you can make small and subtle changes to keep up with the ever-changing markets.

Learn More Than One Strategy

There will be times during our trading career when we believe that we have learned all that there is to learn when it comes to the strategy that we are using. That is great, but that doesn’t mean that there is nothing else for you to learn. Your strategy may work well in certain conditions, but it won’t work in all of them. So in order to combat this, we need to start thinking about learning a second strategy too. This will give you a lot more variation in your trading. It will give you better insights into how you can trade and will also let you trade when your other strategy would not work well. You never know, it may also help you to learn a little bit more about the strategy that you are already using or to look at it from a different point of view, giving you the opportunity to improve it further than you thought you could.

Never Stop Learning

We have covered this a little bit above, but the fact is that you will never actually stop learning about your strategy or even new strategies. You should never get into the mindset that you are always able to learn more and always able to improve. As soon as you begin to get complacent, that is where the problems often start. Never sit back and believe that you know it all, consider looking into new aspects of trading which could then give you better insight into your own strategies.

Stay Vigilant

You will need to remain vigilant on things like your trading rules. We have set those rules for a reason. They are there to give us an idea of when we should be trading, what we should be trading, and when we should be getting out of trades. The rules are there to be followed and so we should stick to them as much as we can. When we go against those rules then we are placing what would be considered bad trades. We need to spend that little extra time making sure that we are placing the right trade, it may add an extra few seconds or minutes to each trade but the overall results will be worth it, ember, those rules are there for a reason.

Always Adapting

Once your strategy has been created, that is not the end. You will always need to continue to adapt and change little parts of it. The market conditions will be constantly changing, and so you will need to adapt to it. Most strategies have the capabilities of working within different trading conditions, changing parts to better suit them. You will only be able to do this by knowing the strategy inside out and by spending a little extra time to work out what it is that you need to change in order to adapt it and how you can maintain the strategy’s profitability.

So those are some of the reasons why you should be spending a little more time working on our strategies. You don’t have to stick to one once you believe you have mastered it, but you should also remember that you have never learned everything that there is to know about the strategy that you are using. Spend some time developing it, but then also make sure that you spend some time following it too.