Firstly, the abbreviation of the AUDUSD currency pair is the Australian dollar and the US dollar. AUDUSD is a major currency pair. It is considered a major pair because it is AUD is paired with the US dollar, and also, this is one of the pairs where a huge volume of trading takes place. In AUDUSD, AUD is the base currency, and USD is the quote currency.

Understanding AUD/USD

The exchange value of AUDUSD represents the units of USD equivalent to one unit of AUD. In technical terms, it is the value of AUD against USD. For example, if the current market price of AUDUSD is 0.6960, then it means that it takes 0.6960 US dollars to buy 1 Australian dollar. Trading the AUDUSD currency pair is basically trading the Aussie (Australian dollar).

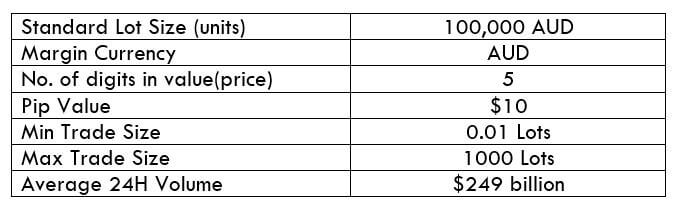

AUD/USD Specification

Spread

Spread is the difference between the bid price and the ask price. The spread usually varies based on account type. The spread on an ECN account and an STP account is as follows:

ECN: 0.7 | STP: 1.4

Fee

There is charged by brokers for every trade a trader takes. However, this depends on the type of forex account. Typically there is a fee in ECN accounts and zero-fee in STP accounts. Also, there is no exact value of fee on a single trade, as it differs from broker to broker.

Slippage

Slippage is the difference between the trader’s requested price and the real executed price. Slippage happens when the volatility of the market is quite high. It happens for market orders. Slippage can be in favor of the trader or against him. If entering and closing of the trade is done by market execution, then slippage happens twice. The slippage is usually between 0.5 and 3 pips. However, it depends on the broker’s execution speed as well.

