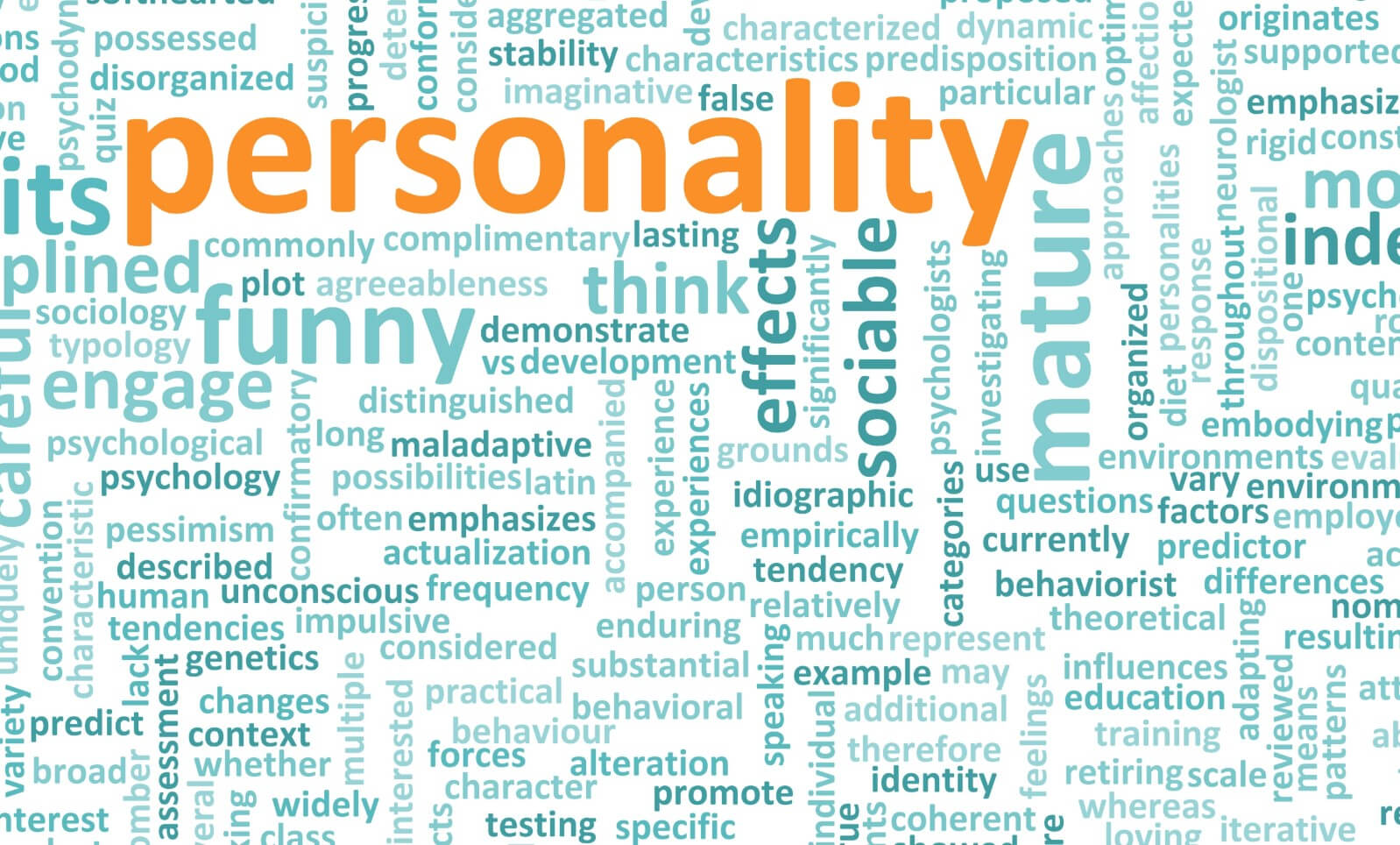

This concept that we will discuss here is not new. Personality Tests are used when hiring new employees. It is not all about the skills they may have, the employer may want his staff to have certain personality traits for the task in mind or company culture. Companies know that they may perform better for the role, sometimes even the skills and knowledge are secondary. Traders are independent, they do not have anyone superior, their performance is easily measured. The forex market will be their judge and a reflection of the effort, personality, and experience.

Still, it is rarely known prop companies test their traders’ personalities as there are so many videos, books, and mentors that are mostly focused on trading technicals, methods, management, and so on. If you have not heard already what are the two most important elements of trading, they are Risk Management and Psychology. Risk Management can be developed with testing and devotion but the Psychological part is a bit harder to master.

Everybody has unique personalities, habits, goals, and so on. Your Trading Plan and your Trading System will reflect this, and it should. Meyer Briggs Personality test is used by a group of prop companies so they can assess their new trader recruits and find out their strengths and weaknesses. If the company has the experience and has researched the personality-psychology relation in trading, they will know what traders’ mistakes are most likely to be. You will rarely find a video or a book about this if you are not searching, unfortunately, and it is such an important topic.

Prop company coaches even dare to say your Trading System is not important, it will increase your odds but it does not matter if you do not master your personality bad habits. Meyer Briggs test has 16 personality categories that cover enough psychological areas of a person so a trader can know on what weak spot he can focus on improving right away. How this is done depends on the weakness. What is important is to know that this test can be done for free, it is easy, and it is widely available. Once you complete it, we move on to explain how you can improve those bad aspects that bring your account down.

Know that this personality test does not have the right or wrong answers. In the end, you will have bad and good perks for trading as every trader has. There is no scoring, just the classification based on your answers. Let’s say you are stubborn. If you think this is all bad trait for trading you are wrong. It will mean you are not a quitter, you will likely keep trading despite the challenges. On the other hand, you could be doing things persistently wrong. What is even more interesting is that Forex will state this in your face as you trade. Are you persistent in chasing to recover that losing trade? Well, your account balance will suffer. Still doing this will bust the account. There is no way you can beat the market, if you want to become a professional trader, you will have to adapt.

