How can you diversify your income streams and improve yourself at the same time?

It’s decision time. It’s time to decide whether you are going to just stick to what you’re doing right now or whether you are going to put time and effort into making yourself a success. You could carry on holding down your job and carry on trading, or you could decide that it is in your best interest to add new streams of income to your life.

Why would you choose to do that? There are two main reasons. The first is that by diversifying your sources of income, you can insulate yourself from any future shocks. The more streams of income you have, the better protected you are from things like the economy tanking or your company going under and leaving you unemployed. The second, perhaps more convincing reason is that you are almost sure to end up making more money this way. The greater the number of income streams you introduce into your life, the greater the odds are that one of them will become a runaway success.

Why would you choose to do that? There are two main reasons. The first is that by diversifying your sources of income, you can insulate yourself from any future shocks. The more streams of income you have, the better protected you are from things like the economy tanking or your company going under and leaving you unemployed. The second, perhaps more convincing reason is that you are almost sure to end up making more money this way. The greater the number of income streams you introduce into your life, the greater the odds are that one of them will become a runaway success.

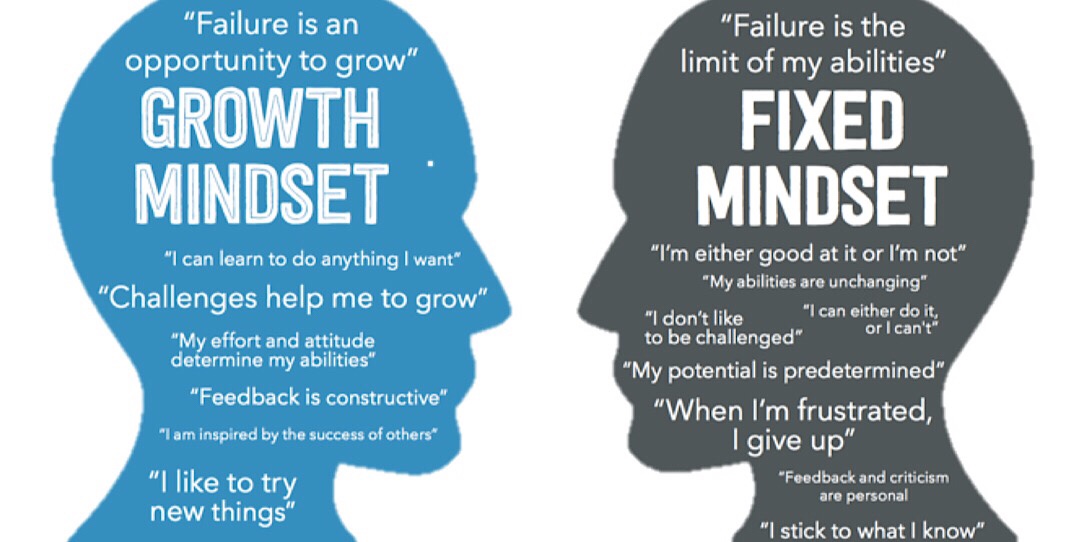

Of course, that’s not an easy thing to achieve. Particularly if you’re stuck in a rut or have allowed your brain to talk you down to the point where you don’t have the confidence to start something new. But, if you’re reading this, that means you have in all likelihood already overcome that first hurdle. You have probably already started forex trading or are on the road to teaching yourself how to trade. Take a moment to give yourself a hearty pat on the back because that is no small feat. It is, in fact, a paradigm shift away from being a bystander in your own life and towards being able to know what you want and how to go out and get it.

Diversifying Income Streams

The huge advantage you have, living in this time, is that there are now more ways than ever to explore new avenues of earning an income than there ever have been before. Better still, a great many of them do not require you to quit your job or abandon your forex trading routine. They can be bolted on without causing the kind of life-changing disruption that would have been inevitable in the past.

Of course, as is the case with everything you do as a trader and – speaking more broadly – every big decision you take in life, you will have to run a careful risk assessment to figure out the potential pros and cons. Not just in terms of your financial portfolio but also in terms of the amount of time invested, whether that time could have been used more productively on another endeavor and, ultimately, on your own personal wellbeing.

Your risk assessment cannot, however, involve no risk. Otherwise, you are just back to square one. Why take any risks when you can sit on your couch and eat chips? That’s not the name of the game. Imagine you’re in a casino and the odds of winning a hand at blackjack or roulette are 12-1. That means that out of 13 possible outcomes, 12 are going the way of the house but if the game does happen to go your way, you stand to make 12 times your stake. Now, of course, betting on a future outcome like that makes little sense. The game is stacked in the house’s favor. That’s why casinos exist in the first place because they can make money by making sure the odds are always in their favor.

Take a look at Las Vegas or Macau in China. There’s a reason why all those casinos look so opulent and it isn’t because the poor schmucks betting on a 12-1 hand are winning all of the money. Okay, but now imagine that the odds of winning the game stay the same but that the winnings go up by a factor of 100. Your chances of winning haven’t changed at all but the potential gains if you do win, gains are now astronomical. No casino would deliberately set up a game like that because they would be out of business in no time. One of the reasons they would go out of business is that suddenly it makes much more sense to make that bet from the punter’s point of view. The reason is that a risk with such a large potential upside starts looking more like a calculated risk that promises to pay out a reward that is out of proportion to both the odds and the initial stake. In other words, it becomes an opportunity.

The point is that when looking for ways to diversify your income, your goal is not simply to search for the low-risk option but to identify real opportunities.

