In the last 20 years, advances in brain imaging technology and other methods of analysis of neurological activity have produced important advances that allow us to better understand the complex functioning and biology of the human brain. This discipline, neuroscience, is closely related to neuroeconomics, which in the last decade has combined knowledge of the brain with biology, physiology, psychology, behavioral finance, and economic theory to improve understanding of decision-making in competitive market environments, where risks and benefits are taken.

For Colin Camerer, Professor of Behavioral Economics and Finance at the California Institute of Technology, neuroeconomics involves opening the “black box” of the brain to inform economic theory and, potentially, for a better understanding to mitigate risky behaviors such as rogue traders. Denise Shull, president and founder of ReThink Group, a New York-based firm that advises professional traders, defines it as the study of “what happens in the brain when we face risk and other decisions that are made under conditions of uncertainty.

When using brain imaging, neuroeconomics also measures heart rate, blood pressure, and facial expressions to evaluate physiological reactions. And it uses games-like tests and experiments to study decision-making, make inferences about how the brain works, and build predictive models about human behavior. These efforts are aimed at advancing and enriching our thinking about economic theory, financial decision-making, or public policy decisions.

Science has advanced in parallel with recent studies of bubbles and crises and how decision-making and risk-taking, at the micro and macro levels, contribute to these events. Andrew Lo, professor of finance and director of the Financial Engineering Laboratory at MIT’s Sloan School of Management, has focused on this area of study. Collaborating with Dmitry Repin of Boston University, Lo has conducted neuroscientific tests on professional traders, looking at how the complex interaction of rational thinking, emotions, and stress can affect risk-taking and the profitability of investments. In his 2011 article, Fear, Greed and Financial Crises: A Cognitive Neurosciences Perspective “by investigating the neuroscientific bases of knowledge and behavior we can identify keys to financial crises and improve our models and methods of dealing with them”.

And watch out because this doesn’t just stay in the financial markets but goes further: President Obama has invested $100 million last year in the Brain Research through Advancing Innovative Neurotechnologies (BRAIN) project, in order to create a map of the brain.