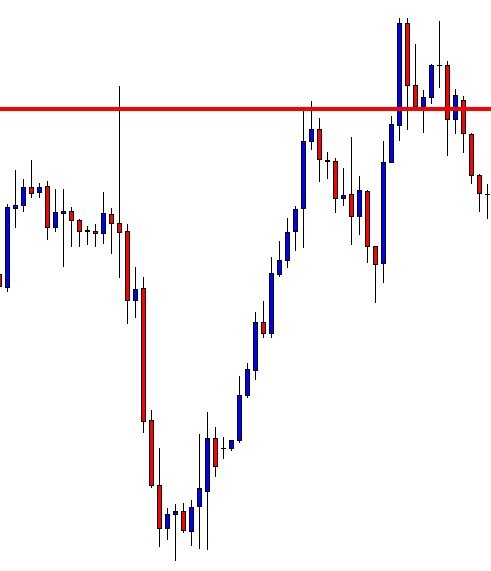

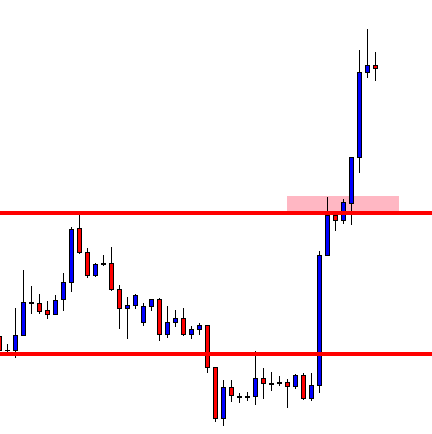

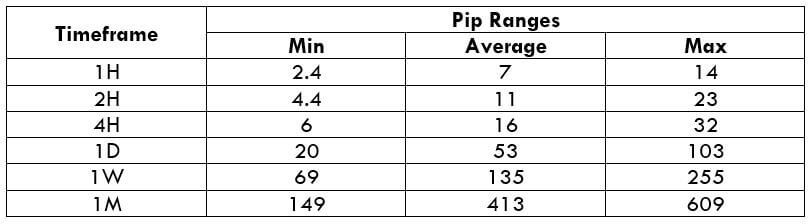

Trading Range in AUD/USD

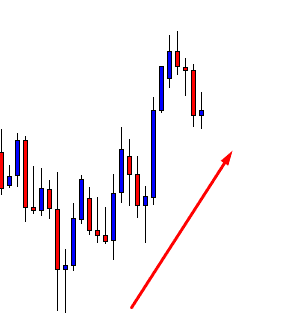

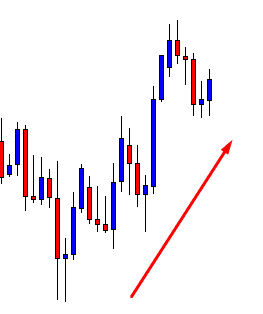

There are several timeframes to trade this currency pair. A day trader may pick the 1H, 4H, or the 1D timeframe, while a positional trader may opt for the weekly or the monthly. Apart from analyzing these timeframes, it is also necessary to know the volatility range in each of the timeframes. Knowing the pip movement range in each timeframe, one can assess their risk involved in each trade.

Below is the table, which represents the minimum, average, and maximum pip movement in each timeframe.

Note: The below values are an approximation from the Average True Range (ATR) indicator.

