General Overview

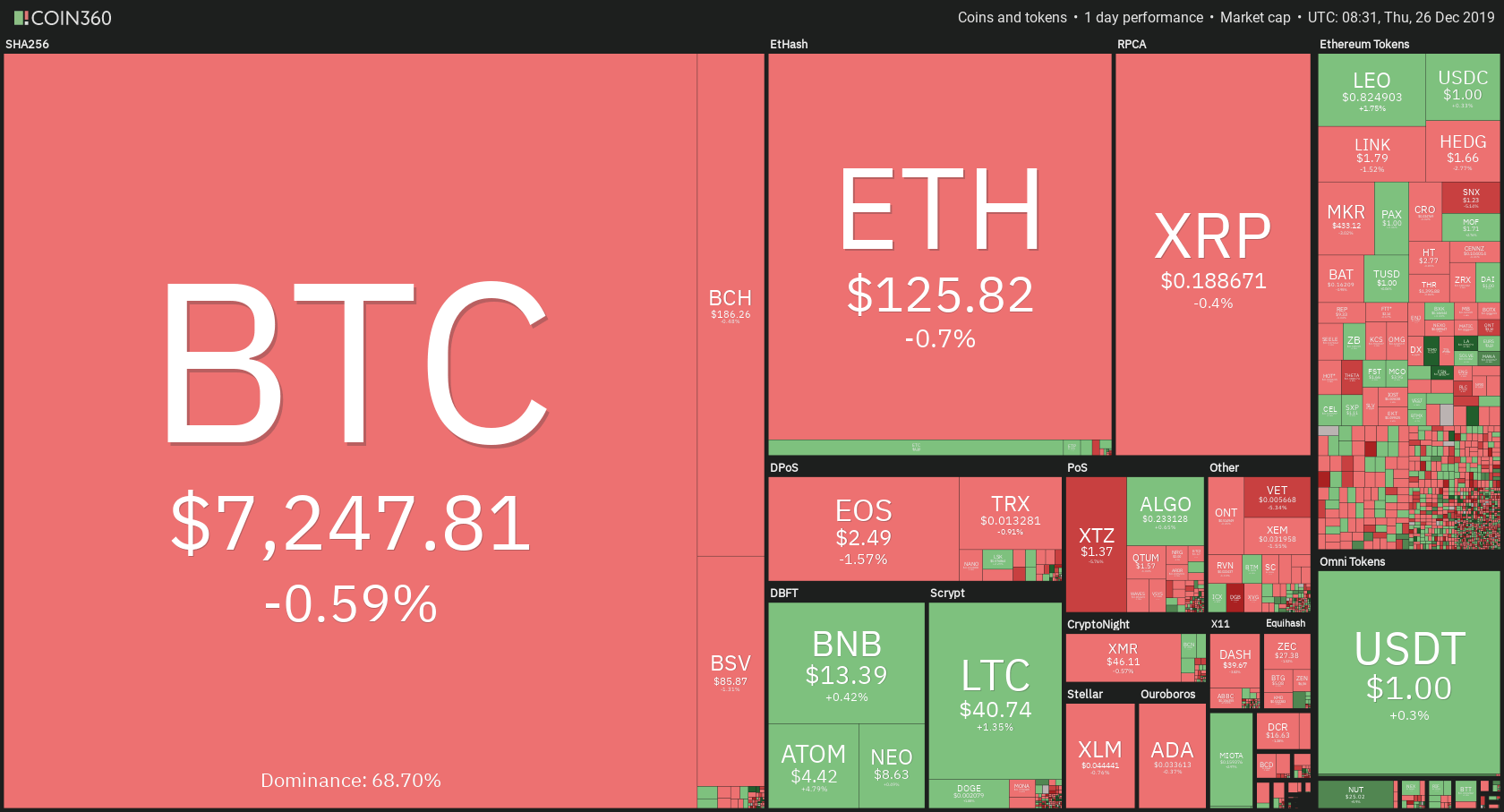

Daily Cryptocurrency Tracker:

Market Cap: $297,297,869,282

24h Vol: $19,935,454,309

BTC Dominance: 38.9%

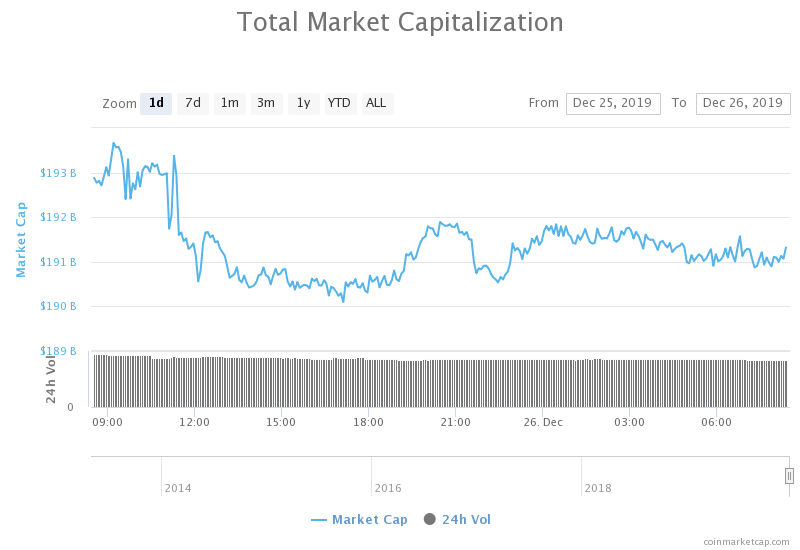

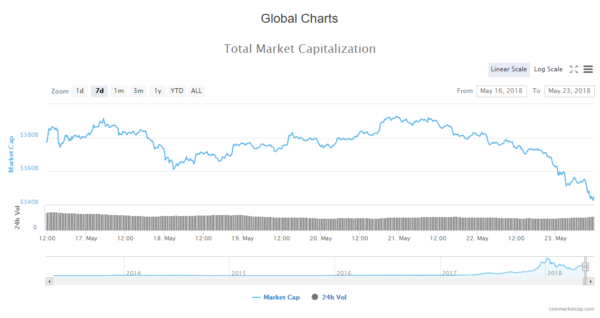

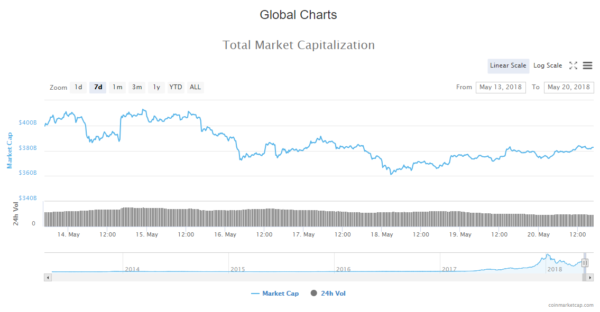

In the last 24 hours, cryptocurrency market capitalisation experienced a significant drop from yesterday’s opening at 340,435,000,000$ to 291,000,000,000$ which was today’s low so far.

The market is in red as you would presume, with an average decrease of 12% amongst the top 100 coins. Biggest losers are: Skycoin -26%, Cortex -18%, WaykiChain -24.45%, and only Veritaseum is green among top 100 with an increase of 6.19%.

The market is in red as you would presume, with an average decrease of 12% amongst the top 100 coins. Biggest losers are: Skycoin -26%, Cortex -18%, WaykiChain -24.45%, and only Veritaseum is green among top 100 with an increase of 6.19%.

News

Most significant headlines that came out in the last 24 hours are those regarding the reason why the markets are pungling hard.

On Saturday, CoinUpdates reported that a “Huge Bitcoin Whale With 94,000 BTC, Transfers Crypto Onto an Exchange, Rattling Nerves” in which they analysed using blockchain data that 8000 BTC where sent to Huobi exchange in two transactions:

Blockchain data shows that bitcoin address 1KAt6STtisWMMVo5XGdos9P7DBNNsFfjx7 accumulated more than 93,947 BTC — at one point worth more than $700 million — during a two-month period between March 25 and May 27. Since then, the wallet owner has reduced their balance by 8,000 BTC.

The post continues on by speculating to whom this address may belong as it is the “sixth-richest in the bitcoin ecosystem”, after Bitfinex, Binance, Bittrex, Huobi, and Bitstamp addresses.

China-based news outlet BABI Finance found that most of the funds appear to have been garnered from wholesale trading on over-the-counter (OTC) platforms. BABI cites an anonymous source involved with OTC cryptocurrency sales who said that the wallet belongs to a broker in Dubai acting on behalf of an unknown — perhaps institutional — buyer.

Many blamed the current dump on the fact, that another exchange, CoinRail, got hacked. According to coindesk, the crypto exchange has suffered a loss of 40 million dollars, which caused a lot of FUD (fear uncertainty and doubt). However, that can be true as this exchange is not that significant

Data from CoinMarketCap showed the platform was ranked around 90th largest around the time of the hack, with some $2 million 24-hour trading volume on the site.

According to cointelegraph “All of Top 100 Cryptocurrencies See Red Amidst CFTC Price Manipulation Probe“.