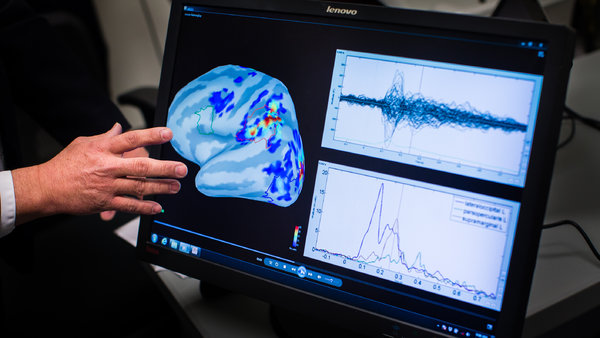

Brain Photos

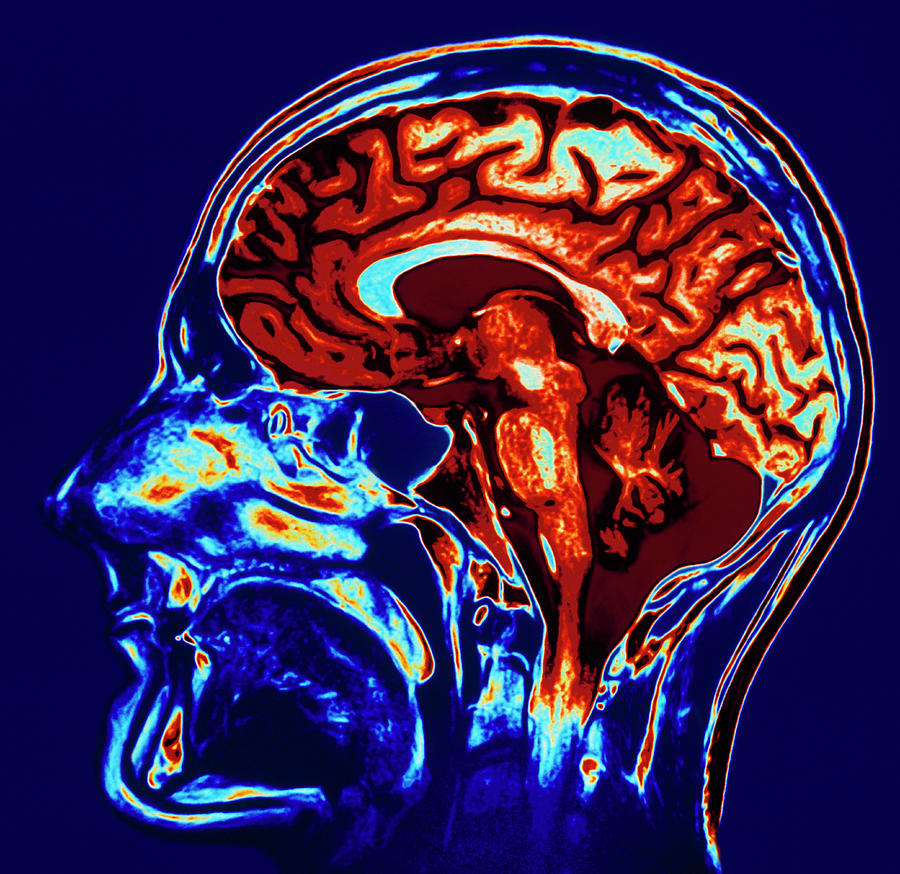

Functional magnetic resonance imaging (fMRI) is the fundamental tool that has allowed a great boost to neuroscience in the last two decades, making it possible to obtain more information about the experiments performed.

With fMRI, scientists are able to scan brains “in action” in a safe, non-invasive way. They are able to obtain empirical data on which specific parts of the brain are active during a given activity. Though there’s still a long way to go in terms of image quality and accuracy, the technology has produced amazing images and scientific findings.

Coates’ case is striking: he currently works as a researcher at the University of Cambridge but is a former operator of the derivative tables of Goldman Sachs and Deutsche Bank so he knows both worlds well. According to Coates, the way risk is assessed has changed in the last 20 years. Thus, in the nineties “the head of the trading table asked what your position was and how you felt about it, so you could decide if a trader could handle a certain position”. But over time, Coates points out, “this approach was replaced by statistical indicators and risk managers who carried out stress tests and made instantaneous assessments of risk levels.”

However, this change has not allowed us to detect “hidden changes” – those moments that Coates calls “the time between the dog and the wolf” – when people become very risky or very averse to the risk of the normal. Coates says statistical-based methods, which do not take into account biology or neuroscience, are not able to capture the behavioral changes in traders.

However, this change has not allowed us to detect “hidden changes” – those moments that Coates calls “the time between the dog and the wolf” – when people become very risky or very averse to the risk of the normal. Coates says statistical-based methods, which do not take into account biology or neuroscience, are not able to capture the behavioral changes in traders.

In any case, what Coates’ book highlights are that neuroscience and physiology have shown that financial decision-making is not a purely cognitive activity, but that physical components also intervene. Human beings do not manage information without passion, we are not computers; on the contrary, we react to information physically, our bodies and brains move in tune.

Research also shows that much thought is normally carried out automatically and involuntarily, in contrast to controlled thinking that is voluntary, conscious, and open to introspection. Daniel Kahneman himself, a psychologist who won the 2002 Nobel Prize in economics, referred to these modes in 2011 in the title of his book Thinking Fast and Slow, that is, what some authors describe as cold and hot decision-making.

Hot decisions include hunches, instinct, or intuition, which are a way for the body to record critical information that has been received. They hardly affect consciousness, but they are essential to rational choice. Some scientists question the reliability of intuition but experts in neuroscience consider intuition a form of pattern recognition that can help traders identify patterns in complex markets and create algorithms for the exploitation of these patterns. In Coates’ words, “the common sense of a winning trader may be due in part to his ability to produce body signals and listen to them”.

Coates has also deepened the impact of natural hormones on economic agents and markets and in particular the “winning effect” on male traders. The biological evaluation of groups of traders in the City has led him to the conclusion that testosterone and cortisol are chemical messengers that point out risks and economic rewards.

Moderate testosterone levels, says Coates, prepare male traders to take moderate risks, but higher levels occur when traders make winning trades and continue to win. The resulting hormonal imbalance can lead to excessive risk-taking (i.e., the winning effect). What’s more, Coates points out that during bullish markets testosterone is likely to increase, causing risk levels to rise altogether which in turn exaggerates the rally. In contrast, cortisol, a hormone associated with stress and anxiety, can rise during a stock market crack, so traders become irrationally risk-averse. Finally, Coates takes his theory to the extreme: “episodes of irrational exuberance and pessimism that destabilize financial markets can be caused simply by hormones.”