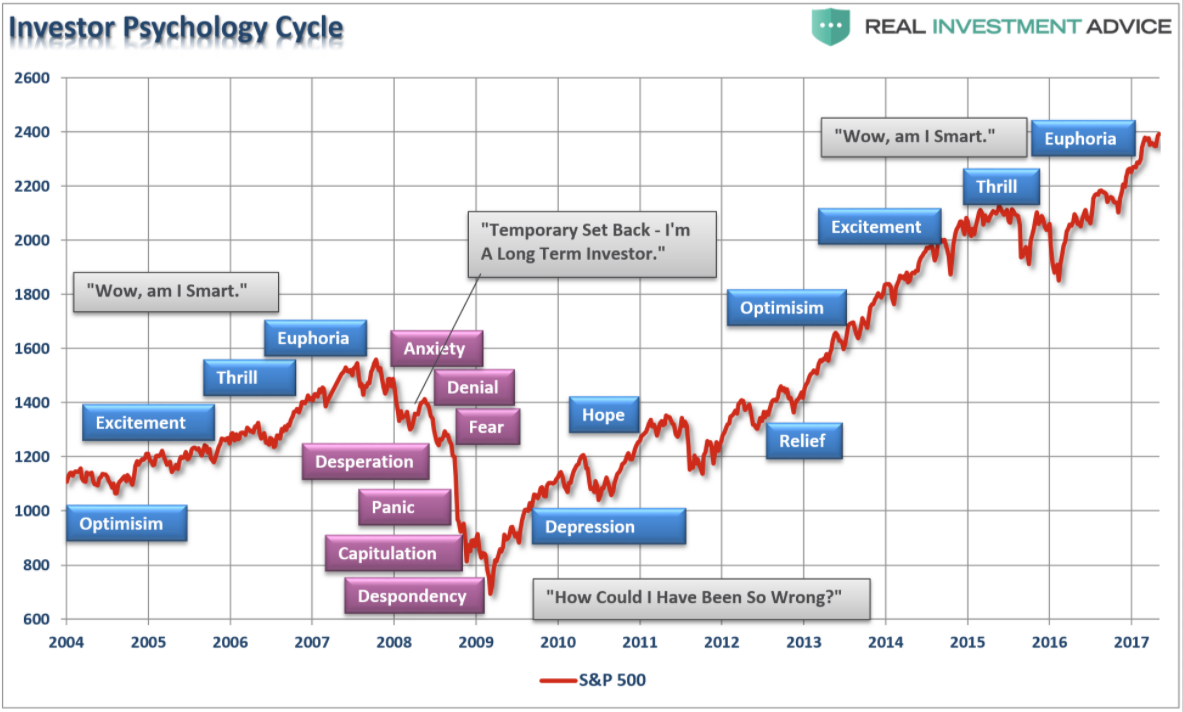

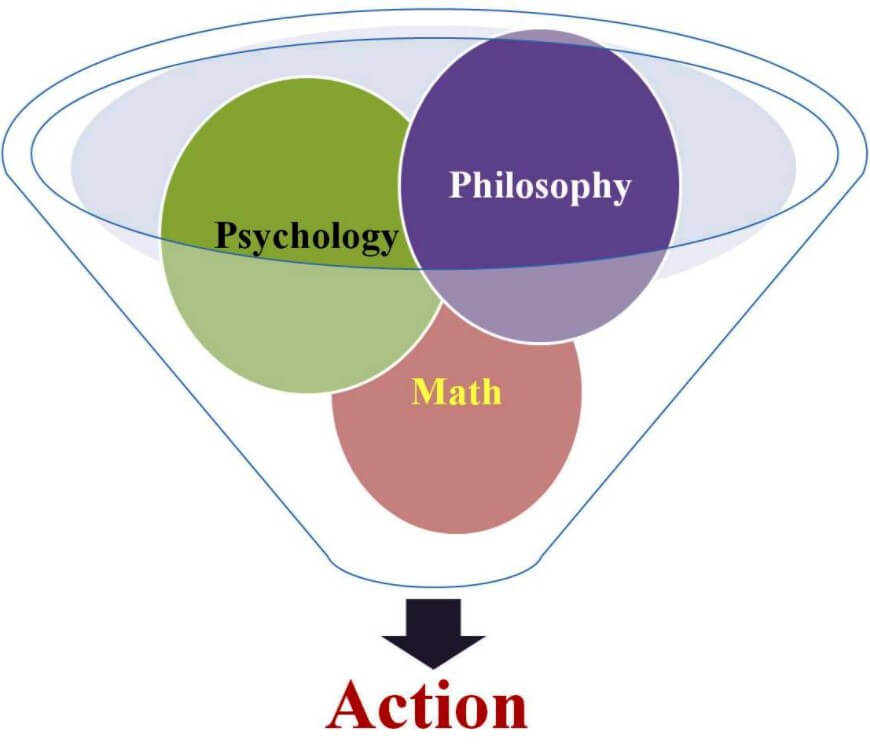

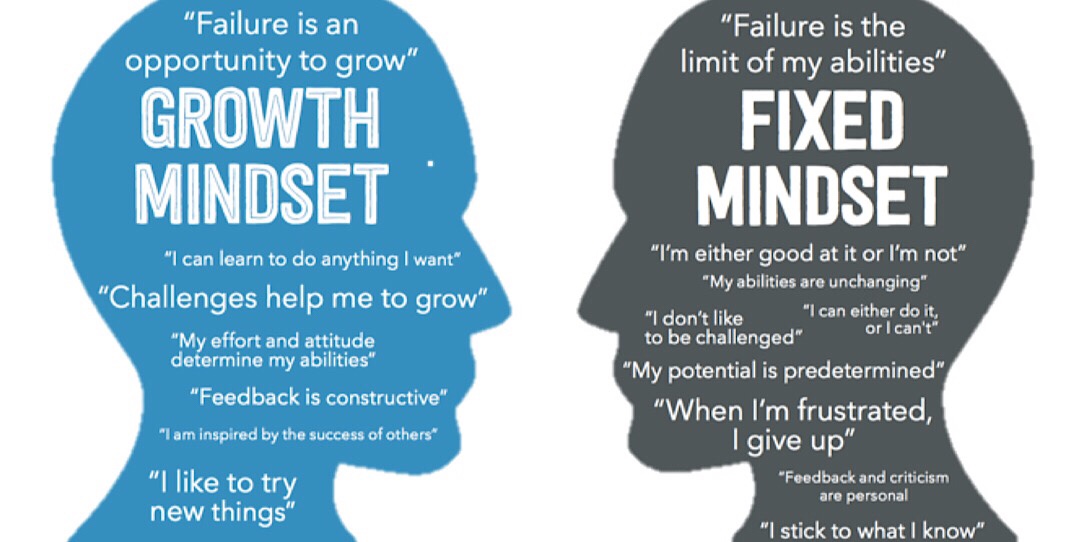

Many traders that have been through the path of Forex trading have recognized they have changed for the better generally as a person. One of the great quotes that match the idea here is by Joseph Plazo saying that “ When it comes to trading in the market, winning is the matter of the mind, rather than the mind over matter…Playing a winning hand depends on knowing your own mind – and understanding the way psychology moves the market.” Finally, traders start to understand that mastering your mind for trading will take a lot longer than learning to make a good Risk Management plan. And it is perfected using special methods. Trading is 90% mental and 10% technical according to prop firm statements.

