Some statistics suggest that 90% of beginners lose the same percentage of their trading capital in the first 90 days of trading. As it appears, the odds of someone failing right from the start are staggeringly high, which is why a number of newbies decide to enter coaching programs. With a massive quantity of available information and websites where they rate various mentors, we cannot but wonder if this is the path we should be taking ourselves.

To answer this question in the most objective and straightforward manner, we have collected extensive data on mentors in the spot forex market and analyzed individual motivation behind a decision to start working with one. We know by now how forex trading neither requires any formal degree or certification nor it is a determinant of a trader’s success, so we naturally want to know why traders seek this form of certification. We also know how traders nowadays have such an incredible amount of data at their disposal – be it in the form of videos, blogs, books, and seminars, among others, and we would like to understand what pushes them towards individualized one-on-one coaching.

Moreover, what place does a trading mentor essentially hold, and how significant and determining is it for traders to immerse themselves in such programs? Before we give our final verdict on whether a mentor is a necessity for a forex trader to be good at trading currencies, we need to clearly and impartially group all relevant facts under common threads.

What is a Forex Trading Mentor?

Owing to the expansion of the media and technical support, we can naturally take on many different paths to learning, and finding a forex mentor you can look up to is certainly one way to do it. In the era of coaching programs, many assume that a mentor needs to be an individual who will be there to constantly give you tips and hints so that you could know what to do next. A mentor, however, can be a person who will serve as a guide or a source of information both as part of a specific program or a persona present in some social media outlet sharing his/her experience. The term mentor is, therefore, not completely (or always) equivalent to the word coach because the former entails a professional who provides guidance and advice in general, whereas the latter more often than not signifies some form of a program (either 1:1 or group work).

While mentors can offer coaching to traders, they need not offer structured programs per se, since the whole idea behind their work is knowledge sharing. The vehicles of this information transfer can be different, as some professionals share their expertise through videos or podcasts, while others prefer some other, written forms of communication. The materials young traders are then exposed to can diverge significantly as can different people’s approaches to trading. Forex mentors who sell various coaching programs may decide what the best learning method for a particular trader is or suggest additional learning materials.

While mentors can offer coaching to traders, they need not offer structured programs per se, since the whole idea behind their work is knowledge sharing. The vehicles of this information transfer can be different, as some professionals share their expertise through videos or podcasts, while others prefer some other, written forms of communication. The materials young traders are then exposed to can diverge significantly as can different people’s approaches to trading. Forex mentors who sell various coaching programs may decide what the best learning method for a particular trader is or suggest additional learning materials.

On the other hand, mentors you see as your guide or a person you look up to will be sharing the content they feel is the most relevant as they please, without necessarily accommodating to the viewers’ preferences or needs. Personal preferences may also differ fundamentally, but mentors should essentially serve to save you time and prevent you from making some common mistakes and lose money as a result. You should expect your mentor to have experience in trading currencies and provide information on skills and tricks to become a successful trader.

What is more, a good mentor is always someone who shares their experience without holding back information that would help you grow. Your mentor should be someone who will want you to test and assess all facts they share with you, as assistance should be given without the expectation to stop searching. On the contrary, your coach should encourage you to keep exploring the market and assessing the tools you have been taught about. While some of the best and most prosperous forex traders do accredit their success to their mentors, you really need to see the difference between coaching as a program and a mentor as a guide or a role model.

What Should a Forex Mentor Have to Offer?

Firstly, your mentor should be a person who will be happy sharing their knowledge and seeing you succeed. This individual must have relevant experience to base their judgment on or draw upon when giving advice and knowledge you require to achieve your goals. Many traders are people who are accustomed to formal education, as they come from backgrounds where academic certification is considered to be a requirement. Forex trading, however, is based on different principles, so you should rather look for other proofs of these professionals’ success, such as whether they have been hired or offered a job by a prop firm for example. Many traders nowadays did not have the luxury of relying on other people’s advice when they first started in this market, so they did not have the opportunity to read or watch any content that would help them evade or tackle some common forex challenges.

Your coach should be the type of trader who experiences the ups as well as the downs of trading in this market and a person who can justify why a certain approach is simply not going to work. A Forex trading mentor should possess the necessary know-how to effectively trade the market, based on which he/she can suggest how you can improve your trading performance. Whether your meaning of the word mentor implies paid or free content on one hand or structured programs or randomly following some professional’s content on the other, your mentor must have a structured system they follow in trading.

