The short answer to this question is yes, absolutely, however, you will need to adapt for it to be so. Let’s dive into how.

① Common Ground

Did I make money whenever I had the chance?

This is your number one question that you would ask no matter the market. When you derive some strategies from the stock/forex market, you do want to see tangible results.

Crypto is unique but there are also some universalities.

You need a plan because we cannot just flip a coin and decide what to do next. We need a clear idea of how we are going to approach and exit the market so that we can correct any mistakes.

→ Solution: When you come up with a plan, you must stick to it. Also, check your totals and see if your overall percentage of trades puts you in the winning or losing group.

② Community

Forex and stock community spirit tends to be quite strong. The same is true for the crypto people. Especially since it is a relatively new market, many individuals want to take the opportunity and give their projections of the future. Unfortunately, as most of these forecasts are incorrect, the only thing traders get is a false sense of support. What is more, these posts and announcements often create a major hype, causing many crypto traders to forsake common sense and their judgment even when things start to turn sour.

→ Solution: Let go of groupthink and start practicing independence and individuality.

③ Testing

You do not want to follow any advice too piously, especially if it proves not to work for you.

How will you know what works? You will test every strategy and idea you find interesting.

Most successful traders had to hit rock bottom to realize what they can do better. Still, you can avoid this scenario if you take time to record your trades and ponder on the ways to make your returns higher.

→ Solution: Like in the forex/stock market, you need tests to be able to improve and learn from your mistakes.

④ Money & Risk Management

Money management is key for long-term success. Without it, we are all just playing the lottery.

Crypto is amazing because, once you limit your downside, the upside can be infinite.

→ Solution: Set your risk at 5% maximum of your entire portfolio.

⑤ Algorithm

Traders claim to have successfully used the same algorithm they applied in forex trading for trading crypto. Still, you can trade cryptocurrencies without an algorithm. What you cannot do, however, is avoid money management.

Crypto is known to move 25% to the positive and then 25% to the negative in only one week (late and early 2020 rallies for example). As the moves can be quite extreme, you need the protection that money management brings.

→ Solution: While you need to be active to catch the big moves, do not forget that you will lose everything without proper money management. Algorithms are optional.

⑥ Scaling out

If you want to earn smart money, you will apply the scaling out strategy. You never want to go all in.

→ Solution: Take a portion of your money off and close positions. Overleveraging can lead to terrible losses in a market that moves as much as this one.

⑦ Holding & Holding

You want to play both offense and defense. Choose your long-term and short-term investment plans to fully use what the crypto market has to offer. Remember that the possibilities are infinite with proper money and risk management.

We noticed how some stocks that generally do not do so well can go up substantially when the S&P 500 does. Similarly, altcoins are known to go up when bitcoin does, and this usually happens at a much higher rate. That is why it’s wise to allocate a small portion of your money (less than 1/5) and invest in these other coins.

→ Solution: Set 30% of your finances for short-term (more aggressive) investments and use the remaining 70% for your long-term strategy.

⑧ Spread out

Like in other markets, you will benefit from branching out. What this means is that you do not need to trade only one cryptocurrency. Rather spread out to ensure a higher return.

For example, you can have the majority of investment in stablecoins as a protection in case everything else falls apart. Your second layer of protection could be bitcoin or XRP or, preferably, both. Then, 5-20% could go into different altcoins. As there are different ideas on which are the best, you can just take your favorites and invest a little of your money there as well. Your final layer should be your longshots or the coins you use for your long-term strategy.

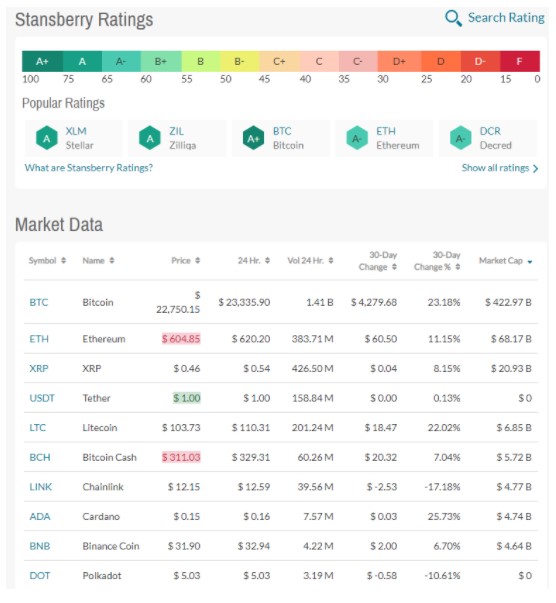

You can always use interesting investing research portals such as stransberryinvestor.com. There is solid research done on crypto and stocks and a very good benchmarking tool that grades crypto assets. These are based on core evaluations on each coin, useful to gauge the market in-depth, underneath the charts. The picture below is a snapshot of the benchmark table. These are free resources but you will have to register your account. Note that you should understand the project behind the coin.

→ Solution: Trade different coins to ensure maximum growth, profitability, and protection.

⑨ Entry

There is no one ideal piece of advice on where you should enter the market. As with forex and stocks, we can rely on different tools to find entry signals. For trading cryptocurrencies, you can always use “Trailing Buy” and even accommodate it depending on how the price moves.

In the image above, the price went low and there is a chance of it going even lower, so we want to move the red line further down.

If the price moves up, we are not going to make any changes in terms of the position of the red line.

→ Solution: To get the signal to enter the trade, move the trailing line down only if the price goes lower than it is right now (i.e. if it breaks down upon the candle close). When the price finally hits the trailing stop, that is your sign to buy.

⑩ Exit

You need to have a defined exit strategy for any outcome- whether a trade has gone well or bad.

Like in any other market, you need to align your exit point with your overall strategy and be consistent with what you do. We cannot make any changes in the middle of a trade.

Your exit strategy may vary depending on the type of trade. As cryptocurrencies are great for holding, your exit will then largely depend on your idea of how long that trade should last.

→ Solution: Always have a projection of how far you want to go and where you want to take your money off. Be disciplined to ensure you know that your approach is working out for you.

⑪ Psychology

Since many are affected by the craze over cryptocurrencies, you may experience the fear of mission our (FOMO). The rules regarding trading psychology are all the same, regardless of whether you are trading stocks or currencies. This means that any strategy you want to use cannot be perfected until you have control of what you are doing.

→ Solution: Complete a personality test and see how your traits might interfere with your plans for growth in this market.

⑫ Similarities and Differences

Fiat may as well one day be completely replaced by crypto. Still, until that time comes, we must know that crypto largely depends on supply and demand – like stocks and unlike forex.

That is why any strategy we wish to take from these two markets requires testing to see if it is going to help or hinder trading cryptocurrencies.

→ Solution: Although forex/stock strategies can generally work with crypto, we need to be careful with our choices.