All traders at the end of the year always take stock of their own trading activity. There still exists an element that is never taken into account and therefore we tend to forget… How much value do we give to our time? Although it seems obvious, time cannot be “preserved”. It just passes. It is said that when we are born we are full of time, because we have a life ahead of us, but no one can quantify this wealth and no one can know how long a person’s life will last.

Even so, this wealth is a certainty, since time can be devoted to all things that free will allows. Bearing in mind that our choices will show us the way because at each decision we take new paths and leave others. This leads to a consequence: we spend more time on what motivates us the most. This motivation can be effective, economic, labor, sense of duty, etc. It is very interesting to know that on many occasions we use time as a currency of exchange.

Traders Exchange Time Continuously

This concept applies particularly well to a trader. He exchanges part of his time to have more availability of it, later. What does that mean? Invest money in the financial markets to get more of it and so have more time to live your life according to your desires and goals. Let me explain in detail what this phrase means.

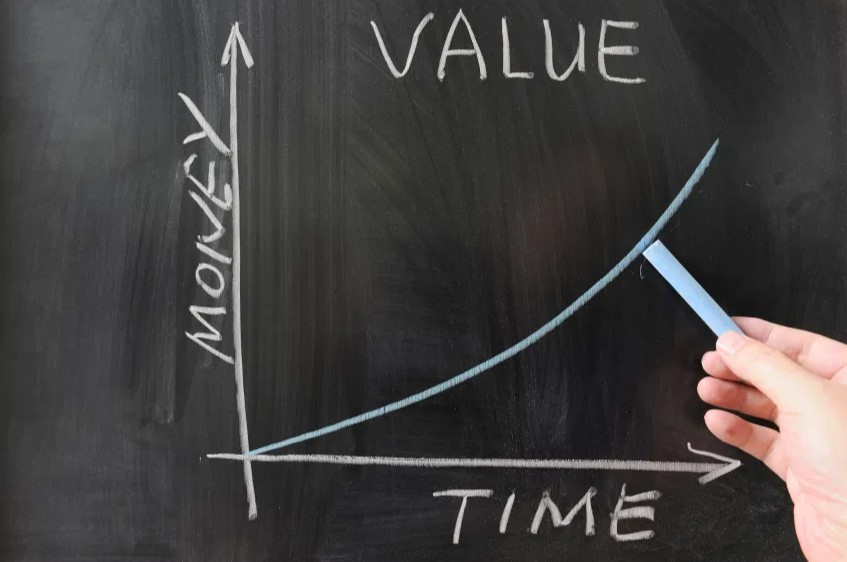

Time and money are surely the two most important resources we have available to invest and make a profit. However, it is money that is really valued as an investment because it allows us, as a system of payment, exchange, and reference, to receive something in return.

Otherwise, when we invest our time, it is not so easy to quantify the return we will get, only in some cases will it give us a profit in the form of money. For example, in the event that we exchange our time with work to be rewarded with a salary. In others, the exchange is not tangible, for example, when we want to increase our knowledge through study.

Paradoxically, these resources have great similarities: both can be managed, lost, wasted, saved, they are not infinite, but the substantial difference is that only money can be earned. If money is lost, it can be recovered over time, but if time is lost, it can never be recovered, even by buying it.

Unconsciously, money is valued more than time, except by increasing age: older people value time more because they realize their lack. Time is available at no cost and is available at will. Moreover, it is the most equitable resource that exists: a priori, we all have it. The problem is your administration.

Different Uses of Time and Money

The same amount of money and time in the hands of different people will not match their uses, even if the source from which they come is the same. If it is easy to answer that time is the main resource we must fight for, we must be aware that money is decisive for our future. Buying new experiences or particular desires requires a significant monetary expense and an investment of time to enjoy them.

The needs of life and the time in which we live mark the future of events:

well-spent money costs little, while well-spent time is scarce and unwittingly spent

It is a good dilemma.

Time measurement precedes the creation of money and is often related to productivity. Benjamin Franklin said that “time is money” and explained that the time spent working to earn money was time well spent; otherwise, if time has been spent on other matters, the money has been lost. This reflection is correct only in its own context, outside it makes no sense because well-spent time not only generates money but also generates many benefits that go beyond money.

Both time and money are consumed even if nothing is done with them. If time passes, it is spent. If we do nothing with the money, like leaving it in a non-productive place, then inflation, over time, will despise its initial value. And this is one of the main theories of finance: while the price of money remains constant, its value fluctuates over time.