Such a system should be based on tools, skills, information, and mindset that together form a specific approach to trading. Sometimes we will be able to learn about excellent indicators from one person, while someone else will teach us about specific psychological skills traders need to adapt to become successful. We cannot expect one person to know everything, although there are a number of professional traders whose algorithms and trading styles reflect their comprehensive knowledge of the forex market. Do not fear looking for additional information elsewhere because it is your money that you will be investing and you have all the right to seek clarification.

While forex experts do commonly share the challenges they have faced in the past, the explanation or the content need not always coincide with your current needs. Moreover, a mentor should always explain for whom their content is meant as beginners may not naturally know as much as some more experienced traders. Always look for practical and applicable information that you can immediately apply to your trading. What is more, be mindful of the content which has been copied and shared as a mantra because retail traders for example, whose success rate is quite low, always rely on some popular information that is shared in the community.

Look for original and specific rather than popular and well-advertised. Search for testimonials to discover what traders who follow the individuals in question say about their individual growth, as good mentors will always have the support of the followers. You can also look for some Q&A sessions where different professionals discuss their approaches to dealing with some problematic areas. Whomever you choose to be your mentor, always do thorough analyses beforehand, invest in learning as much as you can about the person’s capabilities, and, most importantly, test everything you learn.

Should Traders Pay?

The topic of money is always a sensitive one especially because we know that experts devote a great amount of time to learn what they willfully share with others. Sometimes you can discover a book praised by many traders, which you will either order online or buy from the nearest bookshop. Other times, you will look up a company’s website to search for forex training courses you may find suitable. Aside from these paid materials, you can find some invaluable advice on YouTube or Twitter, which are common free online learning hubs. Regardless of the form or the medium, all these sources have one goal in common – to teach you how to do profitable trading.

We know how these items of knowledge and information you need will be the basis of your future success, so the decision of whether you should pay or not should be based solely on the practicality and applicability of the provided content. Some of the best professional traders have decided against charging for their content, whereas others of equal understanding and skills ask for donations or specific fees. There is so much free information available nowadays that you should again be looking for traders who are committed to one specific style of coaching and who are ready to point you in the right direction. Whether this is paid or not does not necessarily talk about the material’s quality as it does talk about individual preferences and choices.

We know how these items of knowledge and information you need will be the basis of your future success, so the decision of whether you should pay or not should be based solely on the practicality and applicability of the provided content. Some of the best professional traders have decided against charging for their content, whereas others of equal understanding and skills ask for donations or specific fees. There is so much free information available nowadays that you should again be looking for traders who are committed to one specific style of coaching and who are ready to point you in the right direction. Whether this is paid or not does not necessarily talk about the material’s quality as it does talk about individual preferences and choices.

If you pay, you may expect to learn about the entire system these mentors use in their trading, while some professional traders on YouTube, for example, would rather have you follow hints to be able to grow more profoundly and independently. Whatever you choose to do, remember that time is money and that your mentor is there to make this road easier for you, without needing to waste time and wander in the market not knowing what to do. Be mindful of possible scams and instant gratification that many false experts like to use to get to beginners hoping to quickly become successful. No one can teach you to become successful in a matter of weeks as learning how to be a good trader can take a few months, if not years.

What If A Specific Approach Is Not Working for You?

An experienced forex trader should know what information to share so that beginners would know what to do next. Nonetheless, sometimes after spending time and effort into understanding what someone is saying, we still find that such an approach is not doing us any good. Therefore, we wonder if it is us who should be worried or can we blame it on the mentors. Even some professional traders who are known for their videos, podcasts, and blogs explain how they only developed their approach after they had realized that they could not be successful following someone else’s system. Some systems suggest that you should be awake all night, waiting for some important news event, only to go to bed not knowing if the move you took is the right one.

Others will tell you to stop relying on the community as much and be as independent as possible. Naturally, there are as many approaches as there are traders, but if you find that whatever system you were taught is not working, move on. Whether you initially paid for it or not, your individual personality and skills may require a different approach, so do not limit yourself or torture yourself with something that is not working. Trading is a skill, just like any other, but this market is extremely specific in comparison to other markets, which is why the information you receive from a stock trader will rarely work in reality.