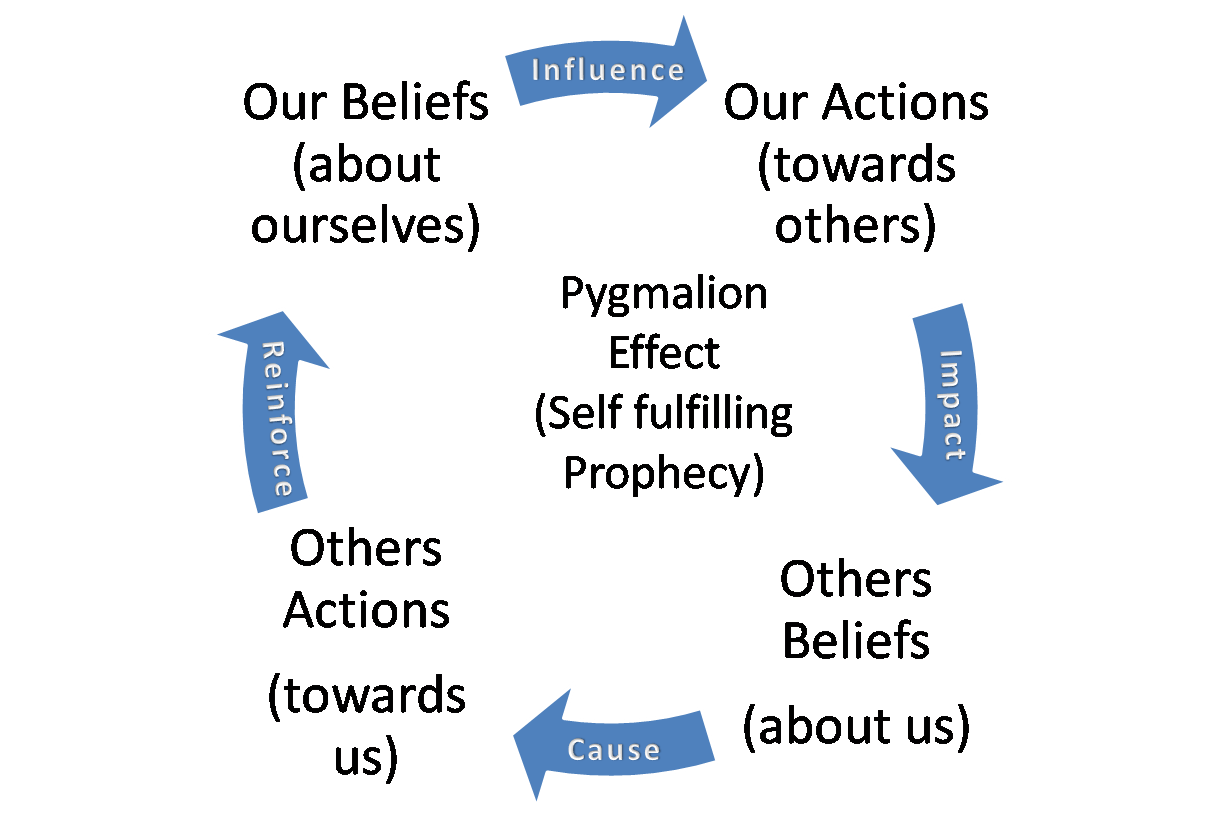

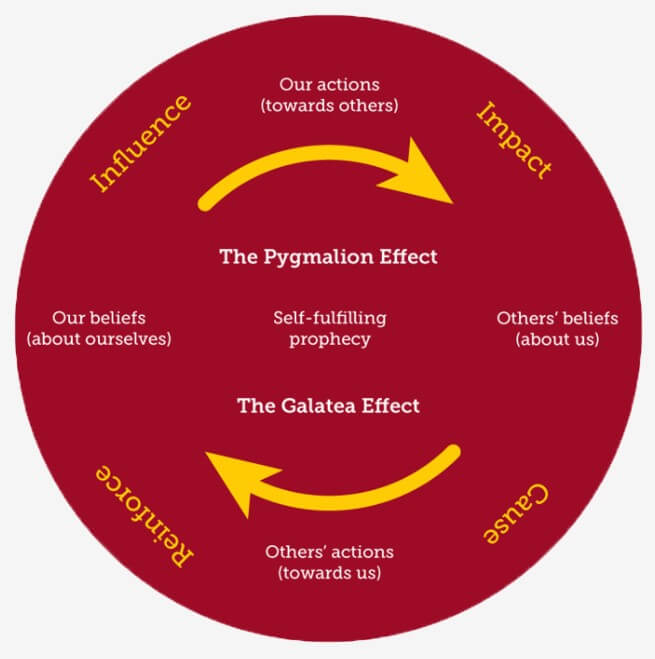

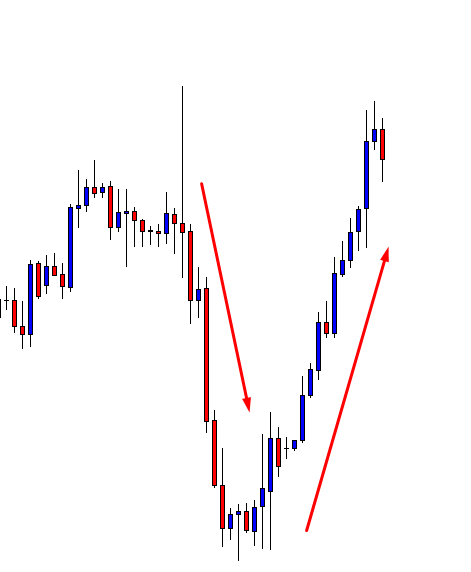

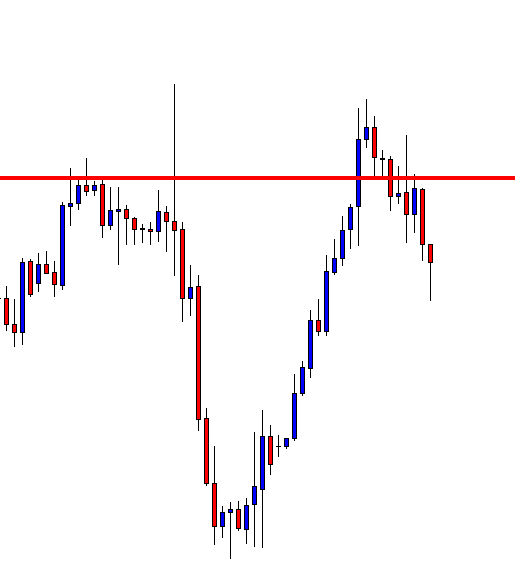

When you look at the market and have some basic knowledge to understand it, you will have an opinion. In a more scientific angle, this is subjectivity. This is your internal interpretation of the phenomena and how you deal with it. Your opinion could be aligned with the truth or not, in other words, you could be wrong. Objectivity is facts, our ability to get free from bias, prejudice. When two traders face and discuss what is going to happen next on the market, using the same data, they will form opinions. More often than not these will be the opposite. They will believe their opinions are facts even though in reality they are not. One of them will be wrong, the price will move in one way.