Opportunities for Self-Improvement

Getting to the gist, there are many ways to invest your money that will look on the surface like they provide an additional income stream where you can just sit there while your money works for you. They include anything from peer-to-peer lending, across ETFs and dividend-heavy equities, to investing in the real estate market. These are all likely to be potential components of your financial portfolio in one way or another. They are not, however, very imaginative ways to diversify your streams of income in a meaningful way. For one thing, while the risk may appear to be low, they are not entirely devoid of risk. Moreover, while these options are relatively low-risk, they also do not offer spectacular rewards. In other words, they are not real opportunities.

Another, perhaps better, way to go is to look for business opportunities.

In that sense, we are blessed with the true plethora of business opportunities that the internet and other modern technologies provide. It can be said we are also still very much in the pioneering stage of online business. While it may seem like everyone is online selling something or marketing themselves in some way, this couldn’t be further from the truth. Wherever you are in the world, you will find that most people around you have still not cottoned on. Most people are still bumbling around, unaware of the potential these high-tech tools offer. All of this means there is still time to get in, if not on the ground floor, then at one of the early floors and let the elevator take you up.

What’s Stopping You?

Here’s what’s stopping you and why it shouldn’t. What’s stopping you right now from starting some form of online business in addition to your job and in addition to your trading, is the very same thing that for a long time stopped you from getting into forex trading in the first place. Fear. Now, the fear we’re talking about here is fear of failure. There’s nothing to be ashamed of, we all have it in one form or another.

Here’s what’s lucky about this situation: The reasons for overcoming that fear are precisely the same as they were for overcoming your fear of getting into forex trading. In fact, not only are they the same but there is one bonus reason that makes this kind of endeavor even more worthwhile. So, when you start a new business venture and that business doesn’t work out, if you’re smart, you still get to walk away with quite a lot.

There will be losses, that’s for certain. But the gains are almost certain to outweigh the losses and they should be factored into your risk assessment. The first gain is that you will have taught yourself a lesson about your own resilience. Your business may have failed but you can pick yourself up and get right into the next thing. That resilience will kill your fear of failure right away. The second gain is that you will have learned from any mistakes you made along the way and will be able to do things better at the next go around. This is a gain from the experience that people actually undervalue time and time again.

It’s a little known secret that no number of online courses and video tutorials will teach you. In short, sometimes you need to mess things up yourself so you know how not to do it the next time. The third gain, the bonus gain, is all of the many big and little things you will have learned along the way. Even if your venture fails, you will have invested time and effort into yourself. You will have bought yourself a whole new skill set that you could not have acquired in any other way. Most if not all of those skills will be applied either to your next business venture or to those things you are already doing – your day job, your daily life, and, yes, even to your trading.

The Idea Factory

Ok, so by now you’re probably interested but maybe you don’t have any ideas. First of all, that is hugely unlikely. Give your brain just a few minutes to explore the enormous scope for new businesses out there and it is bound to come up with at least ten viable ideas. If not, however, even that is made easier for us by the wonderful world of the internet. Get online and do some research, let your searches be your guide. Get on social media, get on YouTube, find out what other people are doing and adapt it to something that’s your own. Your brain is just by its very nature a magical source of ideas and plans and schemes but plug that into an online world with millions of other brains doing the same thing and you have yourself a veritable factory of ideas.

The online world is a great place to explore, investigate, and actually put into practice any range of business ventures you care to name. Lots of people have made a go of selling actual physical products online but that’s just a starting point. Using all the tools the internet provides makes it possible not only to sell products but services, brands, entertainment, and even the very skills you learn along the way as you build and develop your business. You could, just as an example, offer up the skills you learn in growing a business as services to other businesses. This is because, as your experience expands, you will come to know all sorts of things about marketing, logistics, accounting, project management, and a whole host of other fields you never knew you would be able to master.

What’s Hot?

One of the things that are particularly hot as an online commodity these days is knowledge. People are hungry for new knowledge and new skills like never before and there is a rapidly growing sector of online businesses ready to respond to that demand. You may be thinking, “well, I’m no expert on anything” but that’s the wrong approach. That’s the fear talking. First of all, your experience is unique, the way you understand the knowledge you have is a complete one-off, your approach to explaining and transferring that knowledge to others might be just what people are looking for.

Often the greatest experts in a field are so deep into the area they work in that they miss the little things that they too had to learn along the way. But those little tips and tricks, they’re like gold dust right now. The other point to make here is that there has never been a better time to learn new skills and perfect the skills you already have. Use all of the tools at your disposal, follow people on social media, watch tutorials and read articles, take an online course if you feel you have to.

If you can combine the knowledge you can pull down from the airwaves with some experience of putting it into practice – even if you failed along the way, or perhaps especially if you failed along the way – you are almost certainly someone people will be able to learn from. It couldn’t be simpler, learn from others, make that knowledge your own through practice and experience, and put it back out into the world. Others are doing it and making it work, why wouldn’t you?

Just Do It?

As we said in the beginning, the only force holding you back is a fear of failure. And since it is now clear that failing, but failing upwards, is part of the journey, now is the time to convert that fear of failure into a fear of quitting. The only real way to fail is if you fail downwards. That is if you try something but quit along the way before you’ve had a chance to learn anything. That puts you in with the 95 percent of ordinary Joes who are just muddling along through life without a plan. Here’s the good news, all you need to step out of that undesirable state of affairs is to stick at it.

So leap forward, diversify your income, and yourself. Try starting a new business and do it with a smile on your face because even if you fail, you will come through to the other side better, more resilient, smarter, and with some new marketable skills. Diversification works in forex and it works in life too.