Some traders like to trade lower time frames for example, while others insist that it is a waste of time providing facts to back this opinion. If you see that some approach is not working for someone else, research this phenomenon and the reasons why you should decide to follow some other approach. If you made a mistake while trading when you applied the advice you received from your mentor, go to the comments section or ask them directly why that happened. Sometimes traders overlook some minor move they made that put the whole trade at risk, so sharing and looking for similar experiences may help you a lot. If you have done all of this and still feel that a specific system is not leading you to the results you are meant to have, it is time to find another mentor and approach.

Should Traders Consider 1:1 Coaching?

Traders’ individual needs, abilities, and preferences may differ, but is there a uniform approach that all forex enthusiasts should take into consideration? When we think of some professional traders’ statements, we cannot but think of the concept of time. Some of the experts who refuse to provide this form of one-on-one coaching state how one of the main goals for growing as a trader in this market was to have more time. While they willingly provide lessons in the form of videos, podcasts, and social media/website posts, they still refrain from committing to coaching sessions of this type.

The reasons behind this decision are two-fold: on one hand, they primarily do not wish to engage in activities that would limit the amount of their free time; on the other hand, however, they fervently believe that mentorship involving such intense collaboration between the educator and the learner may do more damage than good. Education can come in many forms, but we need to ask ourselves what we are looking for. Are we in need of knowledge or a clutch? Many beginners assume that they would cut the time needed to absorb all important pieces of information by taking 1:1 classes. However, with the ability to explore various educational resources that the most experienced individuals in the spot forex market provide (often for free), this requirement would reflect the desire to enjoy special treatment. Such a desire need not necessarily be defined as bad, but it could potentially endanger your future trading.

If you do not equip yourself with skills and knowledge that are supported by critical thinking, you may have difficulty managing your trade at some important points in the future. Once your external support is gone, what do you envision your trading will be like? Some sources go as far as to say that a mentor should be a companion, which shifts the focal point from independence to a friend-like form of support. While some assistance and knowledge sharing can be positive, traders must think about mental skills and psychology as inseparable and indispensable parts of trading. Unless you incorporate self-sufficiency and analytical thinking, you will discover how sooner or later any other mindset proves to be insufficient.

If you invest in growing as an independent trader who has mastered the skill of impartial decision-making, you will be creating a solid long-term foundation that will serve you regardless of news or any other external factors. Education is truly essential for anyone who aims to be a forex trader, but paying for someone to hold your hand at all times will inevitably make you heavily reliant on external support. Therefore, when assessing education opportunities, always analyze your intentions and aims because you may find yourself in dire straits once the helping hand goes away.

After all the advice and the questions, we really need to think deeply about all the professional traders who managed to find their way to becoming successful in the forex market. How did they get to this stage when they had very few resources to rely on? Most of them claim to have many countless mistakes that were not only grave in terms of numbers but in terms of the impact on their finances as well. Nonetheless, they still managed to learn from their mistakes and build on their critical thinking and money management skills along with growing their experience. Most of them now say how there is no single situation they cannot handle or understand in a short period of time, which they attribute to the steep learning curve that shaped their personalities and skills.

After all the advice and the questions, we really need to think deeply about all the professional traders who managed to find their way to becoming successful in the forex market. How did they get to this stage when they had very few resources to rely on? Most of them claim to have many countless mistakes that were not only grave in terms of numbers but in terms of the impact on their finances as well. Nonetheless, they still managed to learn from their mistakes and build on their critical thinking and money management skills along with growing their experience. Most of them now say how there is no single situation they cannot handle or understand in a short period of time, which they attribute to the steep learning curve that shaped their personalities and skills.

If traders fail to acknowledge the lessons that originate from their mistakes or fear making mistakes so they keep clinging on to coaching companions, they will hardly grow as an independent thinker who makes lucrative decisions. What you must never do, if you want to become a professional forex trader, is to say how learning takes too much work. It reveals that you are unprepared to devote whatever is needed to be good at this type of business and, to become good (and financially stable), the exact opposite is required. What you do want to do is maximize your chances of becoming successful. Learn how to say no and make hard decisions and forget about instant gratifications. Hard work will pay off after a while, but scarcity in terms of mindset will only block any attempt to develop. Your impatience can only make the matters worse than they are at this stage. Build your confidence through knowledge accumulation and remember that many forex traders across the globe can barely speak English, yet they still succeeded.