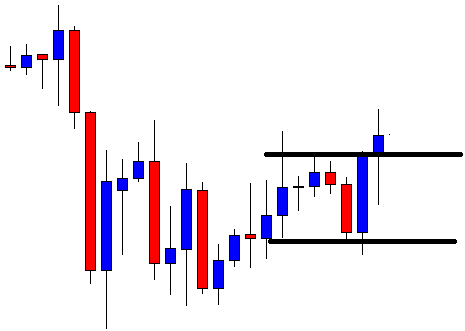

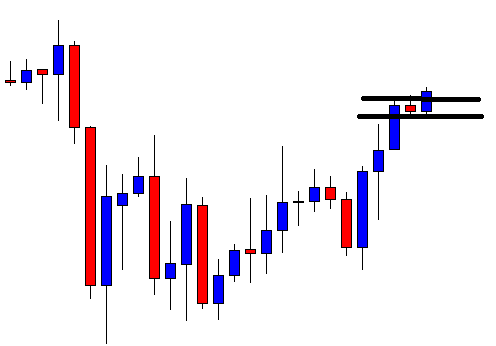

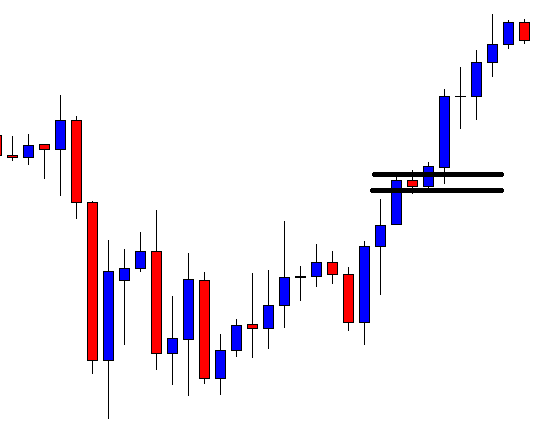

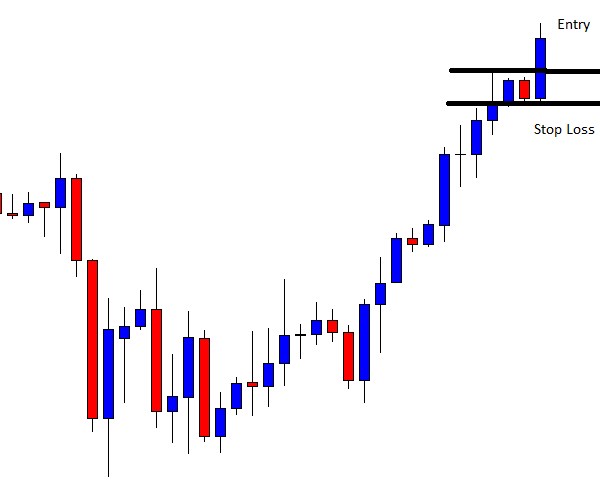

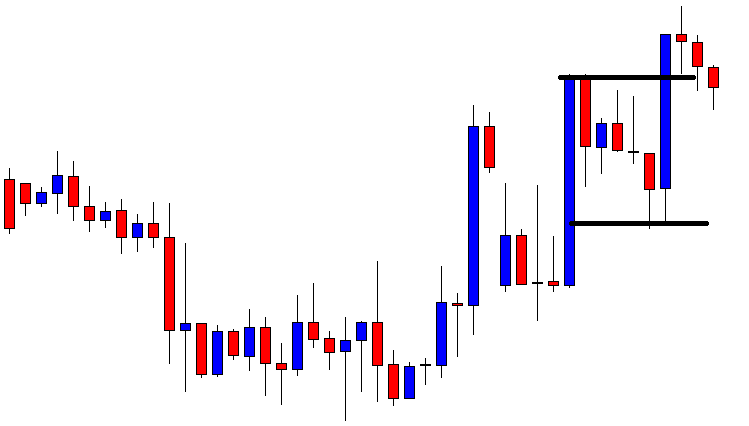

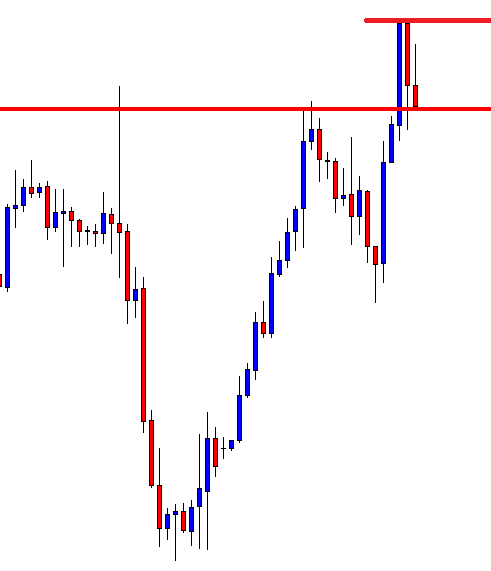

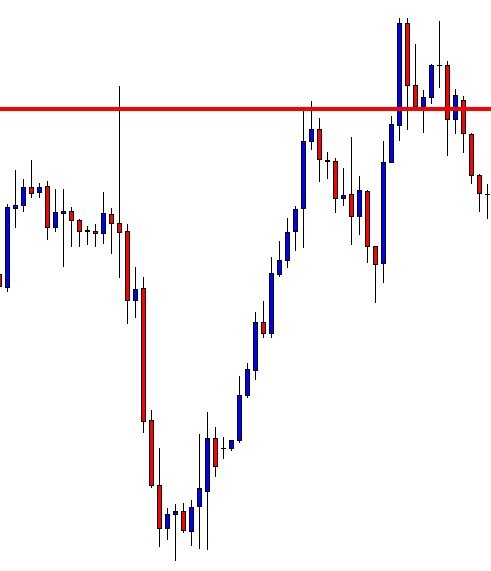

Money is tied to emotions. It will be our Subjectivity versus Objectivity. The separation of emotions from this is impossible according to the professional prop traders. It is very common to see a trader have great results on a demo account and collapse when trading with real money. They cannot trade the same way. If we can get to the point where we trade more on objectivity than on subjectivity, we are steps closer to consistent successful trading. This is one of the reasons trading systems are very helpful to see the objectivity.

Money is tied to emotions. It will be our Subjectivity versus Objectivity. The separation of emotions from this is impossible according to the professional prop traders. It is very common to see a trader have great results on a demo account and collapse when trading with real money. They cannot trade the same way. If we can get to the point where we trade more on objectivity than on subjectivity, we are steps closer to consistent successful trading. This is one of the reasons trading systems are very helpful to see the objectivity.

The Personality Test has 4 classes that describe your Energy, Decision making, Attention, and Lifestyle. For each class, you have two opposite traits. In the end, there are 16 personality types possible. As you gain experience with trading, your personality results will reflect this. The traits describing your Energy can be Extrovert or Introvert, you make Decisions on Intuition or Sensation, Attention will be based on Feelings or Thinking, and your Lifestyle can be Judging or Perceiving.

Traders will have common opinions that the market is against them, that they are the victims. Of course, it is the trader who is in control. Forex cannot be controlled, except maybe by the big banks, but traders are responsible for their actions. The Personality Test will set you into an Introvert or Extrovert but you are a bland, more or less. Below are the peculiarities of each trader type.

Decision making is based on two traits:

Intuitive traders love patterns, correlations. They seek them out, they feel something is about to happen, they take the big picture and wrap their minds around. These patterns will be their facts. Hunches or feelings are the base of their research. Looking at the chart’s history is their main activity.

Sensing traders use all the sensory input to make a decision. This is the way they create facts, with everlasting desire to find more. Details that make the big picture is their way. Having all gathered, they make structures, linear processing, and an organized plan. Everything has to make sense, they rely on tools and precision.

Attention core is defined by:

Thinkers are more analytical. Analysis, logic, and principle. They want to detach subjectivity and focus on facts. Only objective criteria can make them make a decision. They can see imperfections in their system, engaging in self-criticism and everlasting need to improve it. Precision is required, the goals are defined clearly and the results cannot be in the gray zone. It is black and white, to enter a trade or not is clear to them. Math is their friend. Emotions are a sign to the system is not good enough for them and they will try to take emotions away with precise numbers, not fuzzy thinking.

Feelers like the abstract, intangible forces to guide them. They feel the market, focusing on what the emotions are trying to tell them. Facts are not a priority. Human values and needs create a way for them for judgment and decision making. Market psychology is their friend are more likely to act on it, Therefore, they are less objective, tend to force out bad trades led by strong emotions. If not in control, emotional traders are always in danger of default.

