If you are so keen on wiping your account off the map, you are welcome to follow this new series of articles that comprise expert opinions on harmful trading habits and practices. Today, we present you with a thoughtful collection of our favorite mantras for master trading account demolition.

Yes, you read that right. These are really some of the best ways to stop trading in record time. And, today we are giving special attention to the best of the best – the very gem that possibly consumed the most souls. Meet the number 1 strategy sabotage and take your pen out – you will need it.

- Part 1: Don’t Have a Trading Plan

Ok, ok. We’ve got you. You have your system set up. Your algorithm is there, waiting to be used. You’ve searched the internet countless times and you are ready to hit the jackpot. You could just go on and guess your next move. Bring on the adventure and the suspense!

Oops! You forgot something. Or….did you not?

Well, it all depends on what you want to achieve.

We’d say that you may want to stay and finish this article if you really want to see how sabotage works at its finest. By the way, did you know that the word sabotage actually first meant to deliberately and maliciously destroy property?

Anyway, let’s start with trading and money management biggest slips.

- Taking action just because there seems to be movement

Traders love this one. They recognize that some action is taking place in the chart and they want to be in the zone right now, naturally without a specific plan. Expectations build up, creating a false sense of courage, and disappointment typically ensues.

The slip: Traders lack insight into the market’s nature and the skills to plan their actions.

Corrective measure: Wait for an actual trend or a move that is worth the risk you are about to take on and knowing when to get out.

- Not showing any inquisitiveness

Many beginners tend to take bits and pieces from different websites and/or social media pages before ever showing curiosity towards why different strategies exist and what their purpose is. Then, when their strategy renders poor results, they still don’t see the point in trying to understand what went wrong.

The slip: Many people don’t understand the value of being eager to learn and how a deeper understanding of things actually gives perspective, power, and confidence.

Corrective measure: Understand why your results do not match your initial expectations. Practice discipline in notetaking before and after every trade. Eliminate loss drivers first. Keep upgrading your strategy.

- Embracing inconsistency everywhere

Traders often fail to see the bigger picture. They have a desire to earn a few pips here and there and they think that the sole knowledge of how to use MT4 is sufficient to get them where they want to go. Alas, strategy entails much more.

The slip: Traders have no idea what to do in every step of the trade they entered.

Corrective measure: If you plan your entry and exit points properly, you will be able to go long or short in the best possible spot.

- Implementing a “one size fits all” approach

After much studying, a lot of traders think that they finally get everything, so what they do is use the exact same approach for every single trade they are in.

The slip: Traders miss the point of money and trade management. When conditions are different, they still hope to get a good result with the same formula.

Corrective measure: Professionals say that if volatility levels and the time frames you are using are different for the trades you are currently in, you cannot have the exact same stop loss. You need to be adjustable, not rigid.

- Chasing losses

Traders often fall for this trap. They feel angry with themselves and they want to make it up for the losses that they took.

The slip: Traders think that because a trade started to go against them, they can just tweak the settings a little bit, make some changes here and there, move their stop losses as they please and the trade will finally respond to their commands.

Corrective measure: You must never make changes in the middle of trading, particularly in terms of moving your stop loss (not related to trailing stop). You may feel insecure when you see that something is not working, but if you have a plan to fall back onto, you will also be able to compare results and optimize it later.

- Capping your upside

Some experts loudly oppose the strategy where 1:2 or 1:3 Risk/Reward ratios are used to enter a trade and then exit only when your trade well exceeds your stop loss. They believe that, this way, traders only limit their potential to earn a higher return.

The slip: With this strategy, you will miss high-yield trades that matter to the year-end line.

Corrective measure: Traders should strive to be a part of long runs where a trade can go from 1000 to 1500 pips in one go (trends seizing). This ratio strategy will prevent you from getting these big wins. While small wins are there to offset your losses, big wins are those that go directly in your pocket, professionals say.

- Seeing success as every win you make

A lot of traders think that being a good trader is getting one win after the other. However, this is not entirely true.

The slip: Traders forget that trading is very much about protecting the account from losses. If one’s strategy is only aimed at winning, the losses they take may overpower and outgrow all their wins.

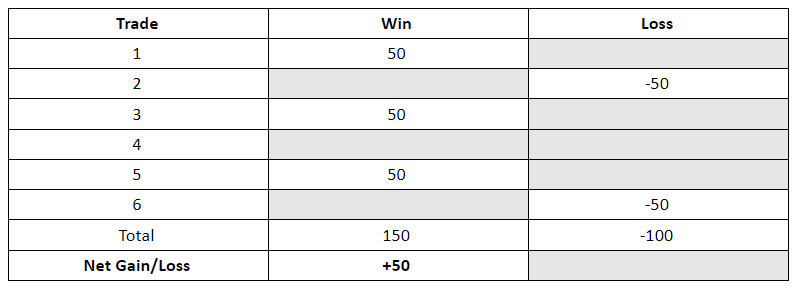

Corrective measure: Build your strategy so that you limit the losses. Track your net gain and loss as shown in the table below, delete the losses as you improve the strategy without cutting the winners too, if possible.

So, what do professionals advise novice and underachieving traders to do?

How can we limit the losses and ensure winning?

No. 1 Advice

First of all, you must set a stop loss and take profit. Instead of capping your trades as a form of protection, you can take half of the winning trade off the table and keep the remainder running. Move your stop loss to break even and add a trailing stop as well.

What’s the benefit, you may be wondering.

This way, you will no longer be asking whether you are going to win – you are now free. You can only wonder how much you are going to win. Even if any trade goes against you, you will earn at least half, which is still better than capping the upside, experts suggest.

Success Factors

There are two conditions you need to meet for any trading plan to reap benefits:

- Write your trading plan step by step

- Follow it religiously

This is important because, if you don’t respect your plan, you will end up trading by feel, which is something we will be discussing in the next article of this series.

The thing is…great traders are not just born. They gradually work towards becoming one.

They invest in understanding what works best along with learning more about themselves. Don’t forget that you – your personality and habits – also make an essential component and a determining factor of your success. See you next time where you will learn another set of perfect ways (not) to completely sabotage your trading strategy.