What is more, remember that you do not need to feel pressured to take everything from a single mentor. You can always combine several pieces of advice from different professionals that you can follow to develop your own approach to trading. Sometimes it will be of technical nature, and other times, more theoretical or factual, such as the lesson concerning the involvement of the big banks. Sometimes some coaches can tell you to read trading books, while other professional traders will insist that mindset books are a much better investment. There is no bad knowledge as long as it is applicable.

Let your mentors guide you, but never lose sight of your independence and freedom, as you will be fighting in the arena alone in the end. Finally, aim to establish your own system consisting of a tested algorithm, money management, and crucial thinking skills that will be the support who may be currently asking for on the outside. Go within and build that independence that will propel you right to the top.

You have probably heard about trading journals, these are records where you jot down everything that you are doing, each trade that you open, the trades that you close, how long they were open, the profit and loss, the reason for the trade, any influencers and more. You are basically writing down everything that you are doing. A trading journal is beneficial for a number of reasons, it can be used for justification for your tradies, it can be used to find out where you may be going a bit wrong and it can be a way that you can check to see whether or not you are following your trading plan. Using it to find your weaknesses will mean that you will be able to make adjustments to your trading based on our findings, ultimately making you a much more

You have probably heard about trading journals, these are records where you jot down everything that you are doing, each trade that you open, the trades that you close, how long they were open, the profit and loss, the reason for the trade, any influencers and more. You are basically writing down everything that you are doing. A trading journal is beneficial for a number of reasons, it can be used for justification for your tradies, it can be used to find out where you may be going a bit wrong and it can be a way that you can check to see whether or not you are following your trading plan. Using it to find your weaknesses will mean that you will be able to make adjustments to your trading based on our findings, ultimately making you a much more  Taking breaks can really benefit your trading. Trading can be a stressful thing to do, it has its ups and downs which can cause stress and even anxiety. No matter your experience levels, when you do it for a long time, you will start to feel tired or stressed, so we need to do something about that. Take a 10-minute break, it can be as simple as that. Stepping away from the trading terminal in order to clear your mind or to think about something else will mean that you are able to help your mind and body to destress. A small break can bring you back with a much clearer mind which will make your trading a lot better, with less stress you will be able to better follow your trading plan and ensure that the trades that you are placing are in line with your trading plan.

Taking breaks can really benefit your trading. Trading can be a stressful thing to do, it has its ups and downs which can cause stress and even anxiety. No matter your experience levels, when you do it for a long time, you will start to feel tired or stressed, so we need to do something about that. Take a 10-minute break, it can be as simple as that. Stepping away from the trading terminal in order to clear your mind or to think about something else will mean that you are able to help your mind and body to destress. A small break can bring you back with a much clearer mind which will make your trading a lot better, with less stress you will be able to better follow your trading plan and ensure that the trades that you are placing are in line with your trading plan. The news and economic events can have a huge effect on the forex markets. In fact, any news event has the potential to change the direction or to cause a small jump in the markets so it is important that you are aware of what is coming up. There are a number of different economic calendars out there which detail different economic news events that are coming up. Take just 1 minute a day to look at one before you start your trading, it will give you an idea of how volatile the markets could be at those stages of the day, so it may even tell you to avoid trading a certain currency pair when those events are coming up, which could save you from some potential losses. It does not take long to do this and it should be something that you are doing at the start of every trading or analysis session that you are doing.

The news and economic events can have a huge effect on the forex markets. In fact, any news event has the potential to change the direction or to cause a small jump in the markets so it is important that you are aware of what is coming up. There are a number of different economic calendars out there which detail different economic news events that are coming up. Take just 1 minute a day to look at one before you start your trading, it will give you an idea of how volatile the markets could be at those stages of the day, so it may even tell you to avoid trading a certain currency pair when those events are coming up, which could save you from some potential losses. It does not take long to do this and it should be something that you are doing at the start of every trading or analysis session that you are doing.

