While trading, you’ve most likely come across a stage in time when there is not a lot of thing happening, in fact, nothing is happening, the markets have flatlined or your strategy just simply is not picking up any trades.

When these times are happening, there are a few things that you can do, you can use this as an opportunity to take a step away from trading, use it to take a break and refresh, you could use this time to learn something new about trading, such as a new strategy, or you could try and make some trades in order to make up a few extra pips and profits.

Hopefully, you didn’t choose the last option, if you did, then you are most likely guilty of trying to force trades when you should not be making any.

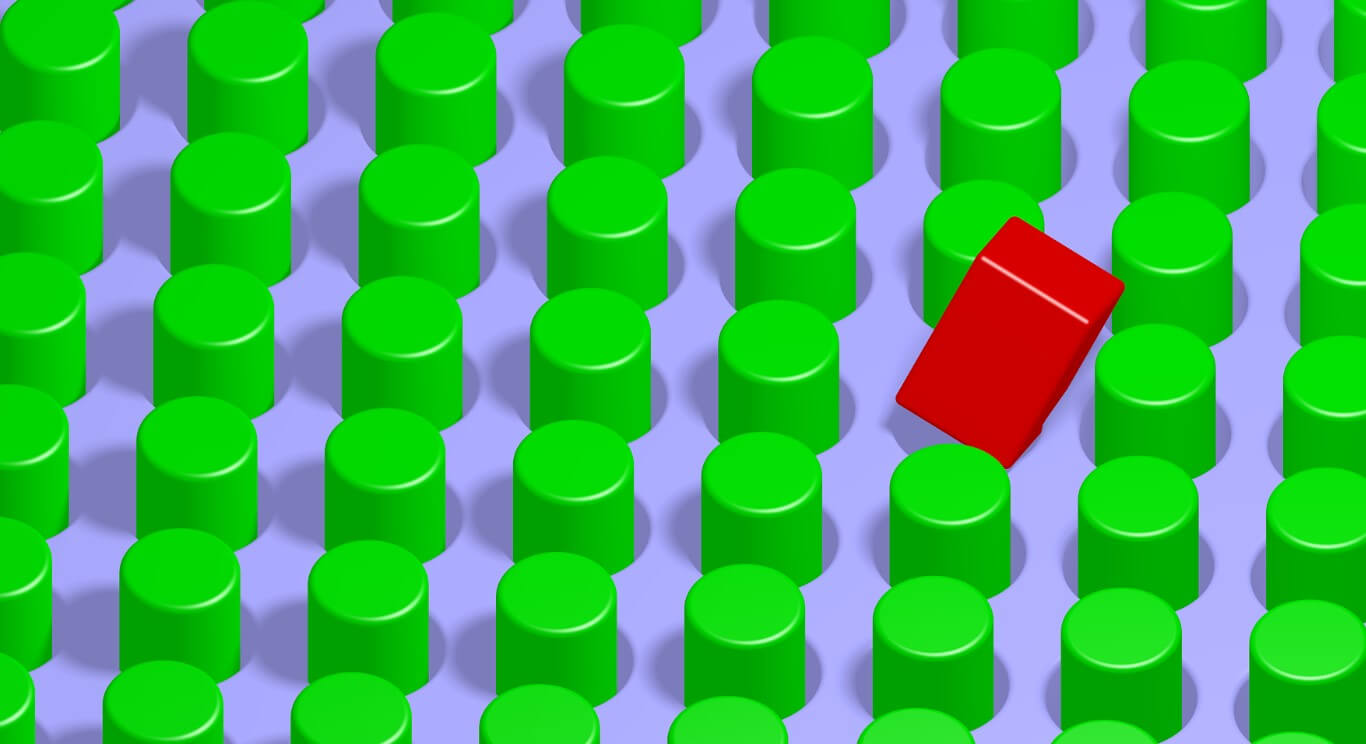

So what exactly is forcing trades? When you created your trading plan, you would have also created certain trading rules that you would stick by. When you make a trade that goes against any number of these rules, then this would be considered as forcing a trade. Traders are most often forcing trades when the markets are relatively slow, or that a trader has gotten a little bit greedy and is looking to make some additional profits.

It is important that you remember that you set up these rules for a reason, so why would you now start to break them?

Think back to the last time that you broke one of your trading rules, what was the reason behind it? The temptation to break the rules when things are quiet can be very strong, in fact, it is one of the most common ways that traders manage to hurt their accounts. Things are slow in the markets, it’s a bit boring, I will just place a small trade, it goes wrong, now you want to make that back so you place a larger trade, this can continue until an account goes bust. When the markets are not a match for your strategy, you simply do not trade.

Why did you create a trading plan if you aren’t going to follow it? Trading and Forex is all about consistency, you cannot be consistent if you are forcing trades and breaking rules. The markets come with exciting trends and boring horizontal movements, you need to be able to fill the quiet times with something that won’t potentially hurt your account.

If you are constantly experiencing times where the markets do not suit your strategy, that is fine. What you could do instead of forcing trades is to have a look at a new strategy that suits the kind of market conditions that your other one does not. This will then give you the opportunity to trade in these quieter times too. Create two separate plans that can be used during different conditions, this is simply adapting, and as you have a full plan for the new system, you will not be forcing any trades.

When starting out it can be hard to stick to your plan all the time, especially when you see others making money. Stick to it, it is all about consistency and when you are able to build up your levels of patience and self-discipline, it will greatly benefit you in the future and will ultimately make you a much more successful trader.

Do not try to anticipate the markets, do not try to lead them and do not try to force them, these are some of the golden rules of trading, you are not in control, the markets are. Trading is a long haul exercise, you do not need to make money the first day or week, you want to make it over the next 20 years, so do not damage your progress by trying to place trades when they should not be placed.