What factors do you assume to be the most impactful in the world of forex trading? Should traders focus on the technical tools more intensely than on their traits? Does one’s personality have a determining role in the development of a trading account? How do we measure our growth and what attitude is necessary to facilitate progress in the forex market? Along with these questions, today we will be discussing all areas traders need to focus on to be able to trade successfully.

The Right Approach

The right approach to trading does not necessarily imply a fixed set of actions that each trader must take but a direction in which one needs to move so as to grow and reap the rewards from trading in any market. Whether you are a beginner or a more advanced trader, you probably already know how maintaining a proper attitude is a necessary continent of successful trading. If you truly want to be good in this field, you must learn how to maintain a degree of curiosity in each developmental stage and in every possible sense.

At the very beginning, curiosity is required in looking for credible sources where you can learn about the key terminology and tools to use later on. Education, however, also entails the aspiration towards understanding different currencies, their respective countries, and central banks along with related events that may affect the market at some point. You will need to polish up your research skills and practice discernment to know exactly which item of knowledge is best suited for your vision. In order to create a purposeful course of movement, naturally, you will need to minimize any reliance on luck and set short-term and long-term objectives through thorough planning.

Ask yourself some vital questions and look for answers in selected sources and in your own attempt to apply theory in practice. Strive to understand what your reasons for entering this market are and how your expectation might affect your trading. Set realistic goals and use analytical and critical thinking so as not to stain facts with your personal projections (e.g. I will get a 20% return in the first go). Finally, prepare yourself to continually show commitment and dedication without expecting to see immediate results. Learning about forex and growing as a trader is a process, which requires both patience and persistence.

Key concepts: curiosity, commitment, dedication, dedication, persistence

Example questions: How do I build an algorithm? Why is this currency pair considered to be risky?

Functional System

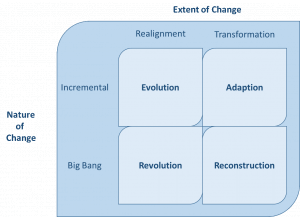

The basis of every trader’s experience with forex is the system that is comprised of various tools, strategies, and techniques specifically selected to produce the best possible result and protect one’s trading account. To be able to set up an algorithm that will function to your advantage, you will not only need to set a good foundation in terms of knowledge but also invest a considerable amount of time in testing. Opening a demo account and applying the theoretical knowledge acquired up to this point will allow you to assess how prepared you are from both the technical and psychological perspective. You will keep looking for areas where your approach lags and track your progress through journaling. Reflecting on one’s wins, losses, and important numerical data allows traders to measure trading in terms of quality and quantity in every respect and have an active role in its further development. Having an efficient algorithm also obliges traders to consider the risk-reward ratio and consciously understand when and why they wish to enter or exit trades.

Remain open to making changes in your system by using different strategies for example and allow to be molded by your experience. If you happen to come up with two viable options, always turn to your records and compare how the two systems compare to one another, picking your top-performing algorithm as a consequence. Lastly, at this stage, you should aim to nurture independence and sense what it feels like to be dependent only on your system and your logical thinking. Your system will only need to reflect your personality and goals regardless of how similar it may seem to what you have read about before, which is why you need to play an active part in every step of its creation.

Key concepts: demo account, testing, journal, improvement

Example questions: What leverage is acceptable to me? Where do I put my stop-losses?

Personal Growth

Forex trading is known to be able to test each individual’s boundaries, awakening people’s greatest fears, and bringing to light their deepest desires and urges. To facilitate your learning and development as a trader, you will have to invest in personal growth. Investing wisely necessitates that every forex market participant understands their triggers and compulsive behaviors or those situations and conditions that provoke emotional responses and reactions we may not be able to keep under control. Experts always advise traders to take a personality test where they can learn about their personality type and how it can potentially impact their trading.

People generally try to erase traces of whatever they deem negative, but if you learn how to trust your system and you make a habit of communicating with parts of your personality that seem to need more attention, you will soon be on top of your weaknesses. Personal development also includes the skills of balancing trading and other life responsibilities, whether you are learning how to allocate time to obtaining education or how to let go of the stress you face on a daily basis. Working with your personality additionally entails deliberate action to improve whatever you discover you may be lacking, be it diligence, discipline, or any other skill or ability. The best part about the effort that you will be investing in this area, no matter how scary it may seem, is the fact that your overall living conditions will change for the better and you will see benefits in different areas of life.

Last but not least, personal growth also involves thinking about future progress, which is why you are advised to think about how you can use the skills and knowledge you have acquired so far down the line. Will you expand to other markets we trade or possibly decide to present your trading achievements to a prop firm and sign a contract for bigger yearly returns? Wherever your path takes you, remember that your personality traits will always have a varying impact on your trading but that the effort to improve your personality will impact your entire life positively.

Key concepts: personality test, triggers, emotions, control, discipline, balance, benefit

Example questions: How does my personality affect trading negatively? How can I improve myself?

We can now say that your position sizing is equally important as your reactions to failure. Your skills in managing high risk may be exceptional, but if you fear to invest more when you can, your account will not grow as much as it can. The examples of these correlations and contrasts are many, but at the same time, traders must focus on the process rather than on their desired profit. Goals are amazing because they make us create plans, but if we are unwilling to adapt and adjust to changing circumstances, our objectives will only be farther and farther away. Generated layer by layer, excellence is a product of hard work and continual faith in oneself. Trading is a multi-faceted skill and, as such, it encompasses several key areas where your focus is mandatory. Like a singer who needs to overcome stage fright, practice singing techniques, and considers different styles of singing, a trader also needs to adopt and test specific knowledge and skills while ensuring the right mindset to secure success.