There are a lot of traders out there. A lot of them are experienced and a lot of them are completely new. The one thing that the majority of them have with forex is that they are simply losing. Yes, they are losing money. You have probably seen the warning signs from pretty much any forex related site, stating that the majority of people that trade forex or any sort of CFD will lose money. So why do we still trade? It is because of the potential, but in order to achieve that potential, we are going to need to work out why it is that so many traders are failing when it comes to forex trading.

Some reasons are based on the individual, some through inexperienced and some through simply making mistakes, common mistakes that a lot of people make. We are going to be looking at some of the main reasons why people fail at forex trading.

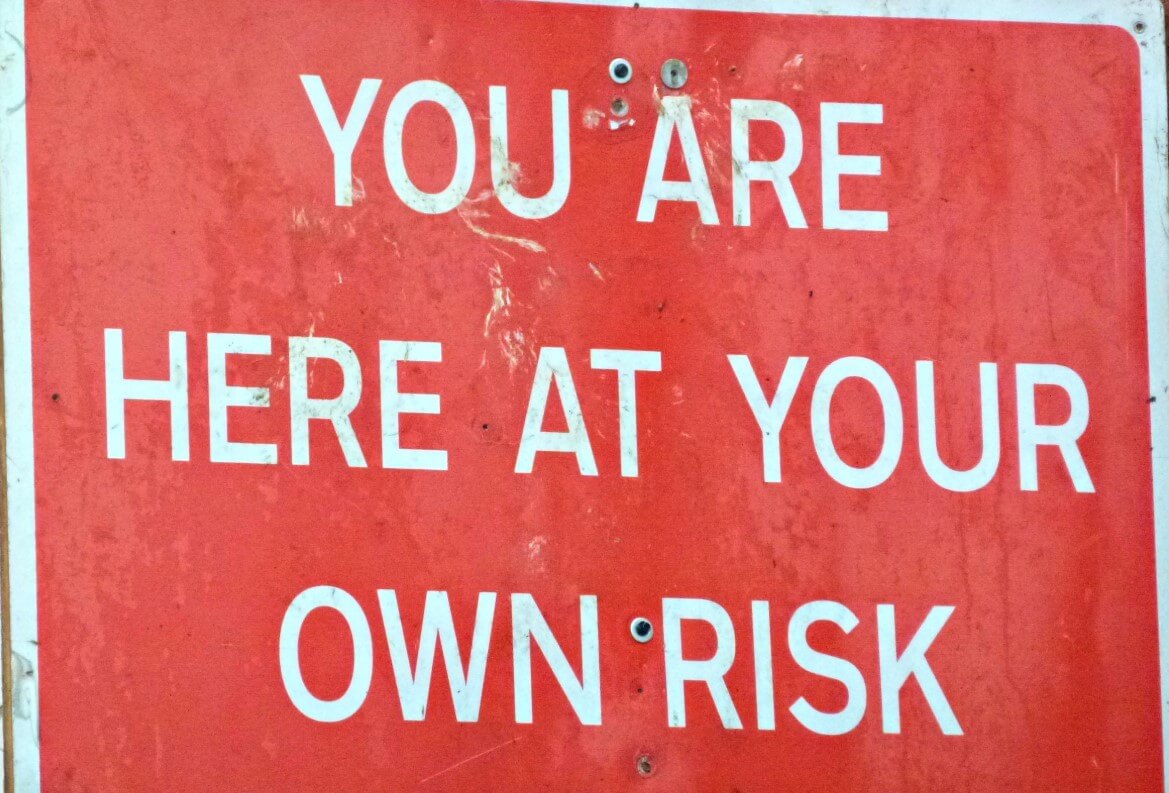

Lack of Risk Management

Something that should have been cemented into your mind when you read any sort of trading course or help site is that you need to have a risk management plan in place. Yet it is something that a lot of traders still fail to do, and when you fail to do this, you are failing to trade properly. The risk management plan outlines a number of different things including trade sizes, stop loss distances, your risk to reward ratio, and more. It is paramount that this is in place, its sole purpose is to protect your account and to help you prevent yourself from making large losses. So we really don’t understand why people trade without one, either through lack of understanding or simply being too lazy to follow one. Get a risk management plan and stick to it, you simply cannot be successful without one and will fail if you don’t use it.