AUD/USD PIP RANGES

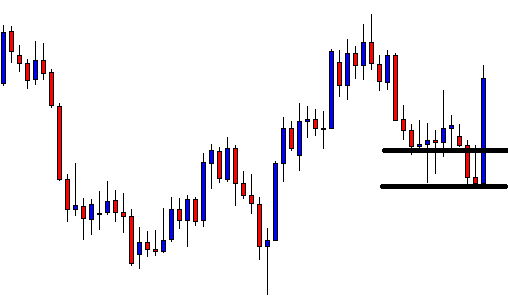

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

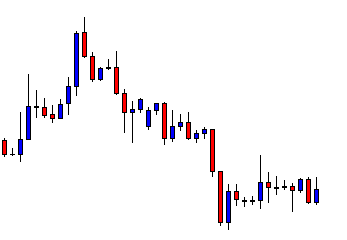

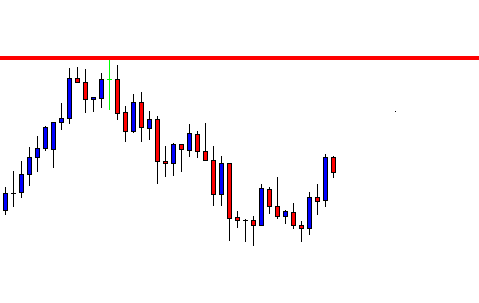

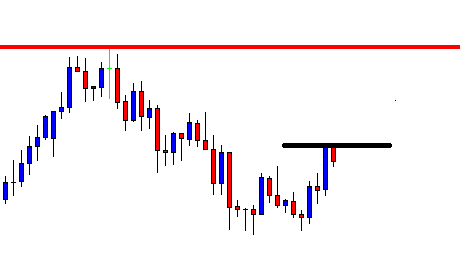

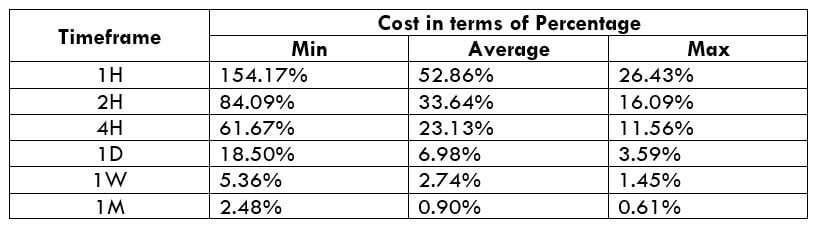

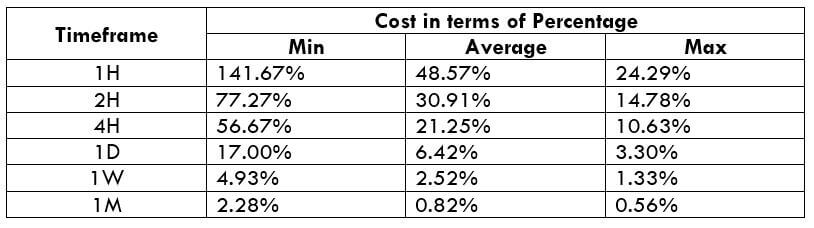

GBP/USD Cost as a Percent of the Trading Range

This is where the above values are put into play. By considering the volatility range in each timeframe, the cost (fee) for a single trade is measured in terms of a percentage for every mentioned timeframe. The basic idea to this is that the higher the percentage value, the higher is the cost of the trade.

The cost is calculated by considering three variables, namely, slippage, spread, and trading fee. And the sum of these values gives the total cost of each trade.

As mentioned earlier, the cost varies from the type of trading account. So, there will be variation in cost percentages as well.

ECN Model Account

Spread = 0.7 | Slippage = 2 | Trading fee = 1

Total fee = Spread + Slippage + Trading fee = 0.7 + 2 + 1

Total cost = 3.7 (pips)