The energy of a trader will align on how they approach to problem-solving:

Introverts focus on their inner voice of ideas, concepts, theories, possibilities, abstractions. They need a reason for a consequence, the source, reasonable argument, proof. They will think reflectively. They will use the market data and action to measure, extract, and define facts. These facts are then aligned into a system used as a machine for decisions. The world is in their head.

Extroverts are outside of their heads. They find meaning in people and what is happening around them. Therefore, interaction is what motivates them, they will also move people into action, create events. They like to make decisions in a team, learn with others, take collective action. The expression is more important than to absorb.

Lifestyle will reflect on how they trade:

Judging traders do not have doubts when they want to trade, they act. Motivation is pumped internally, they will create rules. Unfinished business is not done by the judging trader, the task will be completed, fast. They will act once the basics are known. Plans are created and based on them the trades are executed.

Perceptive traders do not like plans, rules, and strict algorithms. It is not gray or white to them, it is fuzzy. Stop Loss placement is not exact, but close enough where they think it should be. Procrastination is common, easygoing, late at the meetings. They do not lack curiosity, they can adapt and be spontaneous. Before trading, they want to know everything about and tend to make bad trading decisions using too much information.

Now let’s see how all these traits mean for trading and traders. According to the research, all of them have bad and good habits in trading. Recognizing what type you are, you have a good starting point on what area to work on.

Starting with Extroverts’ strengths, they are energetic, passionate, they feel great, optimistic, and ready to trade. Group trading is a great way to trade, they thrive with teams. Chat is their favorite tool, talk about their ideas, and share with the team. Action is their middle name, when it is time to act they will have no fear. When the see the opportunity for trading, it will be done, fast. The weakness in trading is emotions. Extroverts get excited easily and get carried away. Passion for trading is great, but too much of it will cause overtrading, one of the most common bad habits. They may also underperform when alone or when too much information is given to them.

Introvert strengths are very good for trading plan construction. They are introspective meaning they will come up with ideas alone using their analysis. Information is how they base their decisions. That is why they want to know more. They will go deep and be thorough with every info they find. The weak points come with this desire to have more information and then overanalyze. Overanalyzing leads to hesitation. Introverts need just a bit more for that trade execution, until it is too late, missing the opportunity. They really care trade is a good one it blocks their execution. They like their ideas so much they do not want to share easily with others.

Decision-making strengths for the Intuitive type traders are based on patterns they easily see. They get the big picture, understand it, and act on it. Relationships for the movements are also noticeable for them. They zoom out and process all the “invisible” information and act on that. Sometimes they have reasons they cannot explain, but they just feel what is going on, on multiple levels. Their weakness shows up when they hang on to bias, hunch, and how they feel at that moment. If they are asked about a decision, they will have no factual or reasonable argument and probably disregard objectivity.

Sensing traders love details, systems, rules, easy to follow procedures. Organization and plans are precise. Research is top-notch and scientific. All this can be overdone and expose their weaknesses. These are overanalyzing, causing hesitation when trading. They are also stubborn. Once their system is complete it will probably work extremely well. But once the market conditions change at some time, it can stop generating profit. This is a nightmare for the sensing trader, the engineer, who is stubborn to stop trading with these conditions. Failure comes hard on them, they will not accept it and learn from mistakes.

Thinkers have a sea of ideas in their heads. Their strength comes from their mind, creating a reason, logic, clarity, goals, and finally, objectivity. After all, is set and done, they question if everything is based on facts and if it is objective. This is also a filter for emotions. The weakness comes from using the mind too much. Losing trades in a row will start the chain of thoughts about their system, create skepticism. Even when the trade is profitable, thinkers still think about that trade. Stress is something they experience more than other types.

Feelers’ main strength is understanding the market and the psychology behind it. They create a bond with the movements so they understand the relations although they find it hard to explain why. The big picture, the mood, and the energy of the market are easy to assess. Sometimes they can see the sentiment without indicators. The weakness comes from an emotional attachment to the trades. They will often disregard facts and arguments against their decisions. Trading on feelings alone will kick out of the game. Even when loosing extensively, their optimism will fuel their will to continue. This punishing weakness is boxed in with a rigid ruleset.

Judging a traders’ strengths can be very beneficial for trading. As masters of decision making, they will not hesitate. They will take action, complete, push to the goal. The plan will be followed to the letter, and the plan itself will be clear. There is only right and wrong, black and white, nothing in between. Their mindset does not allow doubts, any contrarian opinion will bounce off it. This manifests in the weakness of not taking advice. Additionally, low flexibility is another consequence of this mindset. Thus, traders of this type may have a steep learning curve.

Judging a traders’ strengths can be very beneficial for trading. As masters of decision making, they will not hesitate. They will take action, complete, push to the goal. The plan will be followed to the letter, and the plan itself will be clear. There is only right and wrong, black and white, nothing in between. Their mindset does not allow doubts, any contrarian opinion will bounce off it. This manifests in the weakness of not taking advice. Additionally, low flexibility is another consequence of this mindset. Thus, traders of this type may have a steep learning curve.

Perceptive traders’ strengths come from their ability to be shaped into great traders. They are adaptive, change their mind, open for new ideas. Having a perceptive trader as an apprentice will be easy for the coach. Whatsmore, their curiosity will further improve their trading to an astonishing level of detail. Weaknesses out of all these positives manifest as being unsure of their decisions. Trades that they have entered could be closed before the Stop Loss rule. They change their minds, soak up information, and forex can easily play tricks on them. These decisions will be spontaneous.