Time Must Be Devoted to Investment

In the world of investment, the results are obtained after having devoted much of our time to them. The paradox that to make money I have to invest my time and that if I have money I will have more control over my time, does not go beyond the fact that the reward of both is not proportional. Having a lot of money is not synonymous with having a lot of time.

Time is indifferent to the amount of money. Those who have obtained a significant amount of money have invested a lot of time in it and will also need a lot of time to manage it.

It is clear that everyone is happy in their own way, but those who have less money and more time to devote to themselves and their families may be happier. A study by the journal Social Psychological and Personality Science reveals that 64% of respondents prefer to have money for free time, even if the results changed when asked about happiness. In fact, it has been concluded that the amount of money accumulated is not proportional to happiness.

When a certain money limit is reached, by earning more, that additional amount is not proportional to the increase in happiness. In this sense, it is said, and rightly so, that the rich do not enjoy the same happiness as money. According to experts, this limit is at 60,000 euros per year. 60,000 euros a year? Someone will think: and how to reach them? But here an important reflection must enter.

Investing Time to Buy Time

The trader invests his time because more money improves the ability to use his time. Very true, but how do you use this time invested for this purpose? The trader must be really good at managing the time he dedicates to this profession. If the study of trading requires much of our time and dedication, it is also true that we should not launch it in a 10-hour session that brings nothing good.

Some will say it depends on how much you earn. That’s true, but only in part. If I have to destroy my psycho-physical balance to make money, there’s no point in working like this. Trading is said to be freedom, but this statement is the subtle line between good and evil.

If for the freedom we intend to spend money on totally useless luxury items or sit in front of the computer for many hours to end up repenting and burning our human contact with the outside world, happiness will never be there and this is clear to all. If instead, we refer to the possibility of having quality time, for example, staying with our loved ones or having experiences that enrich us as human beings, then everything changes.

Trading As a Process of Growth

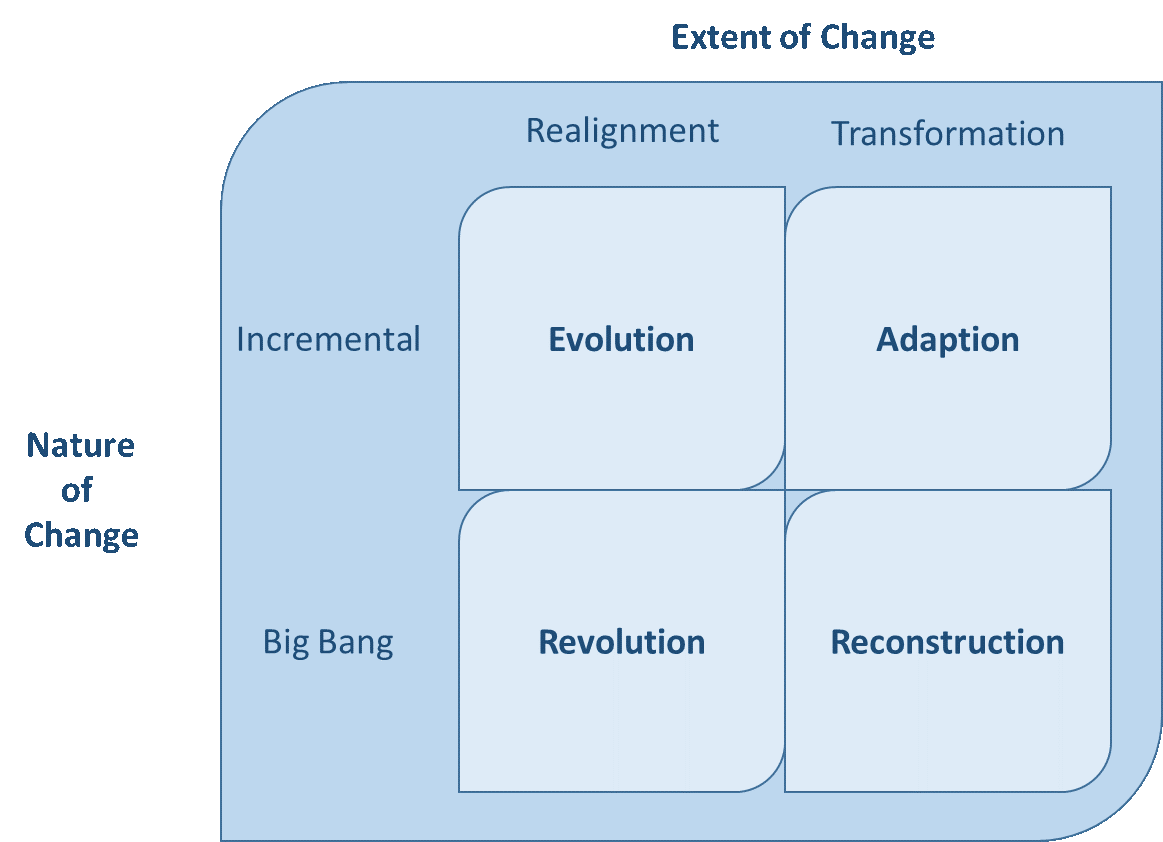

Trading can be seen as a grand ladder: a path where we grow step by step first as people and then as operators. A continuous exchange of time and money that must have a higher quality of time available, but above all awareness of ourselves and how we want to live our lives.

Life… we know well that it is unique and we will never know the exact moment when we will leave. We must therefore be very responsible to ourselves throughout this journey. Negative emotions, the lack of objectives, and the inability to react in the difficult moments of this work must be prohibited.

Time is the most precious thing we have. Unfortunately, we rarely evaluate it consciously: it continues to diminish, inevitably tending to run towards a zero balance. Only in the future will we lose the past and this can never be recovered. Therefore, it is necessary to manage time: if you want to achieve something, the first thing is to realize it. It would be sad and illogical not to do so, it would be an act of self-denial.

You have probably heard about trading journals, these are records where you jot down everything that you are doing, each trade that you open, the trades that you close, how long they were open, the profit and loss, the reason for the trade, any influencers and more. You are basically writing down everything that you are doing. A trading journal is beneficial for a number of reasons, it can be used for justification for your tradies, it can be used to find out where you may be going a bit wrong and it can be a way that you can check to see whether or not you are following your trading plan. Using it to find your weaknesses will mean that you will be able to make adjustments to your trading based on our findings, ultimately making you a much more

You have probably heard about trading journals, these are records where you jot down everything that you are doing, each trade that you open, the trades that you close, how long they were open, the profit and loss, the reason for the trade, any influencers and more. You are basically writing down everything that you are doing. A trading journal is beneficial for a number of reasons, it can be used for justification for your tradies, it can be used to find out where you may be going a bit wrong and it can be a way that you can check to see whether or not you are following your trading plan. Using it to find your weaknesses will mean that you will be able to make adjustments to your trading based on our findings, ultimately making you a much more  Taking breaks can really benefit your trading. Trading can be a stressful thing to do, it has its ups and downs which can cause stress and even anxiety. No matter your experience levels, when you do it for a long time, you will start to feel tired or stressed, so we need to do something about that. Take a 10-minute break, it can be as simple as that. Stepping away from the trading terminal in order to clear your mind or to think about something else will mean that you are able to help your mind and body to destress. A small break can bring you back with a much clearer mind which will make your trading a lot better, with less stress you will be able to better follow your trading plan and ensure that the trades that you are placing are in line with your trading plan.

Taking breaks can really benefit your trading. Trading can be a stressful thing to do, it has its ups and downs which can cause stress and even anxiety. No matter your experience levels, when you do it for a long time, you will start to feel tired or stressed, so we need to do something about that. Take a 10-minute break, it can be as simple as that. Stepping away from the trading terminal in order to clear your mind or to think about something else will mean that you are able to help your mind and body to destress. A small break can bring you back with a much clearer mind which will make your trading a lot better, with less stress you will be able to better follow your trading plan and ensure that the trades that you are placing are in line with your trading plan. The news and economic events can have a huge effect on the forex markets. In fact, any news event has the potential to change the direction or to cause a small jump in the markets so it is important that you are aware of what is coming up. There are a number of different economic calendars out there which detail different economic news events that are coming up. Take just 1 minute a day to look at one before you start your trading, it will give you an idea of how volatile the markets could be at those stages of the day, so it may even tell you to avoid trading a certain currency pair when those events are coming up, which could save you from some potential losses. It does not take long to do this and it should be something that you are doing at the start of every trading or analysis session that you are doing.

The news and economic events can have a huge effect on the forex markets. In fact, any news event has the potential to change the direction or to cause a small jump in the markets so it is important that you are aware of what is coming up. There are a number of different economic calendars out there which detail different economic news events that are coming up. Take just 1 minute a day to look at one before you start your trading, it will give you an idea of how volatile the markets could be at those stages of the day, so it may even tell you to avoid trading a certain currency pair when those events are coming up, which could save you from some potential losses. It does not take long to do this and it should be something that you are doing at the start of every trading or analysis session that you are doing.

The first thing comes down to your education, there is such a thing as too little information, but also too much information. There are three types of traders, those that learn the very basics and then jump in, those that try to learn everything before they touch their trading account, and those that learn as they go along. We would say that there is no right way to do it, but there are certainly wrong ways. Firstly, those that simply jump in with very little information, are setting themselves up to fail, you cannot trade with very little info, you won’t know how to manage your risks, or what certain events or patterns mean.

The first thing comes down to your education, there is such a thing as too little information, but also too much information. There are three types of traders, those that learn the very basics and then jump in, those that try to learn everything before they touch their trading account, and those that learn as they go along. We would say that there is no right way to do it, but there are certainly wrong ways. Firstly, those that simply jump in with very little information, are setting themselves up to fail, you cannot trade with very little info, you won’t know how to manage your risks, or what certain events or patterns mean. You need to learn about risk management, this is how you will protect your account from losses and from the markets moving against you because they certainly will move against you at one point and on a regular basis. Your risk management plan should contain things like your

You need to learn about risk management, this is how you will protect your account from losses and from the markets moving against you because they certainly will move against you at one point and on a regular basis. Your risk management plan should contain things like your  Set your goals and expectations, many people come into trading with the idea that they will make ridiculous amounts of money very quickly, of course, is not the case and is not realistic. You need to set your goals at an appropriate level, think about things like your current capital and account balance, the strategy you are using, and other risk management things that you have in place. You should combine all of these to make more realistic goals. If you see them too high, then you will be risking too much with each trade, not something that anyone would recommend, so set your expectations at the right level and it will keep you grounded and will help to keep you consistent with your trading and risks.

Set your goals and expectations, many people come into trading with the idea that they will make ridiculous amounts of money very quickly, of course, is not the case and is not realistic. You need to set your goals at an appropriate level, think about things like your current capital and account balance, the strategy you are using, and other risk management things that you have in place. You should combine all of these to make more realistic goals. If you see them too high, then you will be risking too much with each trade, not something that anyone would recommend, so set your expectations at the right level and it will keep you grounded and will help to keep you consistent with your trading and risks.

Sometimes when we are in the driving seat, we don’t actually realise whether we are profitable or not, we are concentrating so much on our actual trading that we are no longer looking at or recording the results that we are taking. We could be months in, with hundreds of trades under our belt, but until someone comes along and looks at those results, we won’t realise that we aren’t actually making any money.

Sometimes when we are in the driving seat, we don’t actually realise whether we are profitable or not, we are concentrating so much on our actual trading that we are no longer looking at or recording the results that we are taking. We could be months in, with hundreds of trades under our belt, but until someone comes along and looks at those results, we won’t realise that we aren’t actually making any money. Many people find trading stressful, that is one of the many natural emotions and reactions that you will get to trading, the problem comes when people find it a little too stressful. Some find it so stressful that they simply need to stop or they just cannot think of anything else, or even function properly afterward. If stress is starting to take over whenever you are trading you most likely need help, but first, you need to look at how you are trading.

Many people find trading stressful, that is one of the many natural emotions and reactions that you will get to trading, the problem comes when people find it a little too stressful. Some find it so stressful that they simply need to stop or they just cannot think of anything else, or even function properly afterward. If stress is starting to take over whenever you are trading you most likely need help, but first, you need to look at how you are trading. Trading can take a lot of time, it also can not take a lot at all, it all depends on you and the strategies that you are using. For many, at the start it can take a long time, there is a lot of learning to do even before you place your first trade, and this can be boring for many who simply want to skip it and start trading, but you need to take the tie to learn. The other thing is that certain strategies take a long time to trade with, there can be a lot of analysis, there can be a lot of trade preparation, and then once you place placed your trades, you need to sit there and monitor them, this is especially true for scalping, where you need to be at the computer during the times of your trading.

Trading can take a lot of time, it also can not take a lot at all, it all depends on you and the strategies that you are using. For many, at the start it can take a long time, there is a lot of learning to do even before you place your first trade, and this can be boring for many who simply want to skip it and start trading, but you need to take the tie to learn. The other thing is that certain strategies take a long time to trade with, there can be a lot of analysis, there can be a lot of trade preparation, and then once you place placed your trades, you need to sit there and monitor them, this is especially true for scalping, where you need to be at the computer during the times of your trading. This is something that is far more common than you may think, yet a lot of people simply do not want to admit it. There will however be situations and times where you simply do not know what it is that you are meant to be doing or how to analyse certain information. Try and get involved in some

This is something that is far more common than you may think, yet a lot of people simply do not want to admit it. There will however be situations and times where you simply do not know what it is that you are meant to be doing or how to analyse certain information. Try and get involved in some

It can be very easy to fall into the trap of taking shortcuts, when we say shortcuts we are referring to the rules and the methods that you use to place trades, your trading plan will have some rules on it, these rules will dictate how and when you place your trades. These can be pretty small shortcuts, like not waiting for additional confirmation, or they can be pretty significant ones like trying to speed up the process by not placing a stop loss with a trade. While they may not seem big, those little things like not placing a stop loss could potentially end up causing some quite considerable losses which will, in turn, put your overall trading results back quite a bit. It is important that you try to avoid these shortcuts, some may work, but when they don’t they can have big effects. Ensure that you stick to your rules and that you do them fully, not doing just half and hoping things are ok, that extra minute that you save is not worth the additional risks involved.

It can be very easy to fall into the trap of taking shortcuts, when we say shortcuts we are referring to the rules and the methods that you use to place trades, your trading plan will have some rules on it, these rules will dictate how and when you place your trades. These can be pretty small shortcuts, like not waiting for additional confirmation, or they can be pretty significant ones like trying to speed up the process by not placing a stop loss with a trade. While they may not seem big, those little things like not placing a stop loss could potentially end up causing some quite considerable losses which will, in turn, put your overall trading results back quite a bit. It is important that you try to avoid these shortcuts, some may work, but when they don’t they can have big effects. Ensure that you stick to your rules and that you do them fully, not doing just half and hoping things are ok, that extra minute that you save is not worth the additional risks involved. A lot of people don’t seem to stick to their risk management plans, at least not entirely. Your plan will have your

A lot of people don’t seem to stick to their risk management plans, at least not entirely. Your plan will have your  Something that we are all probably guilty of, we love to trade, but sometimes it is better not to and when you are tired, that can be one of those reasons. When we are tired we do not have the same concentration levels, we are far more easily distracted and we are far more likely to make mistakes. Yet we love trading so much or feel that we need to trade that sometimes it doesn’t matter how tired we are, we will still trade. This is where a lot of mistakes will be made, things missed out and potential losses gained. If you’re feeling tired, or that you cannot concentrate fully, then you should try and avoid trading as a whole, including analysing the markets and especially placing any trade.

Something that we are all probably guilty of, we love to trade, but sometimes it is better not to and when you are tired, that can be one of those reasons. When we are tired we do not have the same concentration levels, we are far more easily distracted and we are far more likely to make mistakes. Yet we love trading so much or feel that we need to trade that sometimes it doesn’t matter how tired we are, we will still trade. This is where a lot of mistakes will be made, things missed out and potential losses gained. If you’re feeling tired, or that you cannot concentrate fully, then you should try and avoid trading as a whole, including analysing the markets and especially placing any trade. Distractions are horrible things when it comes to trading, pretty much anything can be a distraction. When you set up your trading officer room, you should have ensured that a lot of the things that could cause you distractions were removed. Things like a TV, games consoles, things like hats, things that can take your attention away from your trading. Ensure that others know that you are trading and that you do not wish to be disturbed. Distractions can very easily cause you to miss things or to place trades incorrectly, so it is vital that you eliminate as many as you can.

Distractions are horrible things when it comes to trading, pretty much anything can be a distraction. When you set up your trading officer room, you should have ensured that a lot of the things that could cause you distractions were removed. Things like a TV, games consoles, things like hats, things that can take your attention away from your trading. Ensure that others know that you are trading and that you do not wish to be disturbed. Distractions can very easily cause you to miss things or to place trades incorrectly, so it is vital that you eliminate as many as you can. Emotions are wonderful things, they can make us feel amazing but at the same time, they can make us feel pretty rotten. One thing that we want to avoid is trading while our emotions are pretty high. They can cause us to want to do things that go against our trading strategy, things like greed and overconfidence can make us trade large or more often, while things like anxiety and fear can make us not want to trade at all. When we have our emotions high or you can feel something building up then it is important that you take a break, step away, clear your mind and come back when those emotions have died down.

Emotions are wonderful things, they can make us feel amazing but at the same time, they can make us feel pretty rotten. One thing that we want to avoid is trading while our emotions are pretty high. They can cause us to want to do things that go against our trading strategy, things like greed and overconfidence can make us trade large or more often, while things like anxiety and fear can make us not want to trade at all. When we have our emotions high or you can feel something building up then it is important that you take a break, step away, clear your mind and come back when those emotions have died down.