Evidence of the Emotional Component

Another point of view is that of Denise Shull of ReThink Group. This specialist in trader psychology and experienced futures trader claims that much of what we know and have been taught about rational vs. emotional thinking is wrong. Neuroscience has shown that we perceive, judge, and decide in a totally opposite way to that proposed by the prevailing theories in the field of psychology and economics, in which above all the benefits of rational thought stand out.

In particular, Shull cites a 1992 study by Antonio Damasio and Antoine Bechara, professors of neurology and cognitive neuroscience at the College of Medicine at the University of Iowa and creators of the Iowa Gambling Task, a simulator that attempts to represent the decision-making process in real life. In this study, the patients who participated had suffered damage to the orbitofrontal cortex section of the brain, which had been confirmed by fMRI. By studying patients, they found that this area is part of a broader neural system involved in decision-making. Although these patients retained their cognitive abilities despite brain damage, they also showed a dramatic loss of emotional feeling, having begun to make destructive and wrong decisions for their lives.

One patient, for example, had lost all sense of proportion, spending hours obsessed with trivial details and ignoring more important matters. These data led to the conclusion that emotion or feeling is an integral component of the machinery of reason. Another interesting study cited by Shull is the 2007 study by Myeong-Gu Seo of the Robert Smith College of Business at the University of Maryland and Lisa Feldman Barrett of Northeastern University, on the impact of emotions on the decision-making process of buying shares. They selected 101 investors to record their feelings while making investment decisions every day for 20 consecutive business days.

Seo and Barrett found that individuals who experienced more intense feelings during operations made better decisions and made more money, just the opposite of what one would expect! The purpose of the study is that the common prescription of “ignoring your emotions” seems to be wrong for an effective regulation of feelings and their influence on decision-making. Rather, it seems to be the opposite: that people who are in the best position to identify and distinguish their feelings can better control the biases induced by those feelings and, as a result, achieve better trading results.

So, according to Shull, “in risk management what we’re trying to do is extract emotion and come up with a mathematical model, but neuroscience research shows that that takes us the wrong way. ” Moreover, in his paper The Art of Algorithmic War, Shull states that “after most of the non-scientific debate about feelings and emotions there lies the assumption that a feeling or emotion automatically becomes an action. This is simply false… In their purest form, feelings and emotions are designed to give us information. Without realizing it, Wall Street adds emotional information to analysis reports”.

The Biological Factor

Another author who has much to say in this field is Peter Bossaerts of the Caltech Laboratory for Experimental Finance. Bossaerts has applied neuroscience methods to a variety of risk-related topics, including how individuals process risk in a given situation and make risk-related mistakes.

In the tests conducted by Kerstin Preuschoff, a researcher at the Laboratory of Computational Neuroscience at the Swiss Federal Institute of Technology in Lausanne, and Steven Quartz, professor of philosophy and researcher of neuroscience at Caltech, subjects participating in the study were asked to play cards while observing the brain areas activated during risk management using fMRI. The collected data suggest that the anterior insula section of the brain, considered the seat of feelings and emotional awareness, transmits this information in a fairly precise way – essentially in the form of mathematical signals.

In the tests conducted by Kerstin Preuschoff, a researcher at the Laboratory of Computational Neuroscience at the Swiss Federal Institute of Technology in Lausanne, and Steven Quartz, professor of philosophy and researcher of neuroscience at Caltech, subjects participating in the study were asked to play cards while observing the brain areas activated during risk management using fMRI. The collected data suggest that the anterior insula section of the brain, considered the seat of feelings and emotional awareness, transmits this information in a fairly precise way – essentially in the form of mathematical signals.

For Bossaerts, this means the ability to process risks is encoded in the brain in the form of an algorithm, similar to any mathematical model that quants like so much. Bossaerts has further concluded that while a person may receive new information, the brain’s “processing algorithm” for risk remains constant.

That is, Bossaert claims to have discovered mathematical measurements in an essentially emotional area of the brain so that the processing of emotions in the human being is not something that is done raw, but something that is reported in a reasoned way.”

Conclusion

It is clear that the application of neuroscience to trading opens up a whole new field of research to explore. While the applicability of neuroscience findings to trading is still in its infancy, it is not out of the question that in the future we will be able to reprogram ourselves to trade or act in a certain way to prevent our stress from affecting our performance or even take medications that modify the production of certain hormones to control imbalances in our character that affect trading.