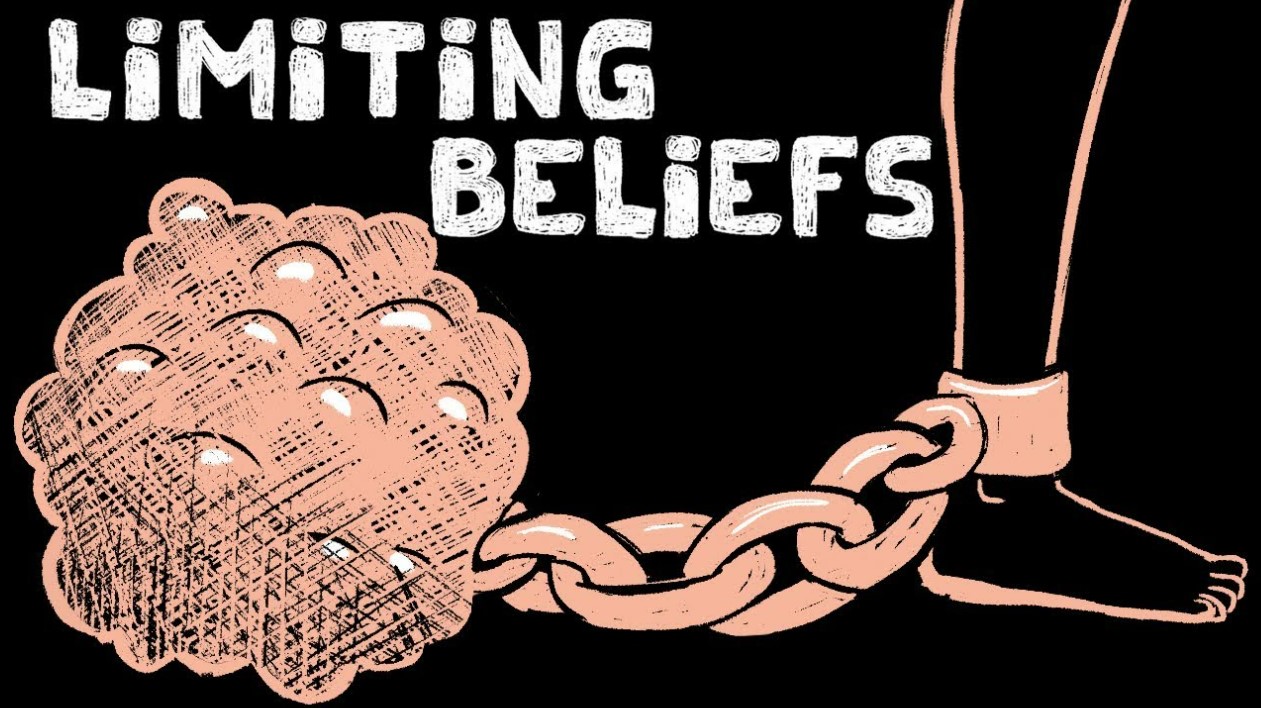

Now once you have defined your weaknesses, you will need ways of eliminating them in trading. Discipline will not be enough. You may try to stay disciplined but your personality weakness will come out. Trying to change what you are is unnecessary. Admitting your weak points, faults, bad habits is a giant leap in trading. Naturally, you will tend to root them out. However, overtrading, risking, impatience, cannot be eliminated just by convincing yourself not do that mistake again. The mistakes will repeat. Because of this, prop traders even advise you to skip this step where you try to eliminate bad trading habits with discipline. Instead, create lifestyle barriers that separate you from the environment where the bad habits manifest.

This can be done in various ways. For example, if you are overtrading, you can appoint some sports activities that will pull you away from the trading platform. You will always feel the next opportunity is around a corner which you can take. This way, you will have an obligation, a barrier, pushing you away from the environment where your habits can manifest. These barriers may diminish at one point, but you will need to create new ways of avoiding exercising bad habits. This can usually be done in agreement with another person. Ultimately, your will to avoid things that bring your account down will decide if you are going to become a professional trader. After some time, the barriers will not be needed, your bad habits will be buried.

Key takeaways for your Personality Test results are:

- Know that trading is 10% technical and 90% mental

- Understand who you are and gain acceptance

- Use your strong points

- Do not try to fight your weakness, find ways to put it out of reach

- Compensate your weak points with systems.

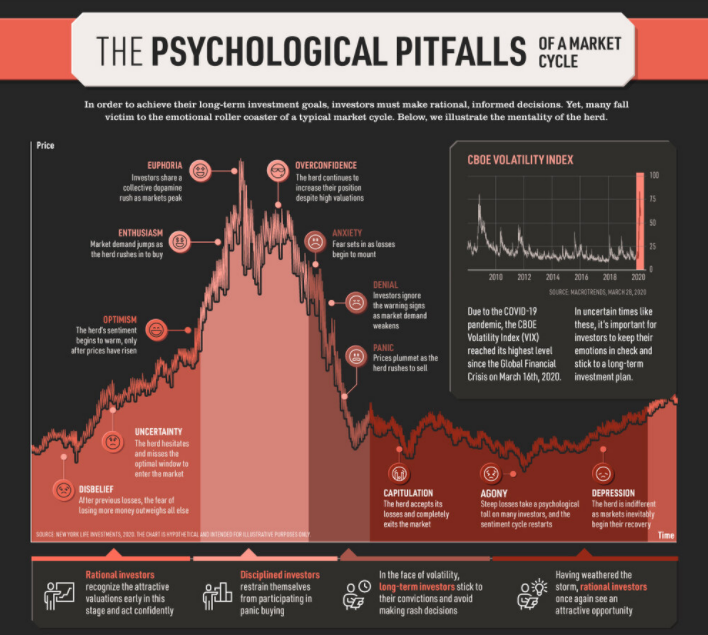

However, this change has not allowed us to detect “hidden changes” – those moments that Coates calls “the time between the dog and the wolf” – when people become very risky or very averse to the risk of the normal. Coates says statistical-based methods, which do not take into account biology or neuroscience, are not able to capture the behavioral changes in traders.

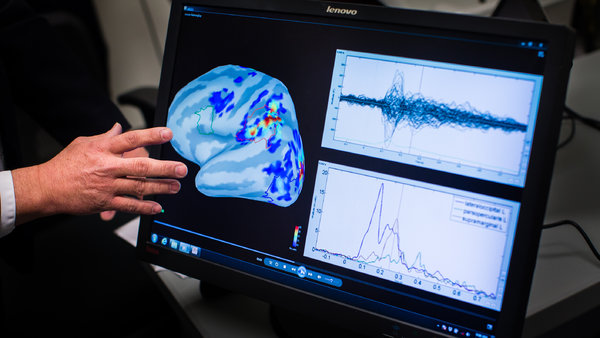

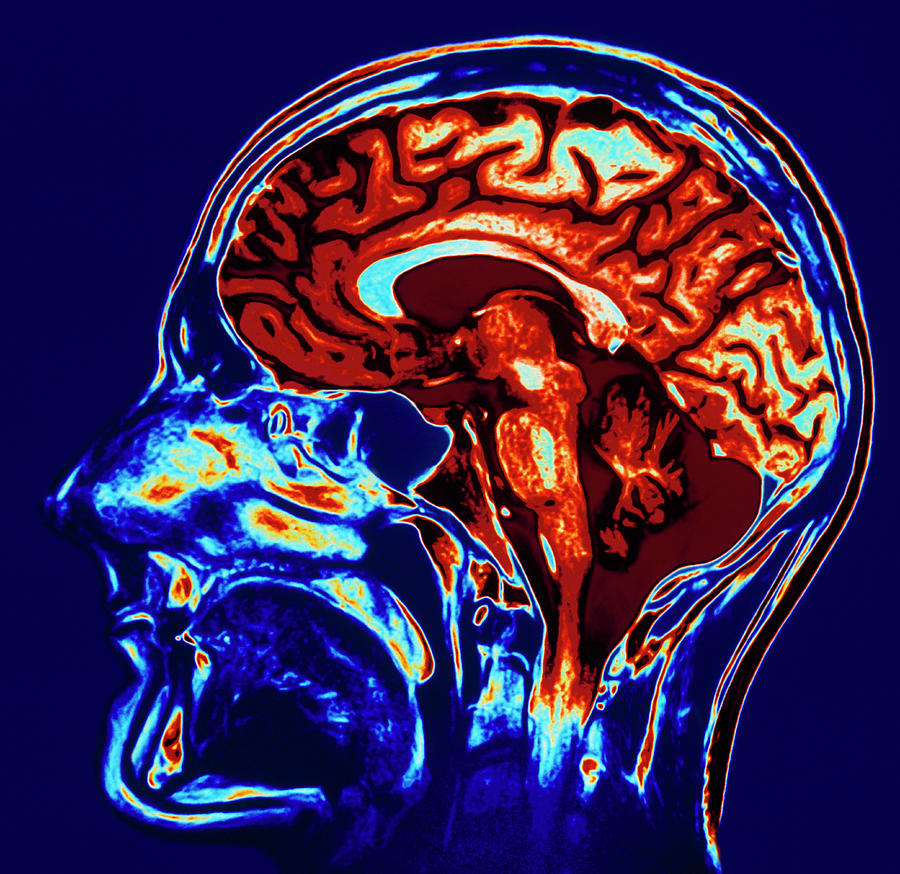

However, this change has not allowed us to detect “hidden changes” – those moments that Coates calls “the time between the dog and the wolf” – when people become very risky or very averse to the risk of the normal. Coates says statistical-based methods, which do not take into account biology or neuroscience, are not able to capture the behavioral changes in traders. In the tests conducted by Kerstin Preuschoff, a researcher at the Laboratory of Computational Neuroscience at the Swiss Federal Institute of Technology in Lausanne, and Steven Quartz, professor of philosophy and researcher of neuroscience at Caltech, subjects participating in the study were asked to play cards while observing the brain areas activated during risk management using fMRI. The collected data suggest that the anterior insula section of the brain, considered the seat of feelings and emotional awareness, transmits this information in a fairly precise way – essentially in the form of mathematical signals.

