aThe Problem With Price Action Noise

In forex trading, a term that is used quite often in technical analysis is market or price action ‘noise.’ Quite often, we find that price action in Any Given currency pair spends an awful lot of time sideways or consolidation motion. Or where price action seems to be rising and falling in small increments, but where these moves tend to form the basis of a trend. However, the lower you go on a time frame and especially with regard to the 1-minute and 5-minutes time frame, the more difficult it becomes in ascertaining exactly where the trend is going, whether it be a part of a bullish move or a bearish move or if it is a part of a consolidation phase.

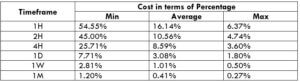

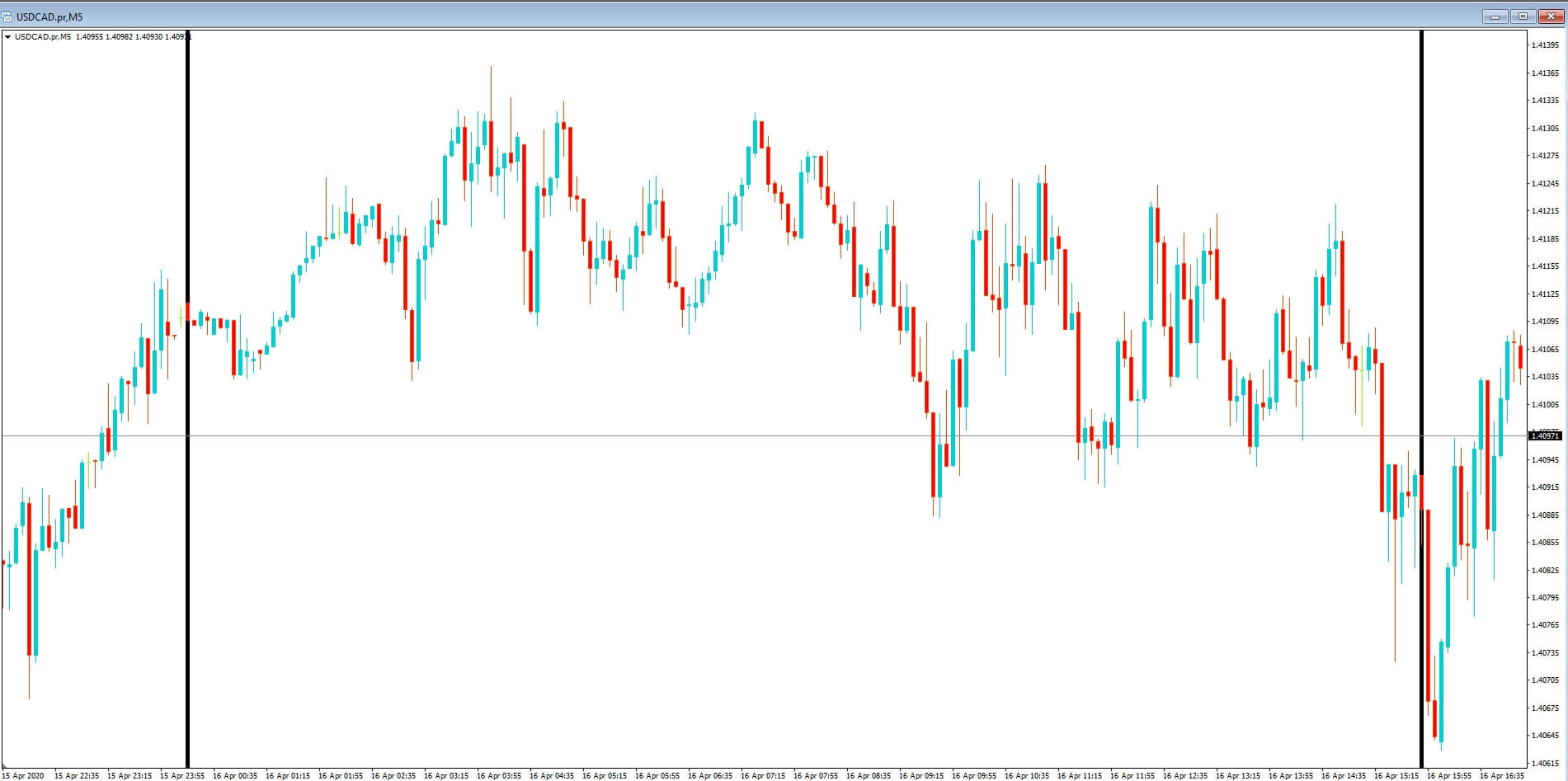

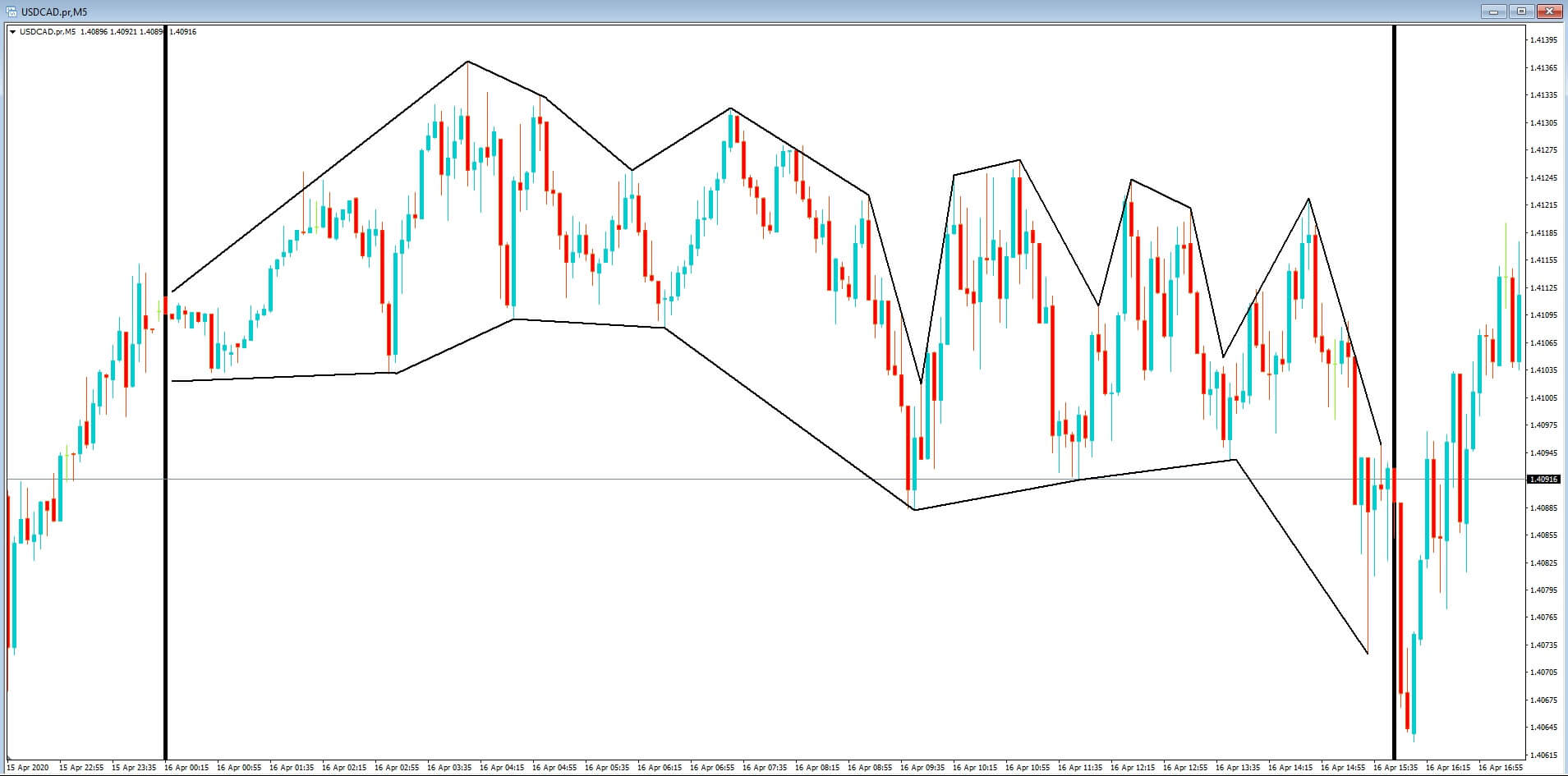

Insert A: This is a section of price action on a 5-minute chart of the USDCAD pair. We have added two vertical bars because this is the period that we want to drill down on a little bit more.

