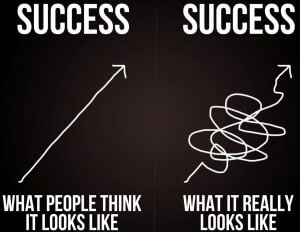

Just like with many things in life, being consistent in what you do can pay off, and deviating from your standard routine and style can leade to disaster. While it may be valid for most things in life, achieving it within the forex trading markets is far easier said than done.

When starting out, you will often be told that you need to find your own strategy, you need to stick to your plan and that you should not trade outside of it. These are all fantastic tips for staying consistent, but they do not really help you to do it, as the temptation to deviate can get the best of us into trouble within the choppy waters of the forex markets.

So why is it so important to stay consistent?

To put it simply, it helps you to maintain your strategy, your confidence, and your results. Let’s imagine that you have just spent the last six months perfecting your very own strategy, you use a number of entry criteria and a number of different exit criteria which are all based on certain patterns or values within the markets. You put it into practice and have now started making small, but consistent profit, for the sake of this example, let’s say £100 per week.

You are using a fixed lot size of 0.1 lots for each trade, and risk a maximum of 2% of your account per trade. You have now been making £100 per week for about two months, which is fantastic, but you want to scale up. How would you do this? Many would simply increase their lot sizes. However, you need to consider how this affects your risk to reward ratio, remember that your strategy only risks 2% of your account if you double the lot sizes to 0.2 lots, this increases the risk percentage, or the stop losses become shorter, wither way, your strategy has changed. So now your stop losses are shorter, trades have started to close in losses.

You have very set entry requirements, there are four or five that need to be met, they have been very accurate and very profitable, but the markets have not been optimal for your strategy, there have not been any trades for a few trading days. Would you stick to your plan and wait, or has the idea of making more profit got the better of you? You change your strategy slightly and get into some trades, but something did not match your criteria, now some trades are going up and some down, you broke your plan, and things aren’t going how you are used to, this can negatively affect your own psychology.

Even when sticking to your plan, there will be losses, it is important that you do not let this change the way you are trading, five profitable trades and a loss is still fantastic going, far better than many would do, so a few losses are simply the markets telling you not to get too confident, but rest assured that your plan is working.

Should you decide to change something, test it out on a demo account first, when you are sure the changes are effective, change them for all future trades, not just one or two, being consistent in your changes is also important.

Having these rules of trading is set by yourself and no one else, often these rules are created from mistakes, and as we all know, a mistake is the best learning tool. So when starting out, experiment, do things a little differently to find those rules, but once you have them, stick to them, you will thank yourself, and your account balance will thank you too.

The moral of the story is to simply stick to your plan, be consistent, and do not change things just because you want more or you are bored.