In the tests conducted by Kerstin Preuschoff, a researcher at the Laboratory of Computational Neuroscience at the Swiss Federal Institute of Technology in Lausanne, and Steven Quartz, professor of philosophy and researcher of neuroscience at Caltech, subjects participating in the study were asked to play cards while observing the brain areas activated during risk management using fMRI. The collected data suggest that the anterior insula section of the brain, considered the seat of feelings and emotional awareness, transmits this information in a fairly precise way – essentially in the form of mathematical signals.

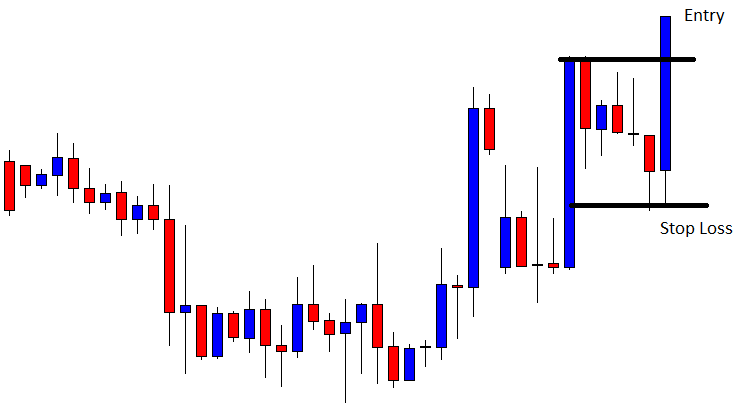

Risk management is the cornerstone of any strategy, it is the foundation that is there to basically protect your account. It is there to ensure that you do not lose more than you want to with each trade and ensures that you do not blow your account. When you have it in place it can help to take out a lot of the stress from your trading. Of course, the opposite is also true, if you do not have proper risk management in place then every single trade that you make will have the chance of blowing your account. If You are in that situation every trade then you will be under constant stress every time that you trade. This is why you need things like trading rules, dictating how and when you trade, stop losses to help protect your accounts, and a proper

Risk management is the cornerstone of any strategy, it is the foundation that is there to basically protect your account. It is there to ensure that you do not lose more than you want to with each trade and ensures that you do not blow your account. When you have it in place it can help to take out a lot of the stress from your trading. Of course, the opposite is also true, if you do not have proper risk management in place then every single trade that you make will have the chance of blowing your account. If You are in that situation every trade then you will be under constant stress every time that you trade. This is why you need things like trading rules, dictating how and when you trade, stop losses to help protect your accounts, and a proper  At times it will be impossible to prevent any stress from building up, so then we will need to try and deal with it. One of the best ways to do this is to simply take a break, breaks are a fantastic way for us to reduce our stress levels. Getting away from what is causing the stress is the first step, it will prevent any new thoughts or new stresses from being added to the equation. Secondly, being away and doing something else will help to take our minds off of things that are already causing us stress. This way we think about something rose, something else that gives us enjoyment or at least doesn’t add to the stress. Doing this regularly can help you to regulate the stress that you are under. Do this regularly, multiple times a day, it is even a good idea to do it even if you aren’t currently experiencing stress. Just ensure that you are not sitting in front of the computer for hours and hours without any breaks. Coming back with a clear and calm mind can really help you to improve your productivity and trading results.

At times it will be impossible to prevent any stress from building up, so then we will need to try and deal with it. One of the best ways to do this is to simply take a break, breaks are a fantastic way for us to reduce our stress levels. Getting away from what is causing the stress is the first step, it will prevent any new thoughts or new stresses from being added to the equation. Secondly, being away and doing something else will help to take our minds off of things that are already causing us stress. This way we think about something rose, something else that gives us enjoyment or at least doesn’t add to the stress. Doing this regularly can help you to regulate the stress that you are under. Do this regularly, multiple times a day, it is even a good idea to do it even if you aren’t currently experiencing stress. Just ensure that you are not sitting in front of the computer for hours and hours without any breaks. Coming back with a clear and calm mind can really help you to improve your productivity and trading results.

Losses are a part of trading, a big part of them, every single person that has ever traded (apart from those that only do a single trade) will have experienced losses, all of the most successful traders in the world have experienced losses and a lot of them. In fact, they are so much a part of trading that we factor them into our trading through our trading strategies and risk management. Ever heard of the risk to reward ratio? This is where we decide how much we will risk with each trade and how much we want to win. Knowing this means that we know exactly how much we might lose with each trade and that each trade is actually a fantastic way for us to learn from what we have done and for us to improve. Look at why the trade lost and what we can do differently.

Losses are a part of trading, a big part of them, every single person that has ever traded (apart from those that only do a single trade) will have experienced losses, all of the most successful traders in the world have experienced losses and a lot of them. In fact, they are so much a part of trading that we factor them into our trading through our trading strategies and risk management. Ever heard of the risk to reward ratio? This is where we decide how much we will risk with each trade and how much we want to win. Knowing this means that we know exactly how much we might lose with each trade and that each trade is actually a fantastic way for us to learn from what we have done and for us to improve. Look at why the trade lost and what we can do differently.

If you’re already tense when you first log into your trading account for the day, the anxiety of trading will likely add to your tension, even if you’re making money. The best thing you can do is to start fresh each day in a great mood, so we suggest finding something that helps you relax beforehand. This could be as simple as drinking a morning cup of coffee or listening to your favorite song. Exercise is another popular option that makes people feel good, so consider yoga, meditation, going for a jog, or some other form of exercise to get those endorphins flowing.

If you’re already tense when you first log into your trading account for the day, the anxiety of trading will likely add to your tension, even if you’re making money. The best thing you can do is to start fresh each day in a great mood, so we suggest finding something that helps you relax beforehand. This could be as simple as drinking a morning cup of coffee or listening to your favorite song. Exercise is another popular option that makes people feel good, so consider yoga, meditation, going for a jog, or some other form of exercise to get those endorphins flowing.