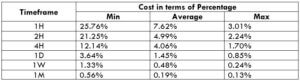

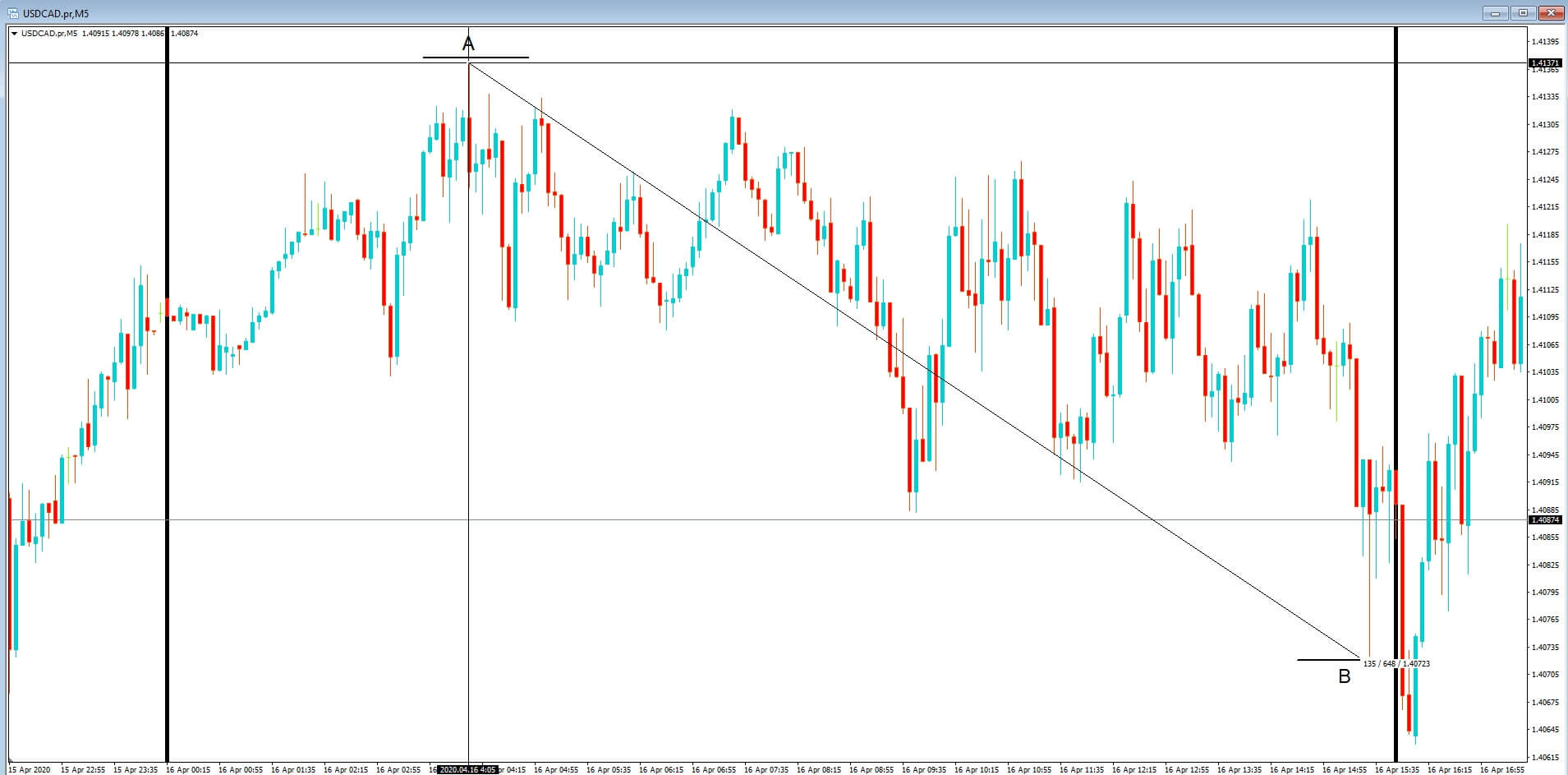

Insert B: This is the same section, but we have added 2 points on the charts at position a and b, and where the interest rate differential is 64 pips. That is to say, had you gone short at position a the maximum you would have made had you got out at position B would have been 64 pips less your spread. And of course had you bought the pair at position A and still being in the trade at position B you would have been offside by 64, pips plus your spread.

Insert C: In this section, we have added our own channel, where we can see a lot of rise and fall and tight consolidation in periods where the price is contracting within the range, but this in itself would become difficult to trade, especially if looking for trends.

