When just starting out, one of the many warnings that people seem to get is to not be greedy, in fact, a lot of mistakes that are made from both the new and experienced can have an aspect of greed in it, but what exactly is greed?

Greed is basically a “selfish and excessive desire for more of something than is needed” as stated by the Merriam-Webster dictionary. If you think back into your life, I am sure that you will be able to see times where this definition matches your own experiences, in fact, you may have experienced it a large number of times, often it can be a subconscious thing, making decisions without us even knowing, other times it can be an aim, not a good one, but it is still an aim.

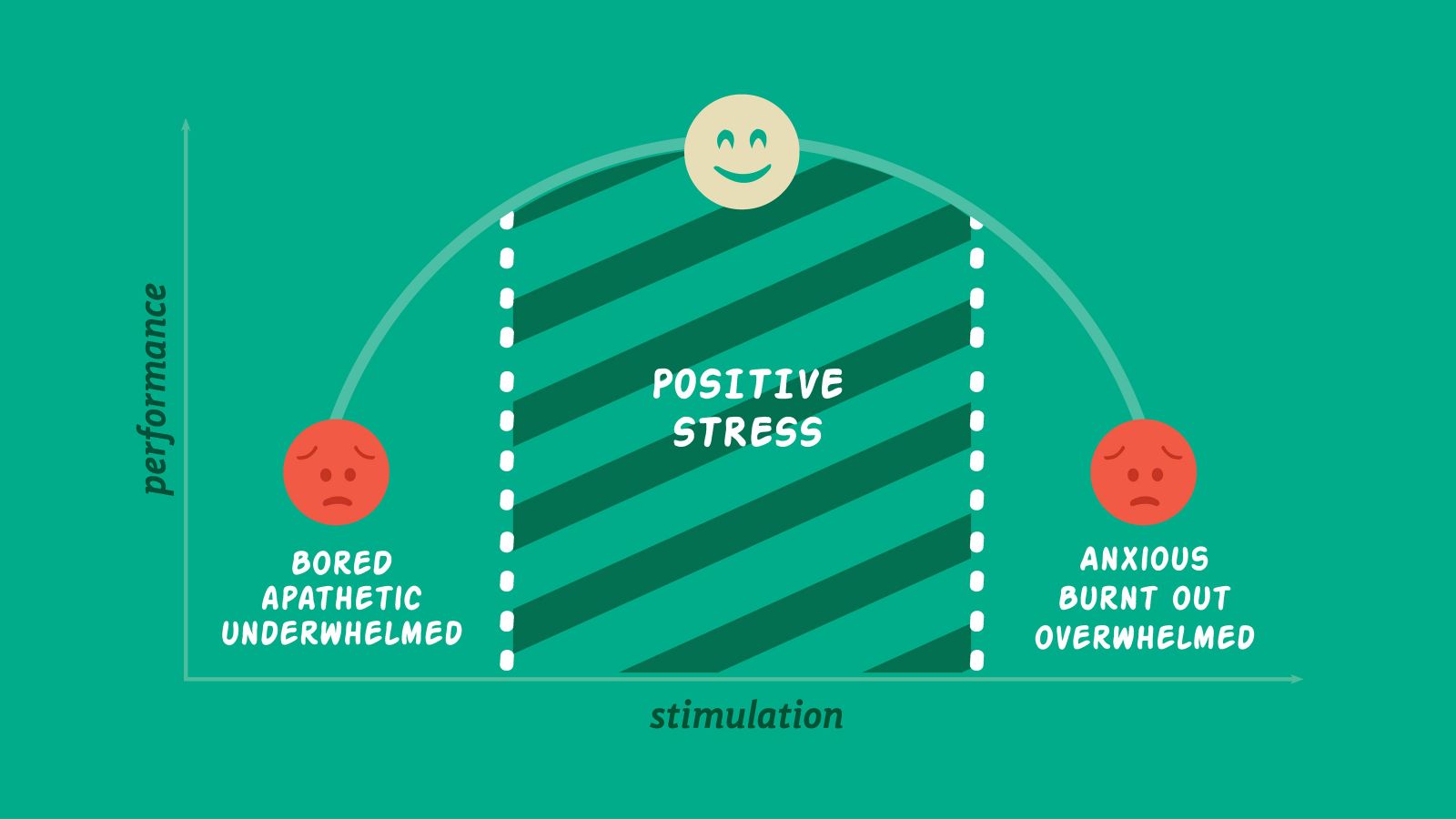

Now greed by itself is not necessarily a bad thing, it involves the desire to gain more, to achieve more which is often a good form of motivation, where things go wrong is when this want for more becomes excessive when you do not have a limit to how much you want and so you keep pushing yourself for more and more and it can eventually push you to do things that you would never have done before and that is way outside your strategies boundaries.

So what exactly are the dangers of it? Greed is a very strong emotion that can prompt you to take actions that you would never have otherwise taken when we are looking at trading, this would come in the form of creating additional trades, larger trade sizes than usual or chasing the markets in order to either make more or to win back some of your previous losses. It can cloud your judgment and take you off the path that you have been working on for so long.

So we know what it is, and we know why it is bad, so how do we get over it? How do we suppress that emotion? It can be done, but it will take effort and discipline to do, its not easy, but once done, it will make your trading far safer and far more successful.

The first thing you need to do is take a hit to your ego, you need to have an understanding that you aren’t always right, you have your strategy with its criteria for a reason, if you were always right, you would not need that at all, and you know what? That is a good thing, you won’t always catch the movement of the entire market and you may miss out setups altogether, it is important to recognise that as when it happens, you still need to move on and concentrate on the next trade and not look back in regret.

That is a part of trading, losses and missed trades are as much a part of trading as winning is, looking at your strategy, in the long run, you can make a lot, but greed will tell you to make a lot now and worry about the future tomorrow, not a good tactic if that greedy trade causes you to lose the last months profits. Being able to forget the previous trades and just look forward is a way of preventing yourself from being influenced by our greed and making unnecessary and dangerous trades.

One way that some people prevent greed from coming in is to convince themself that they are more lucky than skilled when it comes to trading, so they do not have the belief that they can just put in trades and win, instead they need to ensure that they follow their strategies and entry criteria in order to trade, something that helps prevent them from making additional unnecessary trades. So ultimately, you need to look to the future, concentrate on your strategy, and avoid those additional trades.