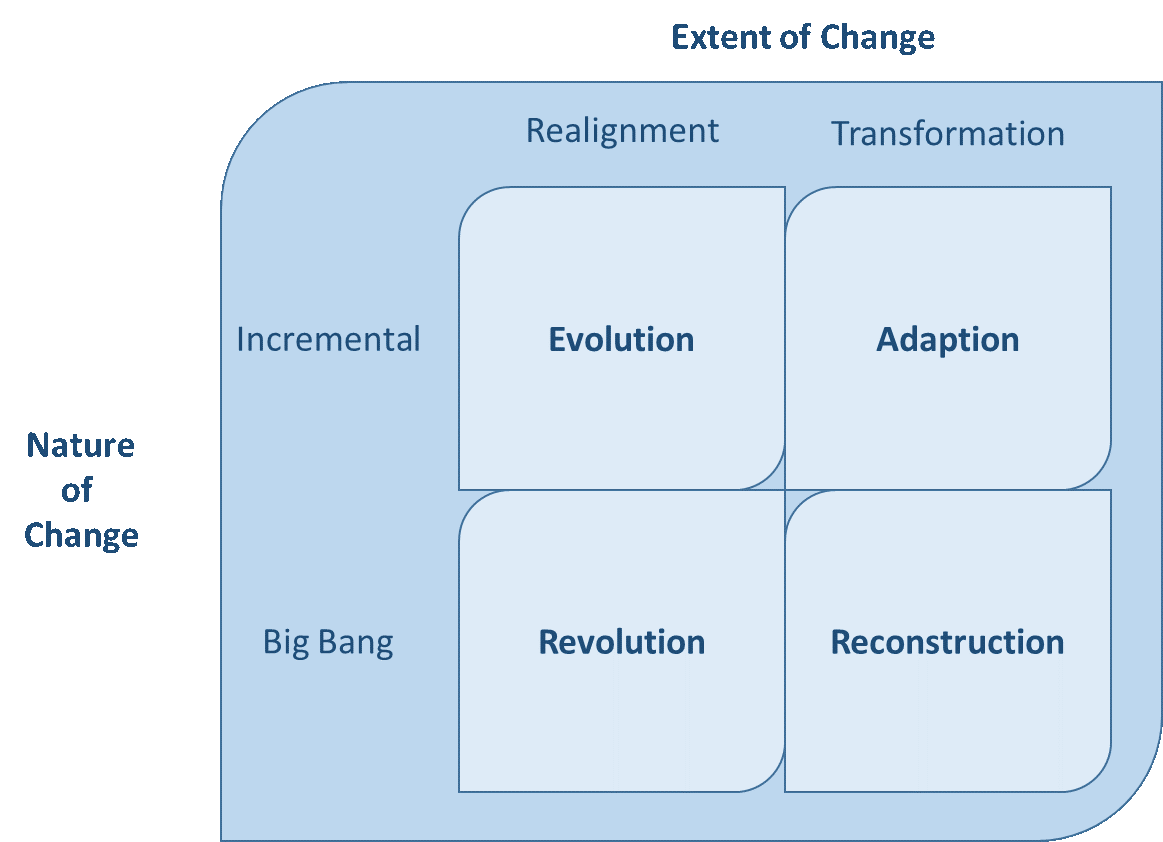

Sometimes things can become very stale, if you feel your strategy has come to the end of its life then there are still things that you are able to do to try and revamp it. One of those things is to start again from the bottom up. Start with the foundations of your strategy, try and rebuild it based on the current market conditions, this way it will once again suit the conditions of the markets. This may seem a little extreme, starting over completely, but that is one of the ways that you can really tailor your strategy to the current market conditions and one of the ways that you can ensure that it will have the best opportunity to be successful in those market conditions.

Sometimes things can become very stale, if you feel your strategy has come to the end of its life then there are still things that you are able to do to try and revamp it. One of those things is to start again from the bottom up. Start with the foundations of your strategy, try and rebuild it based on the current market conditions, this way it will once again suit the conditions of the markets. This may seem a little extreme, starting over completely, but that is one of the ways that you can really tailor your strategy to the current market conditions and one of the ways that you can ensure that it will have the best opportunity to be successful in those market conditions. Sometimes you do not need to make large changes, a simple change to one of the parameters or the rules that you use with the strategy could be enough, part of using a strategy is that you need to keep making small adjustments as you go. As the market conditions change, so does your strategy, but the changes do not need to be large. These regular small updates are all things that will ultimately add up to larger changes, so after a year or so of very small changes, the strategy could resemble something that has pretty much nothing in common with the initial strategy that was created. That is the beauty of the small changes, it will create large or completely revamped strategies without needing to spend a long time at once totally changing it up at the same time.