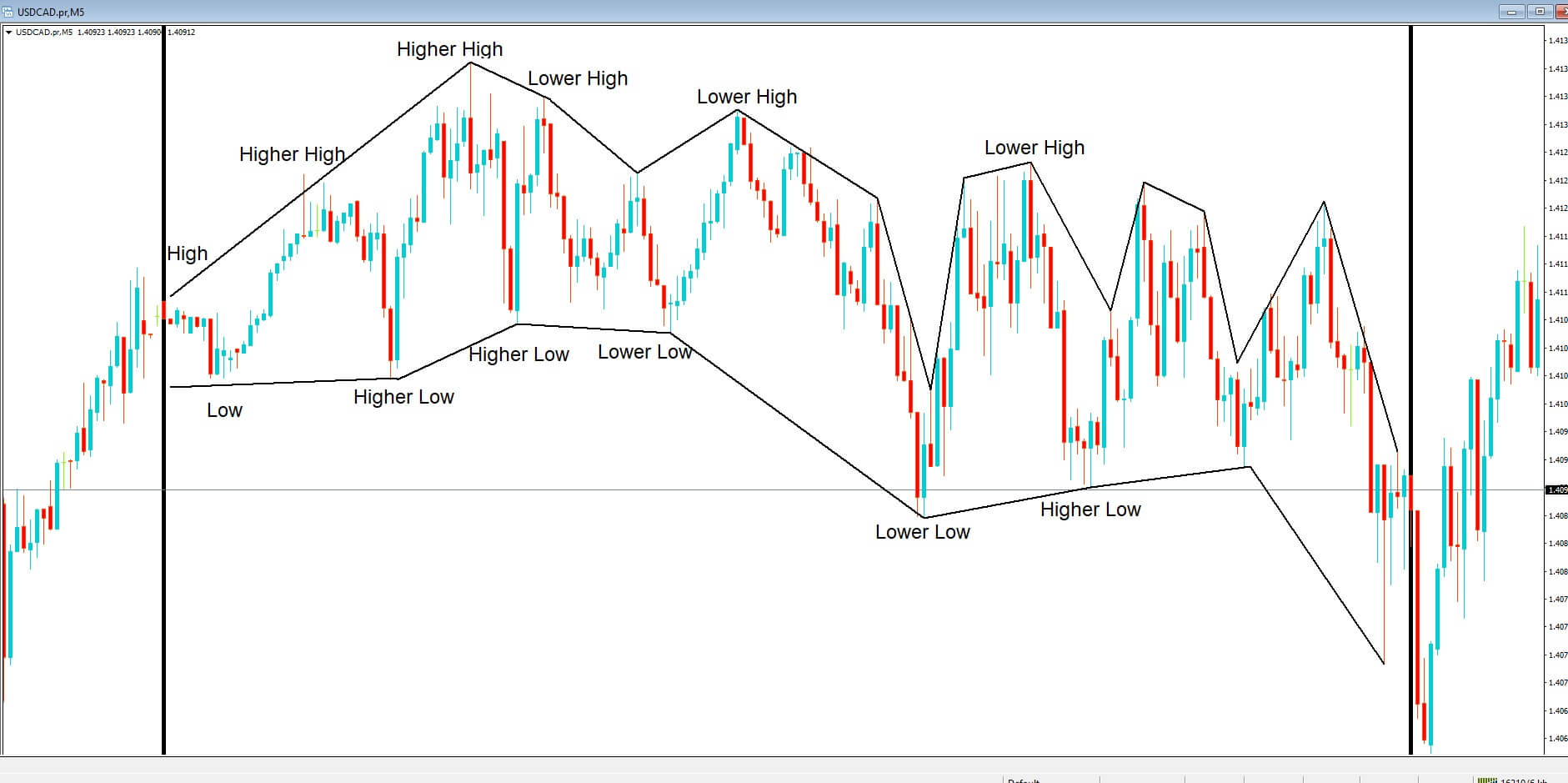

Insert D, Now scalpers, while incorporating technical tools such as statistics, might argue that a few pips could be made here and there possibly based on highs with higher highs and lower lows, etc.

Insert E, But this type of technical analysis can quickly fall out of kilter in areas such as where we have highlighted we suddenly have a lower or high which is followed by buy a higher low, where we would need a lower low in order for the pair to remain in a bearish price pattern.

Insert F. This is also complicated in the area where we have highlighted where we see candles grouped together, which are both bullish and bearish and where several are more wick than candle telling traders that neither bulls nor the bears have this pair under control at this time. This is market noise. And while such noise can be seen in all time frames, the trick is to move up to a higher one to find out where directional bias might be heading.