Not Using Stop Losses

Part of the risk management plan that we mentioned above is your stop losses. These are basically automatic stops that you can place on your trades. When the price of the markets move up or down and hit these levels then your account will automatically close. They are there to help protect you from bigger losses than you planned for, yet so many people refuse to use them. Again, this may be through simply not understanding their use, but for many. It is simply the fact that they do not want to and for this reason, they often lose their accounts. You need to have them set, every single trade needs to have one, no matter what your strategy is. If you are the sort of person that doesn’t set them and instead wants to manually watch your trades then we would suggest you rethink, these are hard stops, they protect you, use them. Otherwise, a single trade could be enough to blow an account, and it has happened many times in the past.

Trade Sizes Too Large

The size of the trade that you place relies on a number of things. It is decided based on your strategy as well as your current account size. If you place trades that are too large, then you are placing your account under an increased amount of risk, not something that you want to be doing. If you have an account size of $1,000 and place a trade size of 0.01 lots then you have a lot of room for movement. However, if you use your leverage to place a 1 lot trade, then it won’t take much movement in the markets to simply blow your account. You need to place your trade sizes responsibly, yes the larger the trade size the larger the potential profits, but the losses are also potentially larger. Stick to appropriate trade sizes and do not try to push them too far.

Overleveraging Your Account

Leverage is a wonderful thing. The brokers are basically lending you money to place trades larger than your account would otherwise be able to place. It is something that you should take advantage of, but unfortunately, a lot of people do not understand the darker side of leverage, the side that can cause you to simply blow your account. When you leverage your account, you will be placing larger trade sizes, and these give more profit potential but also more loss potential. We see $100 accounts with a leverage of 2000:1 placing 1 lot trade sizes. The markets only need to move a few points before the account will blow. You need to use your leverage appropriately, even with a leverage of 2000:1, you do not need to use it all with every single trade. Remember to follow your strategy and do not place trades too large just because you have the leverage to do it.

Quitting Too Early

People don’t like to lose, and that is understandable, but people also should not quit at the first hurdle. Many people from many walks of life have tried things, but do you think that any of the successful ones have quit after their first lesson or two? When you leave after your loss, you are basically accepting that you have lost that money and have walked away. It should be that you were never serious about trading and never serious about wanting to make the money that you are upset that you lost. You cannot quit too early, losses are a part of trading, just because you experienced one does not mean you are a failure or that you should give up. You need to keep going, even the best forex traders fail, but they are the best because they did not quit, and neither should you.

Being Distracted

Let’s be honest, it is easy to be distracted, and far easier in these modern days than it was before with all the different devices that we have to entertain us. Yet when we trade, we need to try and get rid of everything that we do not consider essential. Get rid of the TV in your trading room, get rid of your phone, get rid of anything that can distract you. We have made losses through distractions in the past, we are sure that the majority of traders have, but it is something that we can very easily deal with. Distractions will take your mind off your trading, placing wrong stop losses or take profits, trades too large, and so forth. You need to be focused when you trade, if not, mistakes will happen and you could ultimately fail if you experience too many of those mistakes.

Those are some of the reasons why people fail. If you make a loss to begin with, do not panic, that is pretty much expected of all new traders. In fact, if you are profitable in your first few months, either you are amazing or simply lucky. However each time you make a loss, take a look at the trade, try and work out why you lose, some you will be able to make adjustments, others may have just been unlucky, but use it as a learning experience. Doing this with each trade will enable you to be better, and the better you are, the less likely you are to fail.