Introduction

The abbreviation of AUD/NOK is the Australian Dollar and the Norwegian Krone. AUD is the official currency of Australia and many others like Christmas Island, Cocos Islands, and Norfolk Island. This currency is also proven to be the fifth most traded currency in the Forex market right after USD, EURO, JPY, and GBP. Whereas the NOK stands for Norwegian Krone, and it is the official currency of Norway and its dependent territories.

Understanding AUD/NOK

In the Forex, Currency pairs are the national currencies from two countries coupled for being exchanged in reference to each other. The first currency here is the base currency, and the second currency is the quote currency. Here, the market value of AUD/NOK helps us to understand the strength of NOK against the AUD. So if the value for the pair AUD/NOK is 6.5921, it means we need 6.5921 NOK to buy 1 AUD.

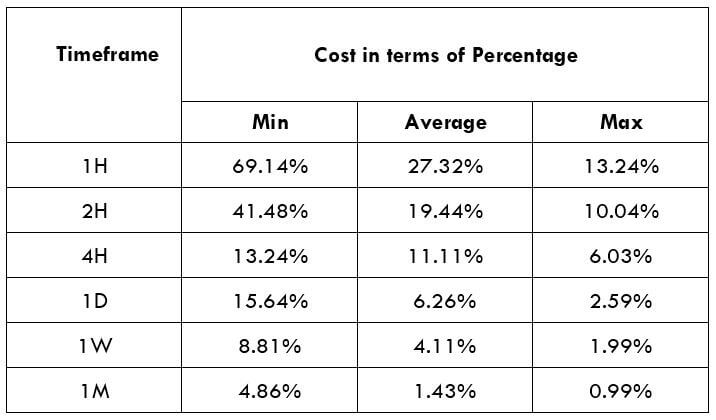

Spread

All Forex brokers have two different prices for currency pairs: selling price and buying price, and they are known as bid and ask price. Spread is the difference between the selling price and the buying price. Below is the spread for ECN and STP brokers for the AUD/NOK pair.

ECN: 50 pips | STP: 53 pips

Fees & Slippage

A Fee in Forex is the commission we need to pay to the broker for executing a particular position. If we subtract the trader’s expected price with the actual price at which the trade is executed, we get the Slippage. It occurs when the volatility of the currency pair is high. It may also occur when a large number of orders are placed at the same time.

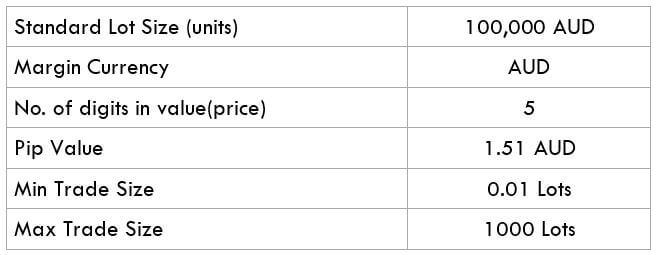

Trading Range in AUD/NOK

Volatility is a basic measure of risk every trader should be well aware of before entering the market. Whether we have a profit or loss in a given time period relies on the pip movement of that currency pair. This can be assessed using the trading range table. The trading range here represents the minimum, average, and maximum movement of the pip in AUD/NOK.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

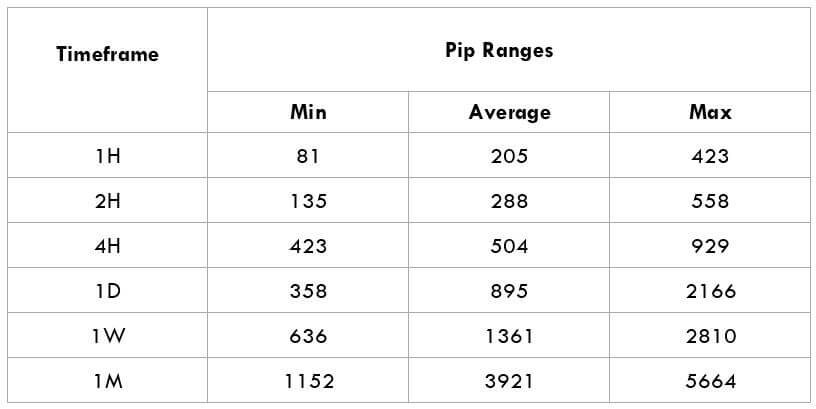

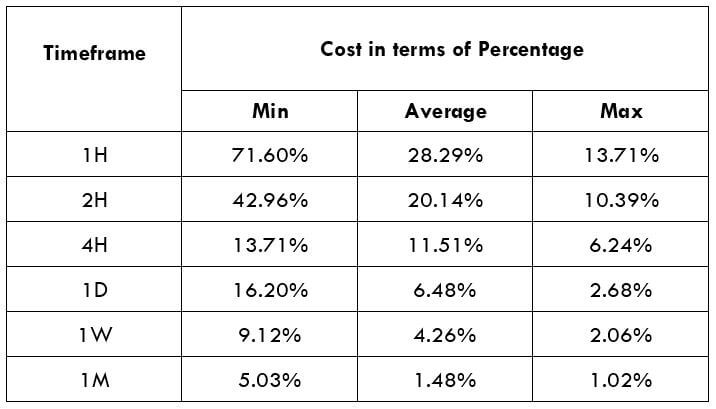

AUD/NOK Cost as a Percent of the Trading Range

We must be aware of the over cost we will pay to trade a currency pair. The cost of trading a currency pair depends mostly on the volatility and also the broker, which we use. The overall cost here involves spread, slippage, and the trading fee. Below we will see the calculation of the cost variation in terms of percentages.

ECN Model Account

Spread = 50 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 50 + 5 = 58

STP Model Account

Spread = 53 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 53 + 0 = 56

Trading the AUD/NOK

We are much aware of major and minor currency pairs, but there are few currencies that are less traded in the foreign exchange market. These currencies are called exotic-cross currency pairs. AUD/NOK is one such exotic pairs. As we see in the trading range chart, the average pip movement of AUD/NOK is 205, and by this, we can conclude that AUD/NOK is a volatile market.

To have a better understanding of the volatility, we will try to understand this with the help of an example. In the 1H time frame, the average pip movement is 205, and the cost percentage is 28.29%. Where in the minimum pip movement in 1hr is 81 and trading, it will cost us 71.60%.

This shows us that higher the volatility lesser is the cost of a trade. But trading in a volatile market involves risk as the movement of the pips is very fast. However, we can trade a volatile market if we follow proper money management rules.