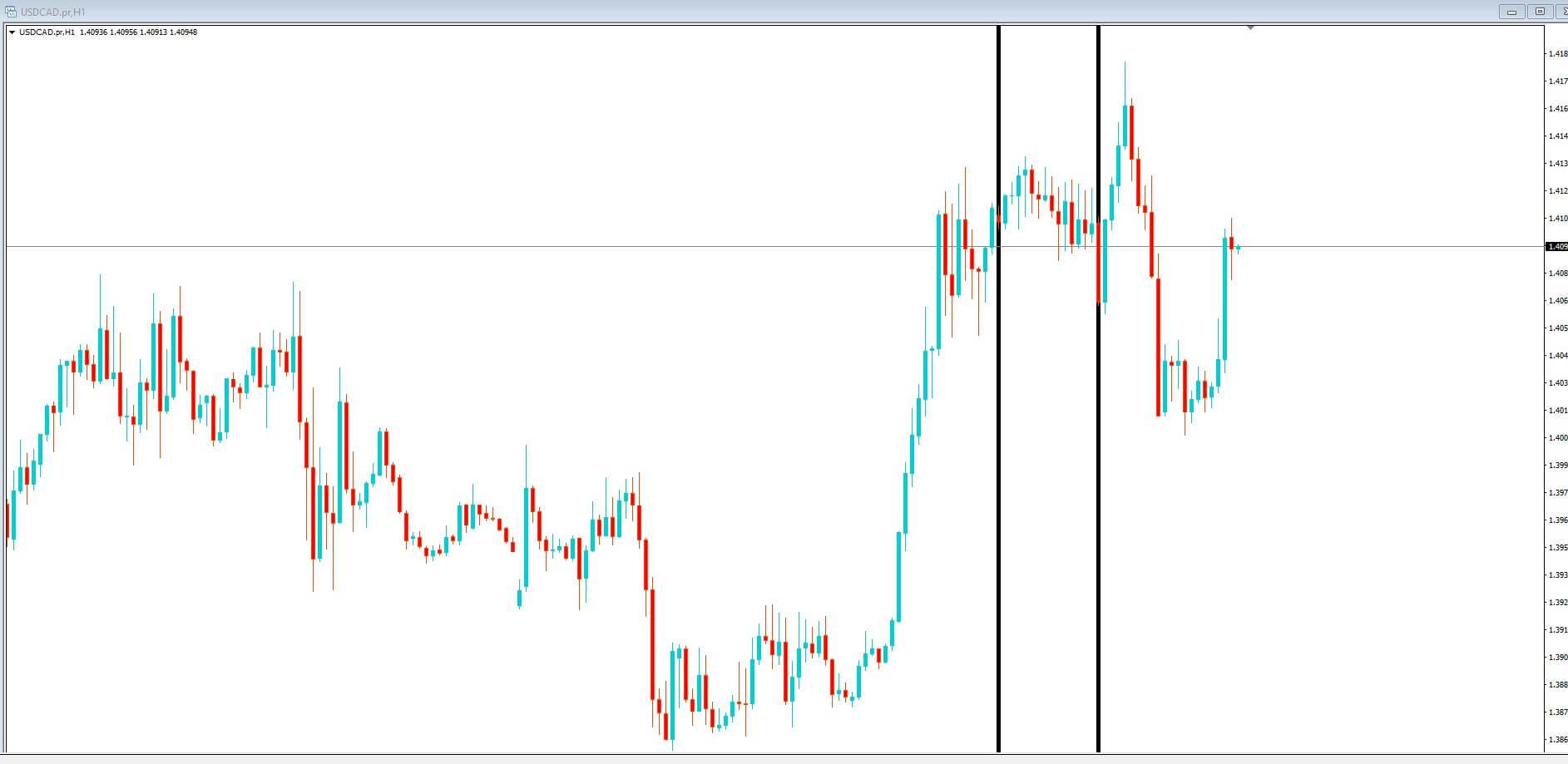

Insert G. However if we moved to a higher time frame, such as the 1-hour time frame here and again, look at the price action within the two horizontal lines we get some more clarity about what is really happening to this pair over the time period which we have highlighted.

Insert H, And here we can see that the price action is consolidating after a rally to the upside and where we have a V-shaped potential reversal pattern within our highlighted area.

There is an old saying which I’m sure you’ve heard of that sometimes you can’t see the wood for the trees. Well, this is a perfectly good example, where in order to avoid the noise of the lower time frames, we must always look to the higher time frames to try and ascertain what the general bias is, even if you prefer to trade the lower ones.