Sometimes you do not need to make large changes, a simple change to one of the parameters or the rules that you use with the strategy could be enough, part of using a strategy is that you need to keep making small adjustments as you go. As the market conditions change, so does your strategy, but the changes do not need to be large. These regular small updates are all things that will ultimately add up to larger changes, so after a year or so of very small changes, the strategy could resemble something that has pretty much nothing in common with the initial strategy that was created. That is the beauty of the small changes, it will create large or completely revamped strategies without needing to spend a long time at once totally changing it up at the same time.

One thing that you also need to do in relation to our strategy, instead of thinking about changing your strategy, there may be something within you that you need to change yourself, or something that you currently do like a bad habit that you need to change. The strategy may actually be working fine, but there is something that you are doing that is causing the issues, or at least reducing the profitability of your trading. So look back at your journal, look back at the trades that you have made in order to ensure that you are following your strategy properly and to help find any bad habits that you may be partaking in, nip those in the bud and your trading will improve without having to make any changes to your trading strategy.

One thing that you also need to do in relation to our strategy, instead of thinking about changing your strategy, there may be something within you that you need to change yourself, or something that you currently do like a bad habit that you need to change. The strategy may actually be working fine, but there is something that you are doing that is causing the issues, or at least reducing the profitability of your trading. So look back at your journal, look back at the trades that you have made in order to ensure that you are following your strategy properly and to help find any bad habits that you may be partaking in, nip those in the bud and your trading will improve without having to make any changes to your trading strategy.

The first thing that any trader should do after placing their first trade is to write everything about it down on awesome paper in a trading journal if you have one. This will include things like the opening price and time, the closing price and time, how long the trade was open for, the profit or loss of the trade, what analysis you did beforehand, which of your trading rules you followed, and any other relevant information that you can think of. It sounds like a lot, but it will be worth it, this sort of information will then allow you to analyse the trade that you made (our next point) which in turn allows you to ensure that you are making even better trades in the future. This is only possible though if you remember to write things down. It does take a little extra time, time that is definitely worth it, so don’t skip this step just to save yourself a few extra minutes.

The first thing that any trader should do after placing their first trade is to write everything about it down on awesome paper in a trading journal if you have one. This will include things like the opening price and time, the closing price and time, how long the trade was open for, the profit or loss of the trade, what analysis you did beforehand, which of your trading rules you followed, and any other relevant information that you can think of. It sounds like a lot, but it will be worth it, this sort of information will then allow you to analyse the trade that you made (our next point) which in turn allows you to ensure that you are making even better trades in the future. This is only possible though if you remember to write things down. It does take a little extra time, time that is definitely worth it, so don’t skip this step just to save yourself a few extra minutes. When we place our first trade, we will have a number of different emotions flowing through us which is completely natural in this situation. We will feel nervous beforehand, during the trade we may feel a lot of adrenaline, afterward, depending on the result we may feel a high or a low. It is important to remember these feelings, however, the reason why we are remembering them is not so that we can try and recreate them, it is to show us that we need to try and get them out of our trading. The nerves that you get at the start should go with time, but if you allow them to remain it can become increasingly hard to actually place trades, the same with the highs and lows, they can become addicting or even bring on other emotions that can affect our trading like greed or overconfidence. So remember those feelings, if you then, later on, feel them becoming quite strong, that is a good time to take a break and clear your mind.

When we place our first trade, we will have a number of different emotions flowing through us which is completely natural in this situation. We will feel nervous beforehand, during the trade we may feel a lot of adrenaline, afterward, depending on the result we may feel a high or a low. It is important to remember these feelings, however, the reason why we are remembering them is not so that we can try and recreate them, it is to show us that we need to try and get them out of our trading. The nerves that you get at the start should go with time, but if you allow them to remain it can become increasingly hard to actually place trades, the same with the highs and lows, they can become addicting or even bring on other emotions that can affect our trading like greed or overconfidence. So remember those feelings, if you then, later on, feel them becoming quite strong, that is a good time to take a break and clear your mind. If we did our analysis properly, we will most likely have a few things to think about, did you follow your strategy? Did you place a good trade or a bad trade? These are things to think about. If things were not entirely perfect which they probably weren’t, then we can start to think about things that we need to change. When starting out there will most likely be a lot of different things that we need to change on our first, second, third, and more trades. They may be very few things, but each change that we make is an improvement that will ultimately improve our overall trading in the long run. Remember, these changes do not need to be big, any changes are also helpful, no matter how small they are.