STP Model Account

Spread = 1.4 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.4 + 0

Total cost = 3.4

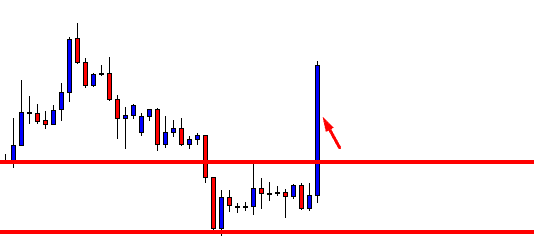

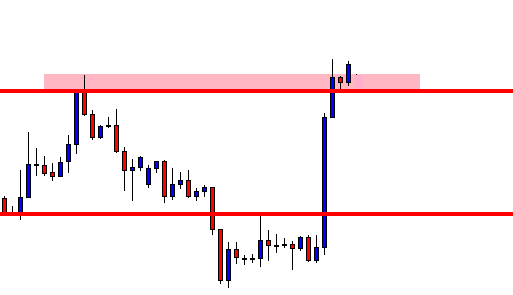

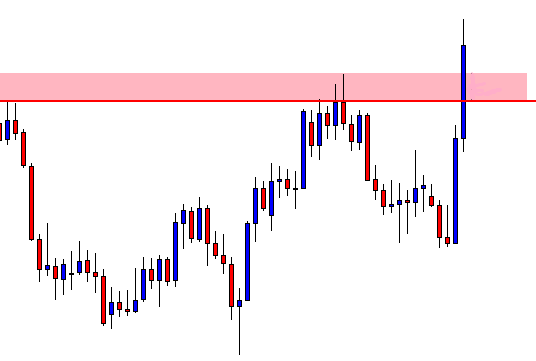

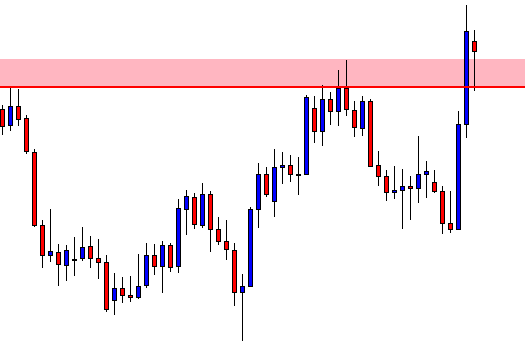

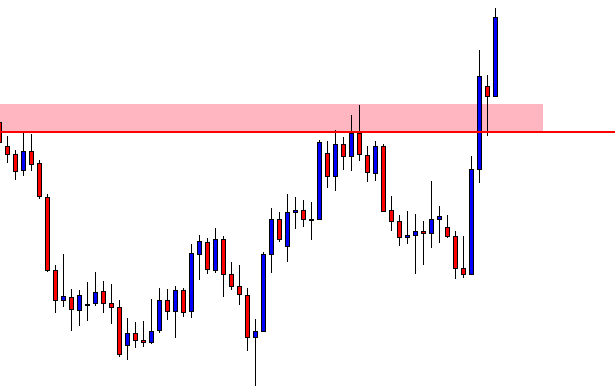

The Ideal Timeframe to Trade GBP/USD

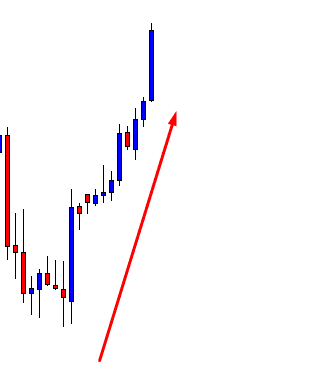

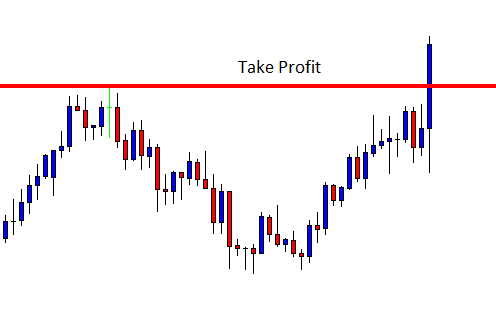

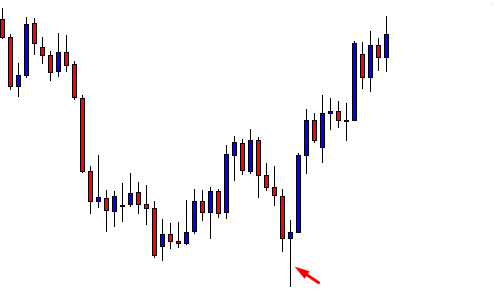

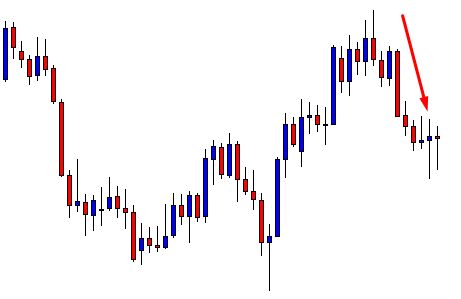

The first observation that can be made from the above percentage values is that the minimum column has the highest percentages compared to other columns. This means that the cost is pretty high when the volatility of the market is too low irrespective of the timeframe. Contrarily, the costs are significantly less when the volatility of the market is high (max column). However, it is quite risky to trade when the market volatility is high though the fee is less. So, it is ideal during those times of the day when the market volatility is above average.

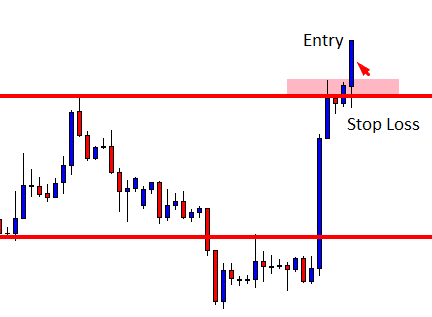

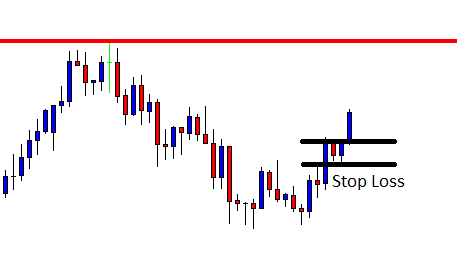

Note that volatility is not only one which decides on which is the best timeframe and time of the day to trade. The slippage value equally plays an important role, as well. For instance, if the slippage is made nil and the percentages are calculated, it is seen that the ranges drop down considerably. Hence, it is recommended to enter and exit trades using limit orders and not market orders.