Don’t you hate it when you are trying to get something done but need a bit of help, so you ask your colleague for a hand but they won’t help because they are doing something else, they don’t know how to do it and they are not willing to try. This lack of flexibility can cause issues in life, and it can also cause issues within the trading world.

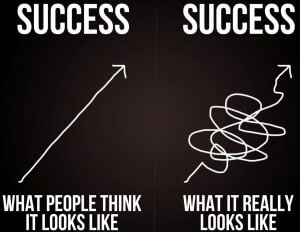

This can most clearly be seen in people’s strategies, often a newer trader will create a new or adapt someone else strategy in order to successfully trade, they manage to get it to a stage where it is being profitable, whether it is slightly or majorly profitable it doesn’t matter. The problem is that the markets change, they are constantly changing, so a strategy that worked yesterday may not work today? The new trader does not want to change anything because it has worked in the past. While the professional trader that the new trader based their strategy off has adapted it to the new market conditions. The experienced trader is being flexible changing things as needed, trying out new techniques, while the newer trader is not being flexible and the trades are starting to move against them.

Being able to change your own bias, such as the direction that you think the markets will move is paramount to being able to trade successfully. Constantly analyzing the markets and changing your stance and approach is what can make you profitable. If you choose one direction and just stick with it, there is no saving your account once things start to move against you.

Flexibility is what allows certain animals and plants to survive while others die out, it is also what allows certain traders to be successful while others blow their accounts. Having a short term memory can often be a bad thing in life, but when it comes to trading it is actually perfect, the short term memory will mean that you are looking at the current trade from a fresh perspective, each trade is it’s own and so your bias towards previous trades is reduced and it is far easier to adapt and be flexible towards any new market conditions that may have come up between now and the last trade you made.

If things have started going against you, or the outlook of the markets has changed, there is no harm in changing part of your strategy, or if your strategy will no longer work, there is no harm or shame starting from scratch, create an entirely new strategy that is adapted to the current market conditions. Don’t forget that old strategy though, you will need to continue being flexible as the markets continue to change, so having that previous strategy that worked, it could either be used again or adapted to yet another new market conditions.

So have a think, do you consider yourself to be a flexible trader, or do you get stuck in your ways and find it hard to adapt to changes?