Today, we are going to demonstrate an example, which has several lessons. Forex price action traders need to concentrate hard on the trading charts. They must have ‘never give up’ attitude, must not make decisions emotionally. In a word, they need to be psychologically strong. Let us now proceed to our lessons with examples.

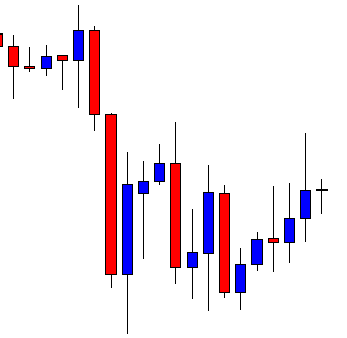

This is a daily chart. After being bearish, the chart produces a bullish reversal candle. The combination of the last two candles is called Track Rail. It is a strong bullish reversal pattern. The daily- H4 combination traders may flip over to the H4 chart to go long on the pair.

The H4 chart does not look that promising. The price heads towards the North, but the momentum has not been strong. However, the buyers have their first signal to keep an eye on this chart. They are to wait for the price to consolidate and produce a bullish engulfing candle to offer them a long entry.

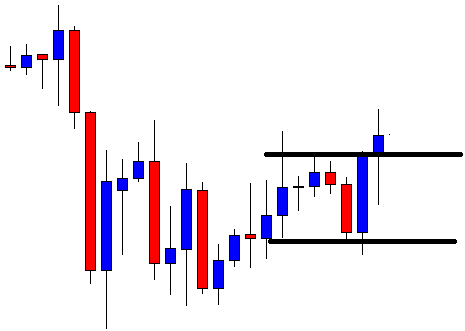

The price makes a deep consolidation and produces a bullish engulfing candle. However, it closes within a level where the price gets rejection twice. The engulfing candle does not close above the level of resistance, but the next one does. This is not an A+ entry. The buyers may skip taking the entry.

The price continues to go towards the North. Some traders may think an opportunity is missed. Do not forget that we shall only go with A+ trade setups. Here is a question. Look at the last consolidation and the bullish reversal candle. The candle closes well above the level of resistance. However, it is not a deep consolidation. Would you trigger a long entry here? Do not miss the point that it is not a deep consolidation. Thus, this is not an A+ entry either. Let us skip it and concentrate on the next chart.

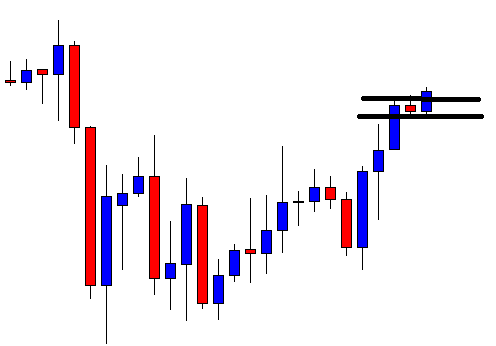

Again, the price heads towards the North. This is where we must not panic and think we keep losing opportunities. It is always better to be safe than sorry. What do you think about the last bearish candle? This seems to be a deep consolidation. If the chart produces a bullish engulfing candle, the buyers may trigger a long entry.

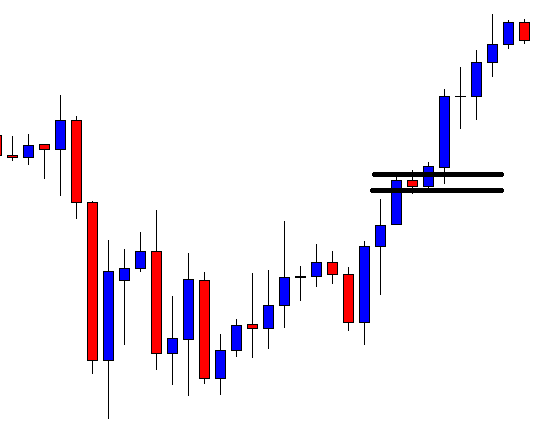

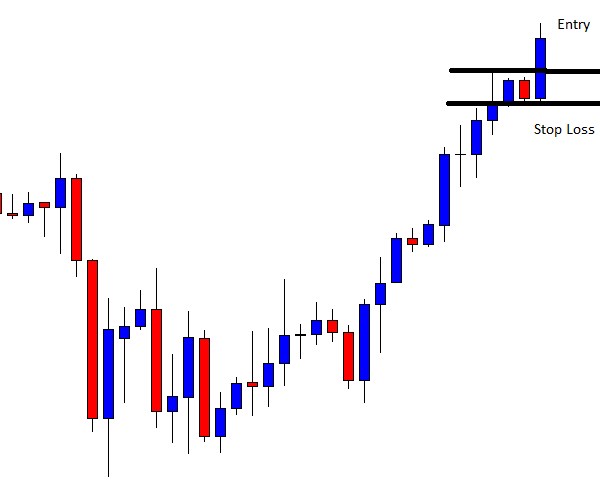

The last candle comes out as a bullish engulfing candle closing well above the level of resistance. The price makes a deep consolidation. This is an A + trade setup. We may trigger a long entry right after the last candle closes. Let us proceed to the next chart to find out how the entry goes.

The price heads towards the North with good bullish momentum. It gets us more than 1R. At last, our patience has paid off. Do you notice how strong we need to be psychologically? This may seem easy, but it never is when we trade and make a decision in the live market. It is tough to restrain ourselves from taking bad entries. Sometimes they may make a profit and make us upset if we do not take the entry. To be consistent, we must not be upset but wait for the best setup (A+ trade setup) to offer us entry.