One of the main lessons that any new trader gets is how to set out their risk management plans, there are a lot of different ones out there and you would most likely have been told a number of different things yourself by different people. There are people that go by what seems to be a new industry standard of 1% to 2% of your account per trade, however, you still often see people a little more aggressive, going up to 5% or even 10% per trade.

The thing is, that all of these styles and risk management plans are perfectly valid, it can be confusing to see so many variations and you can often wonder if they are all safe. The fact of the matters that you will never know which one is right for someone else, as you would need to be able to access their mind, to be able to work out what their risk tolerance levels are and also what sort of money they are using, expendable money (the stuff you should only be trading with) often comes with a much lower risk threshold, people are willing to risk it more than hey ould with money that they may actually need. It all comes down to personal preference and this is what you should be looking at when working out your own risk management plan.

It is important that we get a basic understanding of what risk tolerance is, we need to be able to know what it is for you and that is what is important. Think back to times where someone may have offered you a gamble, would you take it at 50/50 or would you only take it when it reaches 75/25? Knowing what stage you would take the gamble and how much of your trading account you are willing to risk will help you to create your own risk management plan that suits you and one that you will be comfortable with.

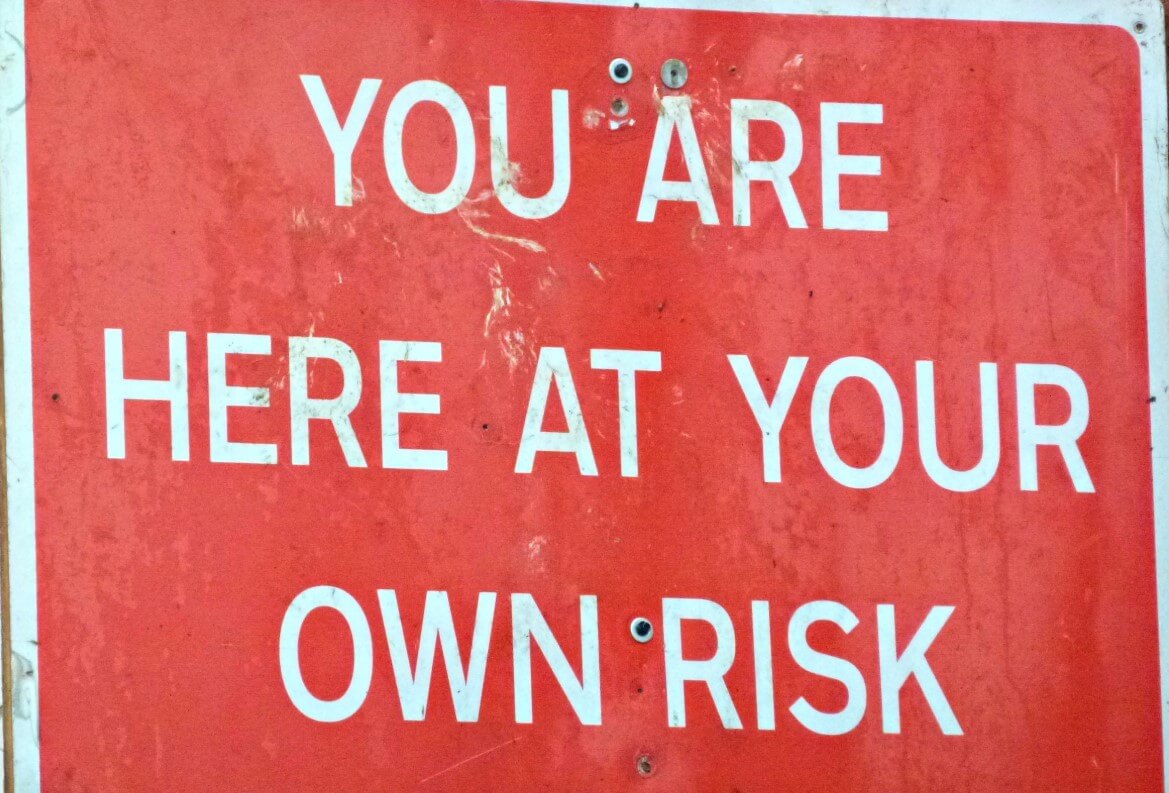

A lot of things in the real work you are often advised to seek financial advice, from an accountant, a lawyer or simply your bank, this is often the sensible thing to do as they know what is best, but the difference between them and reading is that they work in a world where the same advice is relevant for everyone, the same rules apply to everyone. When we are trading, this is not the case. Something that works for one person could be a nightmare for someone else, so this is why we always need to look at things at a personal level when walking about risk management and that is why we say that you should be trading to your own risks and not to what others are risking.

When you started trading you would have created your trading plan and as part of that plan, you should have created your risk management plan. People often look online for help when creating these things, especially when not sure. So let’s assume that you got stuck and went online to see what risk management other people use, you see someone doing quite well risking 5% of their account with each trade, they are doing well so it must work, the problem is that you do not know what their strategy is, it may be completely different to your own, so implementing their risk plan into your strategy could lead to disaster as your strategy is not based around it. The same can go for your own sanity and stress levels, if you are quite a risk-averse person, risking a larger percentage of your account will mean that you will be in a constant state of stress and dread, if you aren’t comfortable with the risk, then you should not be using it.

