We showed how to manage your risk in the last three articles of this series. Today, we are embarking on another journey, teaching you how to manage your money like a professional, wealthy trader. The problem with most traders is that everyone is anxious about how much money they can lose, never thinking about whether there is a win limit too. That is where we are heading in this article – learning about our maximums.

Is the More Always the Merrier?

First of all, where does your money come from? Is it from the pure quantity of items you own or what you get to do with them? You may have an abundance of assets with a remarkable track record of winning trades, but what are they worth if they sit there collecting the dust? Think what the wealthiest people do – they always find a way to liquidate their assets because, otherwise, there is no point in any of the efforts made.

When is Enough Actually Enough?

We have all seen quite a few examples of people who seem to lack boundaries. We witness this behavior in casinos when the initial investment gets multiplied several times, but the lucky individual eventually returns home with empty pockets. We get to see such an unbalanced approach in the world of trading as well, having traders stay in trades too long without taking necessary precautions. It usually happens with those impressive trades where you get to buy something for a price that rises well above what anyone could ever expect. The idea of earning in one trade what you get to earn in an entire year is very exciting, isn’t it? Still, it is also very unfortunate to know the statistics of people who fail to ride these winning trades with a sense of precaution too.

How should I manage my wins?

First and foremost, learn how to scale out – take a portion of your trade off the table, put it into your trading account, and keep the rest running accordingly. You can use the ATR indicator to know exactly when you should take the initial profit. For example, if you are a forex trader and the ATR of the currency pair you are trading is 90, you will need 90 pips before you get to take any additional action.

We will even go one step further and give you the exact formula you can use in trading to manage your trades:

| Calculate your risk based on parts 2 &3 of this series.

Divide your risk (number of pips you are risking) into two halves (for MT4 TP partial closing limitation purposes). Make two half trades with that new number. Place the stop loss properly on both trades. Set the ATR where you want to take the initial profit on one of the two trades. After it closes automatically, move your stop loss to the break-even point (where you entered the trade). Keep the second trade position running, trends may prolong for days. |

How Does Scaling Work in Real Trading?

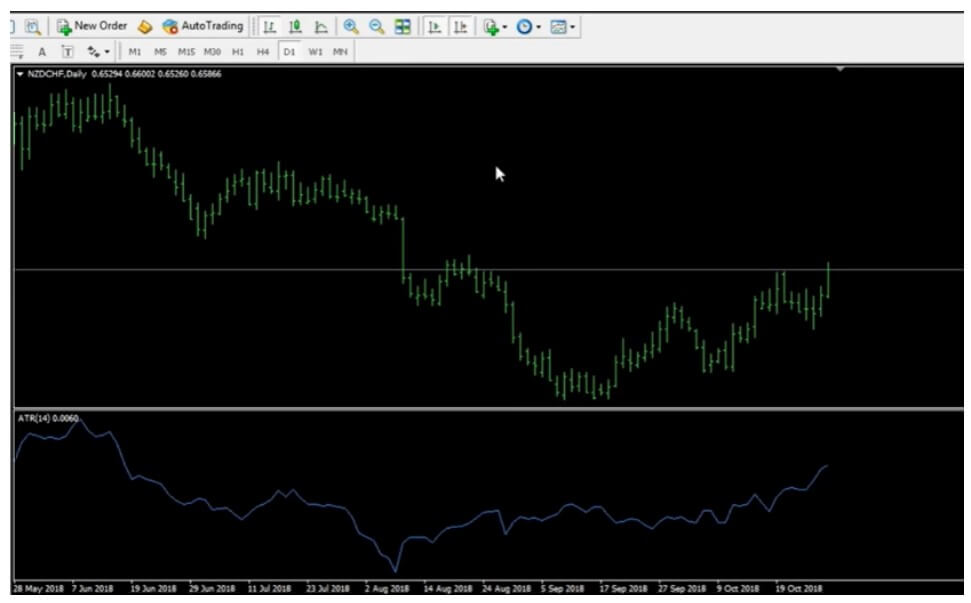

In the NZD/CHF daily chart below, you can see that the ATR equals 60. This information tells us that the stop loss is going to be 90 (please, read the second article of this series if you do not understand why) and that our take-profit point is going to be 90. After finalizing all risk-related calculations, we also know that the value per pip equals 11.11 for our 50,000 USD account. To scale out, we are going to need to cut this value in half, so we get 5.55. Now we should insert all of the necessary information. The only thing we mustn’t do is check up on the trades all the time because we do want to avoid emotional reactions, urges to make changes, or exit the trades prematurely.

The moment the price hits your take-profit level, we are going to move our stop loss (90) to the break-even point, knowing that the first half of the trade is a winner you can no longer lose. At this point, you can make use of some other tools, such as Heiken Ashi, exit indicators, and trailing stops, among others, to assist with your trade. These tools can be of great help with your second trade for as long as it runs, especially since knowing when to exit is one of the crucial elements of professional trading.

What is the Best Return I Can Get?

In the stock market, for example, a 10—11% return per year is considered to be a really good result because it mirrors the stock market average. If you can increase this percentage in time, you will become one of the few elite traders who are able to achieve such returns. If you are considering a specific benchmark to hit, this may as well be a great reference because these trading skills are always in high demand. Warren Buffett for example, one of the most prominent figures on the investment scene in America, makes a 20% return per year while some of the most affluent figures in the forex market willingly give exorbitant amounts of money to their advisors just to get a 13% yearly return.

As usual, we are leaving you with a task that you should complete based on the past few lessons you learned here:

How would you apply the scaling out strategy based on the EUR/USD monthly chart provided below?

What we really want you to know is that this approach helps you know that you are safe and that a portion of your investment is safe too. Many traders never scale out and years may go by before they face the consequences of their actions. You do not have to be the winner only; be a smart winner too. It really doesn’t matter what you trade (gold, corn, stocks, or forex, among others) because all smart traders share this one key skill that is so easy to apply. Accompanied by other trading skills, scaling in and out is the one way you can avoid the casino scenario and ensure the best trading position. Lastly, even if you encounter an unfavorable period or take a loss at some point in your trade, be patient and refrain from reacting impulsively because your stable and consistent approach to trading will even out any transient imbalance in the end.

Part V to be posted tomorrow. Stay tuned!