Obsession with control is an exceptional feature in the animal world. Humans develop more or less complex systems to direct each and every facet of our lives, or so we try. The illusion of being in charge reassures us, and when it comes to handling our money, much more. Is that why professional traders are so upset that Forex trading is compared to casinos?

In part, yes; but what really irritates us is that equating gambling with trading is the same as saying: Hey, you don’t control the situation, everything is a product of chance! Certainly, there are factors that cannot be assumed in a casino’s bets, as much or more than in trading. Obviously, there are subtle differences. The first is that, in gambling, we call that uncontrollable factor ‘luck’. In Forex, we call it ‘strong hands.

Without euphemisms, the reality is that there is a degree of uncertainty that is impossible to calculate accurately. And its weight is of such magnitude that it can destroy any trading strategy, no matter how elaborate. You can’t predict the movement of the market, just as you can’t guess at what number the roulette will drop the ball. Of course, when it comes to decision-making, Forex offers us a much more attractive illusion of control.

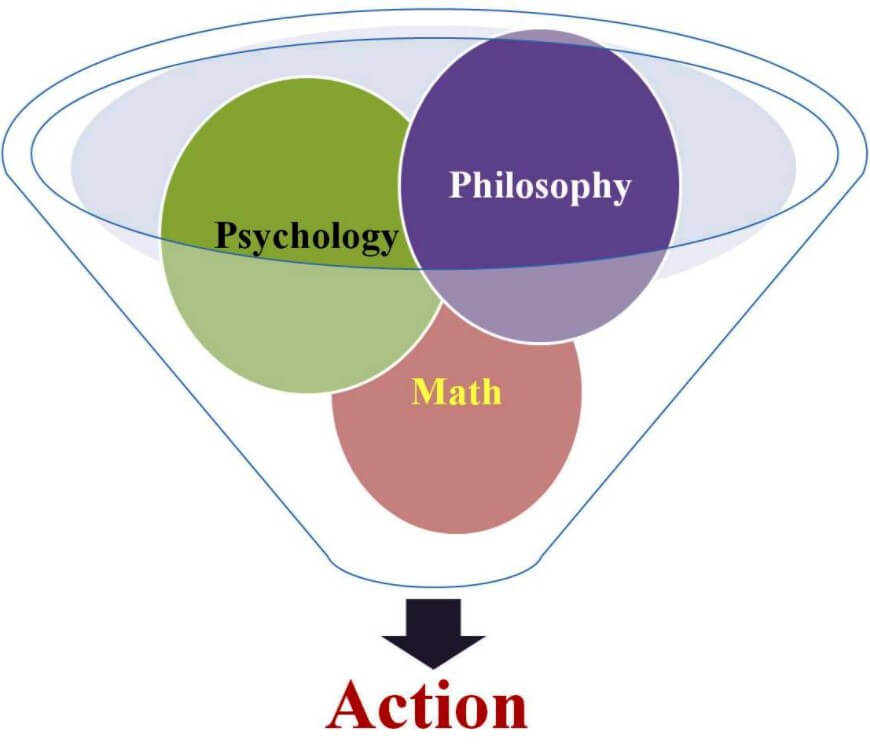

Forex: A Matter of Psychology

Certainly, a lot of decisions have to be made when we talk about investing in currencies, many more than putting a lot of chips on a number or a color. The problem is that most novice traders focus on building extremely elaborate systems, thinking that the important decisions are those that have to do with the application of indicators. It is clear that technical analysis is important, but it is not the control of the chart that should worry a good trader.

The real challenge of the initiative is self-control. In fact, psychological decisions often determine the future of small investors. The reason is obvious: when you enter the jungle, you will live hard times for which you have to prepare mentally. When you dive into the market, no matter which one, you have to go with a lesson learned: you’re going to lose money and a lot. If you’re not psyched for that, stick to something else.

Forex isn’t built to make easy money. What’s more, to make a profit by trading in foreign currency, you have to go through a tortuous path of profit and loss that can undermine anyone’s mood in a few months. It sounds exactly like what happens in casinos, so why are we still determined to put a dividing line between bookmakers and Forex? Surely, because once the psychological work phase is over, luck is a negligible element in the equation.

Forex and Probability Calculation

In reality, rather than luck, the risk that can be assumed is the variable that defines bets and investments. In both cases, and greatly simplifying the matter, there is a chance of losing and a chance of winning. Just take as an example a short transaction with CFDs: the price can go down (profits) or up (losses). The difference is that decisions are made based on in-depth market analysis, the development of a strategy, and certain probabilistic calculations.

This is not to say that, in general terms, it is not possible to operate with CFDs following the same philosophy as the bookmakers. Trading with a casino mentality means adopting one of the fundamental premises of trading: minimize losses and maximize profits, increasing the probability of success above 50%. Casinos get it by adapting their games; experienced traders, choosing strategic zones on trend lines, resistance, and support.

Finding these points is not easy. It requires a study of the market and an exhaustive search for patterns; but, in addition, it implies not being carried away by emotions, enduring astronomical losses, and cutting profits early because of anxiety. Anyway, trading in the currency market may not be the same as playing roulette; but, as Mr.Khoo says, you can (and should) do trading thinking like a casino.