Introduction

The AUD/ZAR is an exotic currency pair in the forex market. AUD is the Australian Dollar while ZAR is the South African Rand. Trading the AUD/ZAR pair is expected to attract higher volatility than trading major forex currency pairs.

The AUD is the base currency in this exotic pair, while the ZAR is the quote currency. It means that the price associated with the AUD/ZAR pair represents the amount of ZAR that you can buy with 1 AUD. Let’s say that the price of AUD/ZAR is 11.5077; it means that with 1 AUD, you can buy 11.5077 ZAR.

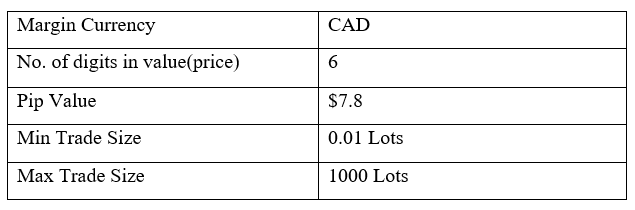

AUD/ZAR Specification

Spread

At any given moment, forex brokers display the “bid” and “ask” price, which represents the price at which you can buy or sell a currency pair. The spread is the difference between these two. The spread for the AUD/ZAR pair is – ECN: 7 pips | STP: 12 pips

Fees

Forex traders with ECN type accounts can sometimes be charged commissions by their forex brokers whenever they open a position. The fees vary with the broker and the size of the position. STP accounts are typically not charged commissions.

Slippage

The price at which we place our trades isn’t always the price at which the broker executes these trades. The difference between the two prices is called slippage in forex trading. It can be because of extreme market volatility or broker inefficiency.

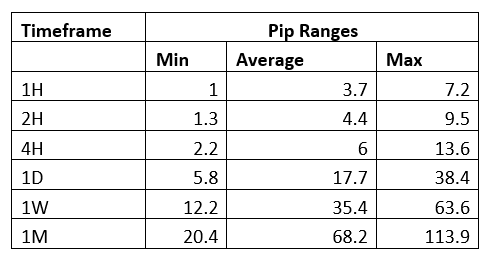

Trading Range in the AUD/ZAR Pair

The trading range refers to the pip movement of a currency pair throughout a trading day. The pip movement can be analyzed across different timeframes to determine the volatility of the pair.

The Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a larger period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

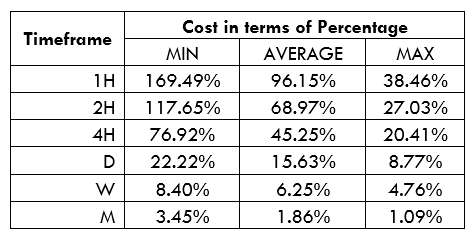

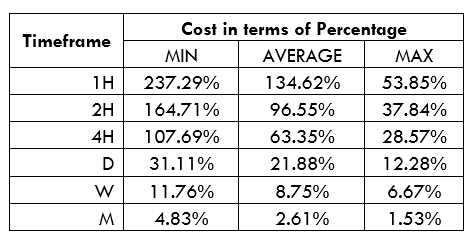

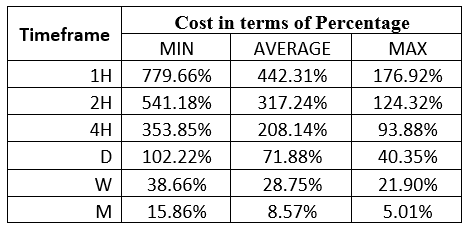

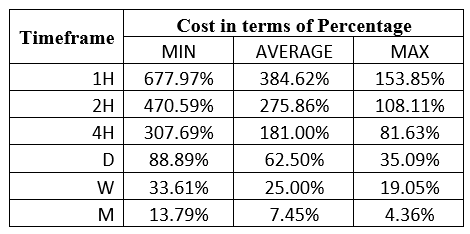

AUD/ZAR Cost as a Percentage of the Trading Range

We can compare the total cost of trading a particular currency pair alongside the volatility of that pair. This will help us determine the total trading costs of the pair across different timeframes and find out the optimal trading periods.

ECN Model Account Cost

Spread = 7 | Slippage = 2 | Trading fee = 1 | Total = 10

STP Model Account Cost

Spread = 12 | Slippage = 2 | Trading fee = 0 | Total cost = 14

The Ideal Timeframe to Trade the AUD/ZAR

From the analysis of the trading range and the costs in terms of Percentage, we notice that low volatilities attract the highest costs. Since lower timeframes have the least volatilities, it means that trading costs are higher in lower timeframes.

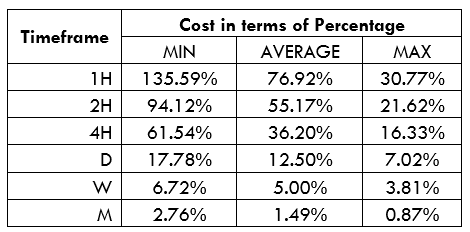

We can say that the ideal timeframe to trade the AUD/ZAR pair is when the volatility is approaching the ‘Maximum”. Traders interested in this pair can also choose to use forex pending orders instead of market orders. With pending orders, you get to eliminate the costs associated with slippage.

Here’s an example with the ECN account when slippage is 0.

Total cost = Slippage + Spread + Trading fee = 0 + 7 + 1 = 8

Eliminating the slippage cost has helped reduce the trading costs of the AUD/ZAR pair across all timeframes. The highest cost in the ECN type account has been reduced from 169.49% to 135.59%.