The sharp decline in cryptocurrencies’ prices takes place in the wake of the news that the US Commodity Futures Trading Commission (CFTC) has requested trading data from crypto exchanges Bitstamp, Coinbase, itBit and Kraken. These are respectively the 21st, 14th, 45th and 13th largest exchanges in the world by trade volume, according to Coinmarketcap.

This also doesn’t make sense even though those are significant exchanges with large trading volume, unlike CoinRail, but I don’t see how exchanging subpoenas for potential price can manipulate and scare investors, and push them to sell their crypto.

What is more likely is what is reported on a Coinsupdates post titled “What Caused a Flash Crypto Crash?” in which the stated reason is “Bitcoin investors in the United States are selling off their crypto to pay off capital gain tax”.

First-time investors in Bitcoin are faced with large capital gain taxes from the profit they made in 2017. Reports show that they are now selling off quickly before they file their April taxes. If an individual buy and sells Bitcoin within the same year, the person will be taxed on short-term capital gains which can be as high as 39% depending on the tax bracket. However, when a person holds on to Bitcoin for more than a year before selling, it will only be liable for what the IRS refers to as long-term capital gains. The rate for this kind of tax is significantly lower from about 15 to 23.8%.

While fundamental reasons for this sell-off are still unclear, they always tend to come after the fact as a bias justification. So as a predominantly technical analyst, I am always looking for clues that come beforehand, and the chart told me all of this throughout last week that the prices are going lower. So in my mind, there is no other reason than basic price action and human psychology.

Analysis

BTC/USD

In the last 24 hours, the price of Bitcoin has been declining steeply from 7501$ to 6675$ which is an 11% decrease and is currently up a bit, sitting at 6748$.

Looking at the hourly chart we can see the interaction with what was until now unconfirmed baseline support 2, like I had predicted in my last week’s weekly update video. If the price bounces back to the upside I am going to confirm the baseline support 2. The price is currently consolidating in a triangle. We will see what happens next. Maybe we will see another straightforward drop after the consolidation, or we may see a bounce off of the baseline support 2 and a quick recovery.

Market sentiment

Hourly chart technicals signal a sell.

Oscillators are on neutral, and moving averages signal a strong sell.

Pivot points

S3 5199.1

S2 6078.8

S1 6418.4

P 6958.5

R1 7298.1

R2 7838.2

R3 8717.9

ETH/USD

From yesterday’s open at 579$, the price of Ethereum has dropped by 14% to today’s low at 503$.

As you can see from the hourly chart, the price has bounced back from those levels by 30$, off the 0.236 Fibonacci level leaving a wick below it. The price has fallen steeply to the levels of prior low, as like I’ve expected it.

Market sentiment

Hourly chart technicals signal a sell.

Oscillators are on sell, and moving averages signal a strong one.

Pivot points

S3 343.83

S2 440.75

S1 482.15

P 537.67

R1 579.07

R2 634.59

R3 731.51

XRP/USD

The price of Ripple decreased by almost 16% in the last 24 hours from 0.6571$, which was yesterday’s open to 0.55214$, which was today’s dip.

On the hourly chart, we can see that the price is currently sitting on the support at 0.573 and on the uptrend significant level (dotted purple line) which also served as support. So the price found some temporary support there, but we will see if that support is strong enough to stop the momentum, after which I will confirm it, as the price fell below it leaving a wick.

Market sentiment

Ripple is in the sell zone.

Oscillators are on buy, and moving averages signal a strong sell.

Pivot points

S3 0.38312

S2 0.48954

S1 0.53503

P 0.59596

R1 0.64145

R2 0.70238

R3 0.80880

Conclusion

Daily Cryptocurrency Tracker: After the steep decline that major cryptos have experienced, today, I am expecting a recovery as there’s a “buy the dip” psychology in the cryptomarkets. Buy the dip is considered to be a good strategy in a bull market, but crypto investors are not that knowledgeable and are acting on what they hear. So after they see that they are holding heavy bags, the sell-off will continue.

The current market sentiment for Bitcoin is positive, meaning 70% out of 85 mentions in total are positive.

The current market sentiment for Bitcoin is positive, meaning 70% out of 85 mentions in total are positive.

Pivot points:

Pivot points:

The current market sentiment for Ethereum is positive, meaning 78% out of total 97 mentions are positive.

The current market sentiment for Ethereum is positive, meaning 78% out of total 97 mentions are positive.

The current market sentiment for Ripple is slightly positive, meaning 69% of 42 mentions in total are positive.

The current market sentiment for Ripple is slightly positive, meaning 69% of 42 mentions in total are positive.

Pivot points:

Pivot points: