As a Forex trader, you will need to pay attention to important points in charts, adjust specific settings, manage your risk, and maximize your returns as a result. The intention here is to show how you can practice long-term sustainable and profitable trading regardless of your market of choice. We truly want you to have the best opportunity no matter how and when you started to trade for the first time, which is why we are delighted to close this topic with special tips that you can apply today. You will probably want to prepare your notebook and take notes so as not to forget any suggestions or ideas you may have.

What is the worst attitude for long-term success?

I need that money now, many people say. Unfortunately, with this degree of dependency on the result of your trading (i.e. the need to succeed now), you are limiting your vision quite a bit. With this point of view, you do not give yourself the chance to learn steadily and the learning curve is unrealistically steep. Since there is a need to debunk this myth of instant wealth, what you can do instead is set the grounds for trading in the way you will be thankful for in the future.

What is the right mindset for sustainable growth?

You should find a way to always preserve a portion of your return and reinvest it so that this system starts running on its own. We call this buy and hold strategy that helps traders take steps that will always put the money back into their accounts. This is the one way you can feel secure about your finances down the line.

What if I don’t feel like allocating part of my earnings?

Changing perceptions and creating a new routine is a tough thing to do. Most people are afraid of changes, but the control you may think you have over your life and your finances now is false. If you just trade, you do not have a plan B. Even if you have a regular job and do trading on the side, don’t you feel like you can do more? We want you to do more and to succeed in an easy way, but this will require you to change your views about how money should be managed.

How do I reduce anxiety about making changes in how I perceive trading?

First of all, start playing offense and defense at the same time by not spending all the money you earn. What you never want to do is work hard for a few months and spend it in a matter of a few days or weeks. Reinvesting your money will help you relieve yourself and alleviate that sense of anxiety. If your worries come from the place of wanting to secure your finances in the long term, this is the way to go. The thing is, with this approach, you will never need to worry about individual trades because, even if something falls through, you will always have security. Whenever you enter the market, it is absolutely never too late if you have a buy and hold mentality.

What if I need the money now?

Well, first ask yourself the question of what is the sum that would make you happy. When you will take this money off your account is yours to decide, but you do need to have a clear idea of how much you need to make. If you generally just want to be rich, you are much better off applying the buy and hold strategy.

What are the essential trading rules?

Perfect your system first and then do everything to stop yourself from sabotaging it. This may sound easy, but it is actually one of the greatest hurdles in trading.

How do I start buying and holding?

You first need to have a plan that you will write down. Whatever situation you find yourself in, do not make any changes to it regardless of what is going on in the market. This means that you will not tweak the settings or change the take-profit point as you please even if it gets tough. The best part about this approach is that you will always have more opportunities to earn money trading and any losses will be opportunities for you to improve your system.

What is the best strategy for buying and holding?

In one of the previous articles, we talked about scaling out if you use a swing trading strategy. This is your best money management solution and a secure way to amass a fortune over time. As long as you don’t react impulsively, get suddenly triggered by some external factor, or make decisions based on your emotions, the money you take off the table and reinvest using the scaling out strategies will provide you with the things you need.

How do I differ from the rest?

You will be different if you design a thorough plan first. Then you will choose if you will be in the buyer’s or seller’s market and whether you will go long or short. Shorting may be more difficult in the stock market than with trading ETFs, gold, or commodities for example. You will strive to pick things that can have a limited downside and can hardly go down to zero, such as gold and oil or healthcare and energy stocks and ETFs. Forex traders should test their algorithms to perfection (backtesting, forward testing, and real money application as well) because this will help you outperform most investors and financial advisors. Opt for the monthly or the weekly chart for a more aggressive approach, rather than the daily one. While these are easy to apply, understand that just by scaling out and buying and holding, you are already way ahead of the majority.

What are the two biggest pieces of advice you can give me?

Firstly, never let yourself be susceptible to the fear of missing out (FOMO) because there is an abundance of opportunities in every market, be it stocks or gold. You can push yourself sporadically in the investment scene, but must never let your emotions guide you while trading. Secondly, always and with whatever amount of money you have, start trading and investing as soon as possible. Make your plan and you will have that bright future of which you keep dreaming.

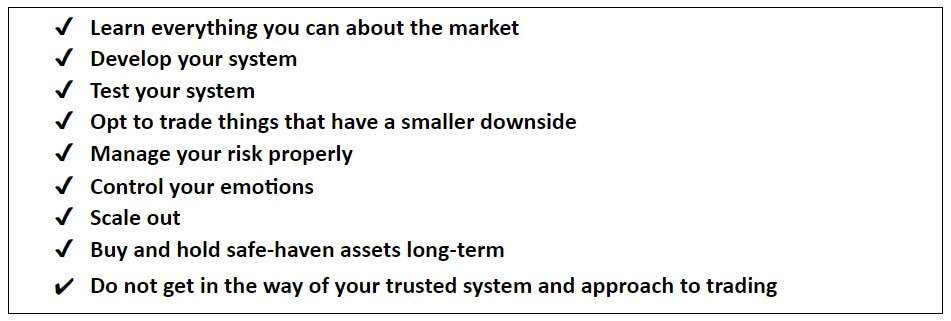

What is the best order of actions I could use to succeed as a trader?

Since this is the last article on the best position you have, we would like to share a form of a checklist you can return to any time you like.

Thank you for sharing this journey with us. Ensuring the best trading position is a really broad topic, but we strived to be as clear and to the point as possible. Consider reading additional articles on the topics that may be of interest to you because the more you know, the sooner you can apply and test. Finally, please also remember that the sooner you start buying and holding long-term, the better. And, once the shorter-term machine starts running, the world is yours.

Good luck!