If we did our analysis properly, we will most likely have a few things to think about, did you follow your strategy? Did you place a good trade or a bad trade? These are things to think about. If things were not entirely perfect which they probably weren’t, then we can start to think about things that we need to change. When starting out there will most likely be a lot of different things that we need to change on our first, second, third, and more trades. They may be very few things, but each change that we make is an improvement that will ultimately improve our overall trading in the long run. Remember, these changes do not need to be big, any changes are also helpful, no matter how small they are. So we placed our first trade, after looking at that trade, analysing it, working out what we need to change, we can then think about placing our second trade. We need to take into account anything that we previously looked at, so if we needed to make a change, this is where we can implement it, of course, if it is a huge change, then it will be good to test it on a demo account, but for very small changes it will be ok in our live account. It should be slightly easier and quicker to place this second trade as we have done one before and the majority will be exactly the same. Place the trade and then do exactly the same again, write down what you do, the same information as before, so you can then analyse the second trade to ensure you are still in line and that any changes that were made are working well. Then do the same for the third, fourth, and any other subsequent trades that you make.

So we placed our first trade, after looking at that trade, analysing it, working out what we need to change, we can then think about placing our second trade. We need to take into account anything that we previously looked at, so if we needed to make a change, this is where we can implement it, of course, if it is a huge change, then it will be good to test it on a demo account, but for very small changes it will be ok in our live account. It should be slightly easier and quicker to place this second trade as we have done one before and the majority will be exactly the same. Place the trade and then do exactly the same again, write down what you do, the same information as before, so you can then analyse the second trade to ensure you are still in line and that any changes that were made are working well. Then do the same for the third, fourth, and any other subsequent trades that you make.

We know how these items of knowledge and information you need will be the basis of your future success, so the decision of whether you should pay or not should be based solely on the practicality and applicability of the provided content. Some of the best professional traders have decided against charging for their content, whereas others of equal understanding and skills ask for donations or specific fees. There is so much free information available nowadays that you should again be looking for traders who are committed to one specific style of coaching and who are ready to point you in the right direction. Whether this is paid or not does not necessarily talk about the material’s quality as it does talk about individual preferences and choices.

We know how these items of knowledge and information you need will be the basis of your future success, so the decision of whether you should pay or not should be based solely on the practicality and applicability of the provided content. Some of the best professional traders have decided against charging for their content, whereas others of equal understanding and skills ask for donations or specific fees. There is so much free information available nowadays that you should again be looking for traders who are committed to one specific style of coaching and who are ready to point you in the right direction. Whether this is paid or not does not necessarily talk about the material’s quality as it does talk about individual preferences and choices.

The only way for any trader to truly feel in control of trading in this market is to make a clear distinction between their emotions and logical thinking. If we allow ourselves to enter and exit trades solely based on how we feel, we are then making vital money-related decisions grounded in our subjective idea of where the market is going to move. This sentiment-governed action is not based on any actual plan or structure, which is why a system is very much needed to bypass the dangers of our human nature. If you have developed and tested one, you have a tool that can certainly work and get you to where you wish to go, unlike this emotion-driven, reckless approach that will undeniably make all your fears come alive sooner or later.

The only way for any trader to truly feel in control of trading in this market is to make a clear distinction between their emotions and logical thinking. If we allow ourselves to enter and exit trades solely based on how we feel, we are then making vital money-related decisions grounded in our subjective idea of where the market is going to move. This sentiment-governed action is not based on any actual plan or structure, which is why a system is very much needed to bypass the dangers of our human nature. If you have developed and tested one, you have a tool that can certainly work and get you to where you wish to go, unlike this emotion-driven, reckless approach that will undeniably make all your fears come alive sooner or later.

-Avoid. Avoidance is one of the best measures in your strategy. Avoid the news.

-Avoid. Avoidance is one of the best measures in your strategy. Avoid the news.