In the meantime, another possible reason people don’t enter a trade, when they otherwise think they should, is over-analysis. This is a bit counter-intuitive since analyzing the technical parameters that lead to a trade is pretty much the bread and butter of most traders. That said, there is such a thing as overthinking it. Some of us love nothing more than to get deep into understanding what causes a given currency pair to move the way it does and, for the most part, that makes us stronger traders. But there’s a flip side to doing too much research because the deeper you get and the more information you try to include, the greater the likelihood that some of that information is going to start contradicting itself. Sometimes you’ll have filled your head with so much reading about news events and looked at so many indicators that some of that begins to cause you to doubt yourself. And not only will you begin to doubt yourself, but you will also – just through the sheer act of spending so much time thinking and analyzing one trade – become too invested in it emotionally.

In the meantime, another possible reason people don’t enter a trade, when they otherwise think they should, is over-analysis. This is a bit counter-intuitive since analyzing the technical parameters that lead to a trade is pretty much the bread and butter of most traders. That said, there is such a thing as overthinking it. Some of us love nothing more than to get deep into understanding what causes a given currency pair to move the way it does and, for the most part, that makes us stronger traders. But there’s a flip side to doing too much research because the deeper you get and the more information you try to include, the greater the likelihood that some of that information is going to start contradicting itself. Sometimes you’ll have filled your head with so much reading about news events and looked at so many indicators that some of that begins to cause you to doubt yourself. And not only will you begin to doubt yourself, but you will also – just through the sheer act of spending so much time thinking and analyzing one trade – become too invested in it emotionally.

Another reason that we have heard from people is that forex is too complex and overwhelming to learn. Surely that forex is not an overnight thing to learn but there are tons of online material out there that is easily accessible and completely free. Forex is around 4 trillion dollars a day market that traders are trying to go in and extract money from over and over so there could be a lot of benefit for those who are persistent and want to build a career in trading. Honestly, the worst thing is not doing anything. The biggest risk we can ever take is simply not taking any. Why? Because we could end up with no retirement money. Most people have absolutely nothing saved. Relying on someone always and all the time might not be the safest house for us, nobody wants that.

Another reason that we have heard from people is that forex is too complex and overwhelming to learn. Surely that forex is not an overnight thing to learn but there are tons of online material out there that is easily accessible and completely free. Forex is around 4 trillion dollars a day market that traders are trying to go in and extract money from over and over so there could be a lot of benefit for those who are persistent and want to build a career in trading. Honestly, the worst thing is not doing anything. The biggest risk we can ever take is simply not taking any. Why? Because we could end up with no retirement money. Most people have absolutely nothing saved. Relying on someone always and all the time might not be the safest house for us, nobody wants that.

Why would you choose to do that? There are two main reasons. The first is that by diversifying your sources of income, you can insulate yourself from any future shocks. The more streams of income you have, the better protected you are from things like the economy tanking or your company going under and leaving you unemployed. The second, perhaps more convincing reason is that you are almost sure to end up making more money this way. The greater the number of income streams you introduce into your life, the greater the odds are that one of them will become a runaway success.

Why would you choose to do that? There are two main reasons. The first is that by diversifying your sources of income, you can insulate yourself from any future shocks. The more streams of income you have, the better protected you are from things like the economy tanking or your company going under and leaving you unemployed. The second, perhaps more convincing reason is that you are almost sure to end up making more money this way. The greater the number of income streams you introduce into your life, the greater the odds are that one of them will become a runaway success.

Money is tied to emotions. It will be our Subjectivity versus Objectivity. The separation of emotions from this is impossible according to the professional prop traders. It is very common to see a trader have great results on a demo account and collapse when trading with real money. They cannot trade the same way. If we can get to the point where we trade more on objectivity than on subjectivity, we are steps closer to consistent successful trading. This is one of the reasons trading systems are very helpful to see the objectivity.

Money is tied to emotions. It will be our Subjectivity versus Objectivity. The separation of emotions from this is impossible according to the professional prop traders. It is very common to see a trader have great results on a demo account and collapse when trading with real money. They cannot trade the same way. If we can get to the point where we trade more on objectivity than on subjectivity, we are steps closer to consistent successful trading. This is one of the reasons trading systems are very helpful to see the objectivity.

Judging a traders’ strengths can be very beneficial for trading. As masters of decision making, they will not hesitate. They will take action, complete, push to the goal. The plan will be followed to the letter, and the plan itself will be clear. There is only right and wrong, black and white, nothing in between. Their mindset does not allow doubts, any contrarian opinion will bounce off it. This manifests in the weakness of not taking advice. Additionally, low flexibility is another consequence of this mindset. Thus, traders of this type may have a steep learning curve.

Judging a traders’ strengths can be very beneficial for trading. As masters of decision making, they will not hesitate. They will take action, complete, push to the goal. The plan will be followed to the letter, and the plan itself will be clear. There is only right and wrong, black and white, nothing in between. Their mindset does not allow doubts, any contrarian opinion will bounce off it. This manifests in the weakness of not taking advice. Additionally, low flexibility is another consequence of this mindset. Thus, traders of this type may have a steep learning curve.

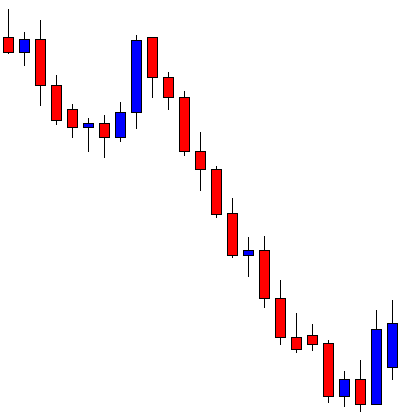

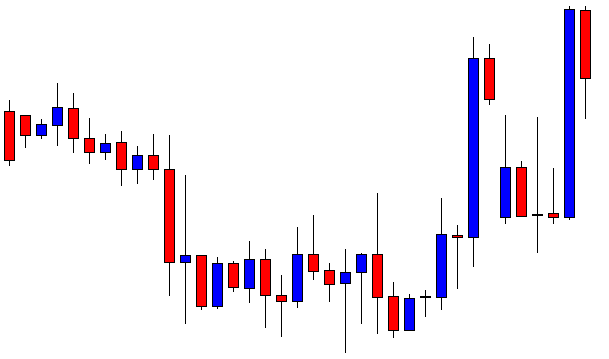

If you’ve attended trading training or if you’ve done your research online, you’ve heard of strategies, how to identify them, when to apply them and how to manage them once they’ve been applied. Strategies are nothing but a list of rules that help you to recognize and apply your methods for making a trade profitable.

If you’ve attended trading training or if you’ve done your research online, you’ve heard of strategies, how to identify them, when to apply them and how to manage them once they’ve been applied. Strategies are nothing but a list of rules that help you to recognize and apply your methods for making a trade profitable.

Another way to help with the psychology of trading is education. Here at Forex.Academy, we supply all the education you will require in order to help you with your Forex trading journey. Therefore, soak up as much education as you can and learn what the market drivers are. Study your charts and identify why your losers happened. This will help you with your subsequent trading activity. And, if you are a novice, make sure you only trade on a demo account. Because, if you can’t be successful there, you will not be successful with a real money account.

Another way to help with the psychology of trading is education. Here at Forex.Academy, we supply all the education you will require in order to help you with your Forex trading journey. Therefore, soak up as much education as you can and learn what the market drivers are. Study your charts and identify why your losers happened. This will help you with your subsequent trading activity. And, if you are a novice, make sure you only trade on a demo account. Because, if you can’t be successful there, you will not be successful with a real money account.