The experiences that people have had often influence the risks that they are willing to take, those that have a lot of experience within the financial markets or just with finance as a whole are often willing to take larger risks as they have a better understanding of how to manage it, those coming in new are often more reserved, wanting to ensure that they are safe. Of course, there are exceptions to this, some professionals risk very little and some newer people come in with the wrong expectation of being rich and so risk too much, but that us a lesson that they will need to learn by themselves, no amount to telling will stop them from making that mistake as the draw of money is just too strong for them.

A reason why it is so important that you only risk what you are comfortable with is that you will experience losses if every loss makes you lose 10% of your account, it is going to destroy your motivation swing profits wiped out with every single trade, this is why many people go for smaller amounts such as 1% or 2%, a loss will still hurt, but it will not take away a large portion of your account. What is important, is that the risk management is built into your own plan and what it is based on your strategy and your risk tolerance, do not go out there looking for what other people are doing, this will not suit you and will not suit your strategy.

An important aspect of risk management is working out what works for you, this can be done through trial and error or by a lot of planning and demo trading. What you do not want to do is to be suckered into those that are stating that they have made tons of money by risking certain amounts, they are often exaggerated or sometimes completely fabricated. It is great to use others for inspiration or to use their knowledge to help create your trading strategies, but one aspect that you should avoid is the risk plans that they have. This is something you need to create yourself, by yourself, of course, you can use a baseline of 1% or 2% that is often suggested, but only take that information, work out the rest yourself.

One good way to help work out your tolerance levels is to use a demo account, of course, a lot of the emotion won’t be there as you are not risking your own money, but it is a way of working out what sort of risk suits your strategy. If you are consistently profitable with a risk of 2% but not at 1% then your strategy may require the higher risk. Set stop losses, if you find yourself closing off trades manually before it reaches the stop loss, then you may be risking more than you are comfortable with, use the demo account to help alter things, fiddle with things until you come to something that works for both you and your strategy. It can often take quite a long time to find the perfect spot, in fact, a lot of traders never do, but you can always get close. Keep practising, keep adjusting and you will get there in the end.

I know we have mentioned it a number of times, but do not go out there and copy others, it is paramount that you do what is right for you, not what is working for others. They have different circumstances to you and so their plan works for them, but it may be a terrible idea for you. It will take time to work out exactly what you are comfortable with, and that is fine, everyone will have different tolerance levels, you may start too high or too low, you can adjust things as you go to ensure that you eventually come up with the strategy that works perfectly for you.